Final Petition Distribution Formula

Description

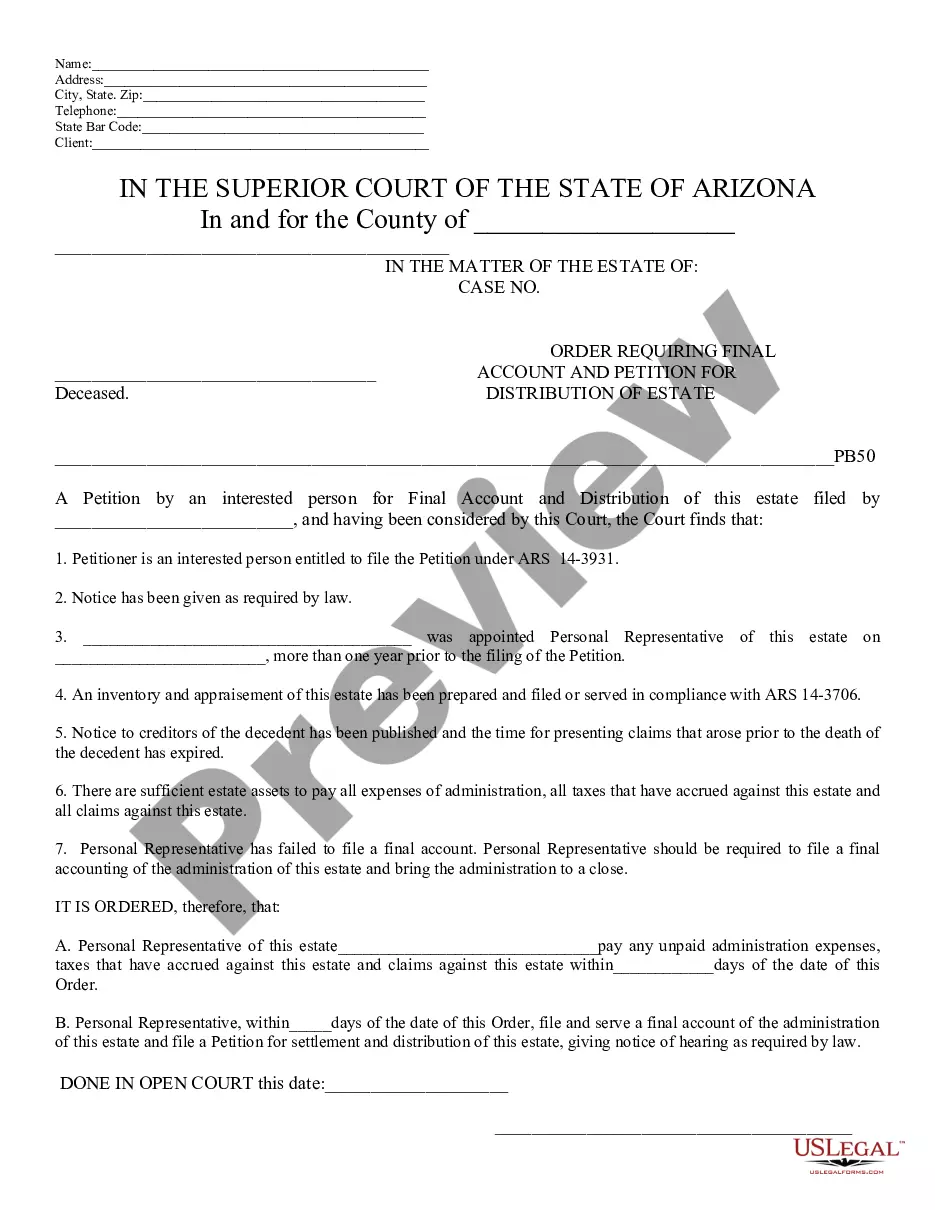

How to fill out Arizona Order Requiring Final Accounting And Petition For Distribution Of Estate?

When you need to submit the Final Petition Distribution Formula that adheres to your local state's laws, there can be numerous options to choose from.

There's no necessity to verify every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Navigate through the suggested page and verify it for alignment with your requirements.

- US Legal Forms is the largest online repository with a collection of over 85,000 ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's regulations.

- As a result, when downloading the Final Petition Distribution Formula from our platform, you can be assured that you have a valid and updated document.

- Acquiring the necessary sample from our platform is remarkably simple.

- If you already possess an account, simply Log In to the system, confirm that your subscription is active, and save the selected file.

- Later, you can navigate to the My documents tab in your profile and maintain access to the Final Petition Distribution Formula at any time.

- If this is your first experience with our website, please follow the steps below.

Form popularity

FAQ

A final decree signifies the court's concluding decision on matters relating to the estate. This decree confirms the completion of probate and provides direction on how remaining assets should be distributed to beneficiaries. Knowing the final petition distribution formula is essential as it influences the clarity and efficiency of the final decree.

A final account and petition for distribution is a document that outlines the estate’s total assets, liabilities, and the proposed distribution plan to beneficiaries. This document is presented to the court for approval prior to the final distribution of assets. Familiarizing yourself with the final petition distribution formula can empower you to create an accurate account, easing the court’s approval process.

A final decree of distribution is a court’s formal approval of how an estate’s assets will be distributed. It marks the legal conclusion of the probate process, signifying that all debts and taxes have been settled. Grasping the final petition distribution formula can provide clarity during this essential time for all parties involved.

A final distribution refers to the last step in the probate process, where remaining assets are allocated to the beneficiaries according to the will or law. This process culminates in a report that supports the distribution of the estate's assets. A solid understanding of the final petition distribution formula can assist in managing this vital step efficiently.

In California, an executor typically has about one year to complete the distribution of funds and assets to beneficiaries. This timeframe can be extended depending on situations such as tax matters or disputes among heirs. Utilizing the final petition distribution formula can streamline this process, ensuring timely settlements that adhere to legal requirements.

A decree of final distribution is a legal order issued by a court that outlines the distribution of assets from an estate after the completion of probate. This decree confirms how the assets will be allocated among the beneficiaries as per the wishes expressed in the will or state laws. Understanding the final petition distribution formula can help clarify this process and ensure that every beneficiary understands their share.

The final estate distribution letter is a crucial document that outlines how an estate's assets will be distributed among beneficiaries. This letter uses the final petition distribution formula to ensure that the distribution is fair and complies with legal standards. It serves as a guide for the executor or administrator in carrying out their duties and provides clarity to beneficiaries about their expected inheritances. Understanding this letter is essential for anyone involved in the estate settlement process.

Distributions from a deceased estate are the processes through which the estate's assets are allocated to beneficiaries. This process typically follows the final petition distribution formula, ensuring adherence to the decedent's wishes and legal requirements. Awareness of the detailed distribution process helps prevent disputes among beneficiaries. For assistance in understanding this complex process, consider exploring the US Legal Forms platform, which provides valuable guidance and legal forms.

Interim distribution occurs during the probate process, allowing partial asset allocation before the estate is fully settled. In contrast, the final distribution follows the completion of all probate tasks and adheres to the final petition distribution formula. Understanding this distinction helps you manage expectations among heirs. The US Legal Forms platform offers forms and resources to facilitate both interim and final distributions effectively.

Distributing estate assets effectively involves following the final petition distribution formula. This formula guides the executor in allocating the decedent's assets according to their wishes and relevant laws. It is crucial to ensure fairness and transparency among beneficiaries. You can streamline this process by utilizing the resources available on the US Legal Forms platform.