Arizona Agreement Contract With America

Description

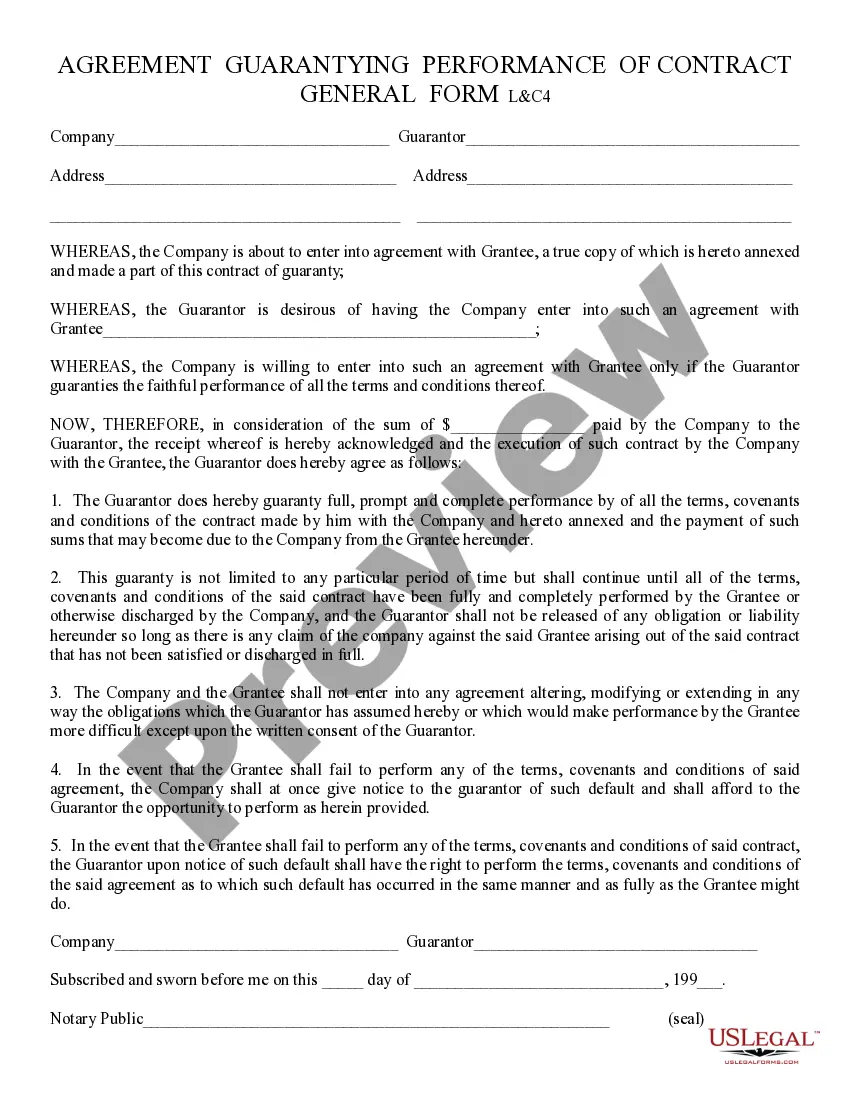

How to fill out Arizona Agreement Guaranteeing Performance Of Contract - General?

Well-structured formal documentation serves as a crucial safeguard against issues and legal disputes, yet obtaining it independently may require time.

If you need to swiftly acquire an updated Arizona Agreement Contract With America or any other templates for employment, family, or business situations, US Legal Forms is consistently available to assist.

The procedure is even more convenient for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected file. Additionally, you can access the Arizona Agreement Contract With America at any time in the future, as all documents obtained on the platform are stored under the My documents section of your profile. Save time and money on preparing formal documents. Try US Legal Forms today!

- Verify that the form is appropriate for your needs and location by reviewing the description and preview.

- Look for an alternative example (if necessary) using the Search bar in the header of the page.

- Click on Buy Now once you identify the suitable template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Arizona Agreement Contract With America.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

If a new employee fails to complete an A-4 within the first week of employment, the employer is required to withhold at the median rate of 2.7% until the employee officially requests a change.

The employee can submit a Form A-4 for a minimum withholding of 0.8% of the amount withheld for state income tax. An employee required to have 0.8% deducted may elect to increase this rate to 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, or 5.1% by submitting a Form A-4.

They mainly included a balanced budget requirement, tax cuts for small businesses, families and seniors, term limits for legislators, social security reform, tort reform, and welfare reform.

Information for Employers, Employees, and Individuals If the new employee fails to complete Arizona Form A-4 within 5 days of hire, the employer must withhold Arizona income tax at the rate of 2.7% until the employee elects a different withholding rate.

To keep your withholding the same as last year, choose a withholding percentage of 1.8% (40,000 x . 018 = 720) and withhold an additional $10.77 per biweekly pay period (1,000 - 720 = 280 / 26 = 10.77). Be sure to take into account any amount already withheld for this year.