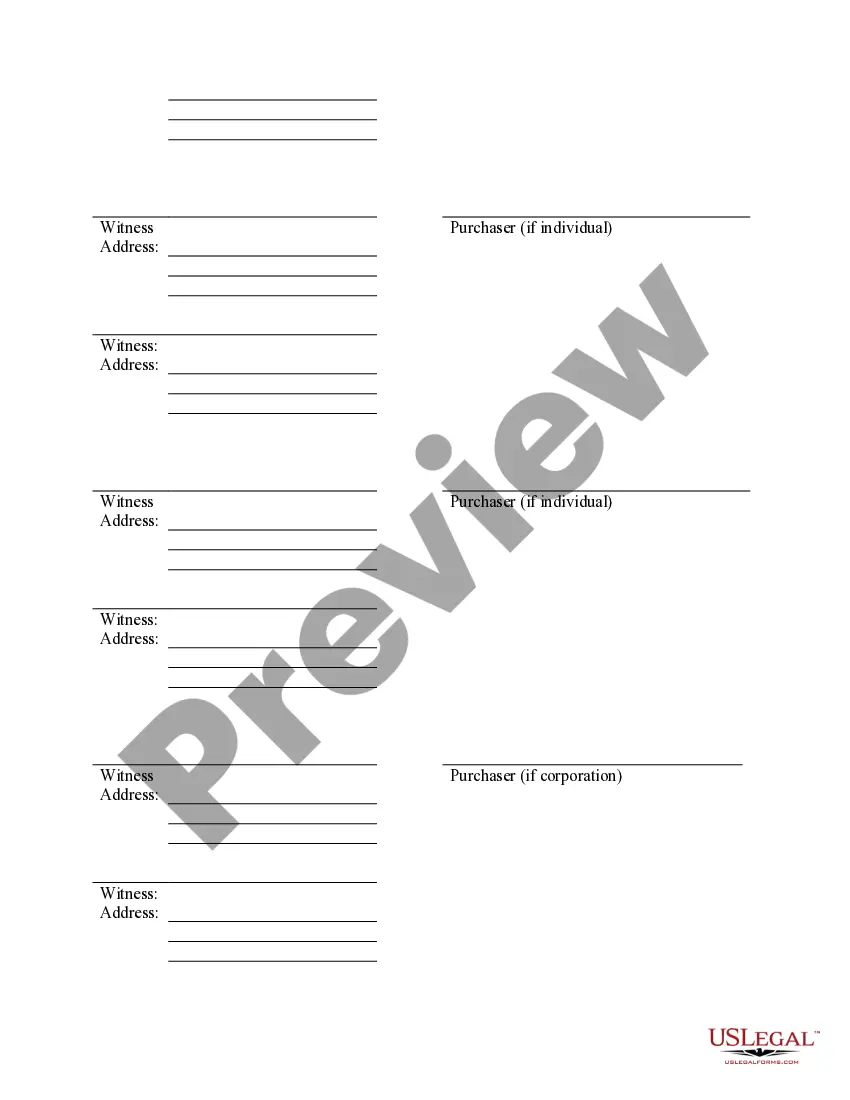

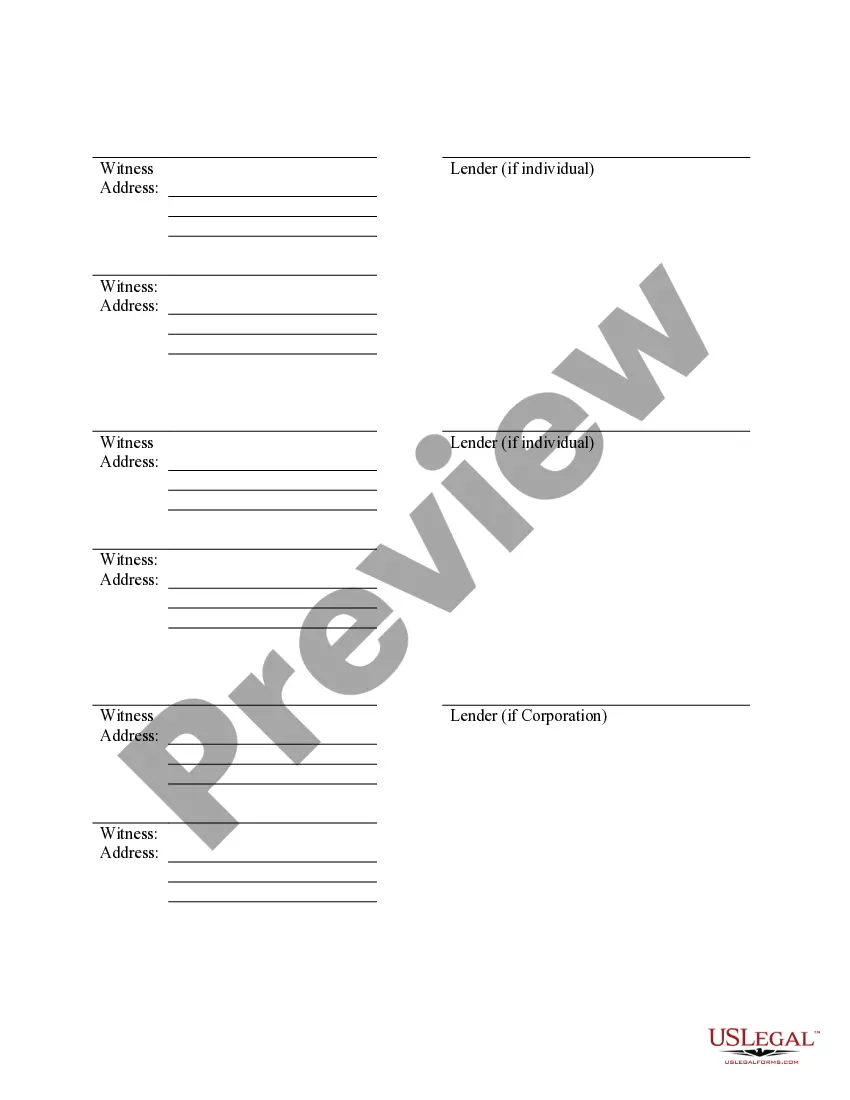

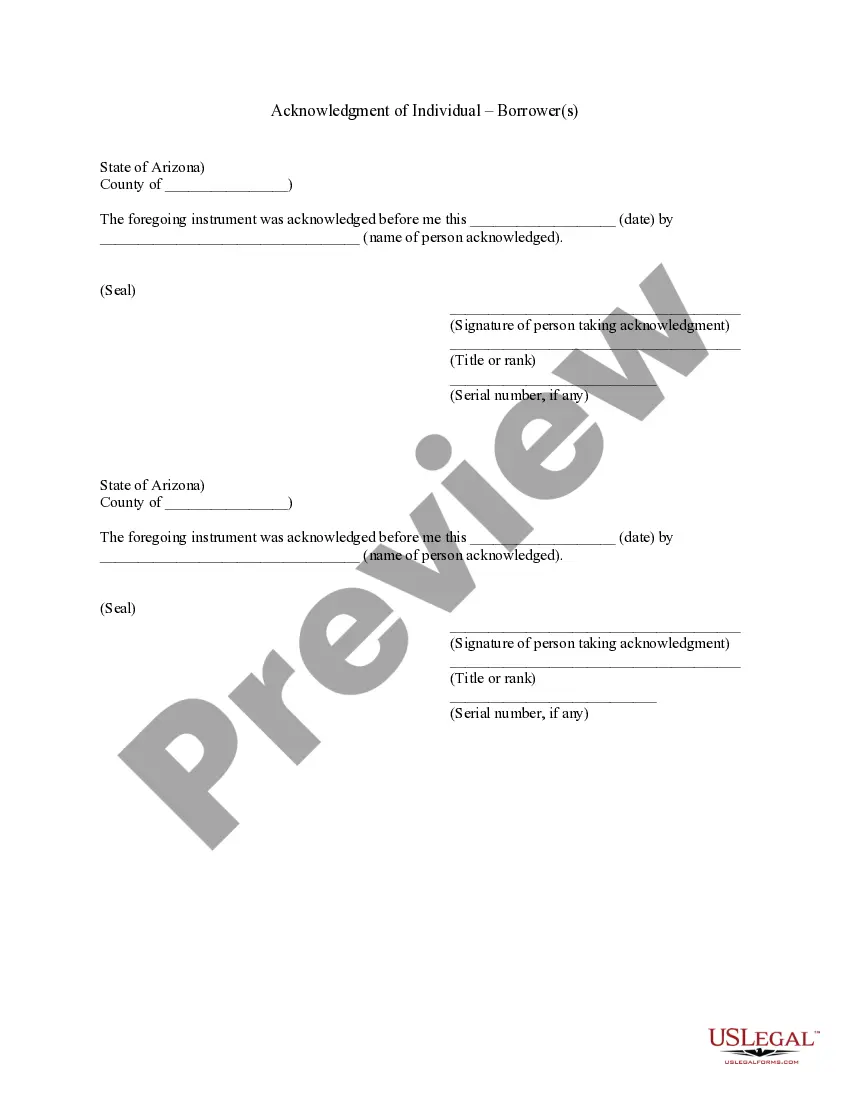

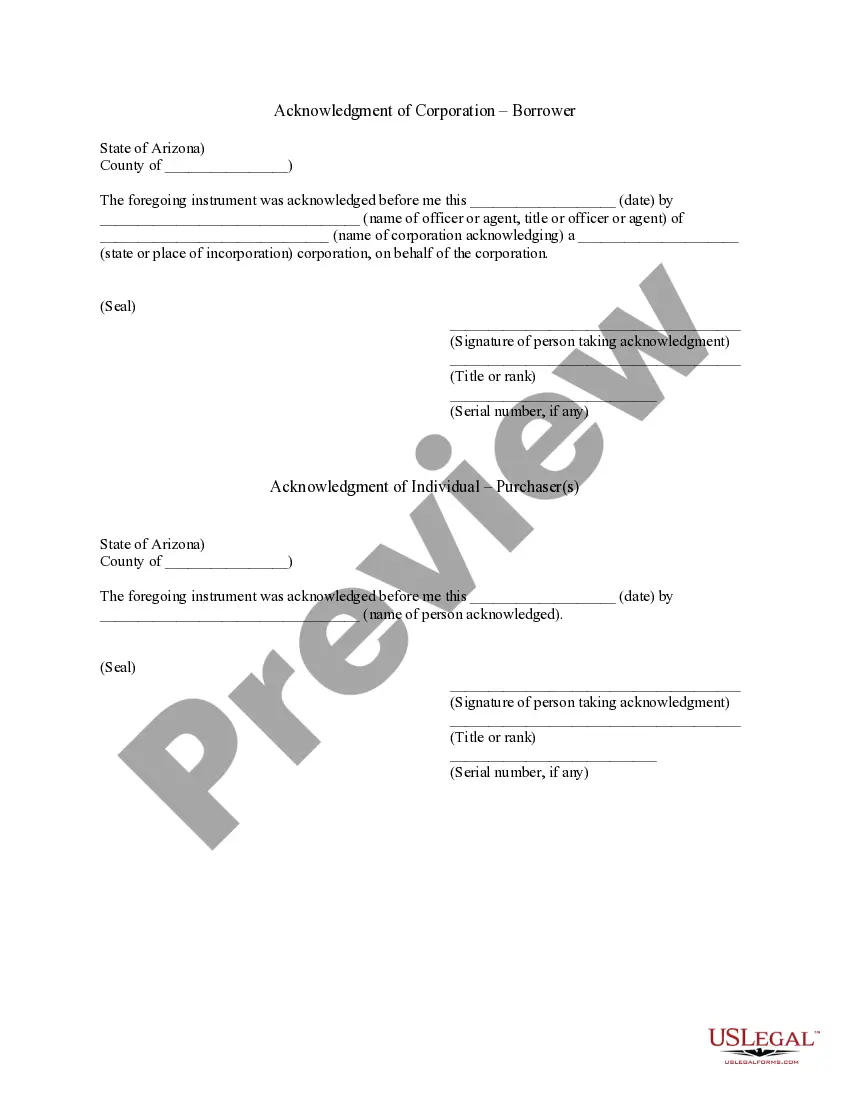

