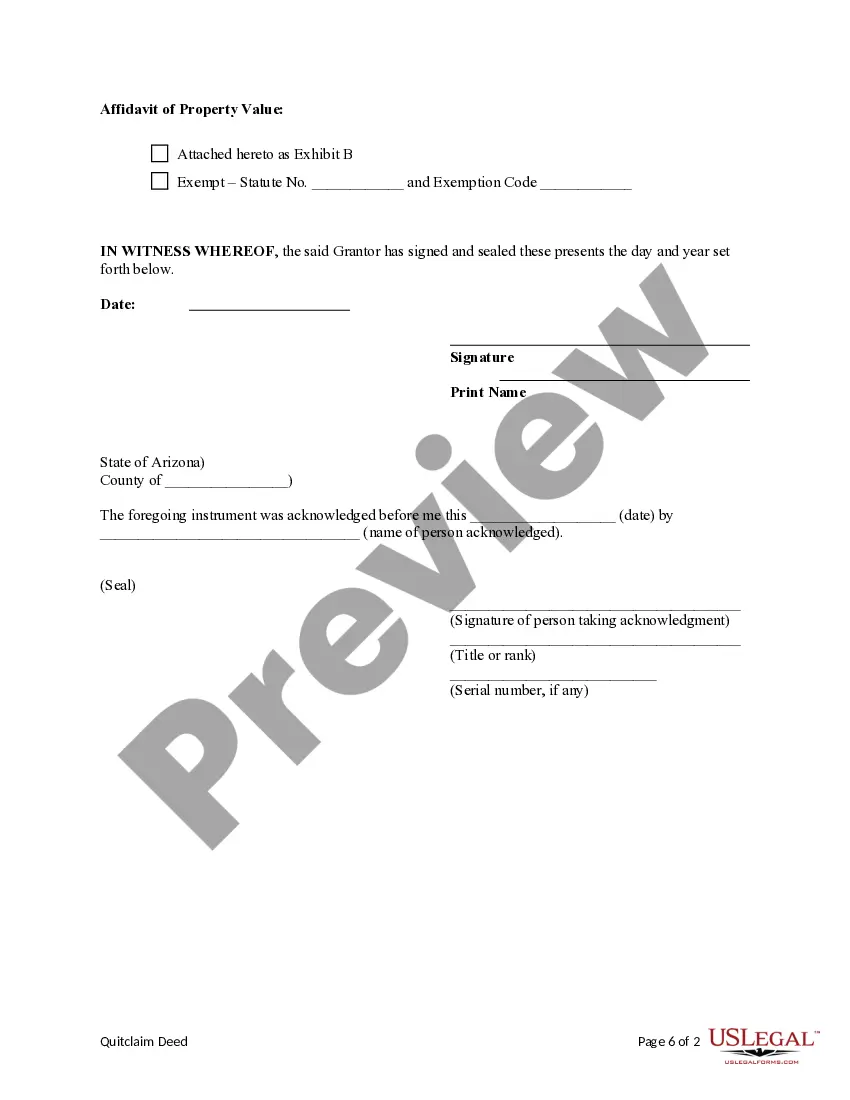

Quitclaim.dead

Description

How to fill out Arizona Quitclaim Deed From An Individual To A Nonprofit Corporation?

- Log in to your account if you're a returning user. Ensure your subscription is active; consider renewing if it has lapsed.

- For first-time users, start by browsing the preview mode and descriptions of available forms. Verify that the selected document meets your specific needs and adheres to local jurisdiction requirements.

- If needed, utilize the Search tab to find a more suitable template. Confirm that it aligns with your requirements before proceeding.

- Select your desired document by clicking the Buy Now button, then choose your subscription plan. Be sure to register an account to access extensive library resources.

- Complete your purchase by providing payment details via credit card or PayPal for the subscription.

- Download the form directly to your device, allowing for easy completion. You can always access it later in the My Forms section of your account.

By using US Legal Forms, you benefit from a robust collection of legal documents that is unparalleled in its affordability. Regular users can easily manage their subscriptions to maintain access.

Start simplifying your legal documentation process today by visiting quitclaim.dead and exploring the extensive library available!

