Quitclaim Deed For Florida

Description

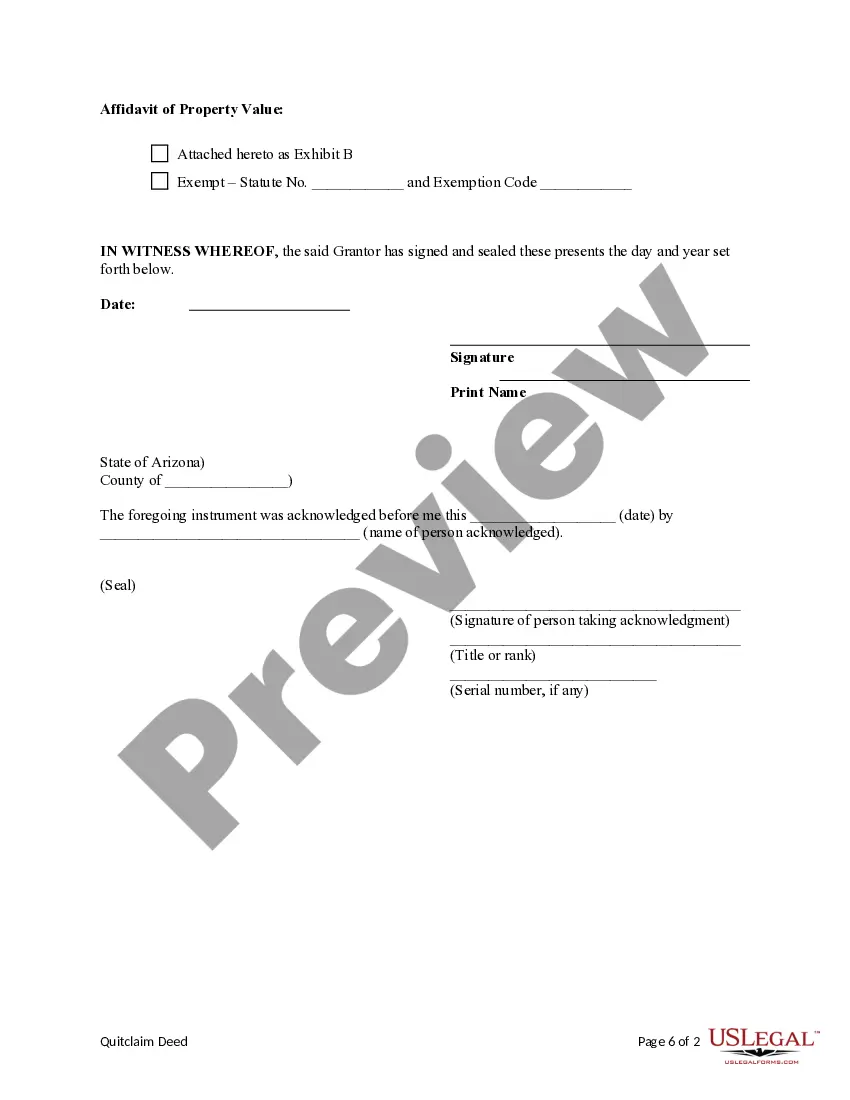

How to fill out Arizona Quitclaim Deed From An Individual To A Nonprofit Corporation?

- Log in to your US Legal Forms account if you are a returning user, ensuring your subscription is active.

- For first-time users, start by browsing the extensive library of over 85,000 legal forms. Use the preview mode to select the correct quitclaim deed template for your needs.

- If the template isn’t quite right, utilize the Search tab to find alternatives that align better with your requirements.

- When you find the right document, click the 'Buy Now' button and choose a suitable subscription plan, making sure to create an account for full access.

- Complete your purchase using your credit card or PayPal, which grants immediate access to your selected forms.

- Finally, download the quitclaim deed template to your device for easy completion, and find it later in the 'My Forms' section of your profile.

Once you have your quitclaim deed ready, consider using US Legal Forms' premium expert assistance to ensure it’s accurately filled out and legally binding. This service empowers individuals and attorneys alike to execute legal documents with confidence.

Don’t let paperwork overwhelm you; take action today with US Legal Forms and secure your quitclaim deed for Florida effortlessly!

Form popularity

FAQ

Typically, family members or parties with a longstanding relationship benefit most from a quitclaim deed for Florida. This type of deed allows for a quick transfer of property without the formalities of traditional sales, making it ideal in situations like divorce or inheritance. It offers an efficient way to clarify ownership among trusted individuals, though it’s essential to understand the associated risks.

Yes, you can prepare a quitclaim deed for Florida by yourself if you feel comfortable with the process. Various online platforms, including US Legal Forms, provide templates and helpful guidance to assist in creating a legally sound document. However, seeking advice from a legal professional is beneficial to avoid potential issues and ensure compliance with state regulations.

