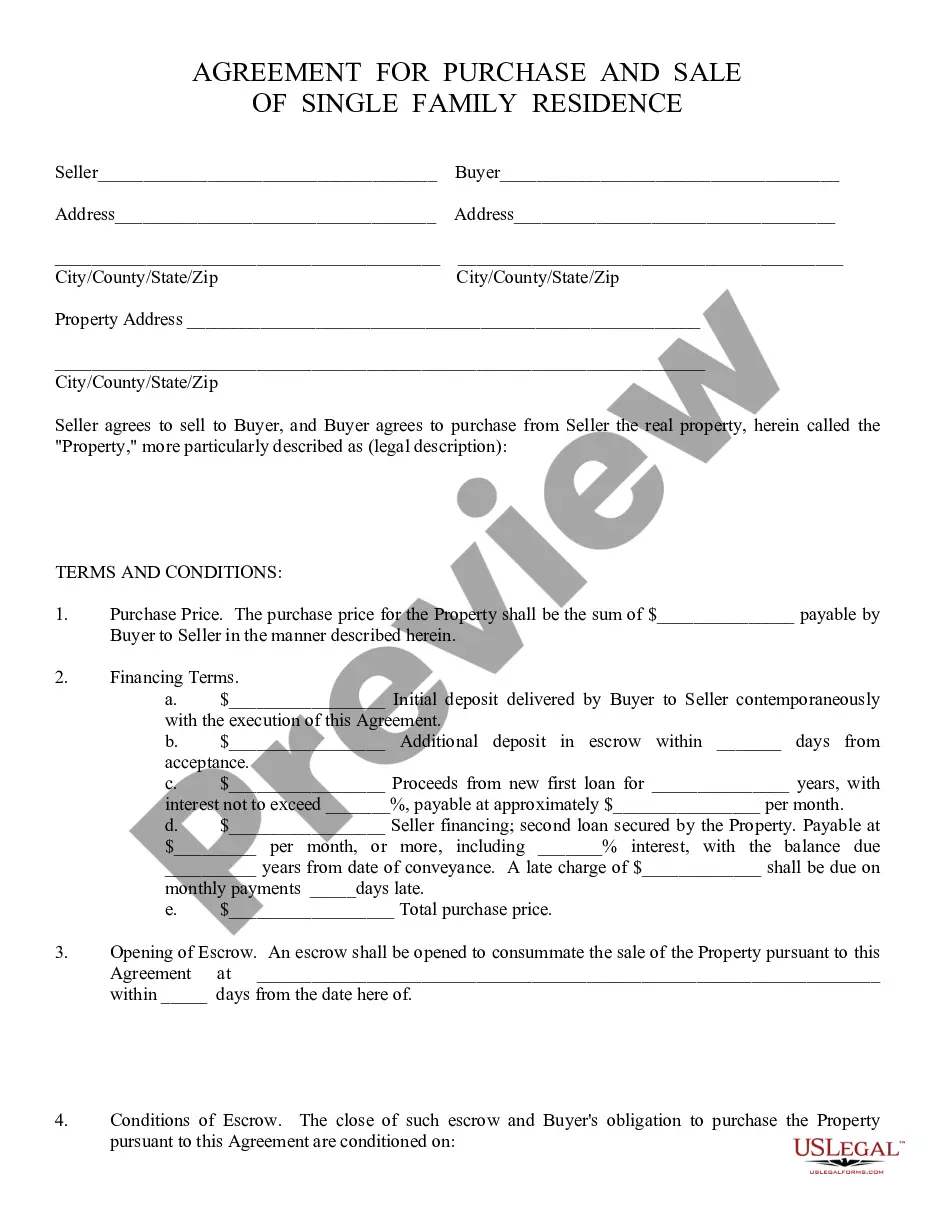

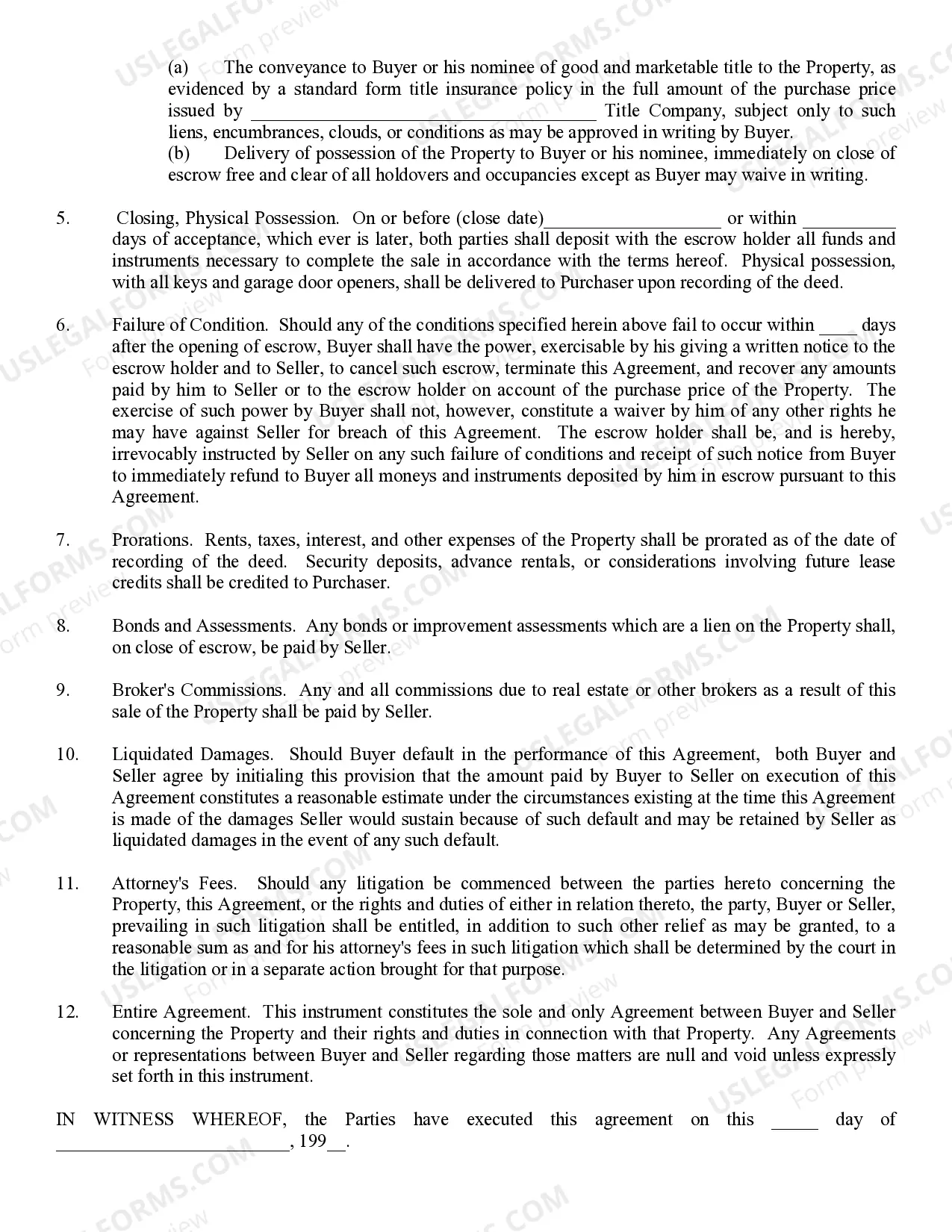

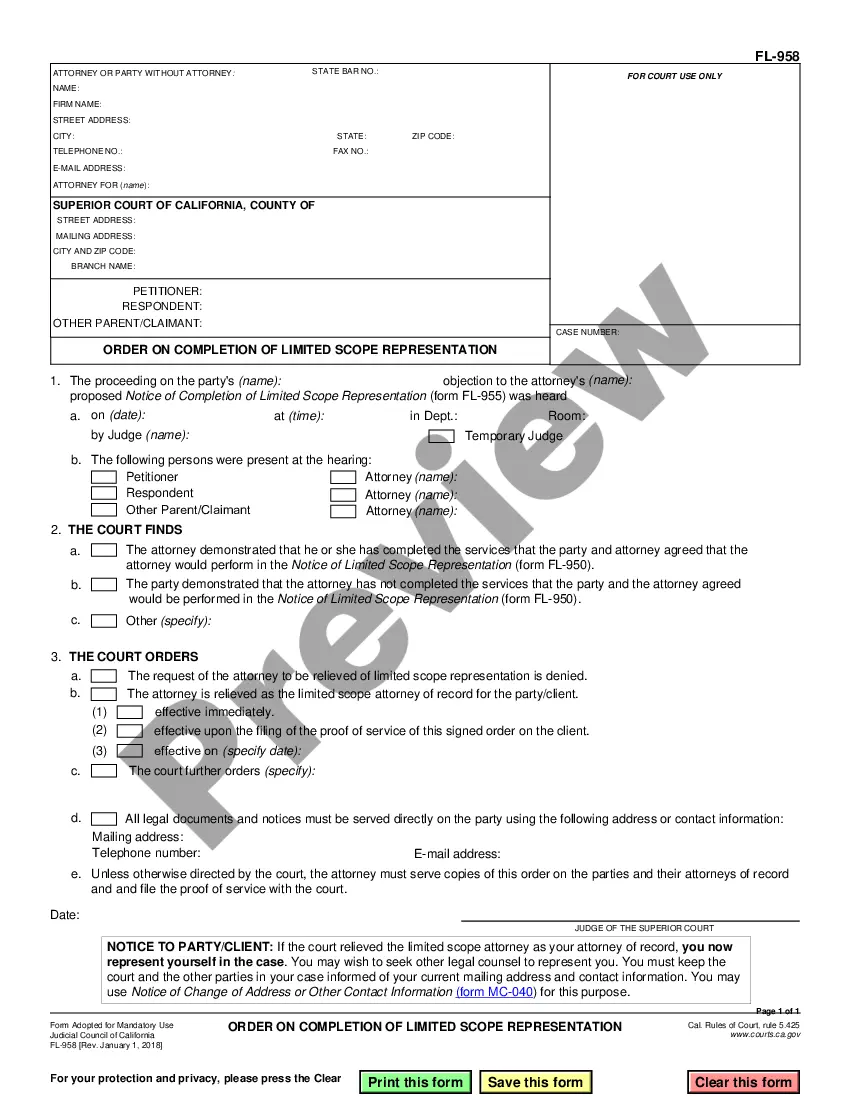

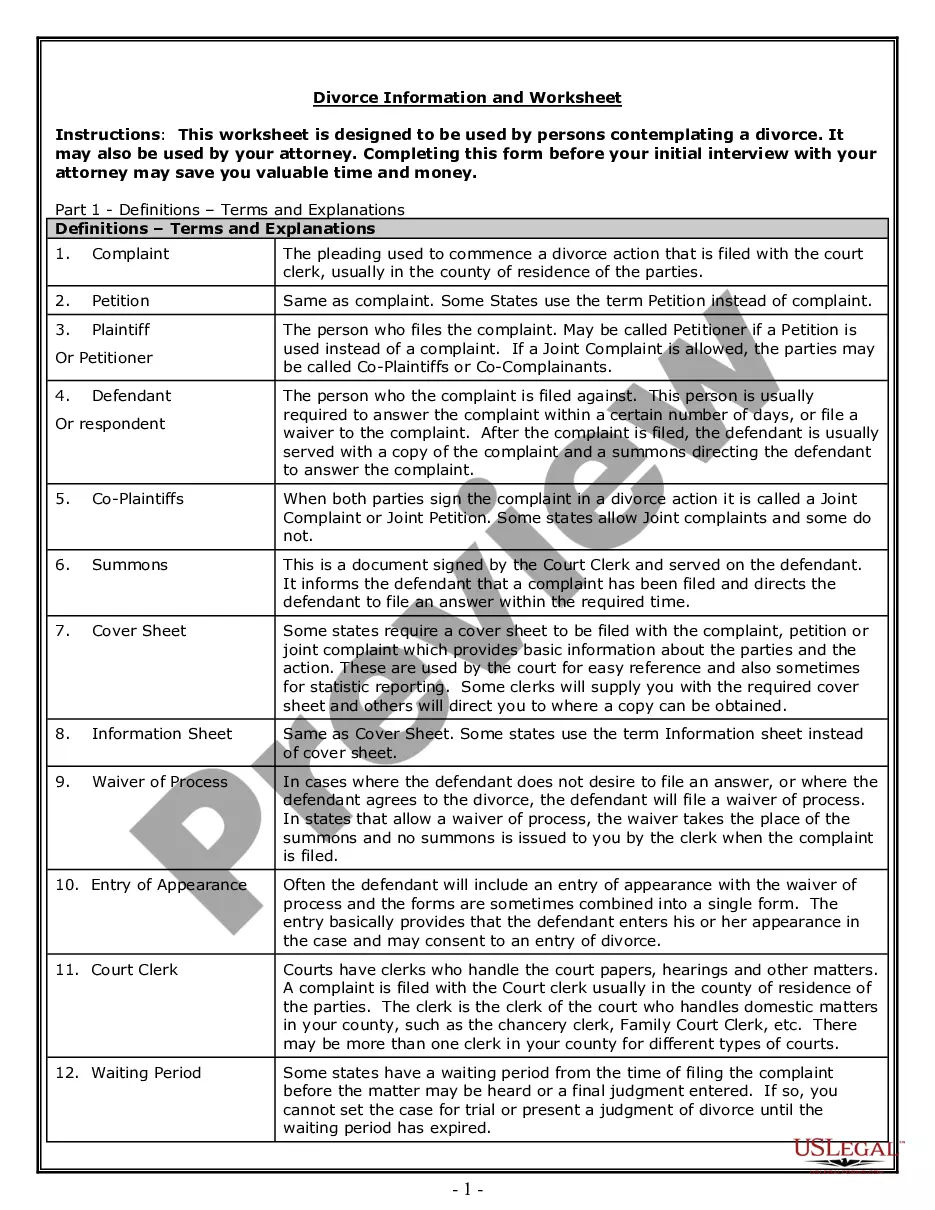

Arizona Installment Agreement Form

Description

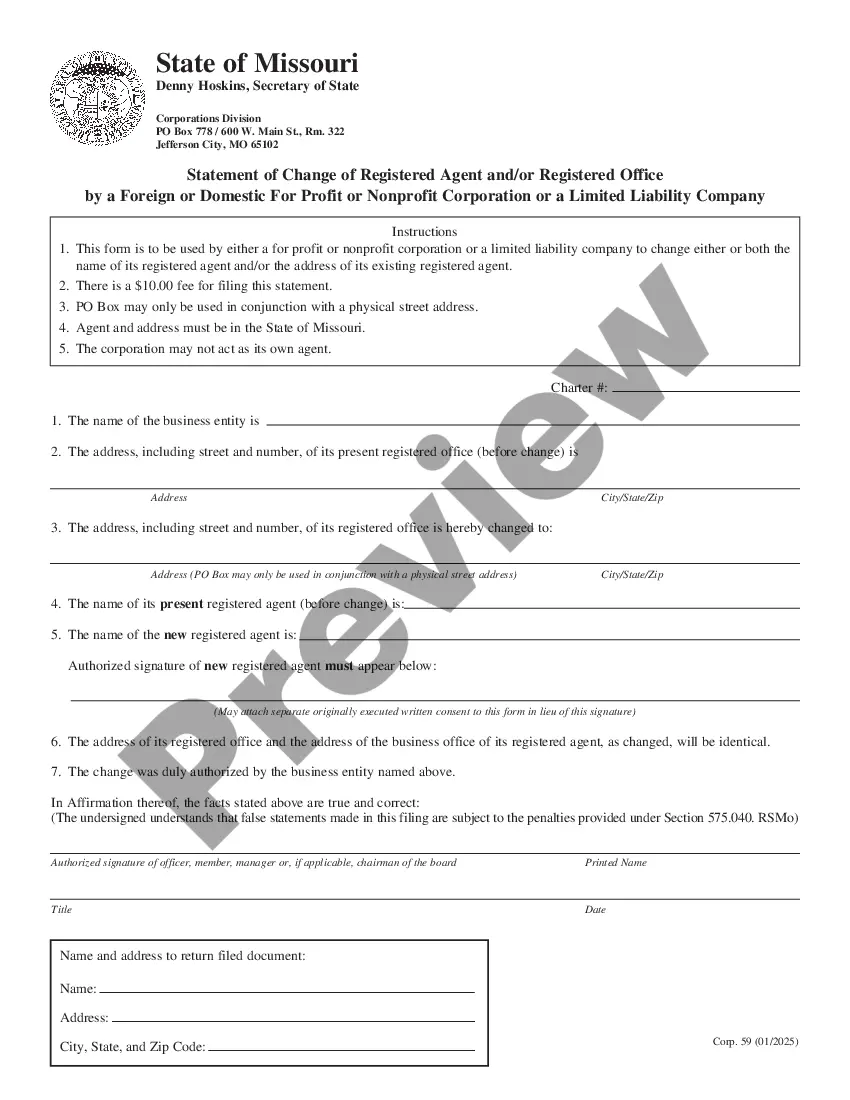

How to fill out Arizona Agreement For Sale, Short Form - Residential?

Individuals often link legal documents with complexity that can only be managed by a specialist.

In a sense, that is accurate, as preparing the Arizona Installment Agreement Form necessitates considerable knowledge of the subject matter, including state and county laws.

Nonetheless, with US Legal Forms, everything has become simpler: pre-prepared legal templates for every life and business scenario pertinent to state regulations are gathered in one online repository and are now accessible to all.

Print your document or upload it to an online editor for faster completion. All templates in our database are reusable: once obtained, they remain stored in your profile. You can access them at any time via the My documents tab. Discover all advantages of utilizing the US Legal Forms platform. Subscribe today!

- Examine the page content meticulously to ensure it satisfies your requirements.

