Grant Of Probate With Will

Description

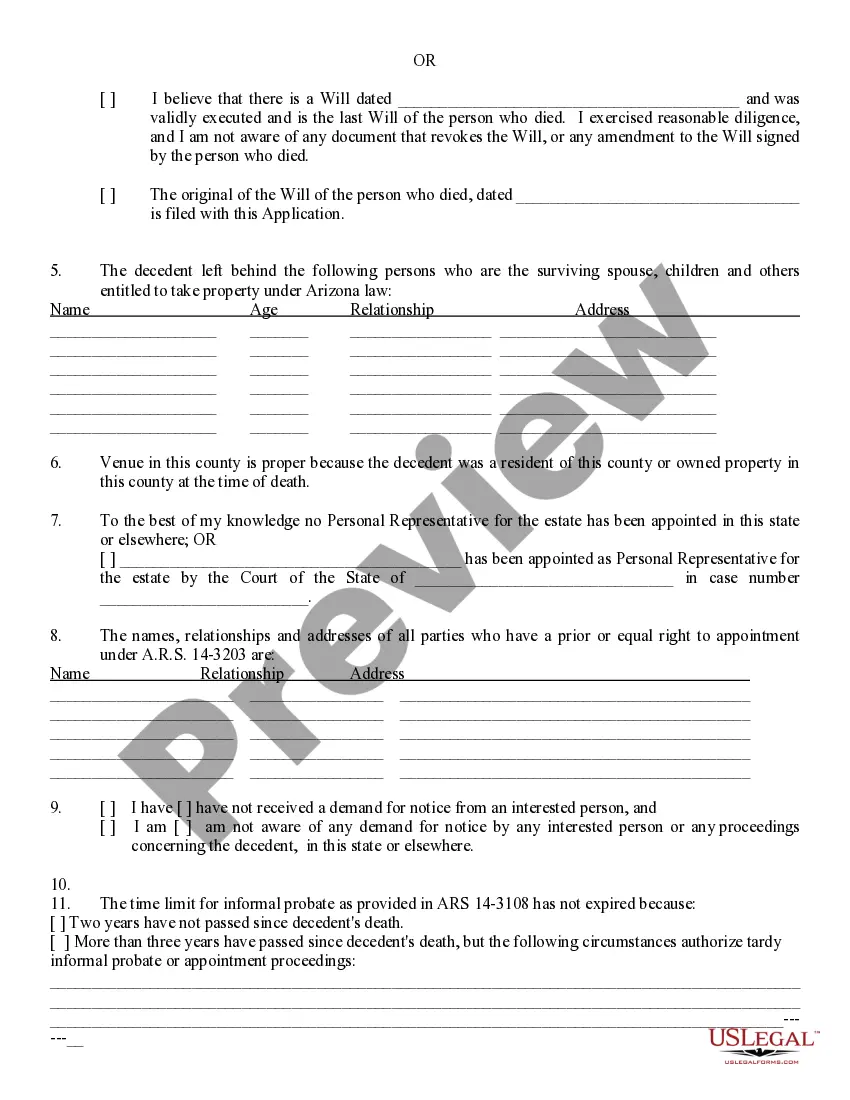

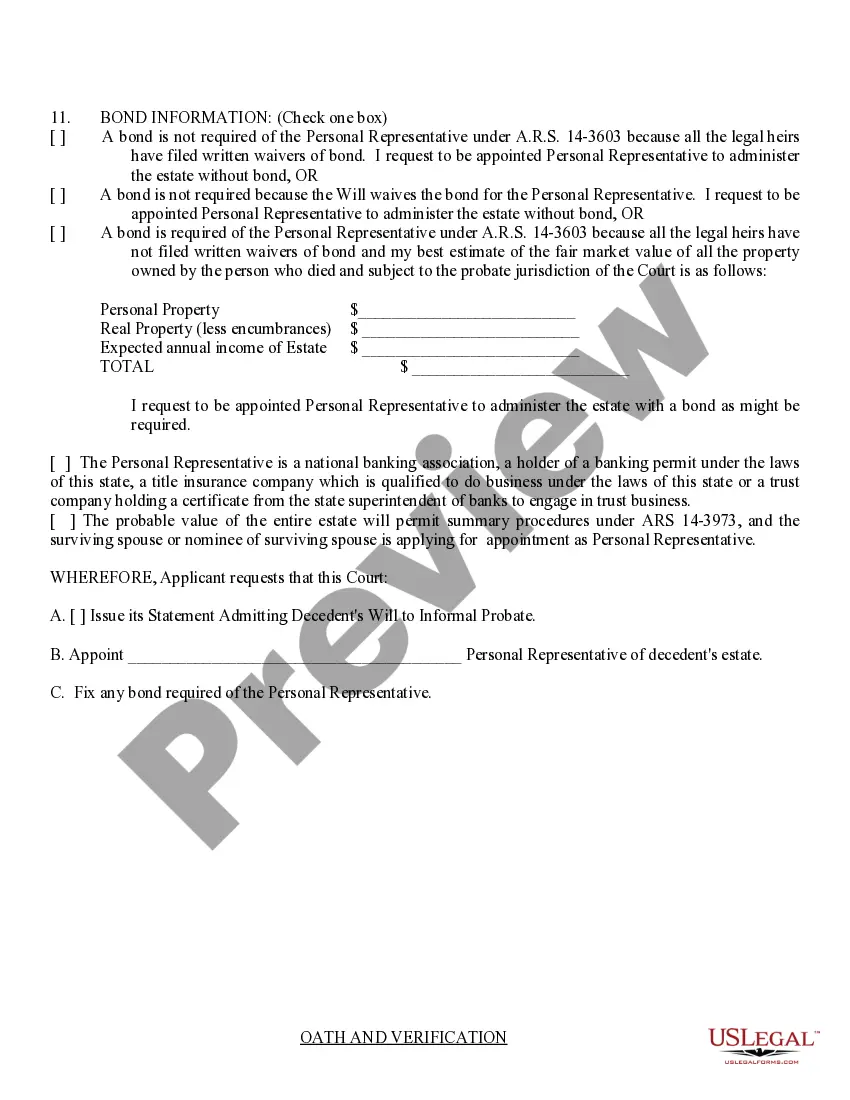

How to fill out Arizona Application For Informal Probate Of A Will And Appointment Of Personal Representative?

- If you're a returning user, login to your account and locate the form template you require. Click the Download button to save it to your device, ensuring your subscription is active; if not, proceed to renew it as per your plan.

- If you're new to US Legal Forms, start by reviewing the Preview mode and form description to confirm that the chosen document aligns with your requirements and complies with local jurisdiction laws.

- Should you need another template, utilize the Search tab at the top to find alternative forms. Once you identify the right one, proceed to the next step.

- Purchase your document by selecting the Buy Now button and choosing your preferred subscription plan. Don't forget to create an account to gain access to our comprehensive library.

- Complete your transaction by entering your credit card information or utilizing your PayPal account for payment.

- Download the required form and save it on your device. You can later find it in the My Forms section of your profile whenever needed.

By following these simple steps, you can efficiently access the legal forms needed for a grant of probate with will. US Legal Forms stands out with its extensive collection and expert assistance, helping users create accurate documents.

For a seamless legal experience, start your journey with US Legal Forms today and simplify your document needs.

Form popularity

FAQ

In Pennsylvania, you should file for probate within three months after the person's death. This is essential to ensure timely grant of probate with will, allowing the estate to be settled properly. Delaying beyond this period can lead to complications or penalties. Staying organized and working promptly can help avoid any unnecessary issues.

To probate a will in Pennsylvania without a lawyer, start by gathering necessary documents, including the will and death certificate. You will need to file the will with the appropriate court to initiate the grant of probate with will. Ensure you complete all required forms accurately and comply with state laws. Many find that online services, such as US Legal Forms, can provide helpful templates and guidance during this process.

One of the biggest mistakes in a will is failing to specify clear instructions for asset distribution. Ambiguities can lead to disputes among heirs and delay the grant of probate with will. It is also crucial to regularly update your will to reflect any changes in your circumstances or relationships. Ensuring clarity and accuracy can save your loved ones from unnecessary stress during an emotional time.

