Power Attorney Form Irs

Description

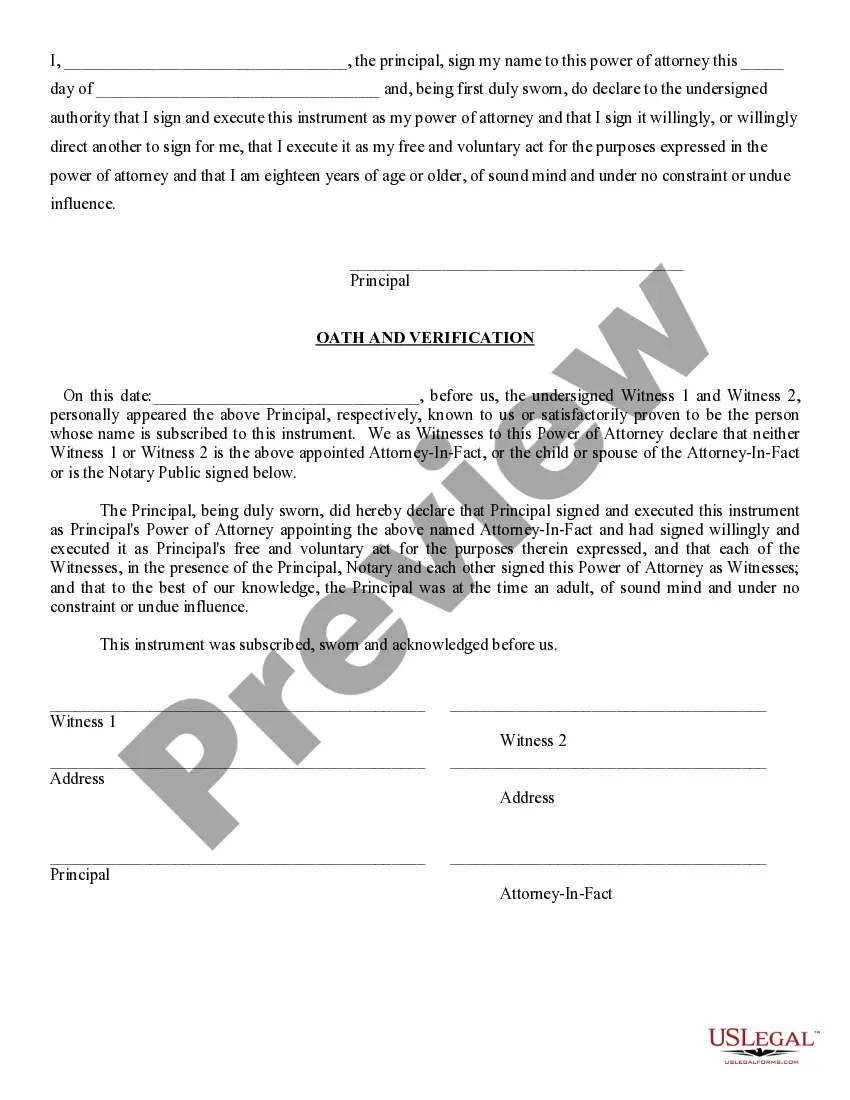

How to fill out Arizona Durable Power Of Attorney?

Individuals frequently connect legal documentation with something complicated that only an expert can manage.

In a certain sense, this is accurate, as formulating Power Attorney Document for IRS necessitates considerable understanding of subject parameters, including state and local regulations.

Nonetheless, with US Legal Forms, everything has become easier: ready-to-utilize legal templates for any life and business event specific to state statutes are compiled in a single online directory and are now accessible to everyone.

Complete your subscription payment using PayPal or with your credit card. Choose the format for your file and click Download. Print your document or import it to an online editor for quicker completion. All templates in our catalog are reusable: once purchased, they are stored in your profile. You can access them whenever necessary via the My documents tab. Explore all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and application area, making it quick to locate Power Attorney Document for IRS or any other specific template.

- Previously registered users with an active subscription must Log In to their account and click Download to obtain the form.

- New users of the service will first need to create an account and subscribe before they can download any documents.

- Here is a detailed guide on how to obtain the Power Attorney Document for IRS.

- Scrutinize the page content carefully to ensure it meets your requirements.

- Review the form description or check it using the Preview option.

- If the previous version does not meet your needs, search for another template using the Search field in the header.

- Once you find the appropriate Power Attorney Document for IRS, click Buy Now.

- Select a subscription plan that aligns with your needs and financial capability.

- Create an account or Log In to proceed to the payment section.

Form popularity

FAQ

The IRS will not process a POA that includes more than three years. If a POA needs to be filed for more than three years, multiple forms need to be filed at the same time. A POA can be prepared up to two years in advance, counting from the last year of actual filing.

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.

It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC).

Submit your completed Form 2848 to the IRS First, you can mail it, which takes at least a week. Second you can fax it, which takes 5-7 business days for processing.

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.