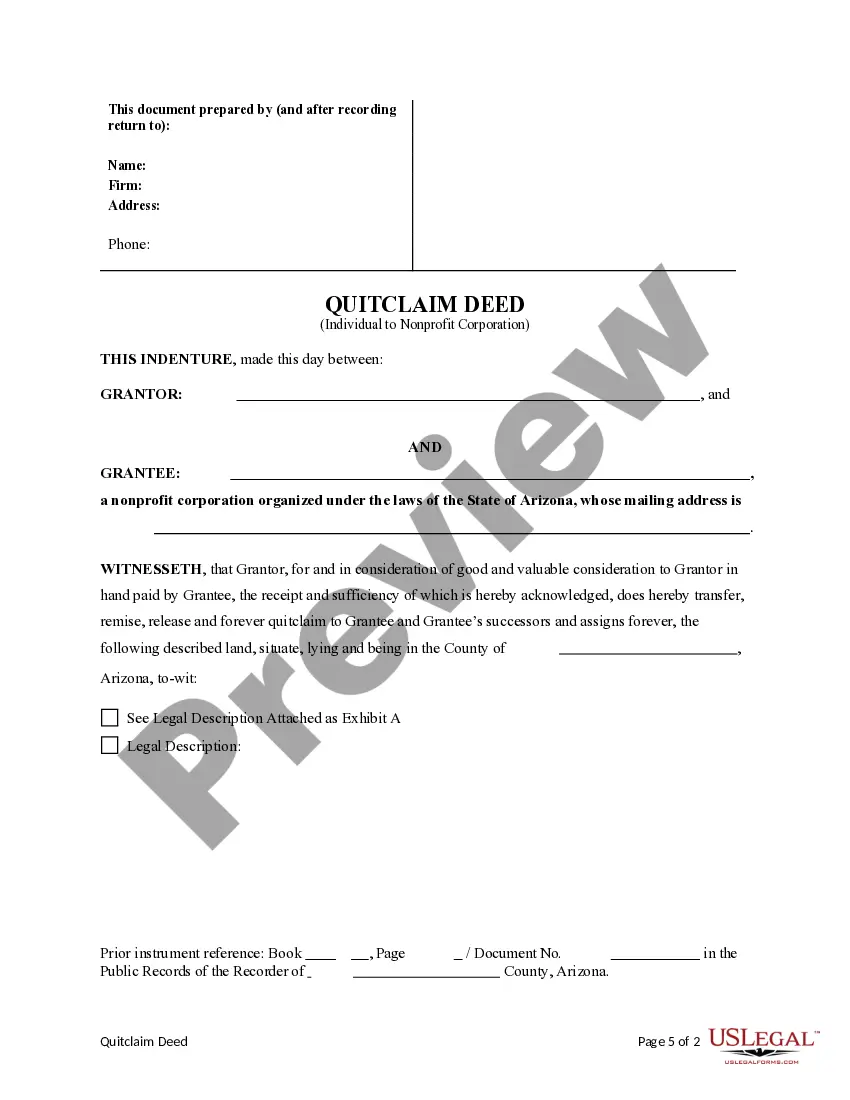

In Florida, a quitclaim deed must meet specific legal requirements to be valid. The document should include the names of the grantor and grantee, a legal description of the property, and be signed by the grantor in the presence of a notary public. Additionally, it is advisable to record the quitclaim deed for Florida with the county clerk to protect one's interests and ensure public visibility.

A quitclaim deed for Florida can come with several drawbacks. One major issue is that it does not provide any guarantees regarding the property title, meaning the grantor may have no legal title to transfer. Additionally, if any debts or liens are attached to the property, the new owner may assume these obligations. Therefore, careful consideration is crucial before proceeding.

You can certainly create a quitclaim deed on your own, but thorough knowledge of the process is important. Many people choose to consult legal resources or professionals to ensure accuracy and compliance. This approach saves time and reduces the risk of mistakes. Platforms like US Legal Forms offer easy-to-use templates and insights to help you navigate through the creation of your quitclaim deed confidently.

Yes, you can complete a quitclaim deed yourself in Florida. However, you should ensure that you understand the specific requirements for filing in your county. Each region might have different forms, fees, and recording procedures. If you want assistance, US Legal Forms provides state-specific resources, which can simplify the process and minimize errors.

The main disadvantage of a quitclaim deed for Florida is that it does not guarantee that the grantor holds clear title to the property. This means you could inherit potential legal issues or claims from previous owners. Additionally, a quitclaim deed does not provide any warranties, which may make buyers hesitant. It’s important to weigh these risks when deciding if a quitclaim deed is the right choice for your situation.

After completing a quitclaim deed for Florida, the next step is to have the deed notarized. Once notarized, you will need to record the deed with the local county property appraiser's office. This recording puts the public on notice of the ownership change and protects the new owner’s rights in the property.

To properly fill out a quitclaim deed, start by clearly stating the names of the parties involved and the property's legal description. Make sure to sign the deed in front of a notary public, who will verify the identities of those signing. Finally, file the completed deed with the county clerk's office to ensure it is part of the property's official records.

While it's not a legal requirement to have a lawyer to file a quitclaim deed for Florida, it is often advisable. A lawyer can help ensure that the deed is completed correctly and complies with local laws. They can also answer any questions about the process, which may provide peace of mind for both the grantor and grantee.