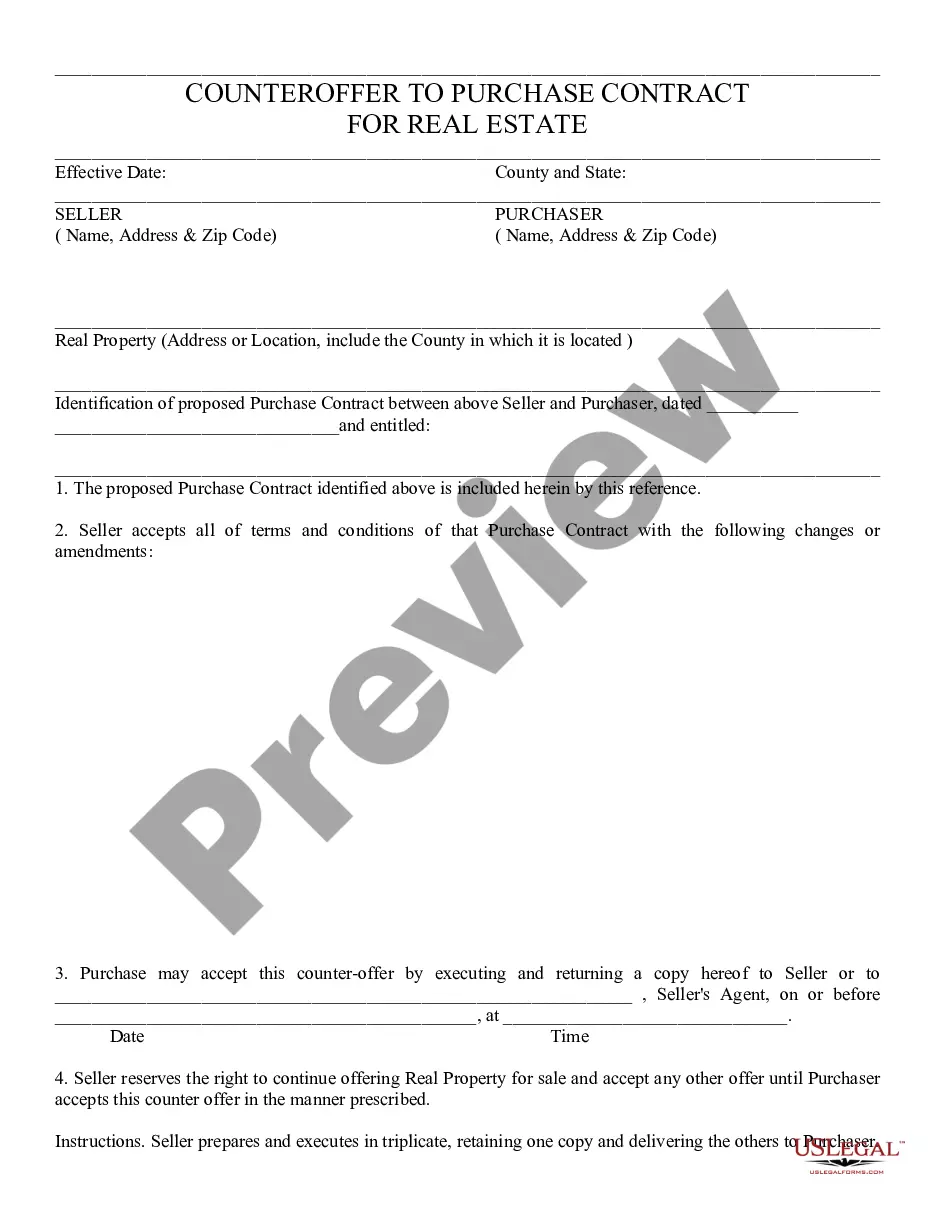

Counter Offer to Purchase 3 - Residential: A Counter Offer is used when the Purchaser and Seller are attempting to reach an acceptable price to both parties. The Purchaser offers an amount for the property in question; the Seller then gives this counter offer which states that he/she accepts the Purchaser's offer with an exception. If the Purchaser agrees to the exception, or counter offer, then he/she must sign the document in front of a Notary Public to accept. This form is available in both Word and Rich Text formats.

Purchase Real Estate With Llc

Description

How to fill out Arizona Counter Offer To Purchase 3 - Residential?

- Visit the US Legal Forms website and log in to your account if you're a returning user. Download the necessary form template by clicking the Download button, ensuring your subscription is active.

- For first-time users, start by browsing the extensive online library. Review the form preview and descriptions, ensuring it meets your specific needs and local jurisdiction requirements.

- If additional templates are required, utilize the Search tab to find them. Proceed with the next step once you identify the correct forms.

- Select your desired document by clicking 'Buy Now' and choose a subscription plan that fits your needs. You'll need to create an account to access all the library's features.

- Complete your purchase by entering your payment details through credit card or PayPal. Once the transaction is successful, download your form.

- Store the template on your device, and remember you can access it anytime in the 'My Forms' section of your profile.

US Legal Forms provides an extensive collection of over 85,000 forms, more than competitors offer at similar prices. This robust library, combined with access to premium legal experts, ensures that users create accurate, legally binding documents quickly.

In conclusion, leveraging US Legal Forms to purchase real estate with an LLC streamlines the documentation process. Start your real estate journey today by visiting US Legal Forms and explore our comprehensive library.

Form popularity

FAQ

People often place their house under an LLC to protect their personal assets from liabilities and legal claims. This strategic move can provide financial safety, especially for property owners involved in rental activities or real estate investments. Additionally, using an LLC can offer potential tax benefits and simplified estate planning. If you're considering this option, platforms like USLegalForms can assist you in understanding the implications and drafting necessary documents.

Yes, you can transfer property from your LLC to yourself. This process is generally straightforward but may involve certain legal considerations and paperwork. It is advisable to keep accurate records of this transaction to avoid tax complications. If you wish to navigate this process smoothly, using a service like USLegalForms can help facilitate the necessary documentation.

Purchasing real estate with an LLC offers significant benefits, including limited liability protection and potential tax advantages. An LLC can help shield your personal assets from risks associated with property ownership. Additionally, it simplifies the management of multiple properties by separating your personal and business finances. Overall, using an LLC can enhance both security and efficiency in real estate investments.

People choose to put their houses under an LLC for various reasons, including asset protection and tax benefits. By doing so, they shield their personal assets from potential risks related to the property. Additionally, putting a house in an LLC can simplify the transfer of ownership, making estate planning easier for your heirs.

People often buy houses through LLCs to manage risks and add a layer of asset protection. This approach not only shields personal assets but can also simplify property management, especially for rental properties. Additionally, purchasing real estate with an LLC may offer tax benefits, making it an attractive option for real estate investors.

Some benefits of purchasing real estate with an LLC include asset protection, potential tax advantages, and operational flexibility. However, there are drawbacks, such as the costs of forming and maintaining the LLC and potential difficulties in obtaining financing. Weighing these factors carefully can help clarify if an LLC is the right choice for your real estate investments.

To hold your real estate in an LLC, you first need to establish the LLC by filing the necessary paperwork with your state's business authority. Next, you would transfer the title of your property to the LLC, which usually involves a quitclaim deed. Be mindful that purchasing real estate with LLC also requires adherence to local laws and regulations, so double-check those during the process.

One disadvantage of purchasing real estate with LLC is the potential for higher upfront costs. Setting up an LLC involves registration fees and ongoing compliance costs, which can add up. Furthermore, lenders may have stricter requirements for loans associated with LLCs, potentially complicating financing. It's essential to weigh these factors against the benefits before making a decision.