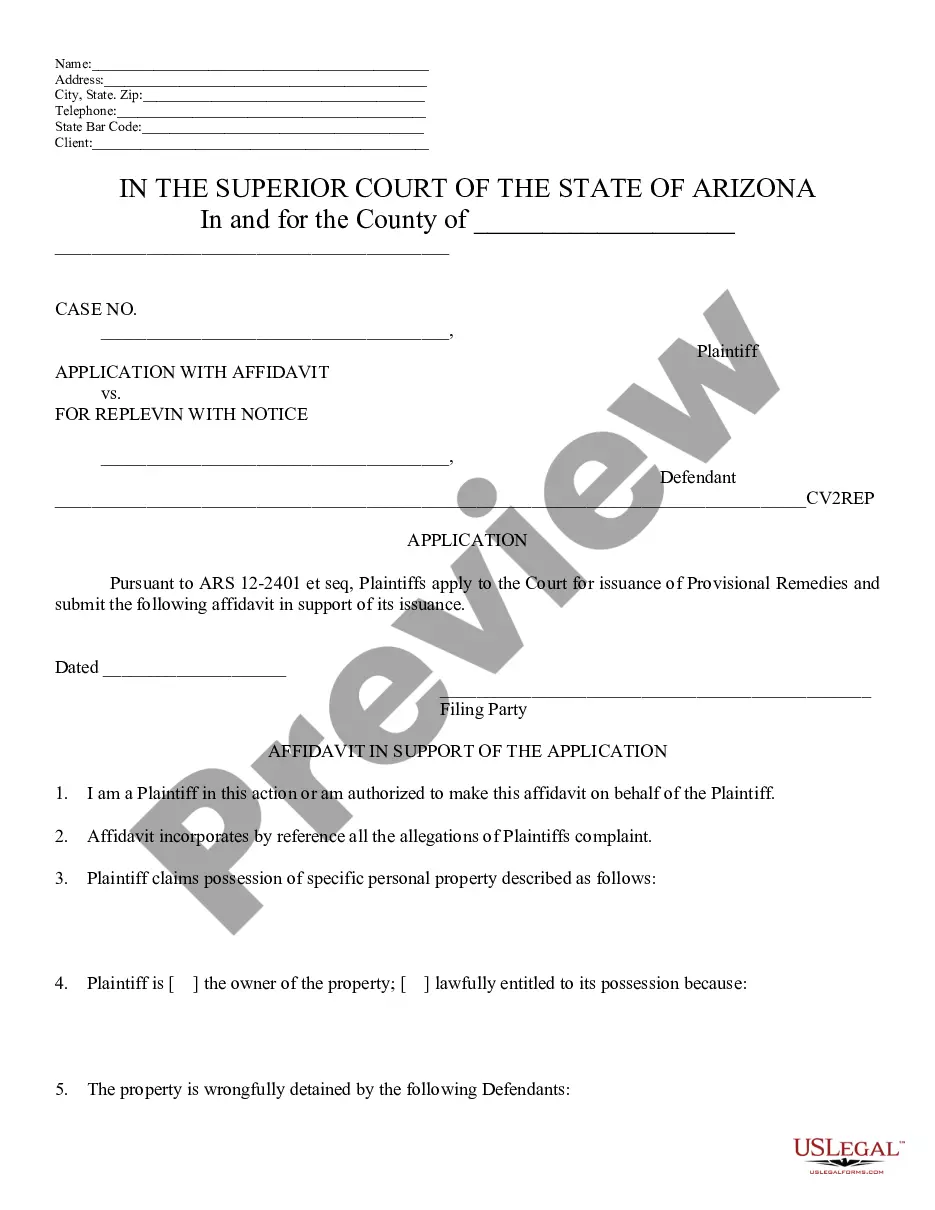

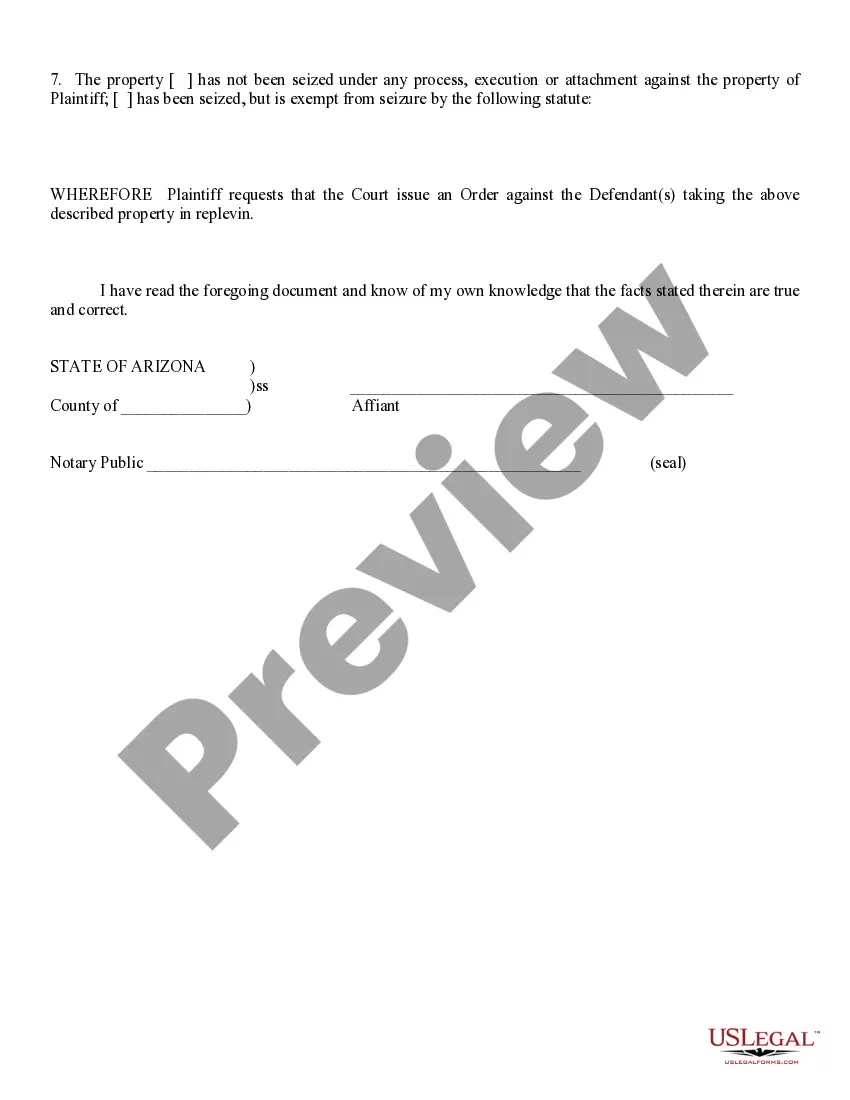

Repossession laws in Arizona are designed to protect the rights of lenders and borrowers during the repossession process. These laws outline the guidelines and procedures that must be followed by lenders to lawfully repossess vehicles or other collateral in case of loan default. The main type of repossession law in Arizona is called the Uniform Commercial Code (UCC) Article 9. This law governs the rights and obligations of lenders and borrowers regarding secured transactions. It provides a legal framework for repossession and establishes the requirements a lender must meet to repossess collateral. Under Arizona's repossession laws, lenders are permitted to repossess collateral as long as they do so without breaching the peace. Breaching the peace refers to actions that may lead to violence, property damage, or disturbance of the peace during the repossession process. There are several key aspects of repossession laws in Arizona, including the following: 1. Notice requirements: Lenders must provide borrowers with a written notice of intent to repossess before initiating any repossession proceedings. This notice typically includes information about the default, the amount owed, and a deadline to cure the default. 2. Right to cure: Borrowers have the right to cure the default by paying off the outstanding balance or taking other necessary measures to bring the loan current. The specific time period for curing the default is usually mentioned in the notice sent by the lender. 3. Repossession procedure: Lenders must follow specific procedures during the repossession process. They are typically required to hire a licensed repossession agent or use their in-house recovery team to repossess the collateral. The repossession agent must not use force or enter private property without permission. 4. No self-help repossession: Arizona law prohibits lenders from employing self-help repossession methods. This means that lenders cannot repossess collateral without a court order or without following the proper legal procedures. 5. Post-repossession notice: After repossessing the collateral, lenders must provide the borrower with a post-repossession notice. This notice informs the borrower about their rights to redeem the collateral, retrieve personal belongings, and dispute any deficiencies. It's important to note that while these are the primary repossession laws in Arizona, other rules and regulations may apply depending on the specific circumstances of the repossession. Consulting with a legal professional or reviewing the Arizona Revised Statutes (AS) Chapter 9-Repo may provide more detailed information tailored to individual cases.

Repossession Laws In Arizona

Description

How to fill out Repossession Laws In Arizona?

