Of Will Personal With A

Description

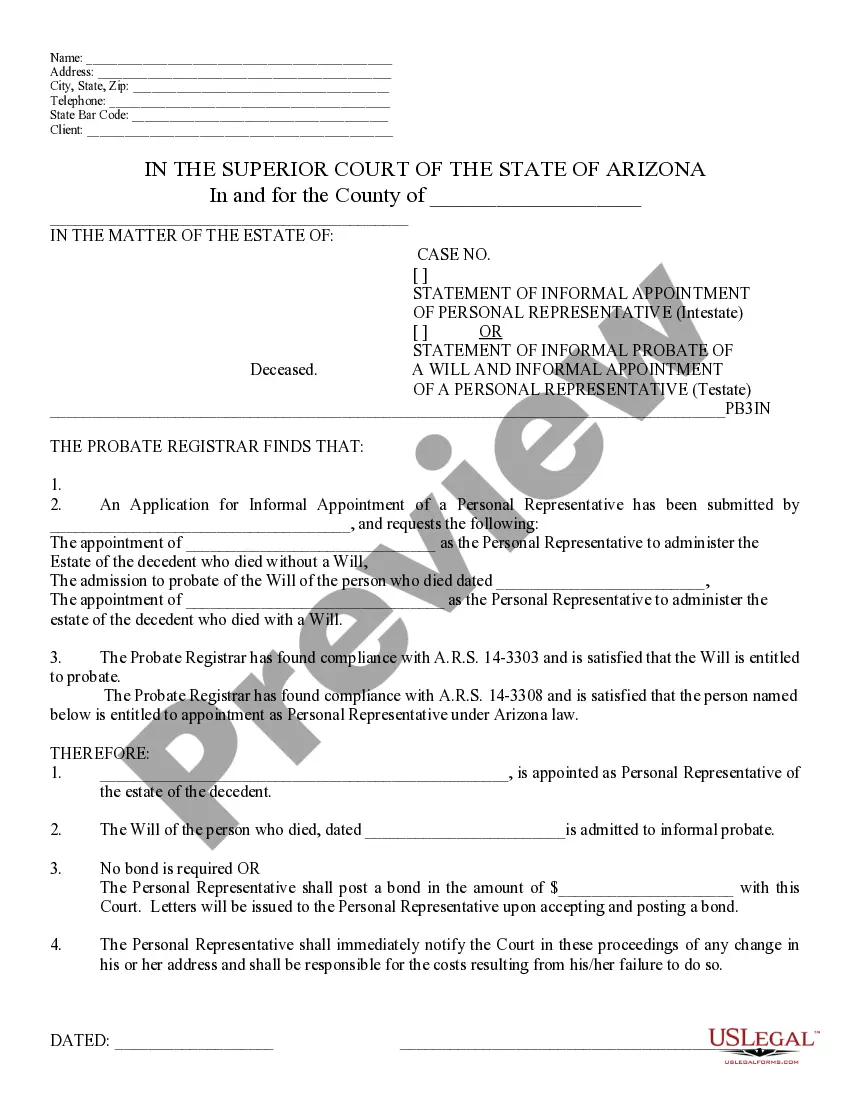

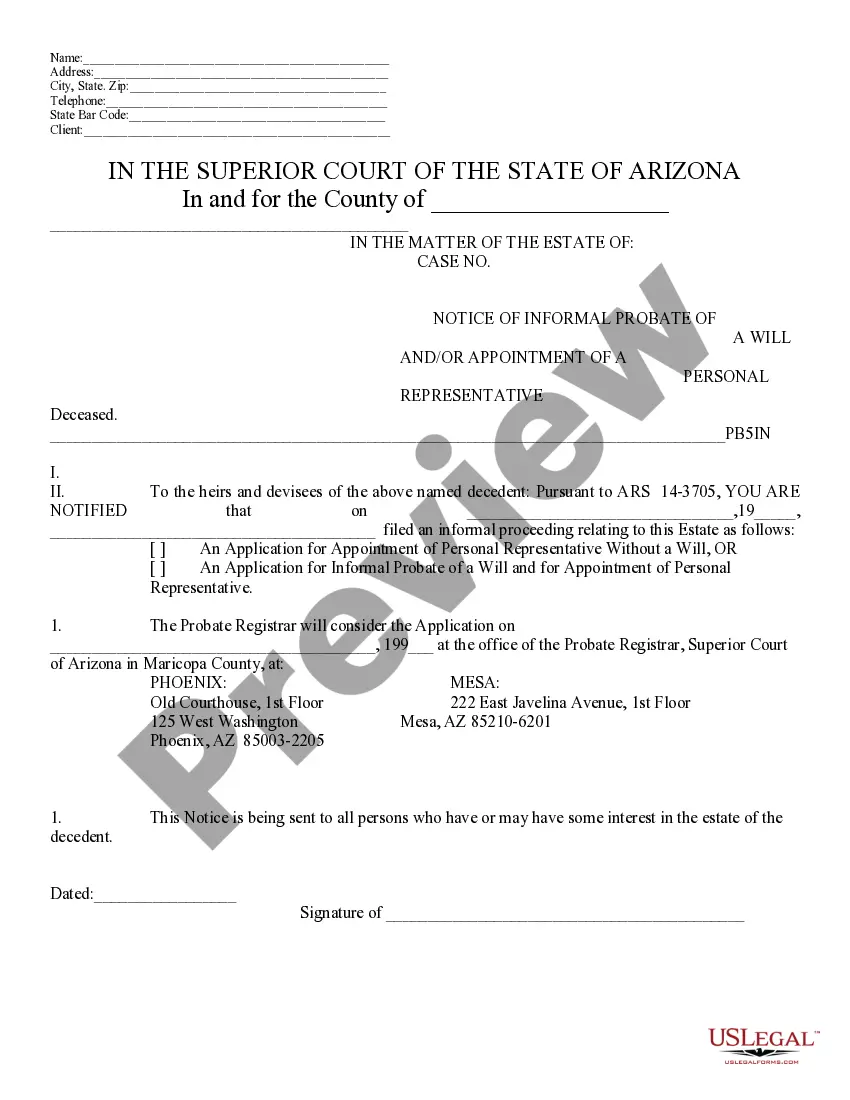

How to fill out Arizona Statement Of Informal Probate Of A Will And Appointment Of Personal Representative?

- Log in to your US Legal Forms account if you’re a returning user and ensure your subscription is active. Click 'Download' next to the desired form template.

- For first-time users, start by reviewing the available forms in Preview mode. Check the form descriptions to ensure it aligns with your needs and local jurisdiction.

- If you need a different template, utilize the Search tab to find the right one. Confirm its suitability before progressing.

- Click the 'Buy Now' option for your chosen document, select your preferred subscription plan, and create an account to access the full library.

- Complete your purchase by entering credit card information or using PayPal for easy payment.

- Download your completed form to your device, ensuring you can access it through the 'My Forms' section at any time.

In conclusion, US Legal Forms offers a user-friendly platform equipped with comprehensive resources to meet diverse legal needs. Whether you're a seasoned user or a newcomer, the process is designed for efficiency and clarity.

Get started today and experience the ease of legal document management with US Legal Forms!

Form popularity

FAQ

In cases where there is no will, an executor typically does not have the authority to decide who receives your assets. Instead, the court appoints an administrator to follow state intestacy laws, which outline how assets are distributed among surviving relatives. To ensure your preferences are honored, it is wise to create a will and designate a personal representative through a reliable platform like uslegalforms.

In many contexts, executor and personal representative refer to the same role; however, executor specifically describes the person named in a will to manage the estate. A personal representative can also refer to someone appointed by the court to oversee the estate if there is no will. Understanding these terms can guide you in choosing the right person to carry out your wishes.

To create a valid will in North Carolina, your document must be in writing, signed by you, and witnessed by at least two individuals. It is essential that you are of sound mind and at least 18 years old at the time of signing. Following these guidelines ensures your wishes regarding the distribution of your assets will be respected, providing peace of mind for you and your loved ones.

