Quitclaim Deed For Mortgage

Description

How to fill out Arizona Quitclaim Deed From An Individual To A Nonprofit Corporation?

- If you're a returning user, log in to your account and select the Download button corresponding to your needed form template. Ensure your subscription is active to avoid disruptions.

- For first-time users, begin by browsing the extensive online library of over 85,000 fillable legal forms and packages. Use the Search tab to find the specific quitclaim deed that fits your jurisdiction's requirements.

- Carefully check the preview and description of the selected form to confirm it meets your specific needs.

- Once satisfied, proceed by clicking on the Buy Now button and select your preferred subscription plan. You will need to register an account to access the full range of resources available.

- Complete your purchase by providing your payment details via credit card or PayPal to finalize the subscription.

- After your transaction, download the quitclaim deed for mortgage and save it on your device for completion. You can also access it anytime via the My Forms section in your profile.

US Legal Forms empowers individuals and attorneys with a remarkable collection of legal documents tailored for various needs. With their easy-to-use platform, users can efficiently navigate legal requirements and secure precision in their documentation.

In conclusion, acquiring a quitclaim deed for a mortgage doesn't have to be overwhelming. With US Legal Forms, you can easily access and complete the necessary documents to protect your interests. Don't hesitate to explore our resources and simplify your legal journey today!

Form popularity

FAQ

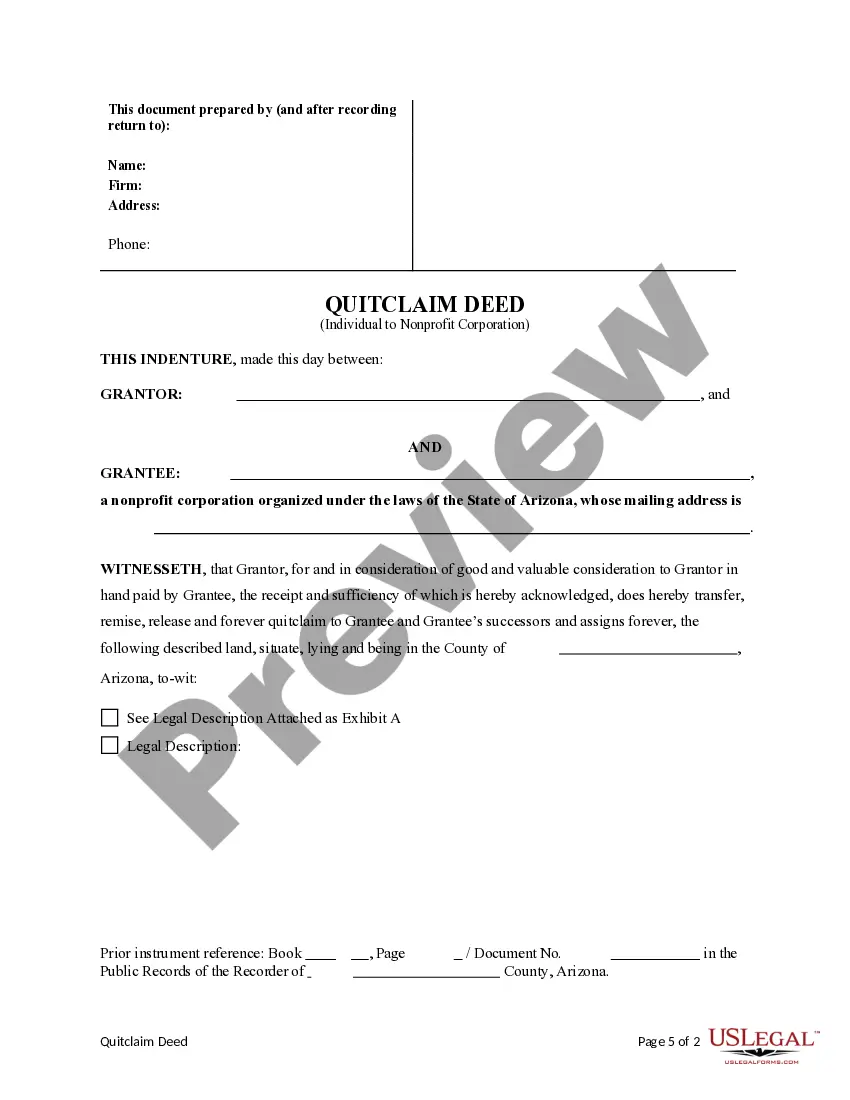

To fill out a quitclaim deed form for mortgage, begin by obtaining the correct form from a reliable source, such as UsLegalForms. Then, fill in the names of both the person transferring property and the one receiving it. Provide the property description, making sure to include all necessary details for clarity. After signature and notarization, submit the completed form to the appropriate county office to finalize the transfer.

Quitclaim deeds for mortgage can be viewed unfavorably because they provide no warranty of ownership. This lack of guarantee means that the grantee might not receive clear title, which can lead to potential disputes later. Additionally, some lenders may hesitate to finance a property transferred via a quitclaim due to these risks. When considering a quitclaim deed, it's wise to understand these implications fully.

