Power Of Attorney With Odometer Disclosure

Description

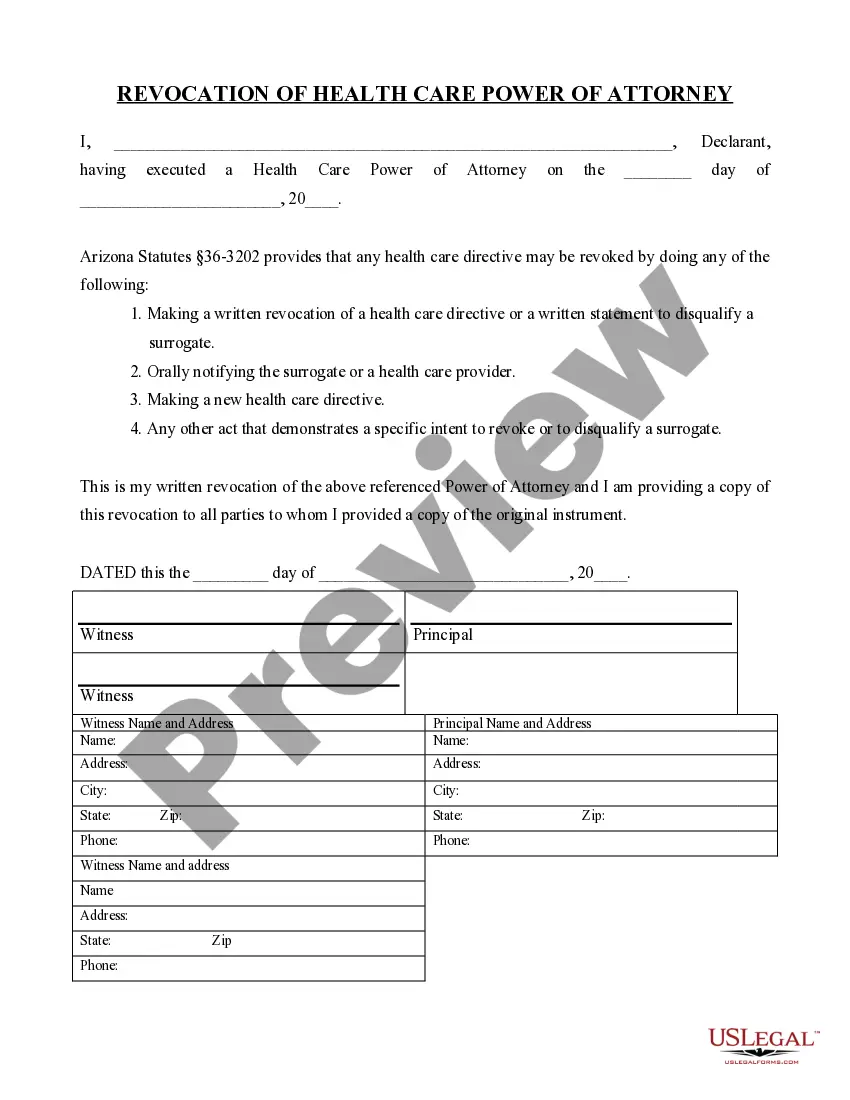

How to fill out Revocation Of Arizona Health Care Power Of Attorney?

Red tape requires exactness and correctness.

If you do not frequently handle paperwork such as Power Of Attorney With Odometer Disclosure, it may lead to some miscommunications.

Selecting the appropriate template from the outset will guarantee that your document submission proceeds smoothly and avert any hassles of resubmitting a document or repeating the same task from the beginning.

If you are not a subscribed user, finding the needed template will require a few additional steps.

- Acquire the appropriate template for your documentation in US Legal Forms.

- US Legal Forms is the largest online forms repository providing over 85 thousand templates across various fields.

- You can easily find the latest and most applicable version of the Power Of Attorney With Odometer Disclosure just by searching for it on the site.

- Store and download templates in your account or verify with the description to confirm you have the right one available.

- With a US Legal Forms account, it is simple to gather, keep in one place, and peruse the templates you save for quick access.

- To Log In to the site, hit the Log In button for authorization.

- Next, go to the My documents page, where your form history is maintained.

- Review the descriptions of the forms and download the ones you need whenever necessary.

Form popularity

FAQ

Effective January 1, 2021, the new 20-year exemption for odometer disclosure applies to 2011 and newer model-year vehicles. This means a 2011 model year vehicle will not become exempt from odometer disclosure until the vehicle is 20 years old, which will be January 1, 2031.

A Texas Odometer Disclosure Statement should be filled out in the following way:State the seller's name and that the seller certifies that the information listed in this statement is true and accurate.Select the appropriate box to make it clear whether the mileage amount listed is one of the following:More items...

Odometer Disclosure Statement (MVR-180): Seller shall disclose the mileage to the buyer in writing on the application with signatures and hand printed name. If a vehicle is 10 years old and older, odometer reading is not required.

The odometer disclosure is required to be made on a secure form to prevent tampering. The Texas Department of Motor Vehicles (TxDMV) has implemented a carbon copy paper form which complies with the requirements of federal law.

Illinois law requires mileage disclosure for all vehicles. Exceptions include: vehicle weight of more than 16,000 pounds; vehicles 10 years old or older; vehicles that are not self-propelled; and vehicles manufactured without an odometer.