Arizona Inheritance Estate Without

Description

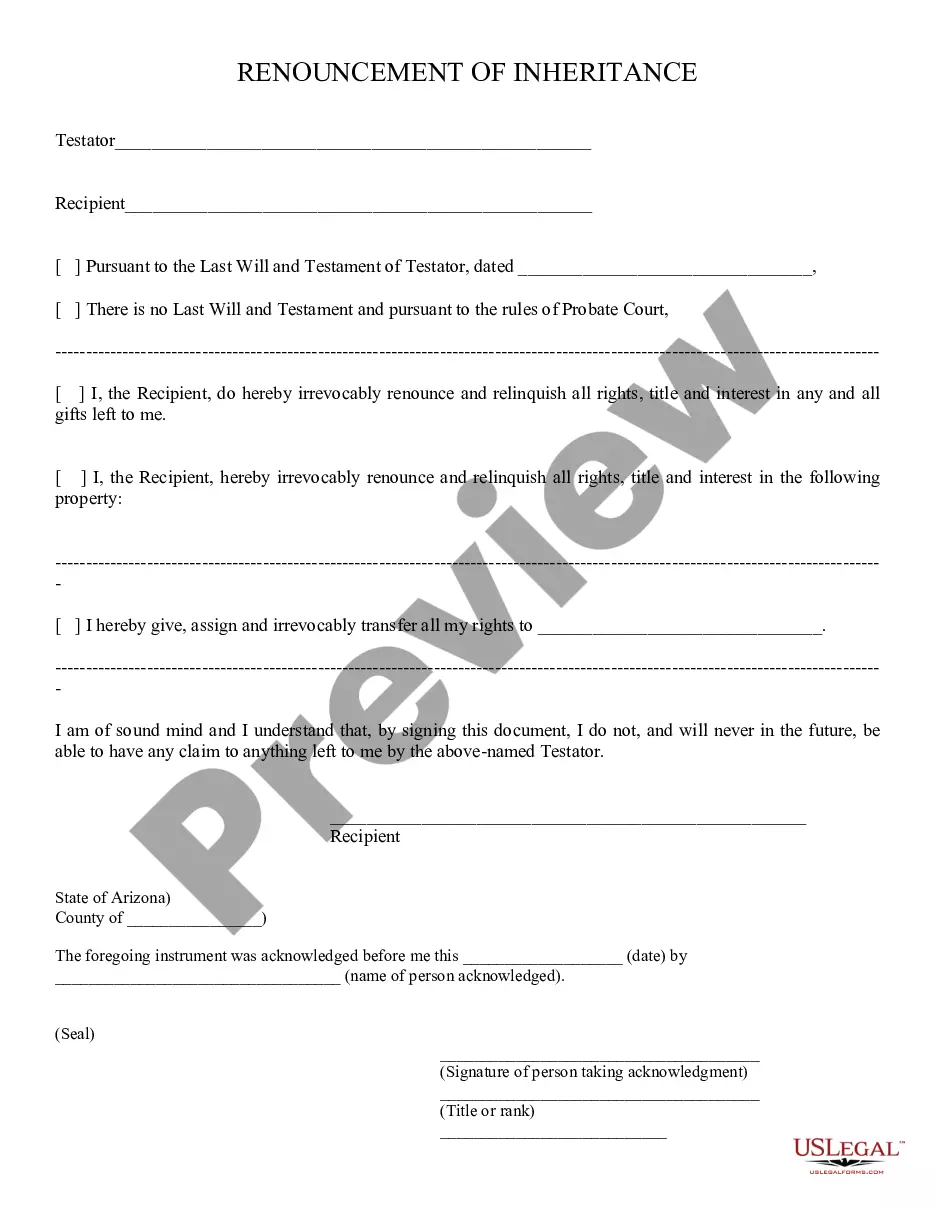

How to fill out Arizona Renouncement Of Inheritance?

Whether for business purposes or for individual affairs, everybody has to handle legal situations at some point in their life. Filling out legal documents needs careful attention, starting with picking the correct form template. For instance, if you choose a wrong version of a Arizona Inheritance Estate Without, it will be declined once you submit it. It is therefore crucial to have a reliable source of legal papers like US Legal Forms.

If you have to obtain a Arizona Inheritance Estate Without template, follow these easy steps:

- Find the template you need using the search field or catalog navigation.

- Examine the form’s information to make sure it fits your case, state, and region.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to find the Arizona Inheritance Estate Without sample you need.

- Download the file when it matches your needs.

- If you have a US Legal Forms account, click Log in to gain access to previously saved files in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Finish the account registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Select the file format you want and download the Arizona Inheritance Estate Without.

- Once it is saved, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time looking for the right template across the internet. Take advantage of the library’s easy navigation to get the correct form for any situation.

Form popularity

FAQ

In Arizona, intestate succession laws give preference to the decedent's spouse and children. If the decedent does not have a spouse or children, the decedent's parents, siblings, and extended family may be entitled to portions of the estate.

How Much Can You Inherit From Your Parents Without Paying Taxes? Based on state and federal tax rules in 2022, a person may inherit up to $12.06 million without paying taxes, provided that the deceased was a resident of Arizona or another state that does not impose an inheritance tax.

If you have a spouse but no descendants, your spouse will receive your assets. For those who are married and have descendants with their spouse, the spouse will inherit everything.

There is no inheritance tax in Arizona. If you have a loved one who lives in another state, however, you should check the local laws. Pennsylvania, for instance, as an inheritance tax that can apply to out-of-state heirs. Arizona also has no gift tax.

If a spouse or children survive the person who died, generally speaking, these assets would go to the spouse and children. If neither exist, a close relative would inherit the assets.