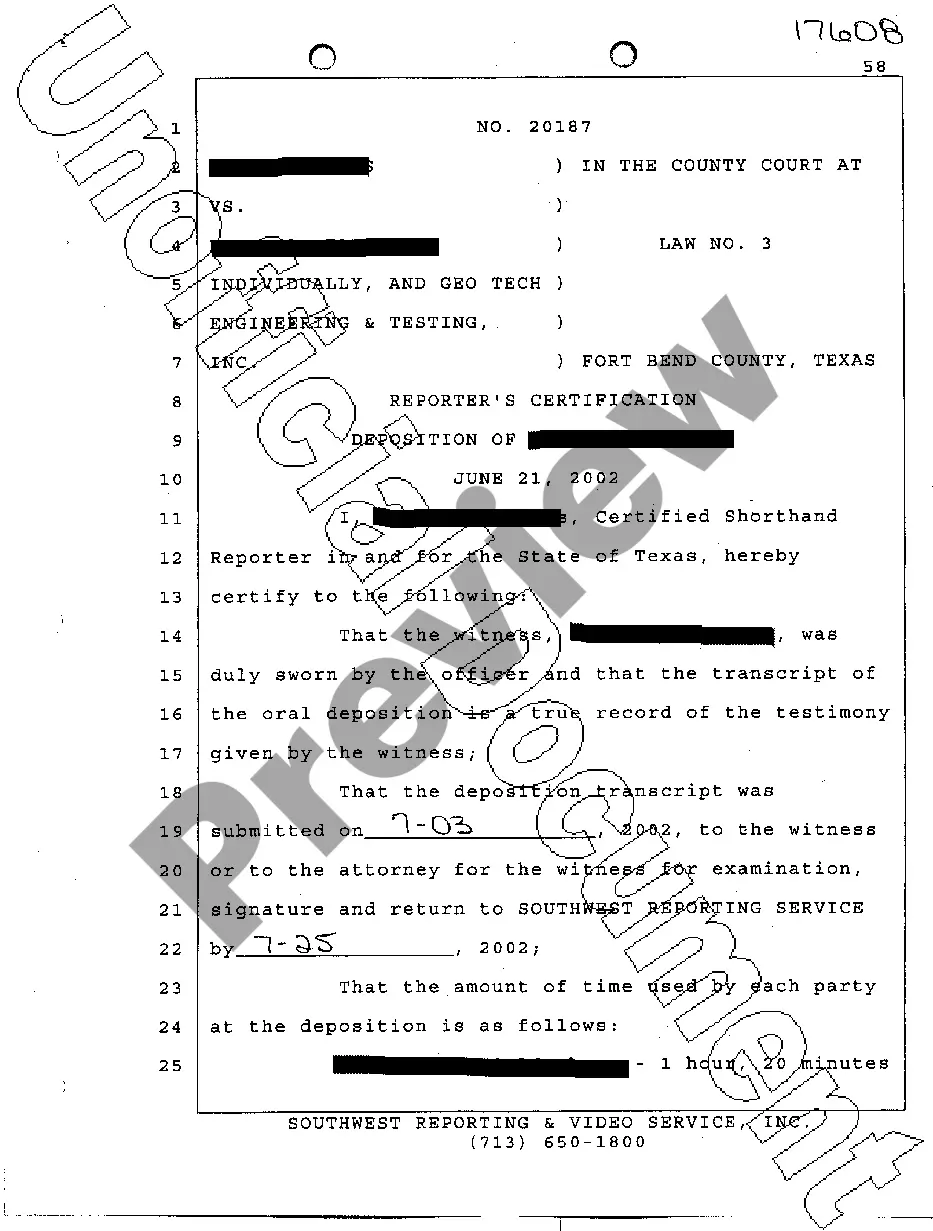

- Review the form description or view it through the Preview feature.

- Search for another template via the Search field in the header if the first one doesn't meet your expectations.

- Select Buy Now when you discover the right Arizona Installment Agreement Form.

- Choose a subscription plan that aligns with your needs and financial considerations.

- Create an account or Log In to advance to the payment section.

- Complete your payment via PayPal or with your credit card.

- Select the format for your file and click Download.

Form popularity

FAQ

Arizona Individual Income Tax Refund Inquiry(602) 255-3381 (in Phoenix) or.1-800-352-4090 (toll-free statewide, outside of Maricopa County)

Installment agreement user fees range from $225 for a payment arrangement set up by phone or mail and paid by monthly checks to $31 for a payment agreement set up online and paid by direct debit.

Electronic payments can be made using AZTaxes.gov under the Make a Payment link. Taxpayers who filed an extension with the Internal Revenue Service do not have to do so with the state, but they must check the Filing Under Extension box 82F on the Arizona tax returns when they file.

Taxpayers can pay their liability in full or make partial payments at . However, if there is an issue making a payment, taxpayers can request a monthly installment plan through AZTaxes.gov .

Who must make estimated income tax payments? You must make estimated payments for Arizona income tax purposes if your Arizona gross income for both the prior year and the current taxable year exceeds $75,000 ($150,000 for married taxpayers filing a joint return).