Death On Deeds

Description

How to fill out Arizona Transfer On Death Or TOD - Beneficiary Deed - Individual Grantor To Three Individuals?

Whether for corporate objectives or personal matters, everyone must confront legal circumstances at some point in their lives.

Filling out legal documents requires meticulous focus, starting with selecting the correct form template.

Once saved, you can fill out the form using editing software or print it to complete it manually. With a comprehensive US Legal Forms catalog available, you don’t need to waste time searching online for the correct sample. Utilize the library's intuitive navigation to find the right form for any need.

- For instance, if you select an incorrect version of a Death On Deeds, it will be rejected when submitted.

- Thus, it is essential to obtain a reliable source of legal forms like US Legal Forms.

- If you need to acquire a Death On Deeds template, adhere to these straightforward steps.

- Retrieve the necessary sample using the search bar or through catalog browsing.

- Review the form’s details to ensure it corresponds with your circumstances, state, and locality.

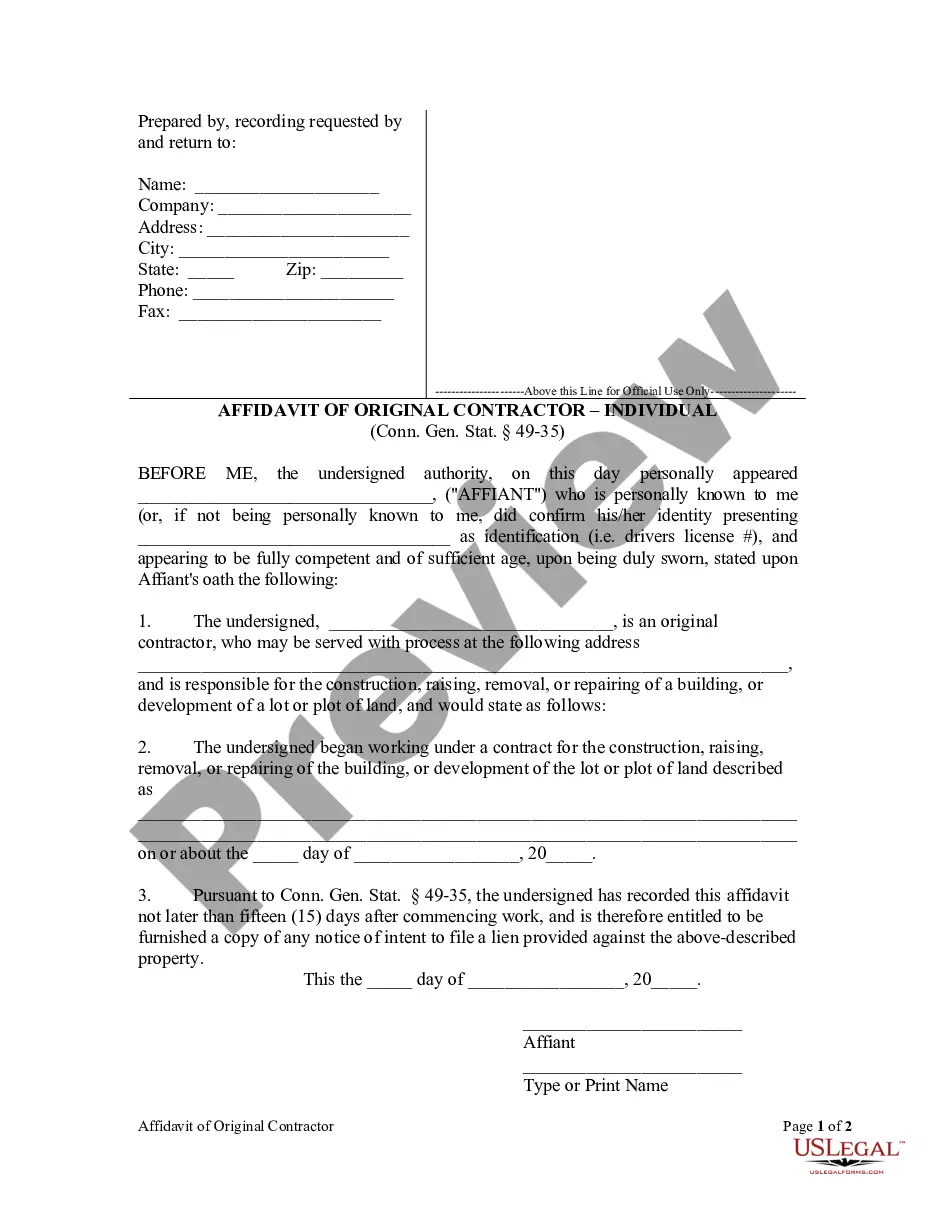

- Click on the form’s preview to take a closer look.

- If it is the incorrect document, return to the search function to locate the required Death On Deeds sample.

- Obtain the template when it satisfies your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the desired file format and download the Death On Deeds.

Form popularity

FAQ

Transferring property after death typically involves several steps, starting with validating the will, if one exists. You will need to gather necessary documents, including the death certificate and the deed. Next, you can either go through probate or utilize a transfer on death deed to pass the property directly to beneficiaries. Using US Legal Forms can streamline this process, helping you navigate the 'death on deeds' with ease.

You do not necessarily need a lawyer to file a transfer-on-death deed, as many states allow individuals to complete this process independently. However, consulting with a legal professional can provide clarity and ensure that all requirements are met. If you prefer a straightforward approach, US Legal Forms offers templates and resources designed to assist you with the 'death on deeds' process effectively.

Yes, you can create a transfer on death (TOD) deed yourself, but it’s crucial to follow your state's legal guidelines. This option allows you to designate beneficiaries for your property without the need for probate. However, if you're unsure about the process, seeking assistance from platforms like US Legal Forms can help you avoid common pitfalls in the 'death on deeds' process.

You can file a transfer on death deed at your local county recorder's office. It's essential to ensure that the deed complies with state-specific requirements. By filing the transfer on death deed, you can make the process of passing on property smoother after your death. US Legal Forms can guide you in preparing and filing the necessary documents correctly.

Changing house deeds after someone dies involves a legal process called transferring ownership. You will need to gather the necessary documents, such as the death certificate and the original deed. After that, you can file a new deed with the local county office to officially change the ownership. Utilizing resources like US Legal Forms can simplify this process, ensuring that you handle the 'death on deeds' efficiently.

To transfer ownership of property after death, you generally need to locate the deceased person's will and file it with the probate court. If a transfer on death deed exists, it can expedite the process by allowing the property to pass directly to the beneficiary. Using platforms like US Legal Forms can simplify this process by providing the necessary forms and guidance you need.

Yes, North Carolina does allow transfer on death deeds. This option enables property owners to designate beneficiaries who will receive their property upon their death without going through probate. It’s advisable to consult with a legal professional or use services like US Legal Forms to ensure compliance with North Carolina laws.

To create a deed upon death, you must draft a transfer on death deed that specifies the property and the beneficiary. Next, you need to sign the deed in front of a notary public and record it with your local county office. This process ensures that your property will seamlessly transfer to your chosen beneficiary after your passing.

To get a house deed in your name after someone dies, you first need to obtain a copy of the death certificate. Then, depending on the state's laws, you may need to file the will with the probate court or use a transfer on death deed if one exists. Utilizing platforms like US Legal Forms can help guide you through the necessary paperwork and ensure a smooth transition of ownership.

A transfer on death deed can be a good idea for many individuals, as it simplifies the transfer of property upon death. It allows you to bypass the probate process, which can be time-consuming and costly. However, it’s important to consider your specific situation and consult with a legal expert to determine if this option fits your needs.