Grant Of Probate For Will

Description

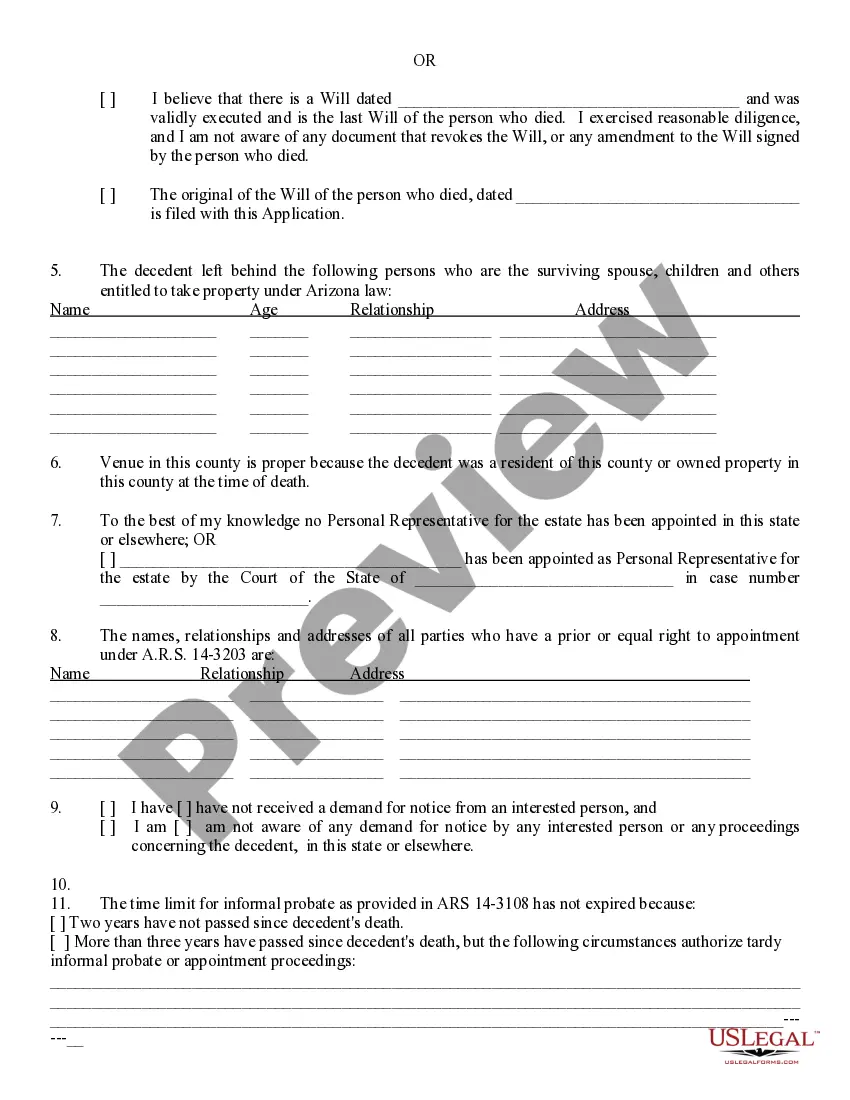

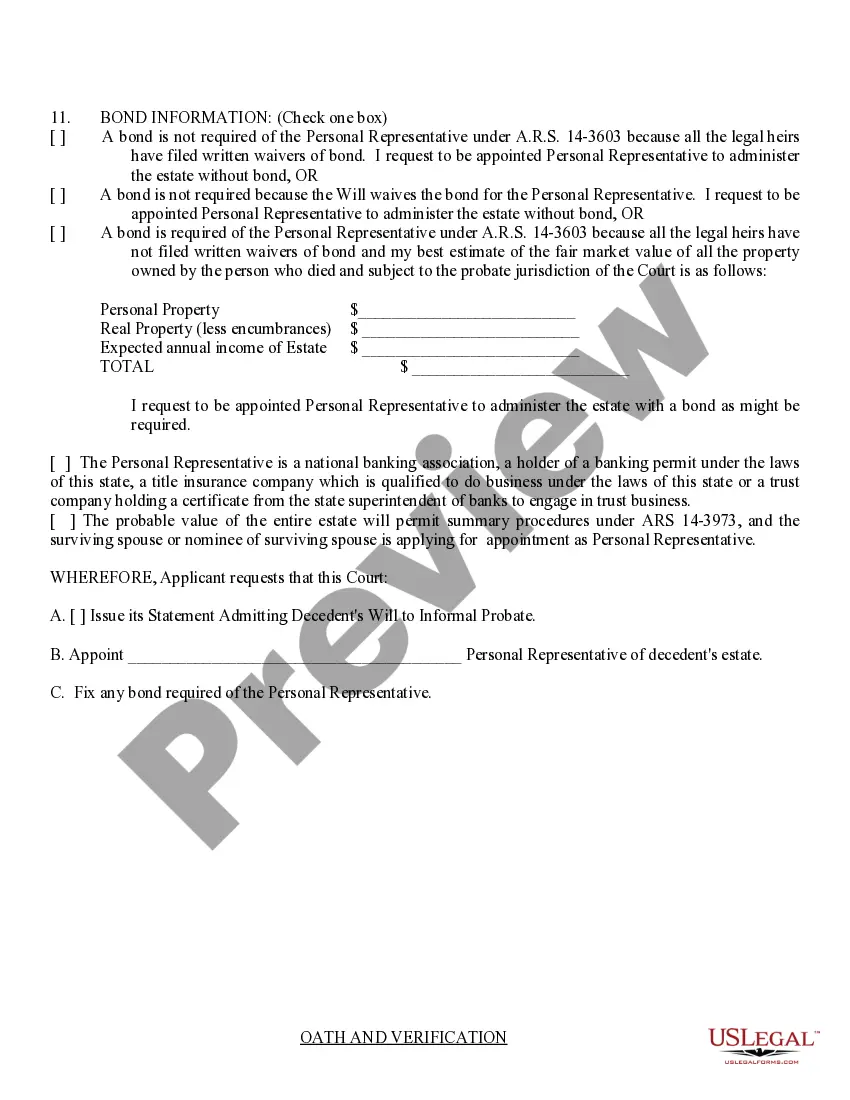

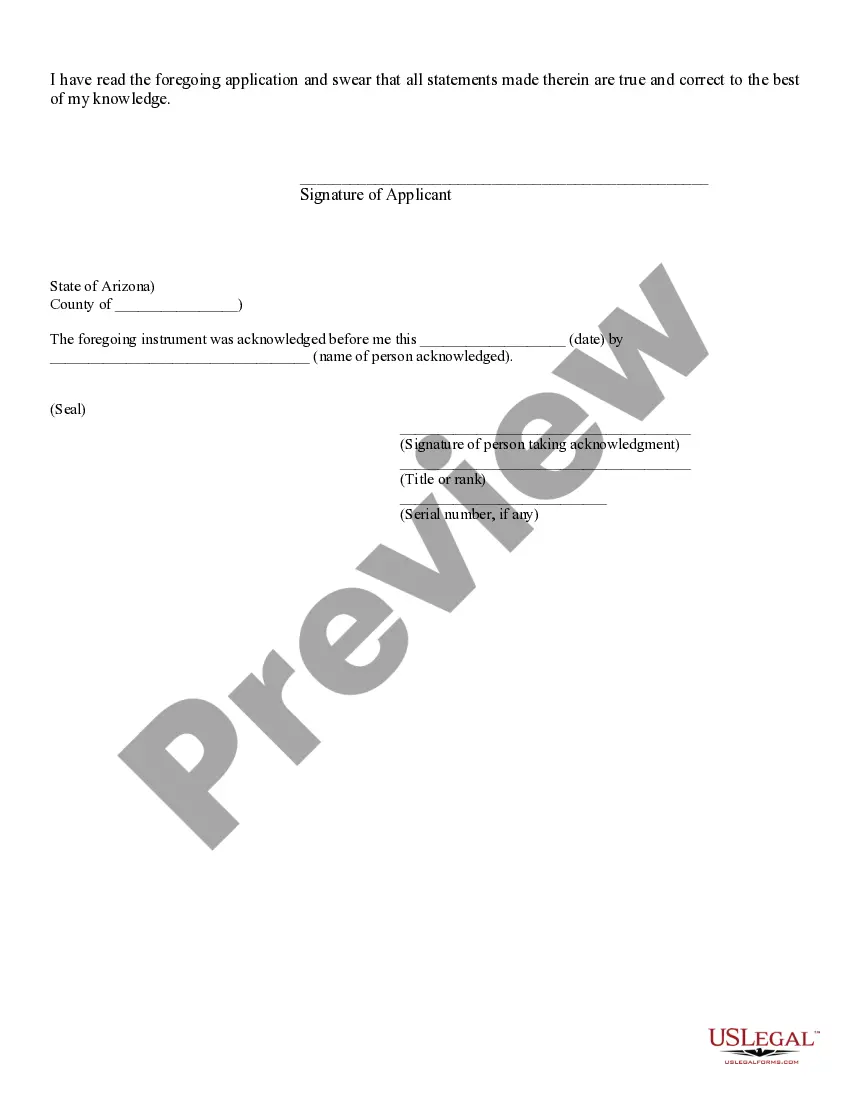

How to fill out Arizona Application For Informal Probate Of A Will And Appointment Of Personal Representative?

- Log in to your existing US Legal Forms account and download the required document template by hitting the Download button. Ensure your subscription remains active, or renew it as needed.

- Review the Preview mode and ensure the form meets your specific requirements and local jurisdiction guidelines.

- If necessary, utilize the Search feature to find the correct template that fits your needs. Once you identify any discrepancies, switch to another form as needed.

- Purchase the document by selecting the Buy Now button and reserving a suitable subscription plan. You'll need to create an account to gain access to the full library of forms.

- Complete your purchase by entering your credit card information or opting for PayPal for convenience.

- Download the completed form onto your device, ensuring you retain access via the My Forms section of your profile for future needs.

US Legal Forms enhances your experience by providing an extensive selection of over 85,000 editable legal forms. In addition, premium experts are available to guide you through form completion, making sure your documents are both precise and compliant.

In conclusion, utilizing US Legal Forms for a grant of probate for a will can save you time and reduce stress. Take advantage of their resources and elevate your legal document management today!

Form popularity

FAQ

