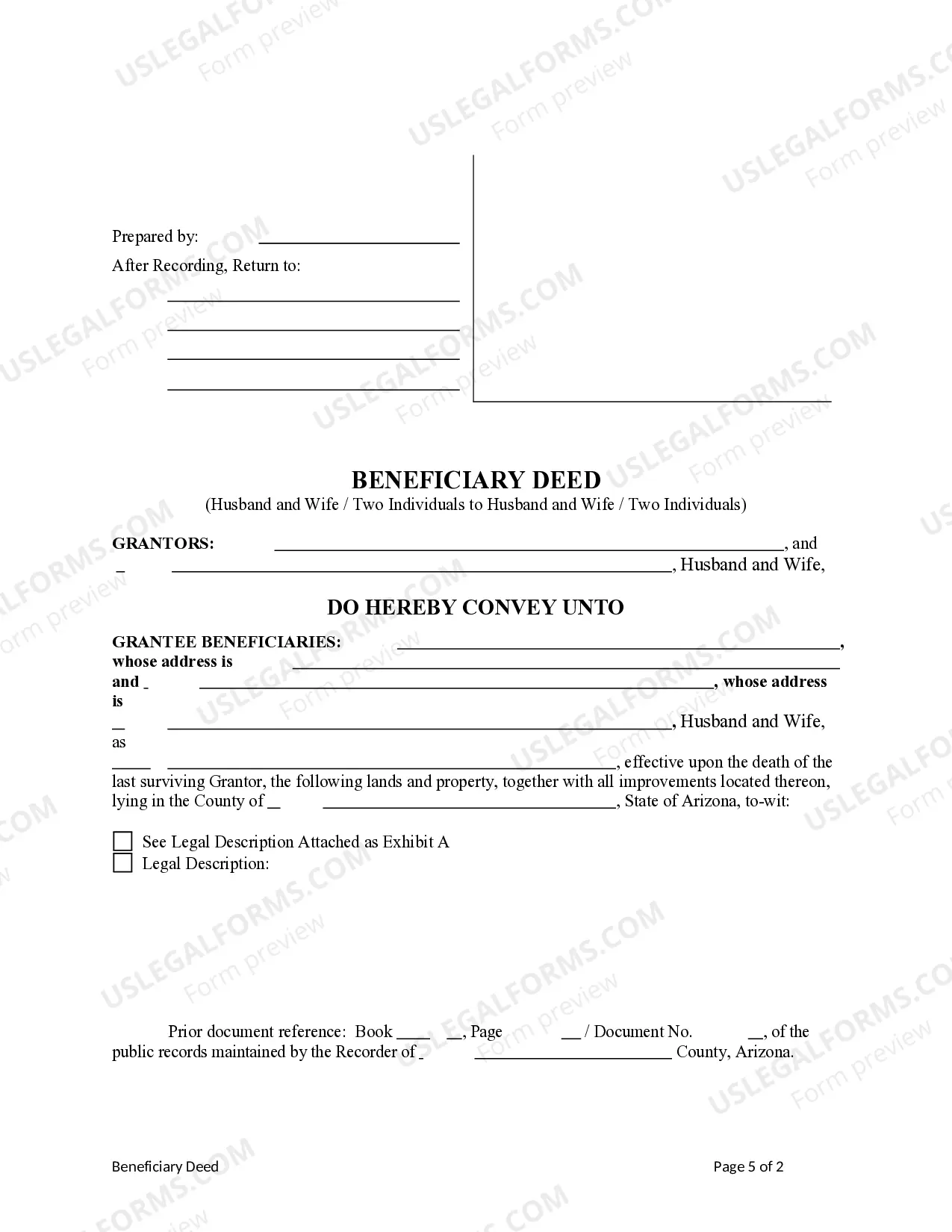

This form is a Transfer on Death Deed where the Grantors are husband and wife / two individuals and the Grantees are husband and wife / two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. This deed complies with all state statutory laws.

Arizona Revocation Of Beneficiary Deed Form

Description

How to fill out Arizona Beneficiary Or Transfer Of Death (TOD) Deed - Husband And Wife / Two Individuals To Husband And Wife / Two Individuals?

