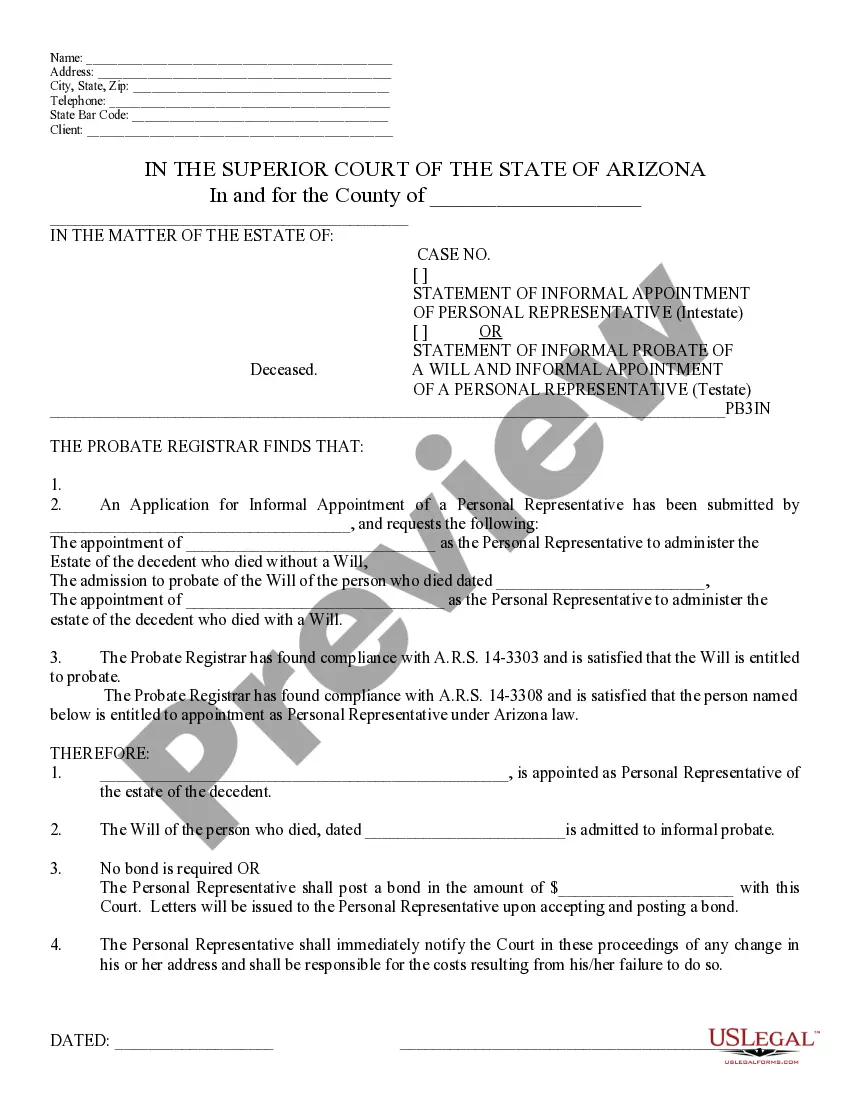

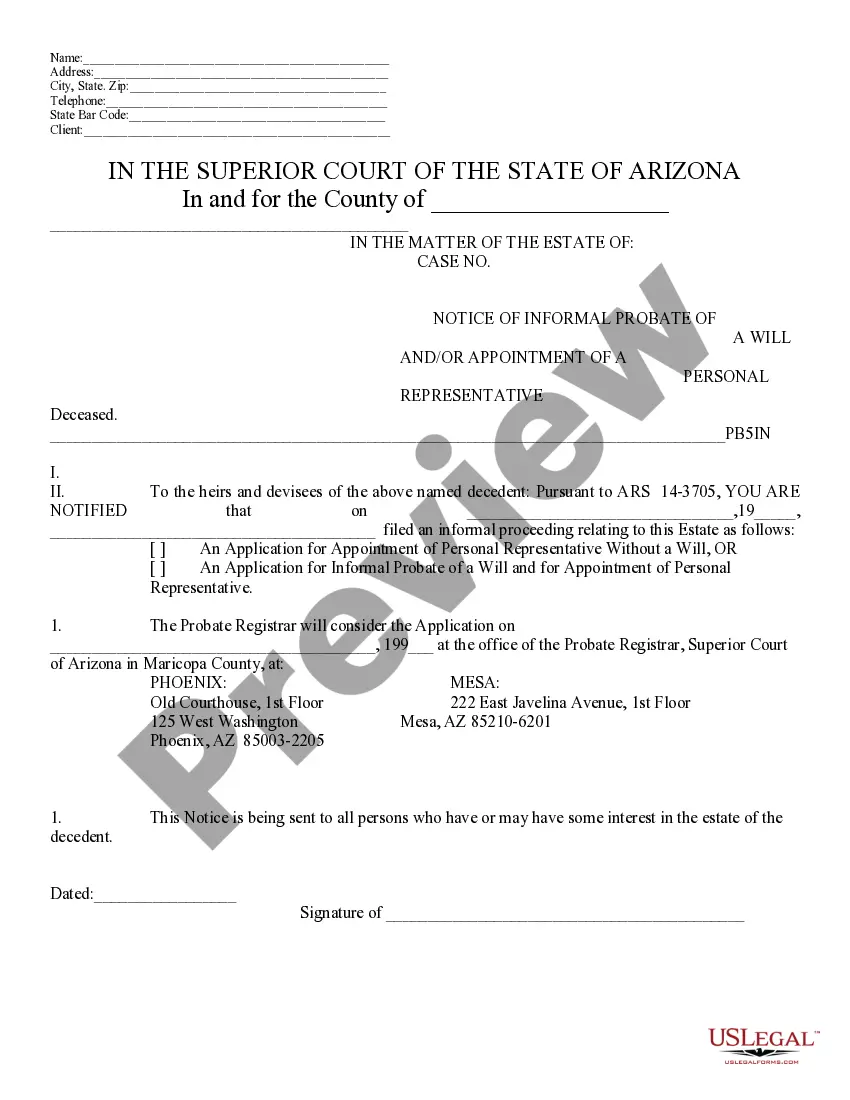

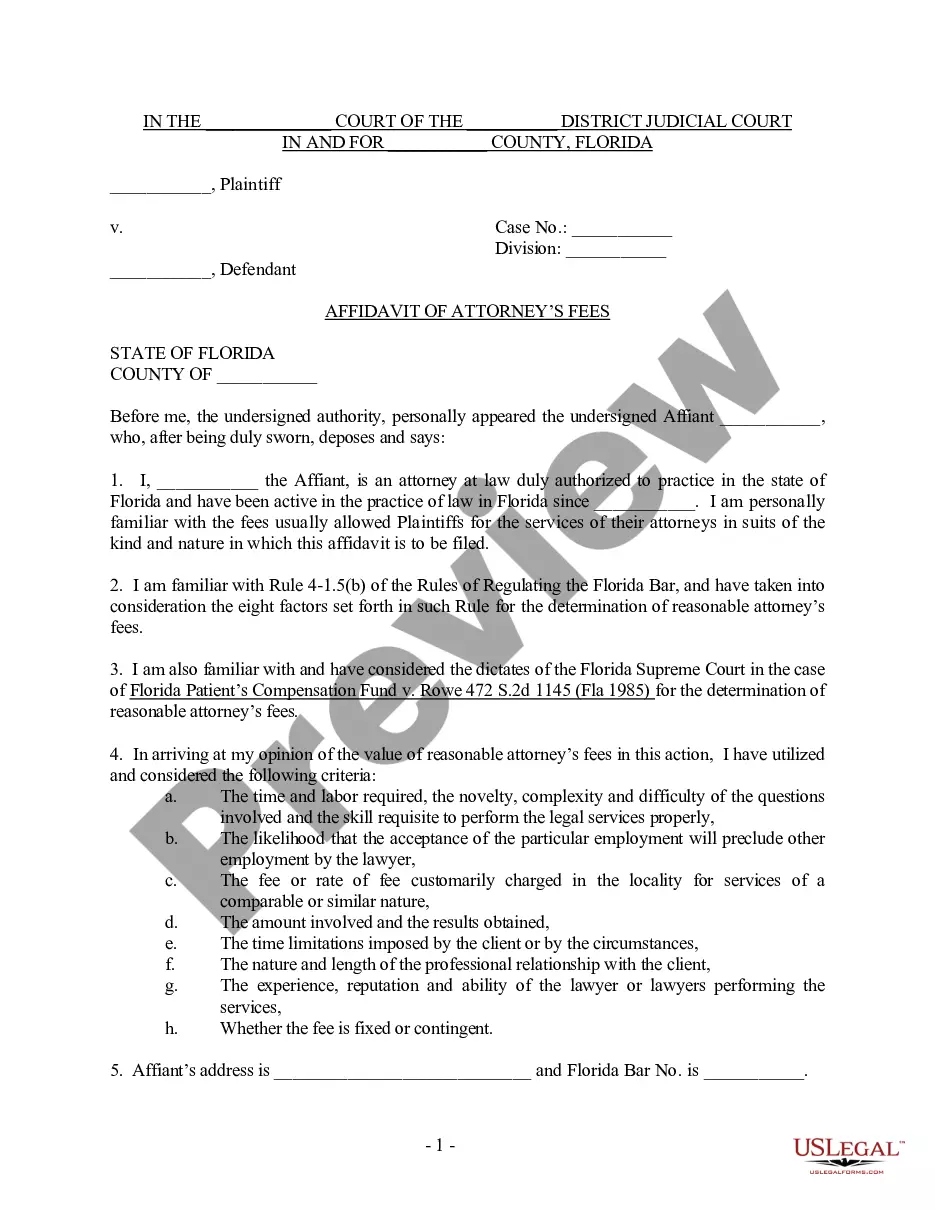

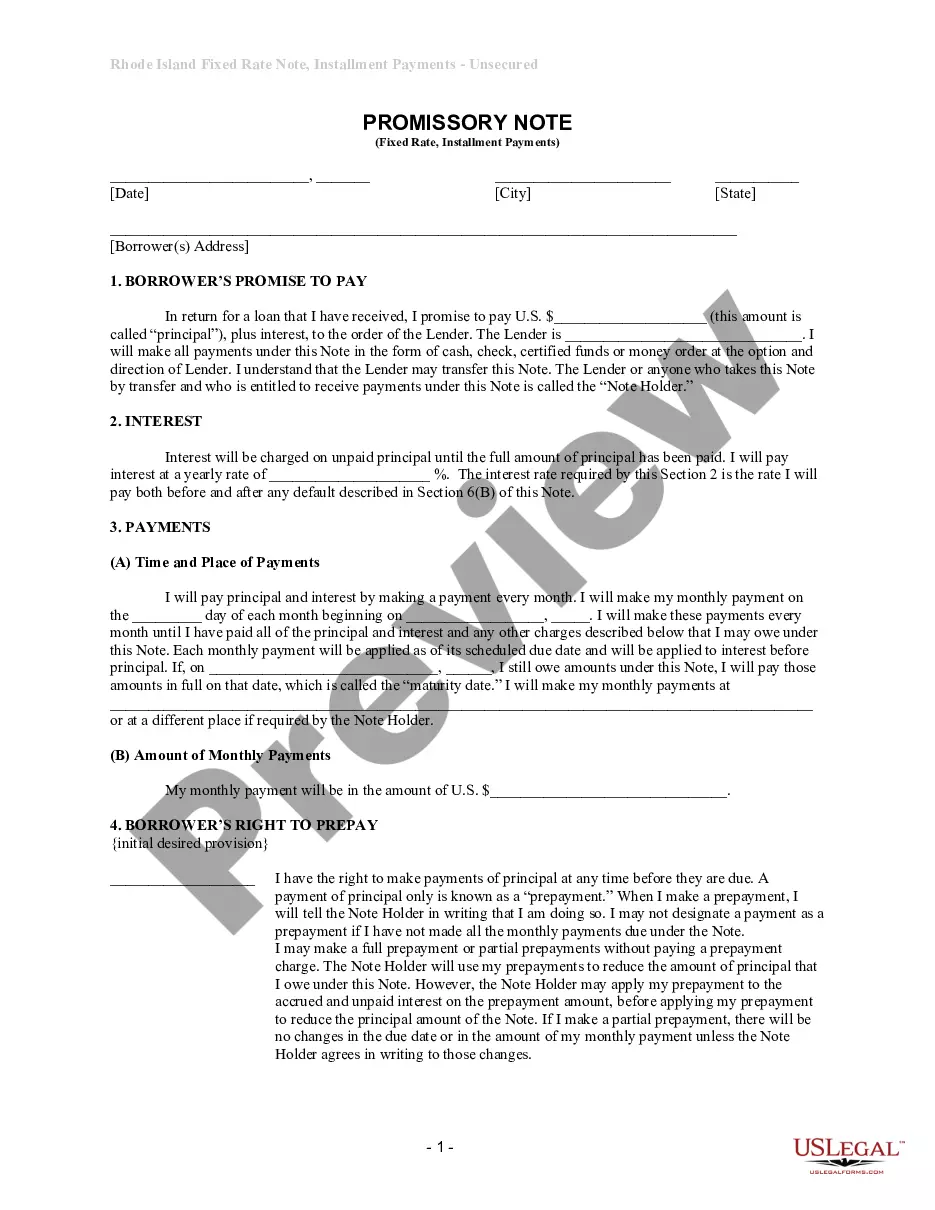

Statement of Informal Probate of a Will; Appt. of Personal Representative - Arizona: This document seeks to both appoint a personal representative for an estate, as well as begin probate of the decedent's will. A personal representative nominee is named, and the proposed will is attached. This form is signed in front of a Notary Public and is available for download in both Word and Rich Text formats.

Of Will Personal With The Law

Description

How to fill out Arizona Statement Of Informal Probate Of A Will And Appointment Of Personal Representative?

- If you’re a returning user, log in to your account and check your subscription status. Click the Download button for the form you need.

- For first-time users, start by reviewing the Preview mode and form descriptions to ensure you select the correct template aligned with your legal requirements.

- If necessary, broaden your search using the Search tab to find any other applicable forms.

- Once you locate the ideal document, click the Buy Now button and choose your preferred subscription plan. You'll need to create an account to unlock access to all forms.