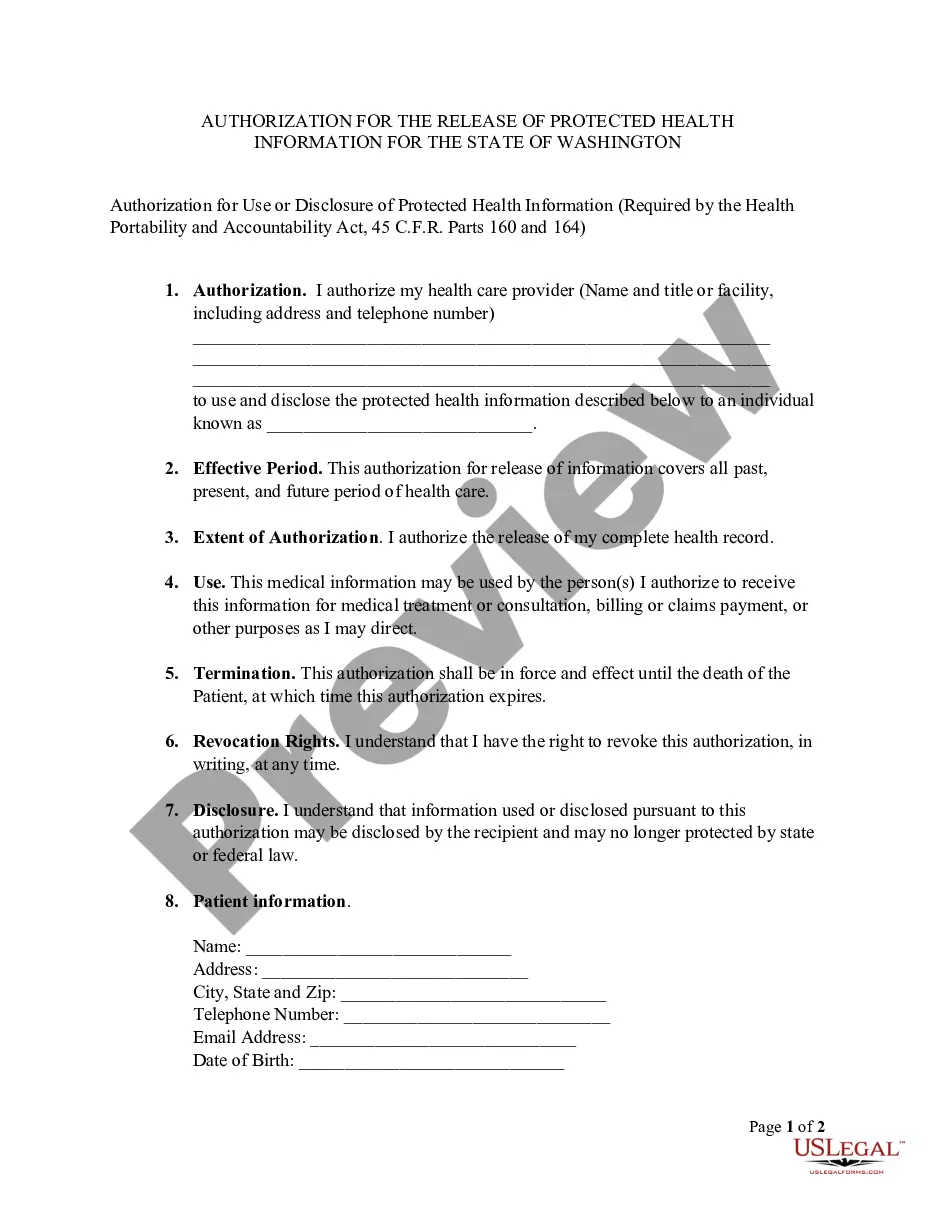

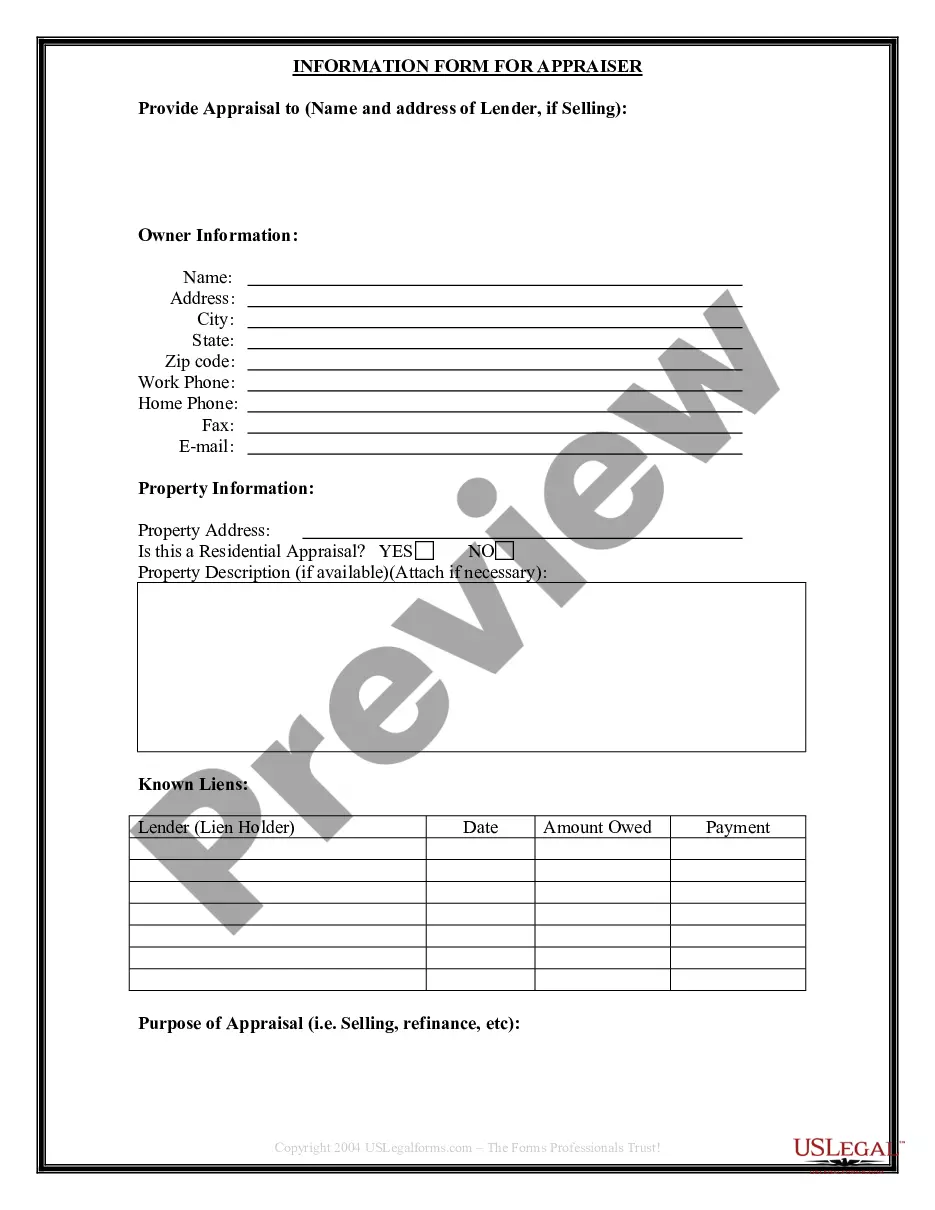

Using legal document samples that meet the federal and regional regulations is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the appropriate Repossession Laws In Arizona sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and personal scenario. They are easy to browse with all files collected by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when obtaining a Repossession Laws In Arizona from our website.

Getting a Repossession Laws In Arizona is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the guidelines below:

- Analyze the template using the Preview feature or via the text description to ensure it meets your requirements.

- Locate a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Repossession Laws In Arizona and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Statute of Limitations The creditor has 4 years from the time it repossessed your car to sue for a deficiency. If more than 4 years have passed, the statute of limitations has run. If you believe the statute of limitations has run, you should notify the creditor and ask them to dismiss the lawsuit.

In order to do so, they must pay back the full amount that remains on the loan, as well as any late fees that they may have incurred and reasonable expenses from the repossession or storage.

If you are late on a payment, the creditor can choose to accelerate your loan. You will then owe the creditor the entire amount due on the loan. If you can't pay the entire amount due on the loan in a certain time period (usually 10 days), the creditor can then take back, or repossess, the property.

If you are late on a payment, the creditor can choose to accelerate your loan. You will then owe the creditor the entire amount due on the loan. If you can't pay the entire amount due on the loan in a certain time period (usually 10 days), the creditor can then take back, or repossess, the property.

The law states someone first must have missed payments for 90 days. Then a dealership must send a certified letter. If the person fails to pay for 30 days after that, they are guilty of "unlawful failure to return a motor vehicle subject to a security interest."