Extrato Do Arizona

Description

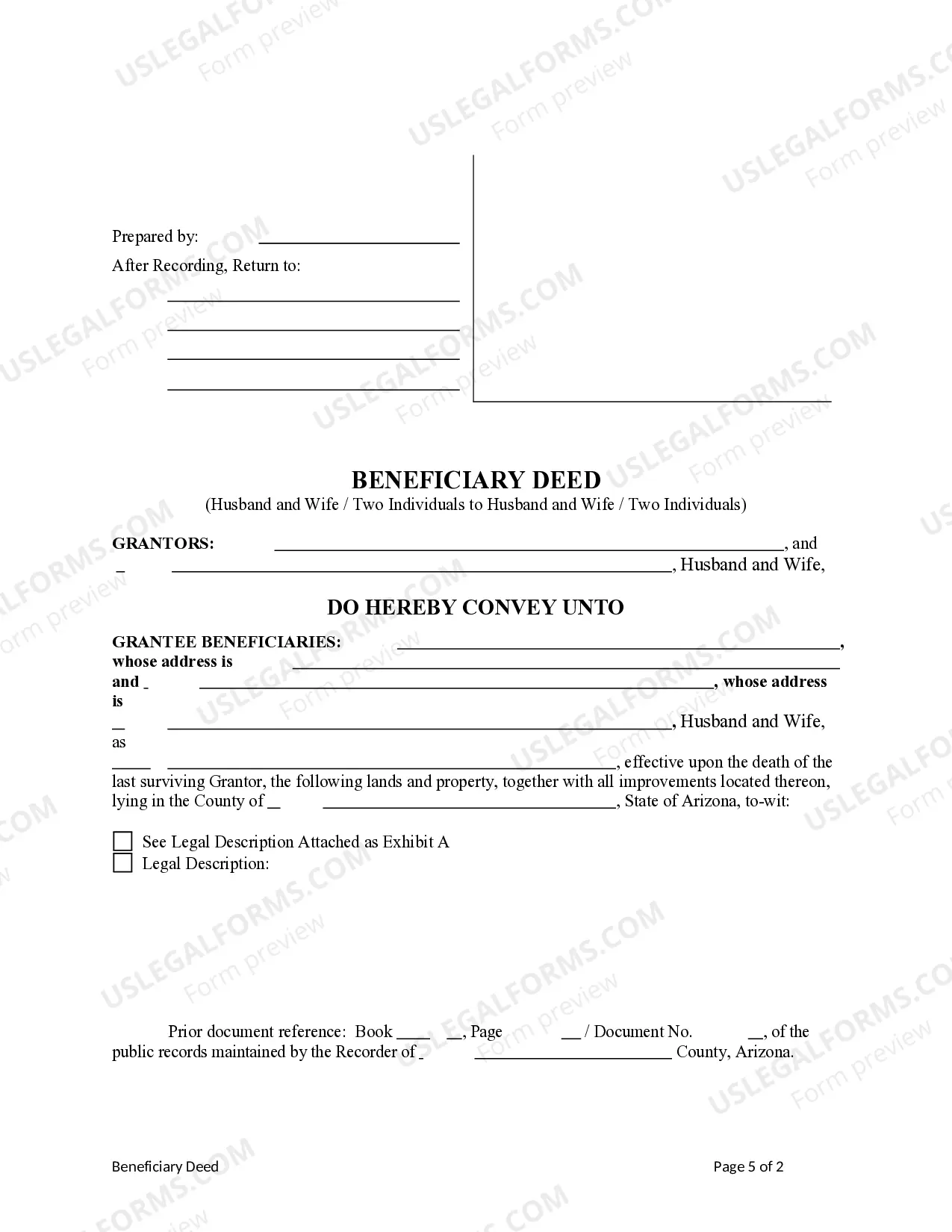

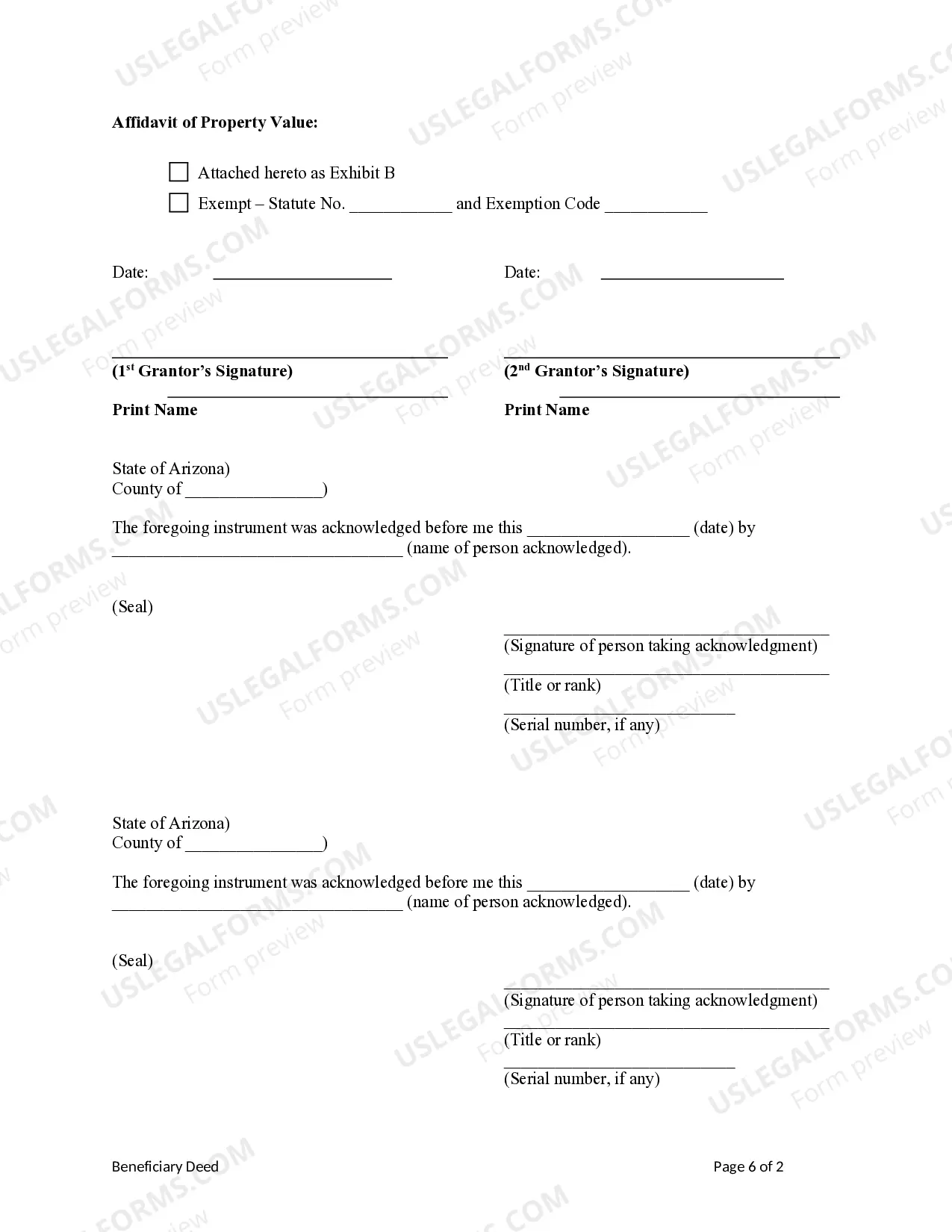

How to fill out Arizona Beneficiary Or Transfer Of Death (TOD) Deed - Husband And Wife / Two Individuals To Husband And Wife / Two Individuals?

- If you already have an account, log in and check your subscription status to ensure it's valid. If needed, renew according to your plan.

- For new users, begin by searching for 'extrato do arizona' in the search bar.

- Preview the relevant form details to confirm it meets your needs and jurisdiction requirements before proceeding.

- Choose the appropriate template and click on the 'Buy Now' button to select your subscription plan.

- Complete your purchase by entering your payment method or using PayPal, ensuring a secure transaction.

- Once purchased, download the form to your device for immediate access and fill it out as needed. You can find it later in the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of obtaining legal documents such as the extrato do arizona. With over 85,000 forms available and expert assistance, you can rest assured that you will have the right documents when you need them.

Don't wait—start leveraging the benefits of US Legal Forms today!

Form popularity

FAQ

New employees in Arizona typically need to complete the federal W-4 form and Arizona's A-4 form for state withholding tax. These forms collect essential information for tax calculations and ensure compliance with state and federal regulations. It's beneficial to provide clear instructions to new hires about these forms. US Legal Forms has comprehensive resources that can help streamline this process for both employers and employees.

To fill out a sales tax exemption certificate in Arizona, provide your business details and specify the reason for the exemption. Each section must be completed accurately to ensure validity. It’s crucial to retain copies of the completed exemption certificates for your records. US Legal Forms offers user-friendly templates and guidance to help ensure your certificate is filled out correctly.

The main difference between Arizona form 5000 and form 5000A lies in their purposes. Form 5000 is typically used for general sales tax exemption applications, while form 5000A specifically pertains to transactions involving certain types of purchases. Understanding these differences can help ensure you submit the correct form for your needs. For further clarification, US Legal Forms provides detailed comparisons and guides for both forms.