There is no longer a necessity to waste time searching for legal documents to adhere to your local state regulations.

US Legal Forms has gathered all of them in one location and enhanced their accessibility.

Our platform provides over 85,000 templates for various business and personal legal situations compiled by state and usage area.

If the previous one wasn’t suitable, utilize the search field above to look for another sample. Once you locate the appropriate one, click Buy Now beside the template name. Choose the most appropriate pricing plan and either register for an account or Log In. Complete the payment for your subscription using a card or PayPal to proceed. Select the file format for your Arizona Revocation Of Beneficiary Deed Form and download it to your device. Print your form to complete it manually or upload the sample if you wish to use an online editor. Creating official documents under federal and state laws is quick and simple with our library. Try US Legal Forms now to keep your paperwork organized!

- All forms are properly drafted and authenticated for legitimacy, so you can be confident in acquiring a current Arizona Revocation Of Beneficiary Deed Form.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also access all stored documents whenever necessary by opening the My documents tab in your profile.

- If you have not utilized our platform previously, the process will require a few additional steps to finalize.

- Here’s how new users can acquire the Arizona Revocation Of Beneficiary Deed Form from our collection.

- Review the page content thoroughly to ensure it contains the sample you need.

- Use the form description and preview options if available.

Form popularity

FAQ

In Arizona, certain assets are exempt from probate, including property held in joint tenancy, trust funds, and accounts with designated beneficiaries. Additionally, if there is a valid beneficiary deed in place, that property can bypass the probate process. Knowing which assets qualify helps streamline the distribution process after death. Utilizing resources like uslegalforms can provide clarity on managing these assets effectively.

To transfer a deed after a death in Arizona, ensure that any beneficiary deed is recorded with the county recorder's office. If no beneficiary deed exists, you may need to go through probate. Preparing the Arizona revocation of beneficiary deed form may also be necessary if you need to update any existing documents. Consulting with a legal professional can clarify the best steps for your situation.

After a death in Arizona, the beneficiary deed becomes effective, allowing the property to transfer directly to the named beneficiary. It is important for the beneficiary to record the death certificate along with the beneficiary deed at the county recorder's office. This step formalizes the transfer and ensures the property is recorded correctly. Following these steps can streamline the post-death process.

To change the deed on a house after the death of a spouse in Arizona, you may need to complete the appropriate forms, including the Arizona revocation of beneficiary deed form if necessary. It's essential to identify how the property was held, joint tenancy or community property. After filing the correct forms with the county recorder's office, the property can be transferred to the surviving spouse or heirs accordingly.

In Arizona, a beneficiary deed typically takes precedence over a will. This means if the same property is mentioned in both documents, the beneficiary deed will control the distribution of that property. It ensures that the property passes directly to the named beneficiary without going through probate. This can simplify the transfer process significantly.

Yes, a beneficiary deed must be recorded in Arizona to be effective. Recording the deed with the county recorder's office ensures that the property transfer upon death is legally recognized. Without recording, the beneficiary deed lacks the necessary legal authority. Therefore, it's important to follow this step to secure your intentions.

