Power Of Attorney Document For Wizz Air

Description

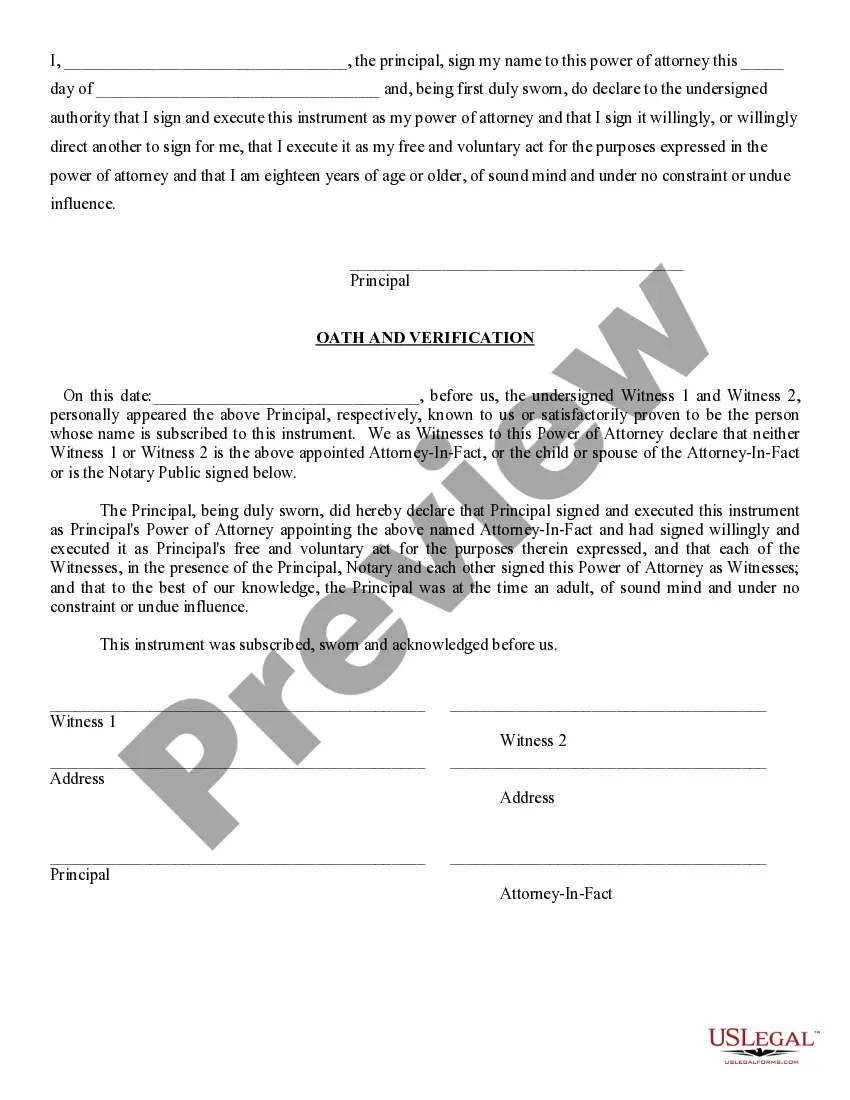

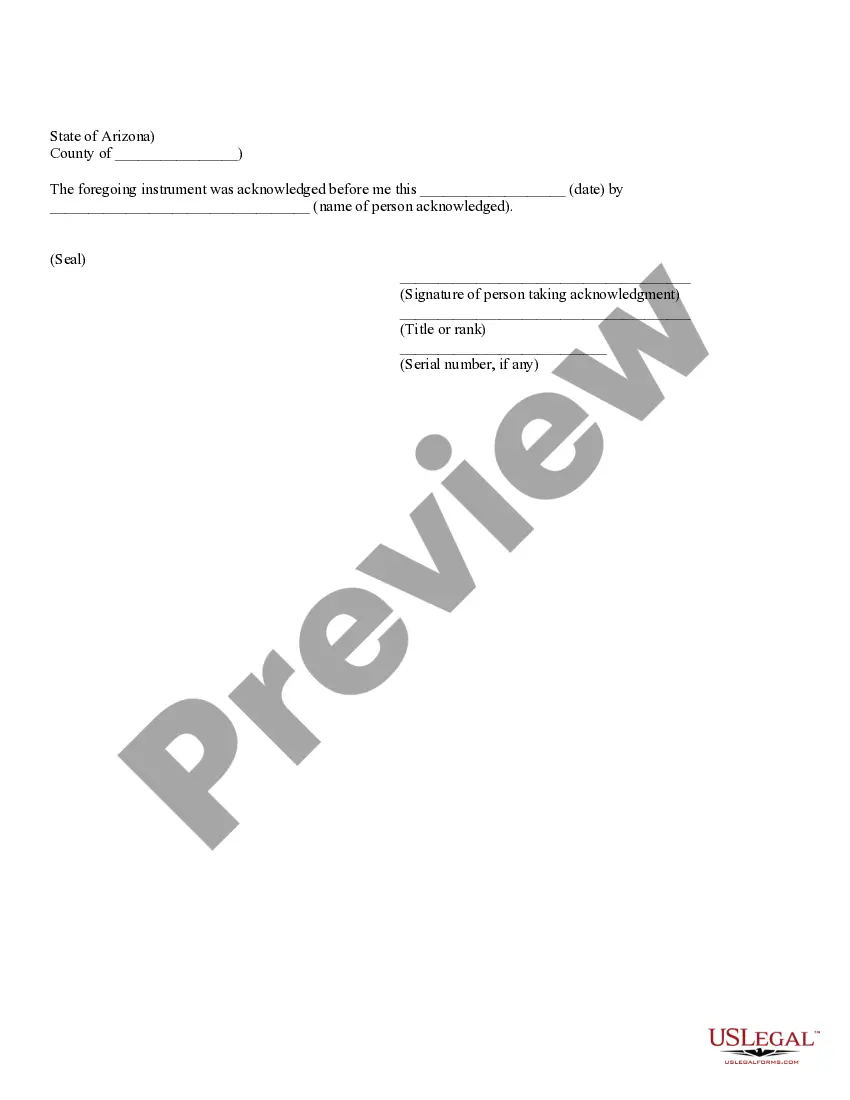

How to fill out Arizona Durable Power Of Attorney?

Locating a reliable source for the most up-to-date and pertinent legal templates is a major part of navigating bureaucracy.

Obtaining the appropriate legal documents requires accuracy and careful consideration, which is why it's crucial to obtain samples of Power Of Attorney Document For Wizz Air solely from reputable sources, such as US Legal Forms. An incorrect template can consume your time and delay your current situation.

Once you have the document on your device, you can edit it using the editor, or print it to fill it out by hand. Eliminate the burden associated with your legal documents. Explore the extensive US Legal Forms library where you can locate legal templates, verify their applicability to your situation, and download them immediately.

- Utilize the library navigation or search bar to find your template.

- Examine the form’s description to determine if it aligns with the regulations of your state and county.

- Preview the form, if an option, to confirm that it's indeed the one you seek.

- Return to the search if the Power Of Attorney Document For Wizz Air does not fulfill your requirements.

- Once you are confident in the form’s applicability, proceed to download it.

- If you are a registered user, click Log in to authenticate and access your selected forms in My documents.

- If you don’t have an account yet, select Buy now to acquire the form.

- Choose the pricing option that suits your preferences.

- Continue to the registration to finalize your transaction.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Select the file format to download Power Of Attorney Document For Wizz Air.

Form popularity

