Do You Need A Will To Apply For Probate

Description

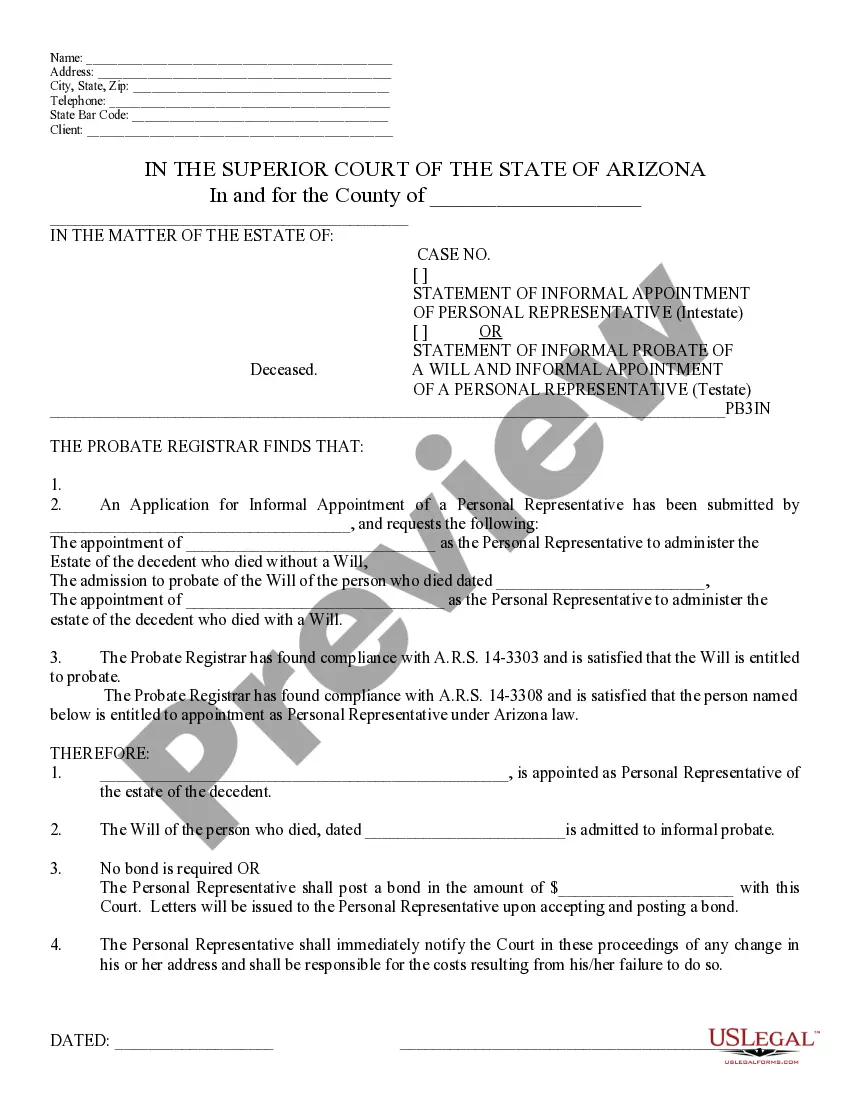

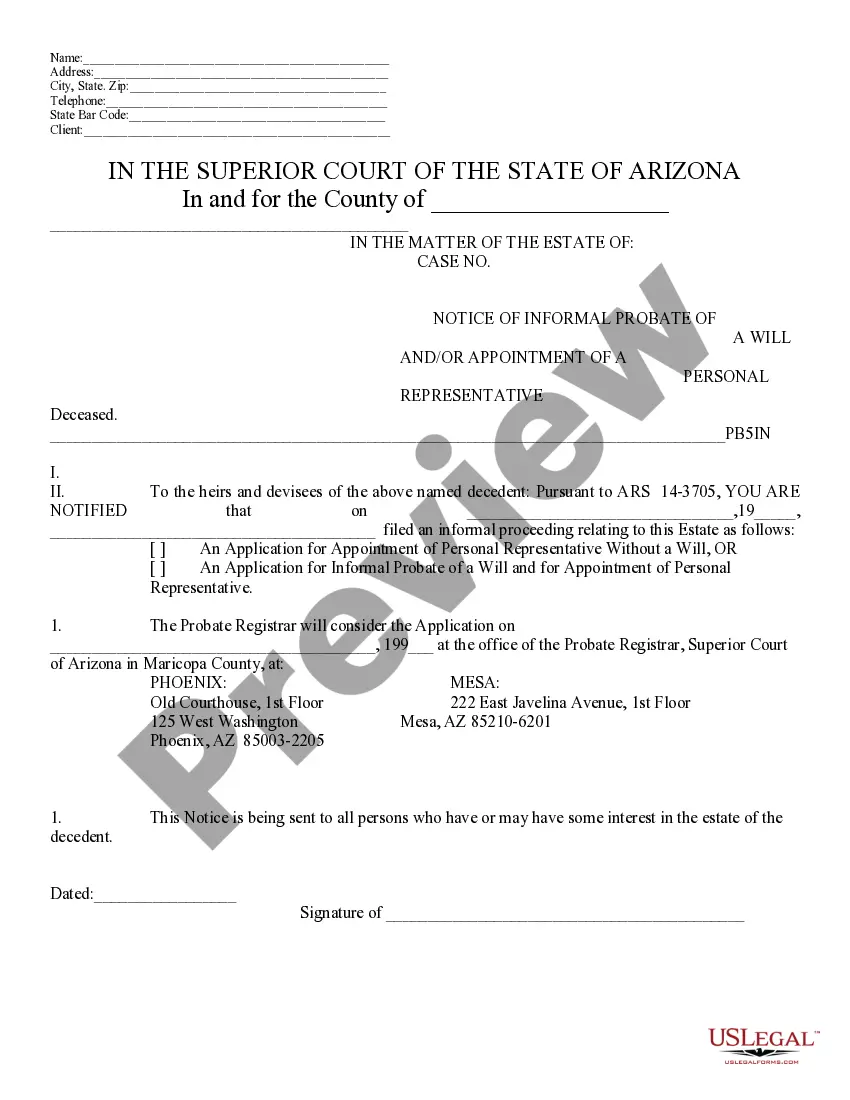

How to fill out Arizona Statement Of Informal Probate Of A Will And Appointment Of Personal Representative?

- If you're a returning user, log in to your account on the US Legal Forms website and download the required document by clicking the Download button. Ensure your subscription is active—if not, renew it based on your chosen plan.

- For first-time users, start by reviewing the Preview mode and the form description. Confirm that you have selected the appropriate template that aligns with your specific needs and local jurisdiction.

- If you encounter any discrepancies, use the Search feature to locate an alternative template that may better fit your requirements.

- Once you find the correct document, click the Buy Now button and select your preferred subscription option. You will need to create an account to access the full library.

- Proceed with your purchase by entering your credit card information or utilizing your PayPal account for the transaction.

- After completing the purchase, download your form to your device and access it anytime from the My Forms section in your account for easy completion.

In conclusion, leveraging US Legal Forms not only streamlines the process of obtaining critical legal documents but also provides access to expert assistance when needed. Ensure your legal affairs are in order—visit US Legal Forms today!

Don’t wait; start your legal journey with confidence!

Form popularity

FAQ

Not all wills in Tennessee must go through probate. If a will is created but the estate is small enough to qualify for a simplified process, probate may not be necessary. However, if you're asking, 'Do you need a will to apply for probate?', it's essential to note that a valid will indeed facilitates this legal process. For those looking to streamline their experience, uslegalforms provides resources to guide you through the probate process effectively.

In Tennessee, estates valued at over $50,000 typically require probate. However, this threshold may vary based on specific circumstances, including the nature of the assets involved. If the estate falls under this value, and you are wondering, 'Do you need a will to apply for probate?', it's important to understand that having a will can simplify the process significantly. For larger estates, it's advisable to consult a legal expert to navigate the probate requirements properly.

Certain assets do not go through probate, such as those held in joint tenancy, life insurance policies with named beneficiaries, and assets in trusts. These assets pass directly to the designated individuals without the need for probate court involvement. This can significantly expedite the transfer process and minimize estate costs. When considering this, think about do you need a will to apply for probate? Understanding which assets are exempt can help you in estate planning.

