Limited Liability Company For Dummies

Description

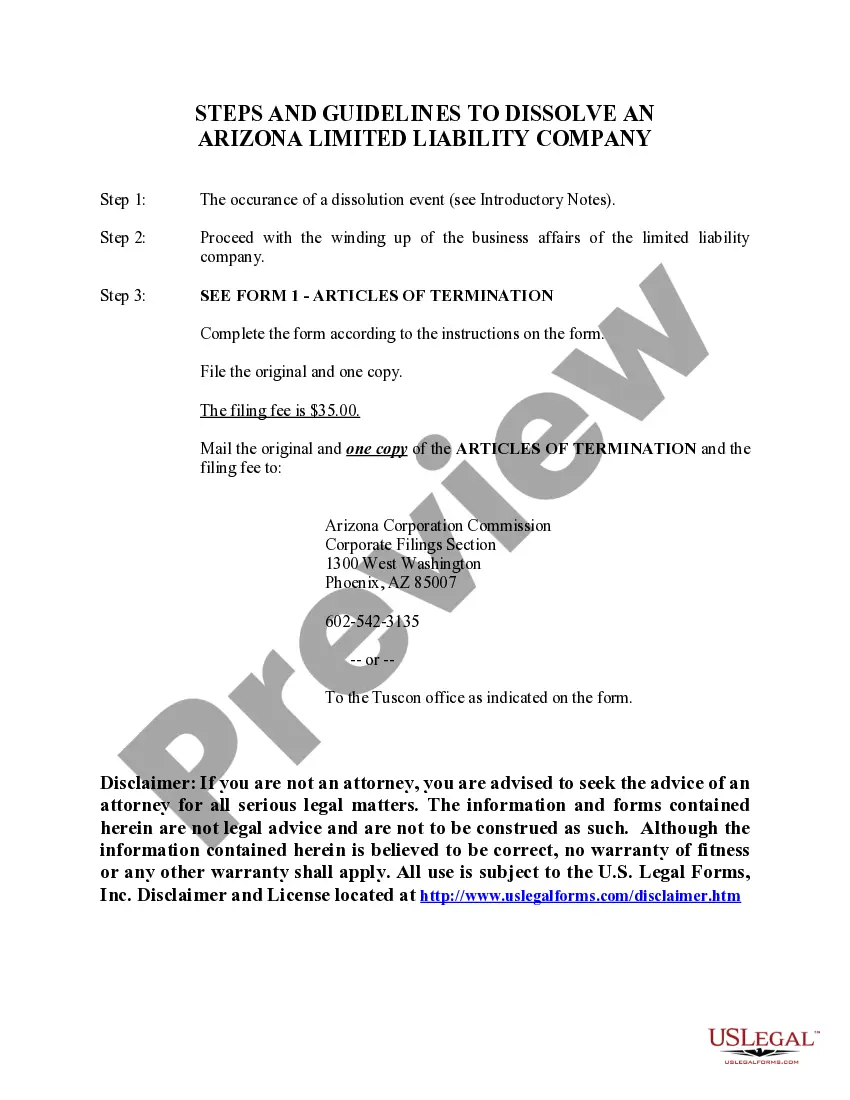

How to fill out Arizona Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your US Legal Forms account if you're a returning user, and check your subscription status. If it has expired, renew it to ensure access.

- Preview the form options and confirm you select the correct template that aligns with your specific requirements and jurisdiction.

- If necessary, utilize the search bar to find alternative templates that better fit your needs, ensuring compliance and accuracy.

- Complete your purchase by clicking the 'Buy Now' button, selecting your preferred subscription plan, and creating an account if you’re a first-time user.

- Proceed to payment by entering your credit card information or using PayPal to finalize your subscription.

- Once purchased, download the form to your device, and access it later through the 'My Forms' section in your profile.

In conclusion, US Legal Forms simplifies the process of setting up a limited liability company with its extensive library and expert support. With a vast collection of over 85,000 fillable forms, you can confidently draft legal documents tailored to your needs.

Start your LLC journey today by visiting US Legal Forms!

Form popularity

FAQ

Limited liability means that your personal assets are shielded from your LLC's debts and liabilities. For dummies, this concept is crucial because it protects your home, savings, and personal belongings from business risks. By forming a Limited Liability Company, you gain this important protection, which allows you to focus on growing your business with peace of mind. Understanding this concept is essential, and platforms like US Legal Forms can provide further insights.

While a Limited Liability Company offers many benefits, there are downsides for dummies to consider. For one, LLCs can face self-employment taxes, which can add up. Additionally, some states impose higher fees or annual requirements that can complicate things. It's essential to weigh the pros and cons carefully, and resources like US Legal Forms can provide clarity on these aspects.

The easiest Limited Liability Company for dummies depends on your personal circumstances and business goals. Generally, choosing a single-member LLC is simpler to start because it involves fewer regulations and paperwork. With the right tools, such as those offered by US Legal Forms, you can tackle the process step-by-step, making starting your LLC less daunting.

When considering the easiest Limited Liability Company for dummies, many factors come into play, including your state requirements. Typically, forming an LLC in states like Delaware and Wyoming is straightforward due to their minimal filing requirements. By using platforms like US Legal Forms, you can find resources that guide you through each step to ensure you create your LLC with ease.

The best way to file taxes as a Limited Liability Company is to maintain clear records of your income and expenses throughout the year. When it comes time to file, ensure you understand which forms are necessary and how your LLC's structure affects your tax obligations. For further assistance, USLegalForms offers valuable resources to simplify the filing process.

Typically, you file your LLC taxes together with your personal taxes since most LLCs are treated as pass-through entities. This means you report income from your LLC on your individual tax return. For comprehensive guidance on this process, consider utilizing resources from USLegalForms.

An LLC files taxes by reporting its income and expenses on your personal tax return, as it often operates as a pass-through entity. The specific forms depend on your LLC’s structure and whether you elect for corporate tax treatment. For detailed steps on filing, resources like USLegalForms can provide clarity and assistance.

The best way to file for your Limited Liability Company is to first determine your state’s requirements. You typically need to prepare and submit the Articles of Organization along with the appropriate fees. If you're unsure about the details, USLegalForms provides guidance and templates to make your filing more straightforward.

LLCs face flexible tax treatment, primarily classified as pass-through entities. This means that profits and losses pass through to your personal income, avoiding double taxation. To understand the specifics of how this works for your Limited Liability Company, consult with a tax professional or use resources available on platforms like USLegalForms.

Yes, you can file your Limited Liability Company (LLC) yourself. This process involves completing the necessary paperwork and submitting it to your state’s business filing office. However, if you feel overwhelmed by the details, using a service like USLegalForms can help simplify the filing process for you.