- Complete your purchase by entering your payment information or using your PayPal account.

- Finally, download the form to your device, enabling you to fill it out and access it via the My Forms section of your profile at any time.

US Legal Forms provides a powerful solution for those looking to efficiently manage their legal documents. With a vast library of over 85,000 customizable legal forms, users can find exactly what they need.

Don't hesitate to empower your legal journey—get started with US Legal Forms today and ensure your documents are accurate and compliant.

Form popularity

FAQ

Yes, you can sue someone for not following a will if you are an interested party, such as an heir or a beneficiary. Disputes may arise regarding the executor's actions or the mismanagement of estate assets. Utilizing resources like USLegalForms can provide essential guidance on how to address issues surrounding will personal with the law effectively.

When a will is not followed after death, it can result in legal challenges and conflicts among heirs. Heirs may contest the validity of the will, or seek court intervention, leading to a lengthy probate process. Understanding will personal with the law can help all parties navigate these complexities with clarity and minimize disputes.

If someone does not follow the directions outlined in a will, it can lead to disputes among heirs and possible legal action. The executor may face challenges in managing the estate properly, causing potential delays and complications. It’s crucial that individuals understand the implications of will personal with the law to maintain harmony and fulfill their loved one's wishes.

Yes, there is a time limit for submitting a will for probate after death, which varies by state. Typically, heirs need to file the will within a certain period, often around 30 to 90 days, to ensure legal validity. Familiarizing yourself with these deadlines is essential for navigating will personal with the law successfully.

The 3-year rule refers to the timeframe within which claims against a deceased estate must be made. Generally, creditors have three years from the date of death to present claims, after which the estate may be settled, and remaining assets distributed to heirs. Understanding this rule can help heirs manage their expectations and responsibilities in matters of will personal with the law.

The original copy of a will is typically kept by the executor named in the document or stored in a safe place, such as a bank safe deposit box or an attorney's office. It's important that the person responsible, often the executor, informs family members of its location. Keeping the will secure ensures that it is accessible when needed, aligning with the aim of will personal with the law.

No, a will does not have to be notarized in Minnesota to be valid. The main requirement is that the will must be signed by the testator and witnessed. However, notarization can enhance its credibility and reduce the risk of future disputes related to its validity.

One of the biggest mistakes people make with wills is failing to update them regularly. Life circumstances, such as marriage, divorce, or the birth of a child, may necessitate changes. Regularly reviewing your will helps ensure that it continues to meet your wishes in accordance with the law.

In Minnesota, a living will does not require notarization to be valid. However, having it notarized may provide an additional layer of legal protection. It's always beneficial to consult with an attorney or use services like UsLegalForms, which can clarify the requirements of living wills.

To be valid in Minnesota, a will must be in writing, signed by the testator, and witnessed by at least two individuals. These witnesses must be present at the signing and understand that they are witnessing the will being executed. Meeting these requirements ensures that your will aligns with the law.