Tenancy Property Agreement With Trust

Description

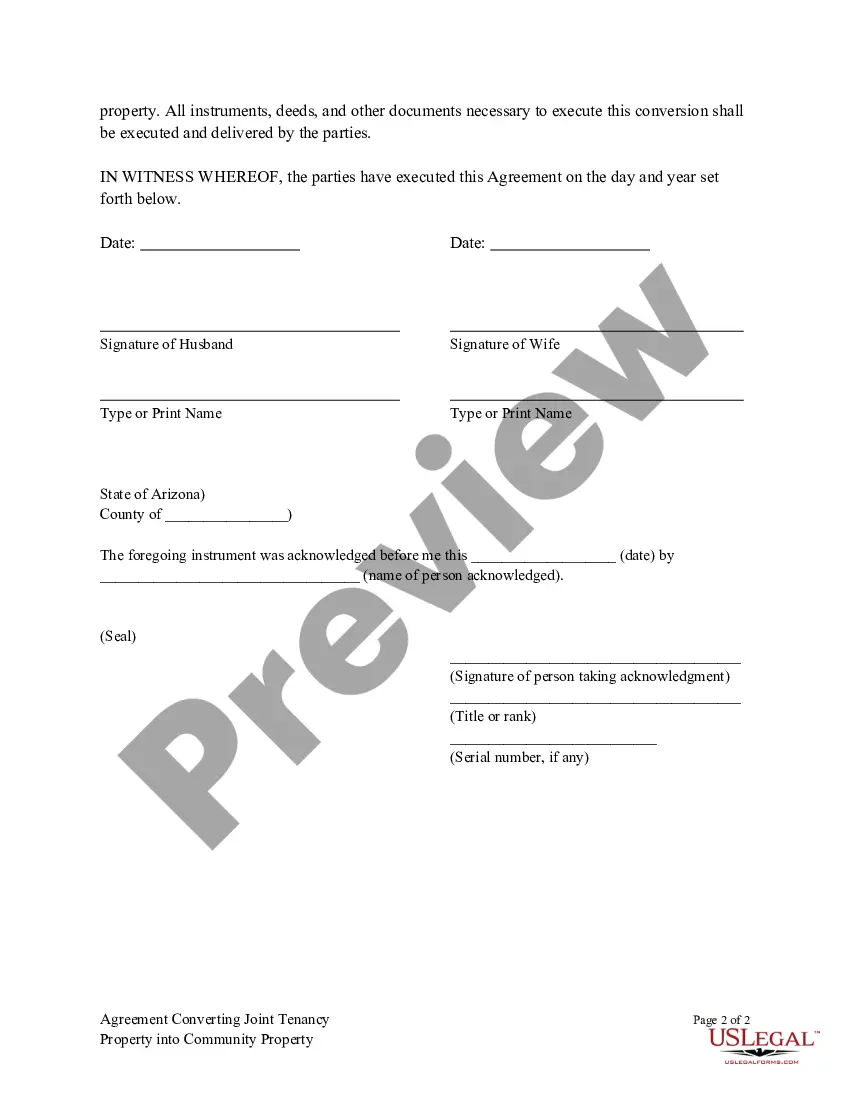

How to fill out Arizona Agreement Converting Joint Tenancy Property Into Community Property - Deed?

- Login to your account if you already have one on US Legal Forms. Ensure your subscription is active, or renew it if necessary.

- Browse the available form templates. Use the Preview mode to review the details and make sure it's the right document for you.

- Utilize the Search tab if you need to locate another template. Finding an inconsistent form? Try searching for a more suitable option.

- Purchase your document by clicking the Buy Now button. Select your preferred subscription plan, and create an account for full access.

- Complete your purchase by entering your payment details via credit card or your PayPal account.

- Download your tenancy property agreement with trust and save it locally. Access it anytime through the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of obtaining a tenancy property agreement with trust. With an extensive library of over 85,000 legal templates and the option to consult with premium experts, you can ensure that your documents meet the highest standards of accuracy and legality.

Start your journey towards legal clarity today by visiting US Legal Forms and exploring the vast resources available.

Form popularity

FAQ

A significant downfall of having a trust is the administrative burden involved, including ongoing paperwork and compliance. Regular updates may be necessary to keep the trust aligned with your wishes and changing laws. If you establish a tenancy property agreement with trust, it can simplify many tasks by detailing expectations and procedures. This proactive planning can help minimize the complexities associated with trust management.

One disadvantage of a family trust is the potential loss of flexibility, as assets placed in the trust may be harder to access without following specific procedures. This can cause frustration if family members need immediate access to funds or property. However, a well-crafted tenancy property agreement with trust can include provisions that allow for certain emergency withdrawals. This balance can help maintain both security and accessibility.

A common mistake is not clearly defining the terms and conditions of the trust, which can lead to confusion among beneficiaries. Additionally, parents sometimes forget to include all assets, resulting in unexpected issues down the line. Having a tenancy property agreement with trust can mitigate these risks by outlining how income-producing properties will be managed. This clarity fosters peace of mind for all involved.

Putting assets in a trust can be a beneficial decision for your parents, especially to streamline the transfer of wealth upon their passing. It often helps in avoiding probate and can allow for more control over how their assets are distributed. A tenancy property agreement with trust can provide a clear framework that aligns with their wishes. It may be helpful for them to consult with a legal professional to discuss their unique situation.

A trust itself cannot evict a tenant; however, the trustee can initiate eviction proceedings on behalf of the trust. The trustee holds the property and has the legal authority to make decisions regarding tenant agreements. If you have a tenancy property agreement with trust, it’s critical to ensure the trustee is aware of their responsibilities and the proper protocols for managing tenants. This clarity can prevent misunderstandings and legal issues.

Yes, you can place a rental property in a trust to manage and protect it effectively. This arrangement can simplify the transfer of property to beneficiaries and can shield assets from probate. By establishing a tenancy property agreement with trust, you provide clear guidelines on how the rental property should be managed and distributed. This structure can also help in avoiding family disputes in the future.

A trust can inherit a step-up in basis on a rental property if it is structured correctly. When the property is passed to the beneficiaries of the trust upon the owner's death, the tax basis of the property is adjusted to its current market value. This adjustment can significantly reduce capital gains taxes when the property is eventually sold. Understanding how a tenancy property agreement with trust affects taxes can lead to better financial outcomes.

Yes, you can lease a car through a trust as part of a tenancy property agreement with trust. The trust can hold the lease and manage payments and responsibilities associated with the vehicle. This arrangement can provide additional asset protection and allow for smoother transitions of ownership. If you need guidance on how to structure this effectively, platforms like US Legal Forms can provide you with the necessary documents and assistance.

While there are benefits to using a tenancy property agreement with trust, there are some disadvantages. These can include costs associated with setting up and maintaining the trust, potential tax implications, and the requirement for ongoing management. It's important to weigh these factors before deciding if a trust is the right choice for your property. Consulting resources like US Legal Forms can help clarify your options.

Yes, you can put a lease in a trust through a tenancy property agreement with trust. This allows the trust to hold the lease and manage its terms according to your wishes. When you do this, you gain control over the lease's obligations and benefits. Using US Legal Forms can simplify the process of drafting a lease that aligns with your trust structure.