Selecting a personal representative is a crucial decision in the estate planning process. Ideally, this person should be reliable, responsible, and capable of managing financial matters. Many choose a close family member or a trusted friend, but consider discussing the role with candidates beforehand to ensure they are willing and able to take on this important responsibility.

The personal representative of a will is the individual appointed to execute your final wishes after your passing. This person is responsible for managing your estate, paying debts, and distributing assets as outlined in your will. You should choose someone trustworthy and organized, as they will play a vital role in ensuring your estate is handled properly.

A trustee manages assets in a trust, while a personal representative handles the estate of a deceased person according to the will. If you create a will, it typically names a personal representative to carry out your final wishes. Both roles have significant duties, but understanding their differences helps you make informed decisions for your estate.

In Minnesota, a will does not have to be notarized to be valid, but it must be signed by two witnesses. However, having a notary public may help streamline the probate process later. If you're unsure about the requirements, using a service like US Legal Forms can clarify the process and help you create a compliant will.

To write a simple will without a lawyer, gather your assets and determine how you would like them distributed. Use clear and concise language, and specify an executor who will ensure your wishes are followed. You can take advantage of online services like US Legal Forms, which provide templates and guidance to make this process easy.

A handwritten letter, often referred to as a holographic will, can override a formal will in certain situations, but it must meet specific legal criteria. The letter should clearly express your intentions regarding your assets and be signed and dated. However, this can lead to disputes, so it's best to use a formal will when possible. Consider using US Legal Forms for a clear and legally binding will.

To write a will for a single person, start by listing all assets and personal possessions. Clearly state your desires regarding the distribution of these items after your passing. Use straightforward language and include an executor who will carry out your wishes. Platforms like US Legal Forms offer user-friendly templates to guide you through this process.