FAQ

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

The law further states that independent contractor status is evidenced if the worker: (1) has a substantial investment in the business other than personal services, (2) purports to be in business for himself or herself, (3) receives compensation by project rather than by time, (4) has control over the time and place ...

How to Write a Contractor Agreement Outline Services Provided. The contractor agreement should list all services the contractor will provide. ... Document Duration of the Work. Specify the duration of the working relationship. ... Outline Payment Terms. ... Outline Confidentiality Agreement. ... Consult with a Lawyer.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

Write the contract in six steps Start with a contract template. ... Open with the basic information. ... Describe in detail what you have agreed to. ... Include a description of how the contract will be ended. ... Write into the contract which laws apply and how disputes will be resolved. ... Include space for signatures.

Complete Form 1099-NEC, Nonemployee Compensation Businesses that pay more than $600 per year to an independent contractor must complete Form 1099-NEC and provide copies to both the IRS and the freelancer by the specified annual deadline.

If you work for a person or a company and earn $600 or more paid to you in cash (again that means paid to you by cash, check, trade, credit card payment?just no taxes taken out) within a year they are required by law to send you a 1099-MISC.

9s and 1099s are tax forms that are required when employers work with an independent contractor. Form 9 is completed by the independent contractor and provides details on who they are. Form 1099NEC is completed by the employer and details the wages paid to the contractor.