Does Child Support Change With Marriage

Description

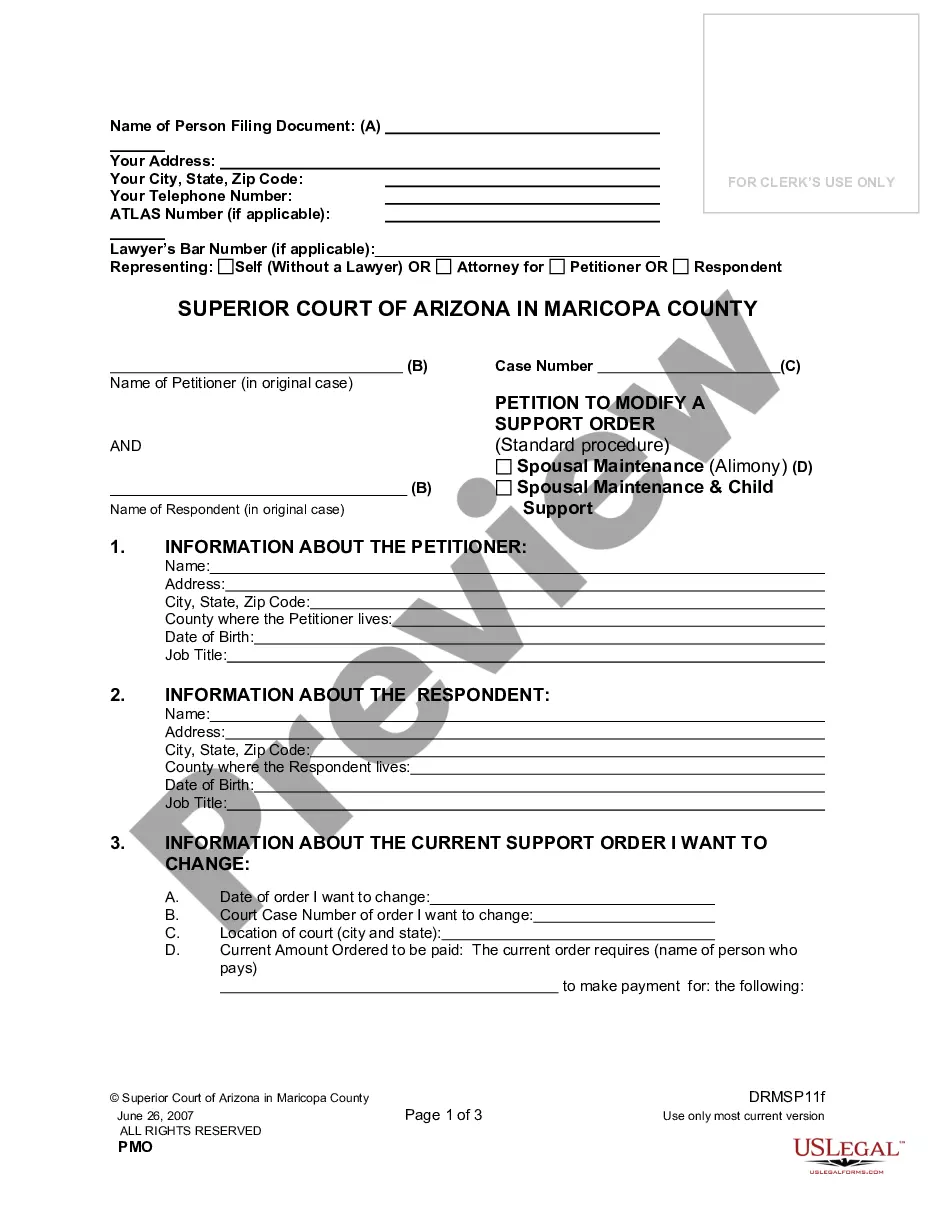

How to fill out Arizona Petition To Modify A Support Order?

- Log into your account at US Legal Forms if you’re a returning user. Ensure your subscription is active, or renew it as needed.

- Preview available templates. Confirm that you select the appropriate form that meets your specific needs and local legal requirements.

- Search for alternative templates if the initial choice isn't suitable. Utilize the Search feature to find documents that better align with your situation.

- Purchase the document. Click the Buy Now button and choose a subscription plan that fits your needs. Registration is required for access to all resources.

- Complete your purchase. Enter your payment information, including credit card details or PayPal account credentials.

- Download your legal form. Save it to your device and find it later in the 'My Forms' section of your account for further use.

In conclusion, US Legal Forms empowers you to handle legal documents with ease and efficiency. With an extensive library that outperforms competitors and access to premium expert assistance, you can ensure your documents are accurate and compliant.

Start navigating your legal needs today with US Legal Forms and streamline your child support documentation process!

Form popularity

FAQ

The mother's new marriage could potentially impact child support, but it largely depends on the specific laws in your state. Generally, the fact that the mother gets married does not automatically change the child support obligations. Courts may review financial situations during a modification request, but they typically focus on the parents’ incomes. If you wonder whether child support changes with marriage, consider reaching out to US Legal Forms for further guidance tailored to your circumstances.