Yes, in certain situations, an estate can be settled without probate in Pennsylvania, especially if the deceased had a small estate. Certain assets, like those held in joint ownership or payable-on-death accounts, may not require probate. However, understanding whether your situation qualifies is essential, and the grant of probate with will can provide clarity if needed. Consulting resources or professionals can help you determine the best course of action.

In Pennsylvania, you do not have to hire a lawyer to probate a will, but it is advisable. The grant of probate with will can be complex, involving various legal obligations. Having a lawyer can help navigate these requirements, ensuring compliance with state laws. If your case is straightforward and you feel confident, you might be able to manage without one.

Filling out paperwork for probate involves gathering various documents, including the will and death certificate. You will need to complete the appropriate forms to initiate the grant of probate with will. Each state has different requirements, so it is crucial to check local guidelines for specifics. Online platforms like US Legal Forms can assist you in obtaining the necessary forms and guidance throughout the process.

You do not necessarily need a lawyer to probate a will in Texas, but having legal assistance can simplify the process. The grant of probate with will requires proper filing of paperwork and adherence to specific deadlines. A lawyer familiar with Texas probate law can help ensure that everything is handled correctly and efficiently. However, if your circumstances are straightforward, you might consider tackling it yourself.

While you are not legally required to hire a lawyer for probate in North Carolina, it is often beneficial. Navigating the grant of probate with will involves understanding legal processes that can be complex. An experienced attorney can provide guidance, help avoid delays, and ensure the estate is managed according to state laws. Utilizing services like uslegalforms can also provide valuable resources and templates to facilitate this process.

In North Carolina, not all wills necessarily go through probate. However, if the estate is substantial, the grant of probate with will is often required to properly distribute assets. Smaller estates may qualify for a simplified process called 'administration without a will', which can expedite asset distribution. Understanding your estate's specific needs can help determine the best course of action.

To avoid probate in North Carolina, you can consider several estate planning strategies. Establishing a revocable living trust allows your assets to pass directly to your beneficiaries without going through the grant of probate with will. Moreover, holding assets jointly with right of survivorship or designating beneficiaries on accounts can also prevent probate. Engaging with comprehensive planning tools can simplify this process.