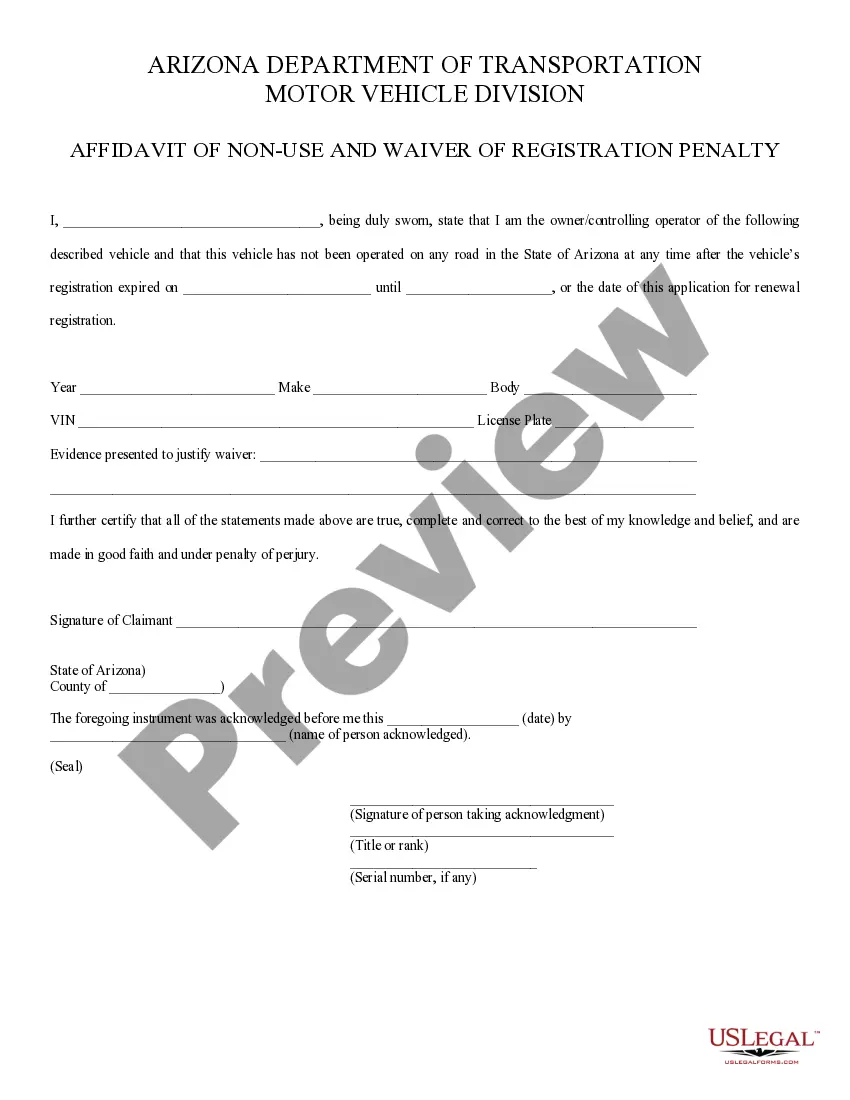

Affidavit Of Non Use Arizona Withholding Tax

Description

How to fill out Arizona Affidavit Of Nonuse?

How to locate professional legal documents that align with your state's regulations and prepare the Affidavit of Non Use Arizona Withholding Tax without hiring an attorney.

Numerous online services provide templates to address various legal situations and requirements.

However, it may require time to determine which of the available samples meet both your usage scenario and legal standards.

Download the Affidavit of Non Use Arizona Withholding Tax using the appropriate button next to the document title. If you do not have an account with US Legal Forms, then follow the instructions below: Review the webpage you've opened and verify if the form meets your requirements. To do this, utilize the form description and preview options if available. Search for another template in the header that indicates your state if necessary. Click the Buy Now button when you identify the suitable document. Select the most fitting pricing plan, then sign in or pre-register for an account. Choose your payment method (either by credit card or through PayPal). Alter the file format for your Affidavit of Non Use Arizona Withholding Tax and click Download. The obtained documents remain yours: you can always access them in the My documents section of your profile. Register for our library and create legal documents independently like a proficient legal professional!

- US Legal Forms is a trustworthy service that assists you in locating formal documentation crafted in accordance with the latest updates in state law and helps you save on legal fees.

- US Legal Forms is not a conventional online library.

- Instead, it's a repository of over 85,000 verified templates for diverse business and personal situations.

- All documents are categorized by field and state to streamline your search process.

- It also integrates with powerful solutions for PDF editing and electronic signatures, enabling users with a premium subscription to quickly complete their paperwork online.

- It requires minimal time and effort to acquire the necessary documents.

- If you already possess an account, Log In and verify your subscription status.

Form popularity

FAQ

Nonresident Employees Compensation earned by nonresidents while physically working in Arizona for temporary periods is subject to Arizona income tax. However, under Arizona law, compensation paid to certain nonresident employees is not subject to Arizona income tax withholding.

Employee Withholding Determination If the employee does not complete the form, the employer must withhold Arizona income tax at the rate of 2.7% until the employee elects a different withholding rate.

An employer must withhold Arizona income tax from employees whose compensation is for services performed within Arizona. Arizona state income tax withholding is a percentage of the employee's gross taxable wages.

If a new employee fails to complete an A-4 within the first week of employment, the employer is required to withhold at the median rate of 2.7% until the employee officially requests a change.

All wages, salaries, bonuses or other compensation paid for services performed in Arizona are subject to state income tax withholding, with exceptions. Visit the Arizona Department of Revenue Web site for detailed information.