Az Death Deed Beneficiary Without Social Security Number

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Getting a go-to place to access the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal files demands precision and attention to detail, which is the reason it is vital to take samples of Az Death Deed Beneficiary Without Social Security Number only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and check all the information concerning the document’s use and relevance for your situation and in your state or county.

Take the following steps to complete your Az Death Deed Beneficiary Without Social Security Number:

- Use the catalog navigation or search field to find your sample.

- Open the form’s information to see if it matches the requirements of your state and region.

- Open the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Get back to the search and find the right template if the Az Death Deed Beneficiary Without Social Security Number does not suit your requirements.

- When you are positive about the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that fits your preferences.

- Proceed to the registration to complete your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Az Death Deed Beneficiary Without Social Security Number.

- Once you have the form on your device, you can modify it with the editor or print it and finish it manually.

Get rid of the inconvenience that accompanies your legal documentation. Check out the extensive US Legal Forms catalog to find legal templates, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

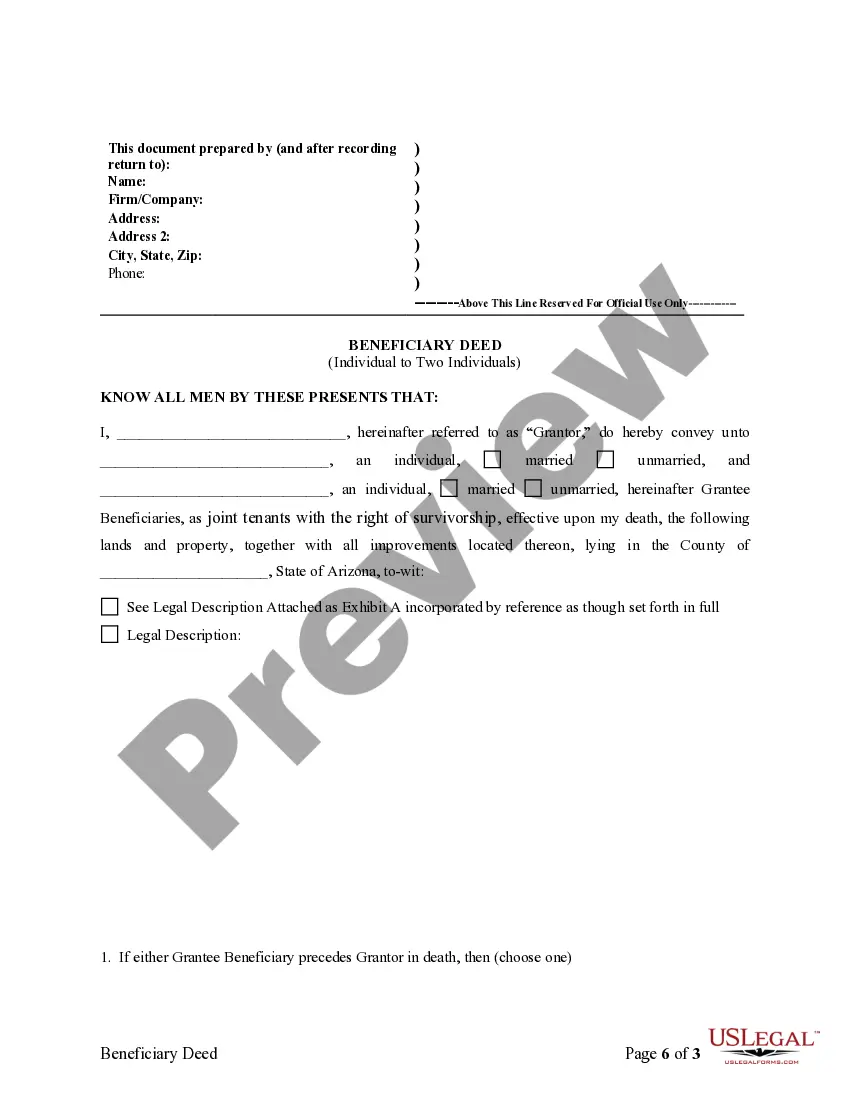

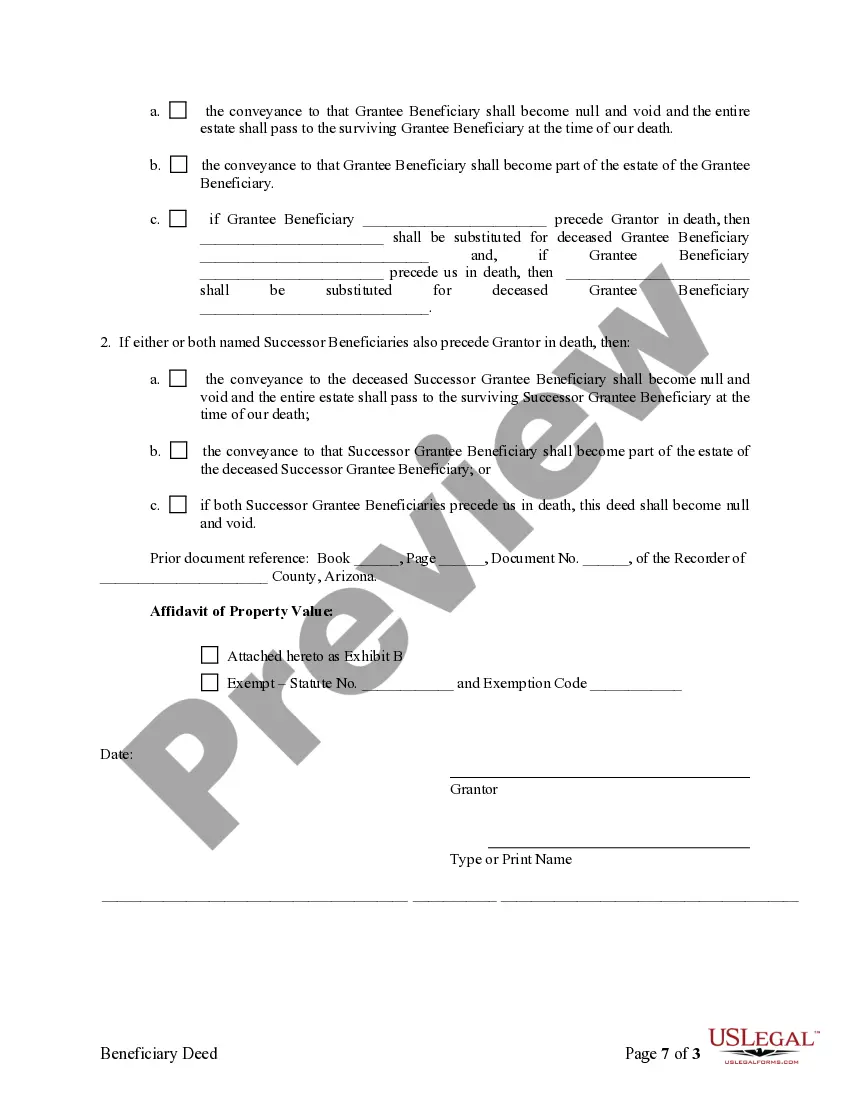

What do I need to do to ensure the beneficiary deed is valid? A beneficiary deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

Avoiding probate: Property passed to another individual through a beneficiary deed skips the probate process and passes directly to the beneficiary. Probate can be a costly and time-consuming legal process. Stay in control: With a beneficiary deed, you continue to control your property until you die.

4. After an Arizona Beneficiary Deed is signed and recorded, the owners may sell, encumber or otherwise deal with their property without any restrictions or limitations. 5. Signing and recording an Arizona Beneficiary Deed has no gift tax liability because it is not a present transfer of property.

At your death, ownership passes automatically to the beneficiary named in the deed. Any mortgage or debt attached to the land goes along with it. To retitle the real estate in the new owner's name, the new owner should record a sworn statement (affidavit) and a copy of the death certificate.