Arizona Deed Of Trust Form With 2 Points

Description

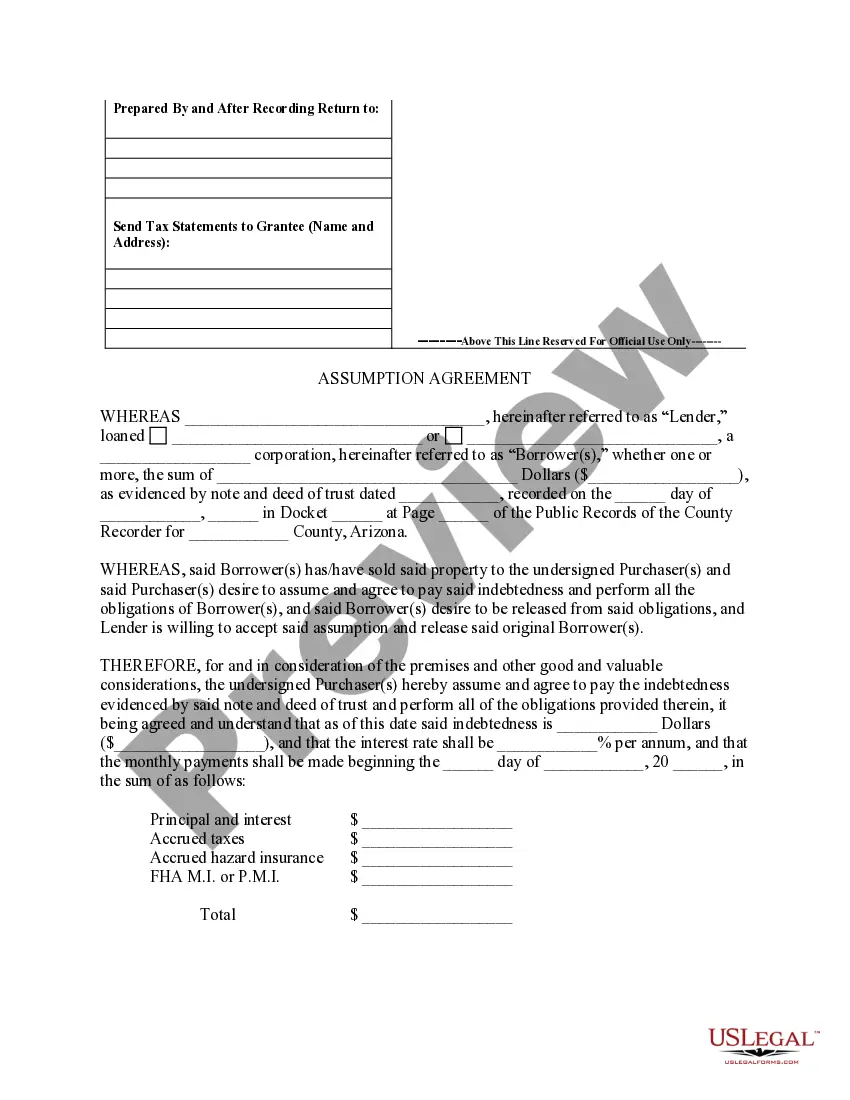

How to fill out Arizona Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Maneuvering through the red tape of official documents and formats can be challenging, particularly when one is not engaged in that profession. Even selecting the appropriate format for an Arizona Deed Of Trust Form With 2 Points will be labor-intensive, as it must be valid and accurate down to the last number.

