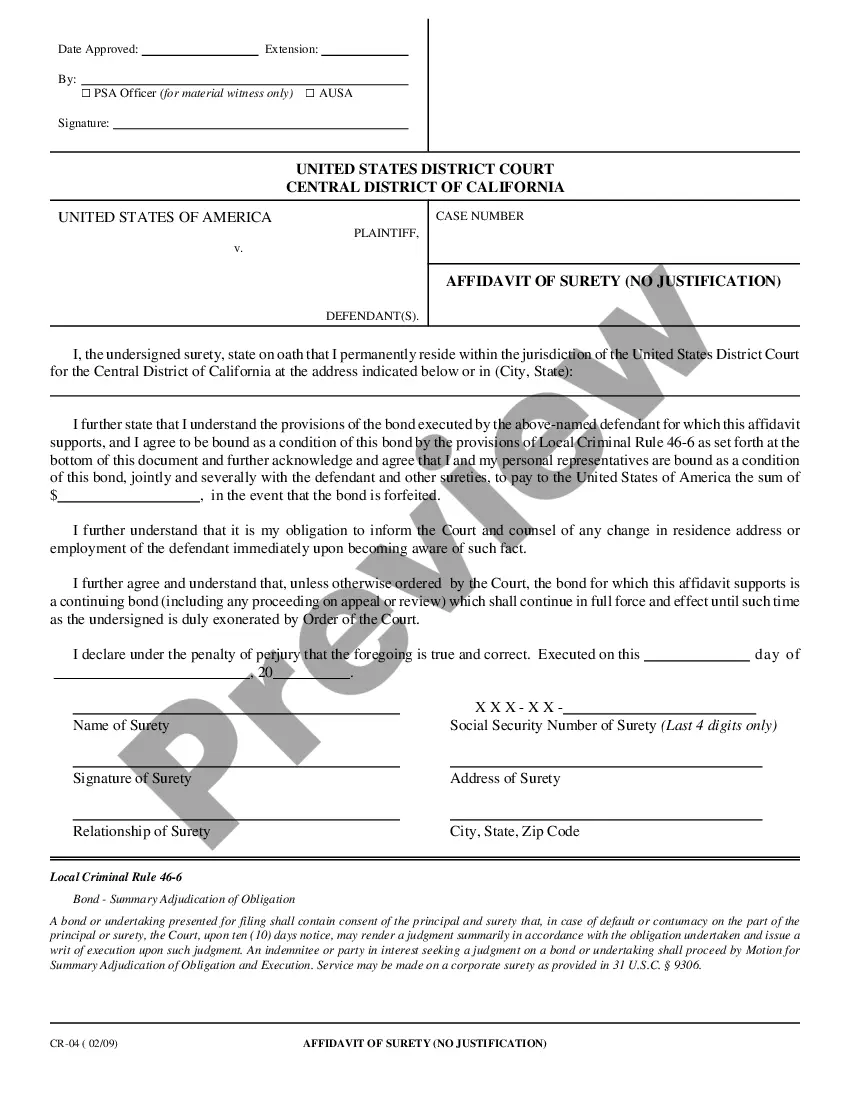

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, a Non-Probate Affidavit for Collection of Personal Property of Decedent , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s).

Non Probate Affidavit With Gift

Description

How to fill out Arizona Nonprobate Affidavit For Collection Of Personal Property Of Decedent?

It’s obvious that you can’t become a legal expert immediately, nor can you learn how to quickly prepare Non Probate Affidavit With Gift without having a specialized background. Putting together legal documents is a long venture requiring a specific training and skills. So why not leave the preparation of the Non Probate Affidavit With Gift to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court papers to templates for in-office communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and get the document you need in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Non Probate Affidavit With Gift is what you’re looking for.

- Start your search again if you need any other template.

- Register for a free account and choose a subscription plan to buy the template.

- Choose Buy now. Once the payment is complete, you can download the Non Probate Affidavit With Gift, complete it, print it, and send or send it by post to the necessary people or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

In order to qualify as a valid Heirship Affidavit, the document needs to be signed in front of a notary public by three people that knew the deceased for at least 10 years. It can be signed in front of a notary anywhere in the world. It does not have to be signed at the same time or at the same place.

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

An affidavit of heirship must be signed and sworn to before a notary public by a person who knew the decedent and the decedent's family history. This person can be a friend of the decedent, an old friend of the family, or a neighbor, for example.

You may be able to proceed without Probate if: the fair market value of the entire estate of the deceased, less liens and encumbrances (everything the deceased owned minus everything the deceased owes) is $100,000.00 or less. thirty days or more have passed since death. you are not a creditor to the estate.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.