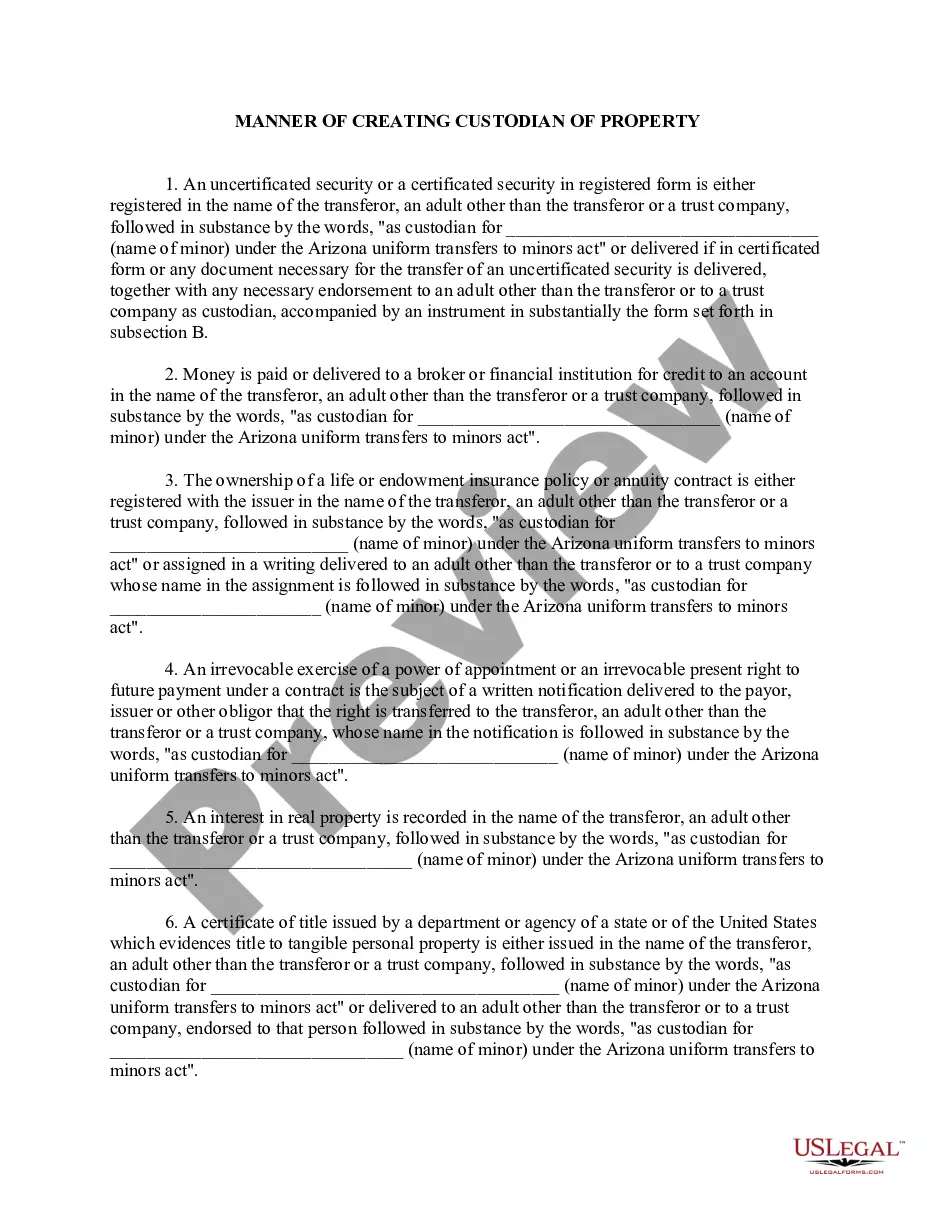

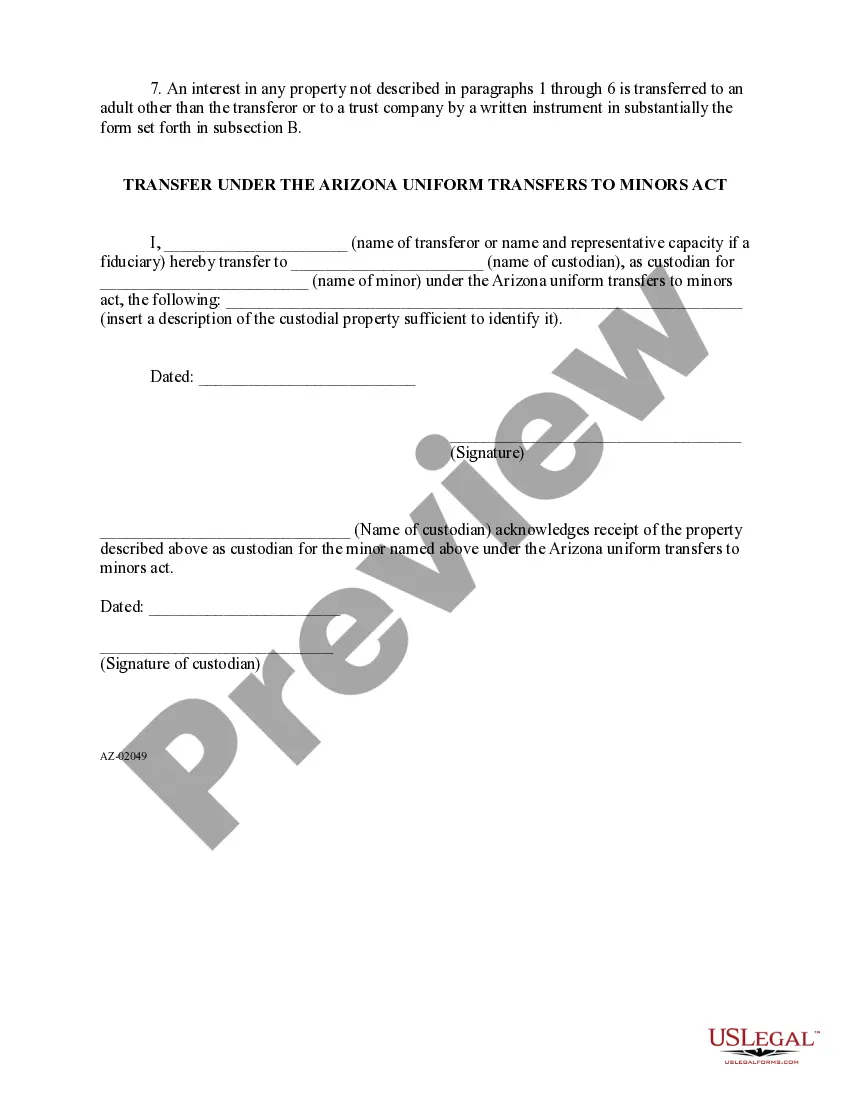

Manner of Creating Custodial Property: This form creates and/or assigns a particular custodian to a minor upon the death of the Grantor. The property granted to the minor, would be managed by the appointed custodian until the minor reaches the age of majority.