Nonetheless, you will need to invest significantly less time choosing an appropriate format from a source you can depend on. US Legal Forms is a platform that streamlines the process of finding suitable documents online.

US Legal Forms serves as a singular location where one can discover the latest examples of documents, inquire about their usage, and download these examples for completion. This is a repository with more than 85,000 documents applicable in various sectors. When looking for an Arizona Deed Of Trust Form With 2 Points, you won’t need to doubt its authenticity as all the documents are validated.

Proceed to choose your subscription option, use your email and create a secure password to sign up for an account at US Legal Forms. Select a credit card or PayPal payment method. Download the template document onto your device in your preferred format. US Legal Forms can save you time and energy determining whether the document you found online is appropriate for your requirements. Register for an account and gain unrestricted access to all the formats you require.

- Establish an account at US Legal Forms to ensure you have all the necessary examples at your fingertips.

- Keep them in your history or add them to the My documents collection.

- Access your saved documents from any device by clicking Log In on the library website.

- If you have yet to create an account, you can continually search for the template you require.

- Obtain the correct document in a few straightforward steps.

- Type the name of the file in the search box.

- Select the right Arizona Deed Of Trust Form With 2 Points from the list of results.

- Review the outline of the template or open its preview.

- If the format meets your needs, click Buy Now.

Form popularity

FAQ

To transfer your house to a trust in Arizona, you typically need to change the title of the property to reflect the trust's name. This process usually requires the completion of a deed reflecting the transfer. Consider using an Arizona deed of trust form during this process to ensure everything is handled legally and effectively.

The statute of limitations for a mortgage in Arizona is also six years. This period starts from the date of default or the last payment made. Understanding this timeline is important when dealing with an Arizona deed of trust form or a mortgage.

While it's not legally required to have an attorney set up a trust in Arizona, consulting one is highly recommended. An attorney can help ensure that your trust meets all legal requirements and effectively protects your assets. Additionally, using an Arizona deed of trust form can streamline the process.

A trust deed in Arizona generally lasts until the debt obligation is fulfilled or the property is sold. If the borrower defaults, the trust deed can be enforced through foreclosure. Knowing how long an Arizona deed of trust form remains valid can aid you in planning your property transactions.

Arizona primarily uses the deed of trust system. This means that, for most real estate transactions, lenders use a deed of trust rather than a traditional mortgage. Familiarizing yourself with the Arizona deed of trust form can provide clarity in navigating these transactions.

The best way to transfer property title between family members often involves using a quitclaim deed. This deed allows one family member to transfer their interest in the property to another. Using an Arizona deed of trust form can help secure the transaction, ensuring all parties understand their rights and obligations.

In Arizona, the statute of limitations for enforcing a deed of trust is typically six years. This means creditors have six years from the date of default to initiate foreclosure proceedings. It’s crucial to be aware of this timeline if you are involved with an Arizona deed of trust form.

Yes, it is possible to have two trust deeds on a single property in Arizona. This typically occurs when a property is refinanced or when multiple lenders are involved. When dealing with multiple trust deeds, being thorough with each Arizona deed of trust form is vital, as each deed must be properly recorded to maintain its standing.

Arizona primarily uses deeds of trust instead of traditional mortgages. This system tends to offer faster foreclosure procedures and clearer rights for lenders. By using an Arizona deed of trust form, both lenders and borrowers can benefit from a streamlined process and avoid potential complications associated with mortgages.

To transfer a deed to a trust in Arizona, the property owner must execute a new deed that transfers ownership to the trust. This often involves completing an Arizona deed of trust form, which includes necessary details such as the property description and trust information. It’s essential to follow local procedures and consider consulting with a legal expert to ensure all requirements are satisfied.