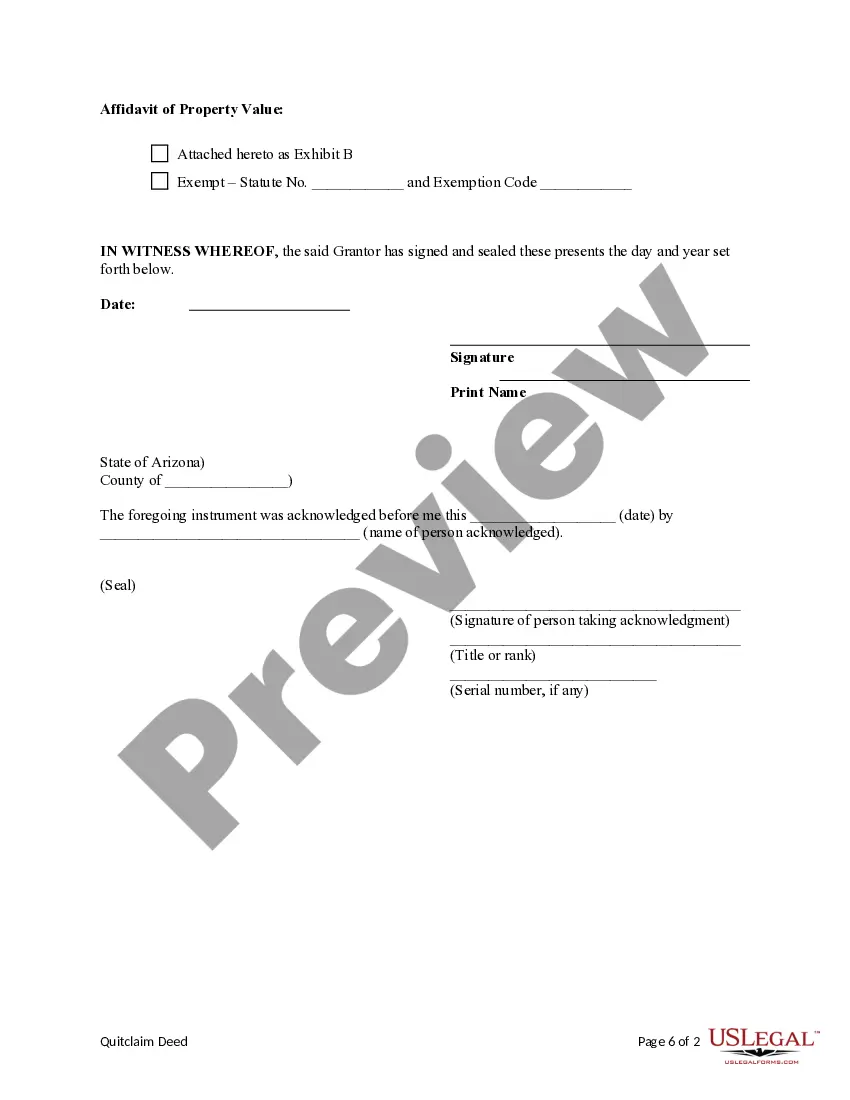

To properly fill out a quitclaim deed for mortgage, start by entering the names of the grantor and grantee accurately. Clearly describe the property involved, including its legal description if available. Ensure that all parties sign the document before a notary public to validate it. Finally, record the finished quitclaim deed with your local land records office to make it official.

Quitclaim deeds are most often used for transferring property interests among family members or in situations like divorce settlements. They are ideal for conveying property quickly, especially when the parties trust each other. For those considering a quitclaim deed for mortgage, it is a straightforward way to manage and transfer ownership efficiently.

The usual reason for using a quitclaim deed is to transfer interest in a property without warranty of title. This tool is particularly helpful in family transactions, such as between parents and children, or among siblings. By using a quitclaim deed for mortgage, parties can simplify the transfer process while maintaining good relationships.

Yes, you can prepare a quitclaim deed yourself, but it's essential to follow your state's specific requirements. You should ensure that the deed is filled out correctly and filed properly with the county office. If you want clarity and correctness, US Legal Forms offers templates and guidance to help you create a quitclaim deed for mortgage effectively.

People often use quitclaim deeds to transfer property ownership quickly and easily. This process is common in situations like settling estates, gifting property, or during a divorce. In these cases, a quitclaim deed for mortgage helps clarify ownership, minimizing possible disputes in the future.

Filing a quitclaim deed for mortgage in New York involves several steps. First, ensure you have the correct form, then complete it accurately with all necessary details. Finally, you must file the completed deed with your local county clerk's office. US Legal Forms can help you find the proper form and guide you through filing.

Yes, it is possible to get a mortgage with a quitclaim deed. However, lenders may have requirements regarding how long you have owned the property. It's crucial to check with your lender about their policies regarding a quitclaim deed for mortgage, as they can vary.

While a quitclaim deed for mortgage can transfer ownership quickly, it comes with disadvantages. One major concern is that it doesn't guarantee clear title; the grantee may inherit any existing liens or claims. Additionally, without warranties, the risk falls on you if issues arise after the transfer.