Applying for a resale certificate in Arizona involves completing the correct form and providing information about your business activities. You must demonstrate that you are purchasing goods for resale, not for personal use. This certificate can help you avoid sales tax on items you intend to resell. For a simplified process, consider using resources available at US Legal Forms, which can guide you through the application.

To set up a withholding account in Arizona, you need to register with the Arizona Department of Revenue. You will usually do this by completing the Arizona Form A-1, where you provide your business details and employee information. It’s essential to keep this information accurate to ensure proper withholding calculations. Additionally, US Legal Forms offers easy-to-follow instructions and templates to assist you in this process.

Filling out Arizona form 5000A requires you to provide accurate business information, including your taxpayer ID and the nature of your exemption claim. This form is crucial for obtaining your sales tax exemption certificate. When completing the form, ensure all sections are filled out clearly to avoid potential issues. You can find helpful resources and templates on US Legal Forms to assist you in filling out the Arizona form 5000A correctly.

In Arizona, certain organizations, like non-profit entities and government agencies, qualify for sales tax exemptions. Additionally, specific purchases related to manufacturing, agriculture, or research may also be exempt. To determine your eligibility for sales tax exemption in Arizona, it’s important to review the guidelines set forth by the Arizona Department of Revenue. Utilizing resources like US Legal Forms can simplify the application process and ensure compliance.

Determining your eligibility for tax credits in Arizona involves reviewing criteria set by both state and federal tax authorities. Generally, income, filing status, and family size are key factors. To better understand your situation and find the relevant credits you might qualify for, consult the extrato do arizona for comprehensive resources and assistance.

To check the status of your Arizona tax rebate, you can visit the Arizona Department of Revenue's online portal. By entering your personal information and details about your filing, you can quickly find the status of your rebate. For a smoother experience, use the guidance available in the extrato do arizona, ensuring you have all required information on hand.

The duration for processing unemployment claims in Arizona can vary, usually taking about two to three weeks. Once you submit your claim, it is essential to provide all necessary documentation for faster processing. For tracking your unemployment status, consider checking the extrato do arizona for updates on your claim's progress.