This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Converting to Joint Tenancy - Deed - Arizona, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Tax Deed Property For Sale

Description

How to fill out Arizona Agreement Converting Joint Tenancy Property Into Community Property - Deed?

- Log in to your US Legal Forms account if you’re a returning user, ensuring your subscription is active. Click the Download button for your needed form template.

- If you are new to the service, begin by checking the Preview mode and description of the form to ensure it meets your local jurisdiction's requirements.

- Use the Search tab to find additional templates if your first choice does not meet your needs.

- Once you find the suitable document, click the Buy Now button to select your preferred subscription plan.

- Complete the registration and provide payment details, either via credit card or PayPal, to finalize your purchase.

- Download the purchased form and save it on your device for easy access anytime. You can also find it under the My Forms section in your profile.

In conclusion, with US Legal Forms, acquiring necessary legal documentation for tax deed property is straightforward and efficient. The comprehensive library and expert support ensure that your documents are both precise and legally sound.

Start your process today and make your legal journey easier with US Legal Forms!

Form popularity

FAQ

In California, after you buy a tax deed, you receive full ownership of the property, but there may be a redemption period during which the original owner can reclaim the property. It is important to check for any other liens, as those may affect your investment. Keeping informed about tax deed property for sale is crucial to ensure a smooth transaction.

While tax lien investing can offer great returns, there are disadvantages to consider. You might face property disputes, and some properties may require significant repairs. Additionally, tax deed property for sale can sometimes have complicated redemption processes, making it essential to stay informed about local regulations.

Buying tax deeds can be a profitable investment if you conduct due diligence on the property. Investors often find tax deed property for sale at below-market prices, and successful buyers can gain full ownership after a redemption period. However, it is crucial to understand the risks involved, including potential property disputes.

The best state to buy tax lien certificates often depends on the local laws, interest rates, and auction processes. States like Florida and Arizona are popular due to their relatively high returns. It’s essential to research the specifics, as the tax deed property for sale can vary significantly from state to state.

A tax sale typically refers to the sale of tax liens, which means the buyer pays the taxes owed and receives a certificate that can accrue interest, whereas a tax deed sale involves the outright sale of the property itself. In Michigan, tax deed property for sale means you are buying the property directly through the auction process. Understanding this difference is crucial for investors looking to engage with Michigan's real estate market effectively.

Yes, in Michigan, you can potentially take ownership of a property by paying back taxes owed on it. This process typically occurs during tax deed sales where properties with unpaid taxes are auctioned. If you win a bid on tax deed property for sale, your payment of the back taxes can secure your ownership. This allows individuals to rehabilitate homes and contribute positively to their communities.

In Michigan, simply paying property tax does not automatically grant ownership of a property. Ownership generally requires proper legal title and deed transfer. However, when purchasing tax deed property for sale, paying the outstanding taxes can lead to acquiring ownership of the property. This process can be an excellent avenue for those looking to invest or gain ownership without traditional methods.

In Michigan, home sales are subject to a state transfer tax when a property is sold. This tax is assessed at the time of sale and is separate from any property taxes owed. If you are selling a property, ensure that you account for this transfer tax along with any unpaid property taxes, especially if you are considering tax deed property for sale as an option. Understanding these obligations can help you approach your sale with clarity.

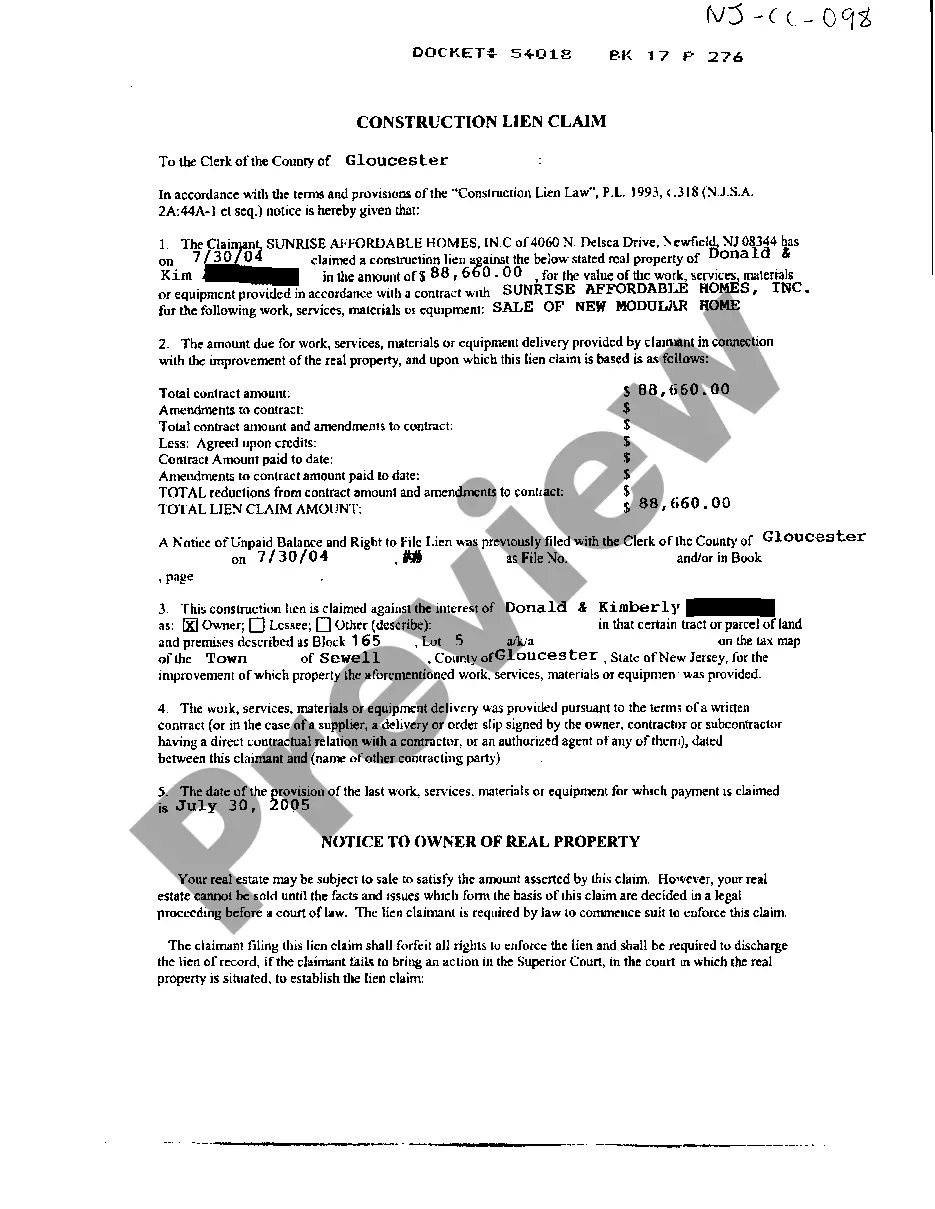

To buy tax deeds in New Jersey, you first need to research upcoming tax sales held by local municipalities. Register for the auction and be prepared to bid on properties with outstanding taxes. Once you win, you must follow legal procedures to secure your deed and become the official owner of tax deed property for sale. Platforms like US Legal Forms offer the necessary resources to understand forms and requirements, streamlining your purchasing process.

New Jersey is considered a hybrid state regarding tax sales, as it engages in both tax lien and tax deed sales. Tax deed sales occur when properties are auctioned off due to delinquent taxes. This creates pathways for investors to secure tax deed property for sale, which can be lucrative if managed correctly. Knowing the distinctions between these sales can empower you to make informed purchasing decisions.