Form popularity

FAQ

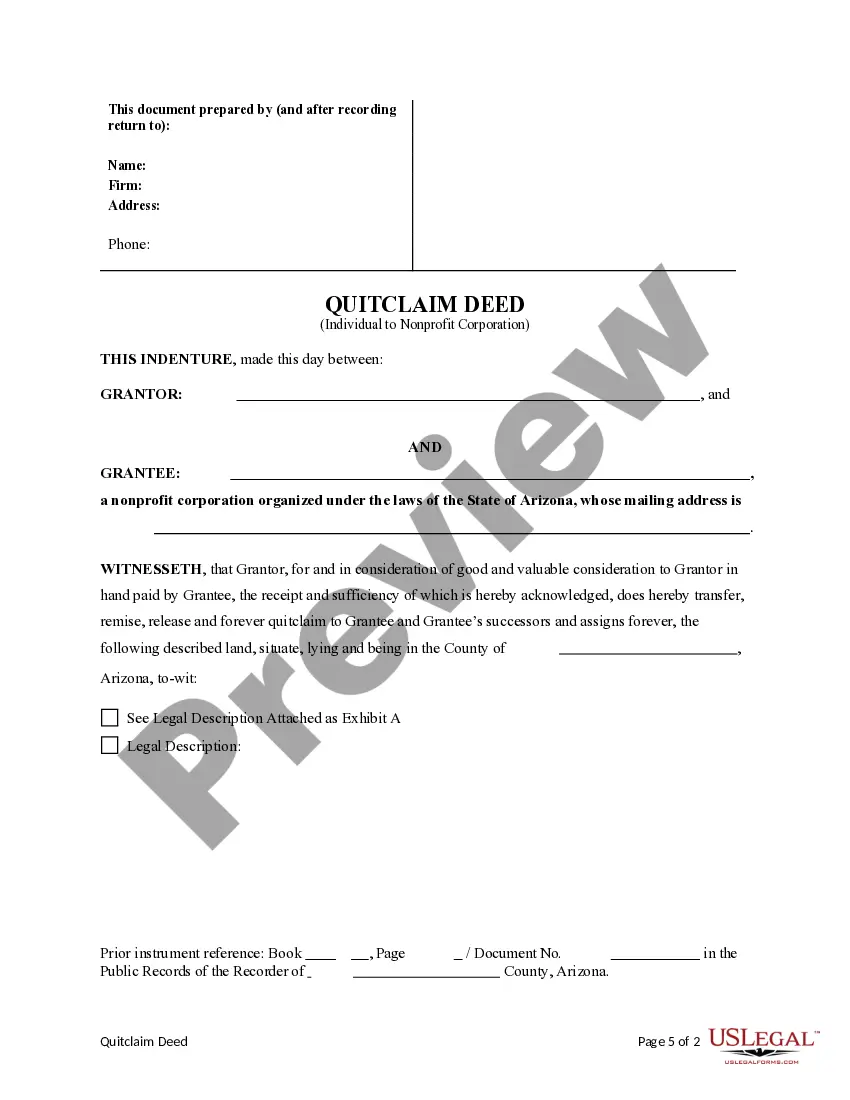

The best way to execute a quitclaim deed involves a few key steps. First, gather the necessary information about the property and the parties involved. Then, use a reliable resource like Quitclaim.dead to access templates designed for your state. Finally, consider using US Legal Forms for extra assistance to ensure the deed is properly executed and recorded.

Yes, you can prepare a quit claim deed yourself. However, it's important to understand the legal requirements in your state. Online resources, like Quitclaim.dead, provide templates and guidance for creating these deeds properly. Using US Legal Forms can further simplify this process and help ensure that your quitclaim deed meets all necessary legal standards.

Yes, you can handle a quit claim deed yourself, as long as you follow your state’s requirements. This includes filling out the necessary forms accurately and ensuring proper notarization. However, using US Legal Forms can simplify the process, providing access to expert resources tailored to your needs and reducing the chances of errors.

One disadvantage of a quitclaim deed is that it does not guarantee clear title to the property, which can lead to disputes later. Additionally, the grantor is not liable for any unpaid property taxes or liens. It’s important to understand these risks, but platforms like US Legal Forms can help you determine the best option for your needs.

In New York, a quitclaim deed requires a legal description of the property, the names and signatures of the grantor and grantee, and a notary public's acknowledgment. You also need to file the deed with the county clerk's office. Utilizing US Legal Forms can simplify this process by providing you with the necessary templates and guidance.

To obtain a copy of your quitclaim deed, visit your local county clerk's office or access their online records, if available. You may need to provide specific information, such as the property address and your name. Additionally, US Legal Forms can help you with request forms and streamline your search for this important document.

Yes, you can complete a quitclaim deed on your own. To do so, you need to fill out the correct forms and follow your state's regulations. However, using a platform like US Legal Forms can guide you through the process, ensuring all details meet legal standards. This can help avoid mistakes that could delay your transaction.

In Minnesota, a quitclaim deed functions as a legal document that transfers a person's interest in property to another party. It requires both the grantor and grantee’s names, the property description, and must be signed before a notary. After signing, it must be filed with the local county recorder for it to take effect. Using uslegalforms can help ensure your quitclaim.dead is properly completed and filed according to Minnesota laws.

The usual reason for using a quitclaim deed is to transfer property without the need for extensive legal formalities. This is especially beneficial in private transactions, such as between family members or during amicable separations. People appreciate this efficient way to release claims on property while minimizing costs and time. That is why many choose to navigate through quitclaim.dead for easy resolutions.

Quitclaims are sometimes viewed unfavorably because they do not provide any guarantees about the title's validity. This means the grantee accepts the property without any claim against potential hidden issues, such as existing liens. Therefore, caution is advised, especially when dealing with significant assets. Understanding these risks highlights the importance of being informed about quitclaim.dead.