Az Death Deed Beneficiary With The Inheritance Payment

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Working with legal papers and procedures might be a time-consuming addition to your entire day. Az Death Deed Beneficiary With The Inheritance Payment and forms like it usually require you to look for them and understand the best way to complete them appropriately. Consequently, if you are taking care of financial, legal, or individual matters, using a extensive and convenient web library of forms on hand will greatly assist.

US Legal Forms is the number one web platform of legal templates, boasting over 85,000 state-specific forms and a variety of tools to assist you complete your papers easily. Check out the library of appropriate papers available to you with just one click.

US Legal Forms gives you state- and county-specific forms available at any time for downloading. Safeguard your papers management procedures with a top-notch services that allows you to make any form within minutes without having extra or hidden fees. Just log in in your profile, identify Az Death Deed Beneficiary With The Inheritance Payment and acquire it right away in the My Forms tab. You may also access previously saved forms.

Would it be the first time utilizing US Legal Forms? Sign up and set up your account in a few minutes and you’ll gain access to the form library and Az Death Deed Beneficiary With The Inheritance Payment. Then, follow the steps below to complete your form:

- Be sure you have found the right form by using the Review option and reading the form information.

- Pick Buy Now once ready, and choose the monthly subscription plan that fits your needs.

- Select Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of expertise helping users manage their legal papers. Discover the form you want today and improve any process without breaking a sweat.

Form popularity

FAQ

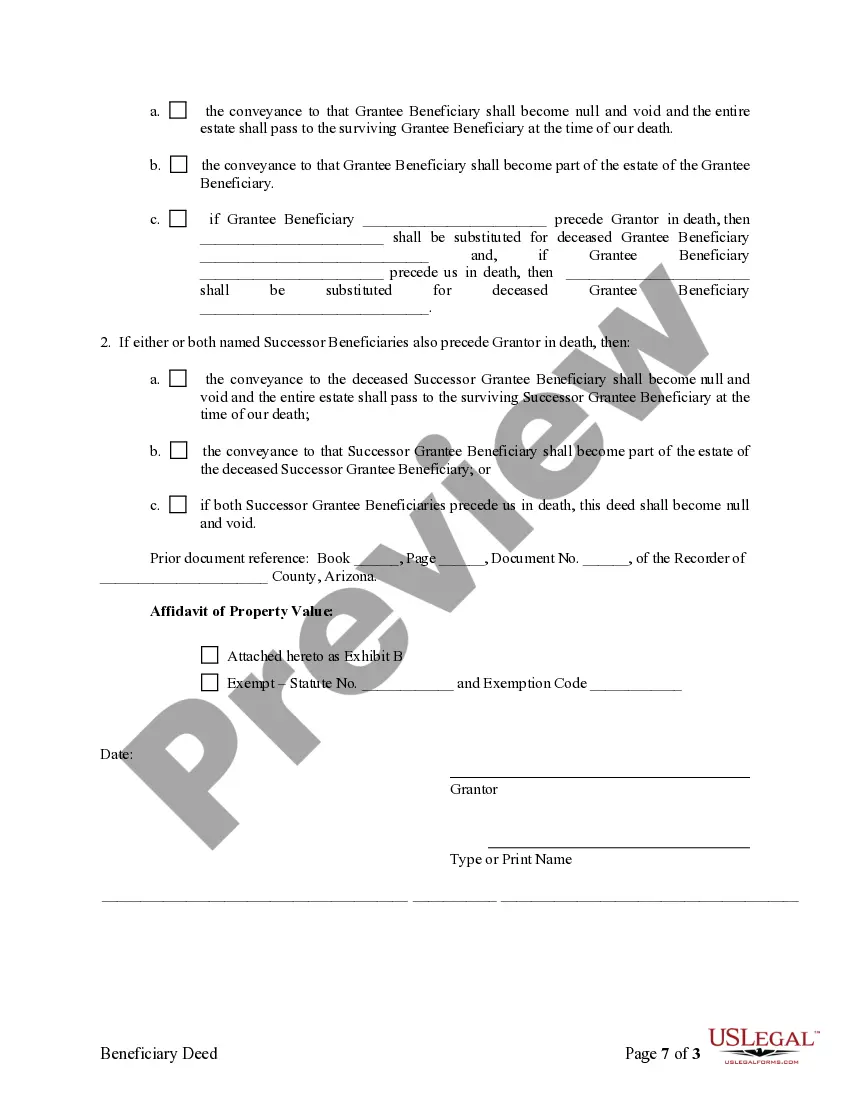

You must sign the deed and get your signature notarized, and then record (file) the deed with the recorder's office before your death. Otherwise, it won't be valid. You can make an Arizona beneficiary deed with WillMaker.

Arizona allows individuals to transfer property to a beneficiary through what is known as a beneficiary deed. A beneficiary deed is sometimes referred to as a ?transfer on death deed,? or TOD deed. It is a legal document that grants a residential property to a designated beneficiary upon the death of an individual.

You cannot use your will to revoke or override a beneficiary deed. How ownership is transferred. To get title to the property after your death, the beneficiary must record a certified copy of the death certificate in the recorder's office.

In the event that your mother recorded the beneficiary deed, the home likely became yours immediately upon her death, and it should not be subject to the terms of her will.

An Arizona Beneficiary Deed is much simpler than creating and administering a trust. In addition, the owner retains complete control over the property with an Arizona Beneficiary Deed. No gift tax liability. Since an Arizona Beneficiary Deed does not transfer property as a ?gift,? it is not subject to gift taxes.