Assets that typically pass through probate include sole-owned real estate, bank accounts solely in the deceased's name, and personal property without designated beneficiaries. These assets require the grant of probate for will to transfer ownership legally to the selected heirs. Familiarizing yourself with this process can help you manage your estate effectively and ensure a smooth transition for your loved ones.

Filling out probate paperwork requires attention to detail and accuracy. You will need to provide essential information about the deceased’s assets, debts, and beneficiaries. If you find this process daunting, uslegalforms offers a range of resources and templates to assist you in completing the necessary forms related to the grant of probate for will.

One effective way to avoid probate is by creating a trust to hold your assets. By placing your assets in a trust, you designate a trustee to manage them, allowing for direct distribution to your beneficiaries upon your passing. Understanding the role of the grant of probate for will can guide you in making sound decisions about asset management and estate planning.

An example of non-probate property is a bank account that is designated as a transfer-on-death account. This type of account allows the funds to pass directly to a beneficiary without going through probate. If you want a smoother transition for your assets, learn about the grant of probate for will and the options available to you for non-probate solutions.

Assets that typically avoid probate include jointly owned properties, payable-on-death bank accounts, and trust-held assets. Such assets bypass the probate process because they have direct transfer mechanisms in place. A clear understanding of the grant of probate for will can assist you in structuring your estate to minimize delays for your heirs.