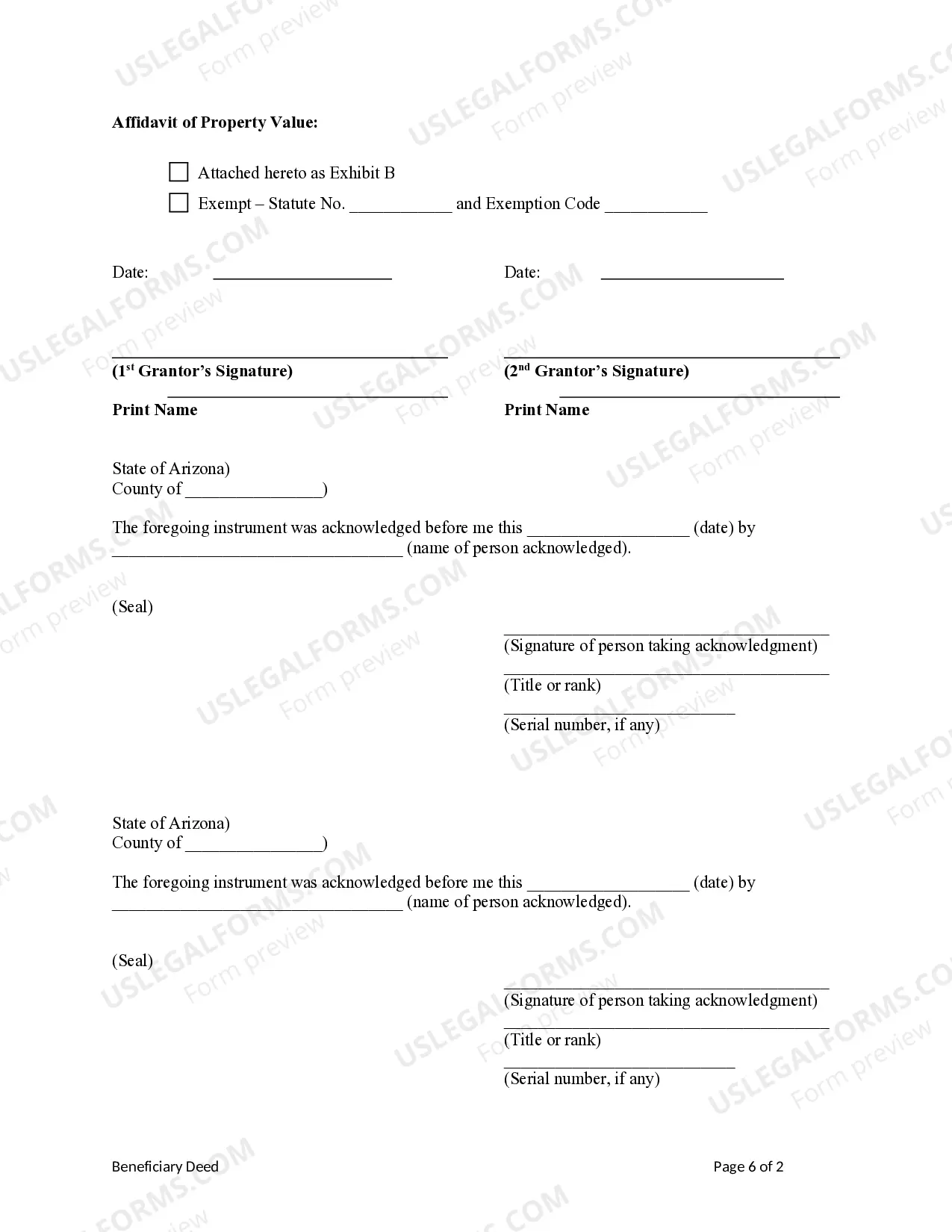

To revoke a beneficiary deed in Arizona, you must complete the Arizona revocation of beneficiary deed form. This form needs to be signed and notarized to ensure its validity. Once finalized, you should file the form with the county recorder's office where the original deed was recorded. This process effectively removes the beneficiary designation.

You can obtain a beneficiary deed form from multiple sources, including legal offices, online legal service providers, or directly from US Legal Forms. They offer a comprehensive Arizona revocation of beneficiary deed form that meets state requirements. It is crucial to select a reliable source to ensure the form is current and properly structured. Having the correct form will simplify your process of managing estate planning in Arizona.

To revoke a beneficiary deed in Arizona, you must complete a revocation form specific to your situation. First, ensure you have the Arizona revocation of beneficiary deed form, which can be obtained from various legal resources or online platforms like US Legal Forms. Once filled out, you must sign the form and have it notarized before filing it with your local county recorder's office. This process effectively nullifies the previous beneficiary designation.

Transferring property after a parent's death in Arizona typically involves utilizing the beneficiary deed if one is in place. This type of deed allows for a straightforward transfer to named beneficiaries without navigating probate. If no beneficiary deed exists, you may need to consider probate court options. Using uslegalforms can provide the necessary Arizona revocation of beneficiary deed form to assist in executing your parent's wishes efficiently.