Utma Age Of Majority In New York

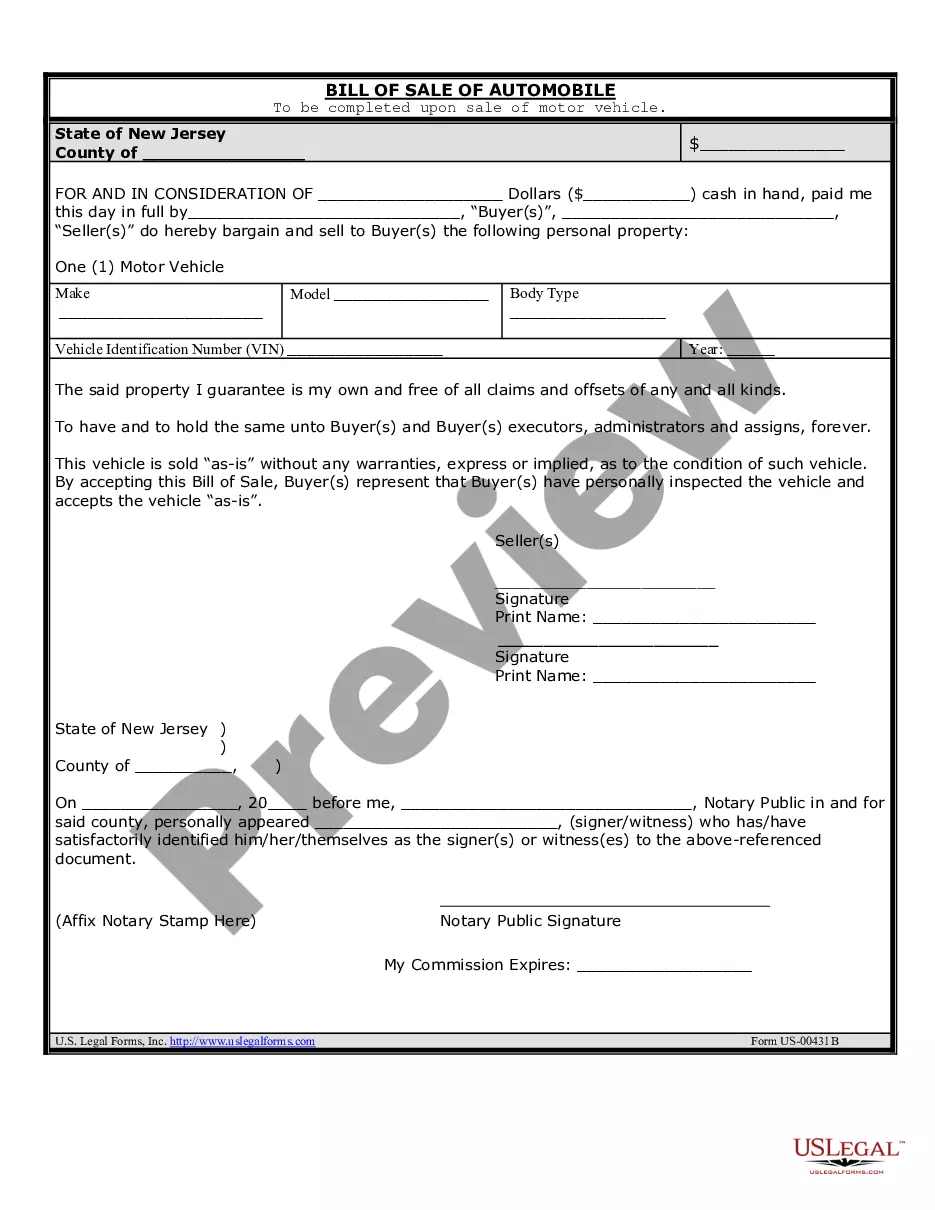

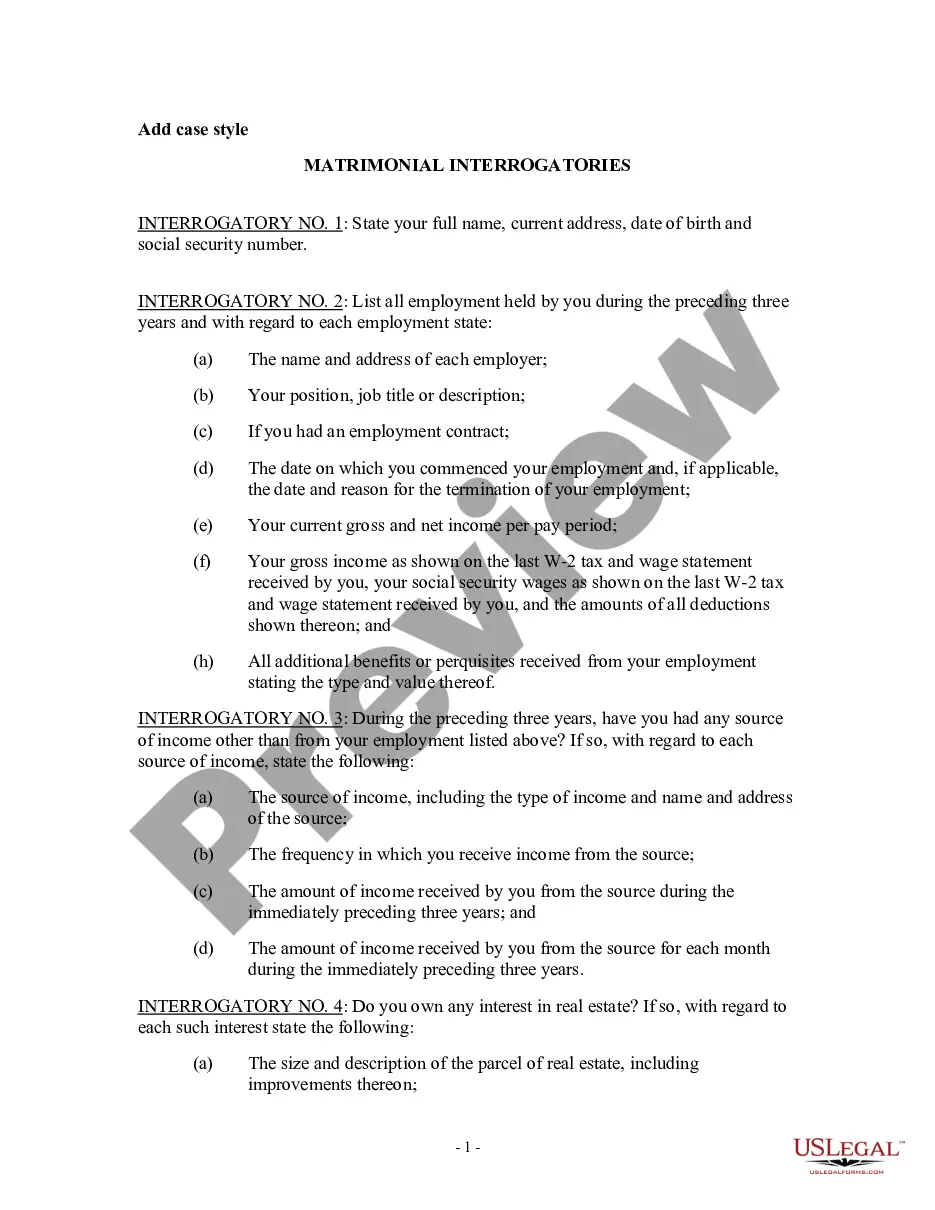

Description

How to fill out Arizona Manner Of Creating Custodial Property?

It’s no secret that you can’t become a law expert immediately, nor can you figure out how to quickly prepare Utma Age Of Majority In New York without having a specialized set of skills. Putting together legal forms is a long venture requiring a specific training and skills. So why not leave the preparation of the Utma Age Of Majority In New York to the specialists?

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court papers to templates for internal corporate communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our website and get the document you require in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Utma Age Of Majority In New York is what you’re searching for.

- Begin your search again if you need a different template.

- Register for a free account and choose a subscription plan to purchase the form.

- Choose Buy now. As soon as the transaction is through, you can get the Utma Age Of Majority In New York, complete it, print it, and send or send it by post to the necessary people or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

B or 1099DIV should be received at the end of the tax year from the financial institution handling the UGMA/UTMA account to report any interest or earnings on the account.

The UTMA generally requires the custodian to transfer the custodial property to the minor when the minor reaches the age of 21 (unless the person creating the account, in designating the custodian, elects the age of 18 instead).

The UTMA generally requires the custodian to transfer the custodial property to the minor when the minor reaches the age of 21 (unless the person creating the account, in designating the custodian, elects the age of 18 instead).

The age of majority for an UTMA is different in each state. In most states, the age of majority is 21 ? which means that when a child turns 21, the custodianship of assets will end. But in other states, the age of majority is either 18 or 25. The custodian can also sometimes choose between a selection of ages.

In 1996, the Uniform Transfer to Minors Act ("UTMA") superseded the Uniform Gifts to Minors Act ("UGMA"). Accounts established on and after January 1, 1997, should have the account title ""as custodian for (name of minor) under the NY UTMA."