Certain assets do not go through probate, such as life insurance policies with named beneficiaries, retirement accounts like IRAs and 401(k)s, and assets held in a living trust. These assets pass directly to the beneficiaries designated by the account holder. When planning your estate, understanding the grant of probate for will can help ensure that your loved ones receive their inheritances quickly.

In general, you should initiate the probate process as soon as possible after a death, typically within four months. However, the exact timeframe may vary by state. In some cases, a late probate may lead to complications for heirs. To avoid these issues, consider securing a grant of probate for your will promptly.

To probate your own will, start by filing it with the local probate court. You will need to submit the death certificate and an application for a grant of probate for your will. The court will then verify the will and appoint you as the executor. Following this process ensures that your affairs are settled according to your wishes.

The 3-year rule allows heirs to claim inheritance from a deceased estate for up to three years after the date of death. If a claim is not initiated within this time frame, the estate may be closed, and assets may revert to the state. This rule reinforces the importance of timely action in probate matters. Taking steps to secure a grant of probate for your will can help safeguard your interests.

In Tennessee, if someone dies without a will, their estate goes through intestate succession. This means the state laws dictate how assets are distributed among surviving relatives. The probate court appoints an administrator to manage the estate. To ensure a proper distribution according to your wishes, consider obtaining a grant of probate for your will.