Yes, you can handle your own probate in Texas, but it's important to know the process can be complex. You will need to file the appropriate forms and gather the necessary documents to initiate the probate. Make sure you are familiar with Texas laws related to probate, as mistakes can lead to complications. Consider that do you need a will to apply for probate? A valid will can make this process easier.

You are not required to register a will when someone dies, but it must be filed with the probate court to begin legal proceedings. This filing is how the court recognizes the will as valid and allows the executor to carry out its directives. It’s essential for the executor to act promptly, as delays may complicate matters. Remember, do you need a will to apply for probate? A properly registered will is crucial.

Filling out a simple will involves identifying your assets and naming beneficiaries to inherit them after your passing. You will want to outline guardianship if you have minor children. Additionally, include the executor who will manage your estate. As you complete this task, consider that do you need a will to apply for probate? A clear will can make the probate process smoother.

In order to probate a will, you must gather essential documents. These usually include the original will, a death certificate, and the necessary court forms for probate. You may need to provide financial documents that list the deceased's assets and liabilities. As you proceed, keep in mind that do you need a will to apply for probate? Having a valid will simplifies the journey.

To probate a will, you typically need the original will, a death certificate, and a petition for probate. The will serves as your primary document, while the death certificate proves that the individual has passed away. If you're dealing with real estate or other assets, additional paperwork may be required. Remember, do you need a will to apply for probate? A properly drafted will simplifies this process.

Probate in Indiana is typically triggered when a deceased person's assets exceed a certain value or when specific types of assets are involved. If the estate includes real estate or exceeds the limits set by the state, probate is necessary to ensure proper distribution. Additionally, having a will often simplifies the process. Consider whether you need a will to apply for probate to avoid potential roadblocks.

The 3-year rule in Tennessee refers to the time limit for creditors to claim debts against a deceased person's estate. After three years from the date of death, creditors lose the right to collect debts from the estate. This rule emphasizes the importance of understanding estate management timelines. Knowing whether you need a will to apply for probate is crucial for protecting your estate and your heirs.