Stepparent income can influence child support decisions, particularly if it significantly impacts the household's financial resources. Courts may look at the overall economic situation, which could prompt a reevaluation of support obligations. However, stepparents are not automatically liable for child support. If you need guidance, using a legal platform like USLegalForms can help clarify your rights and obligations.

Married filing jointly does affect child support calculations since it typically considers the combined household income. This can lead to adjustments in support amounts, depending on your financial situation. To navigate these complexities, consult with a legal professional. Recognizing how filing affects your obligations will help ensure compliance and fairness.

Yes, married filing jointly entails that both spouses' incomes are combined for tax purposes. This combined income can impact child support calculations, particularly if either spouse has existing support obligations. Understanding how this affects your finances is important. A tax advisor or legal expert can provide insight into the implications.

Filing jointly when your husband owes child support can complicate the situation. The combined income might lead to increased financial scrutiny, affecting future obligations. It is advisable to consult with a legal expert before making any decisions. Being informed about the implications of tax filings can help you protect your interests.

You can still file for child support while married and living with your spouse, especially if children from previous relationships are involved. Your spouse's income may affect the outcome, as child support calculations consider household income. If you are unsure how to proceed, using a platform like USLegalForms can help simplify the process and provide necessary forms.

Getting married can lead to changes in child support, but it depends on various factors. The court may reevaluate support obligations due to combined household income. Also, if you have a new baby or change in financial circumstance, that could prompt a review. Consulting with a legal professional can clarify how marriage might affect your specific situation.

Your husband's ex-wife typically cannot use your income directly for determining child support. However, if you share financial resources, the court may consider your household's overall income for future adjustments. It is essential to review your situation with a legal expert. Understanding how child support calculations work can provide clarity.

Marriage can impact child custody arrangements, as new marital statuses may influence child care considerations. Courts often view the stability of a two-parent household positively, which may benefit custody outcomes. However, the primary concern remains the child's best interests. Thus, it is crucial to approach custody discussions with legal guidance.

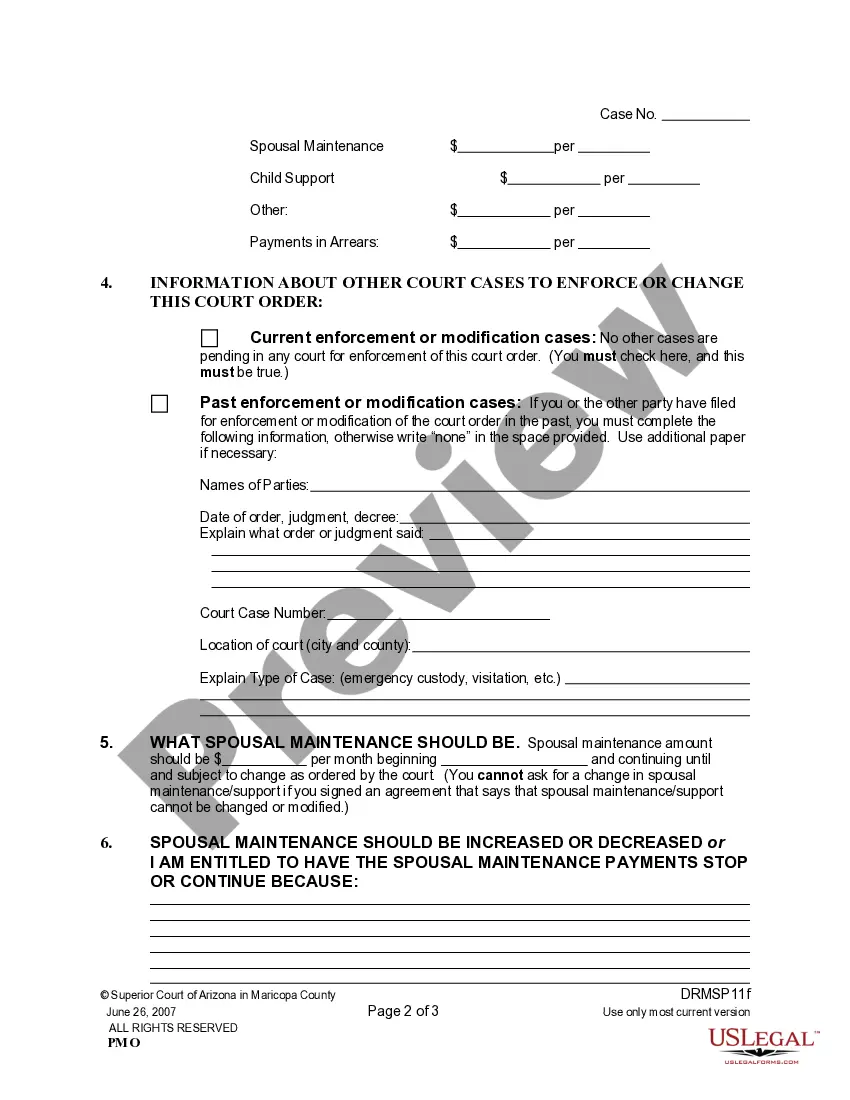

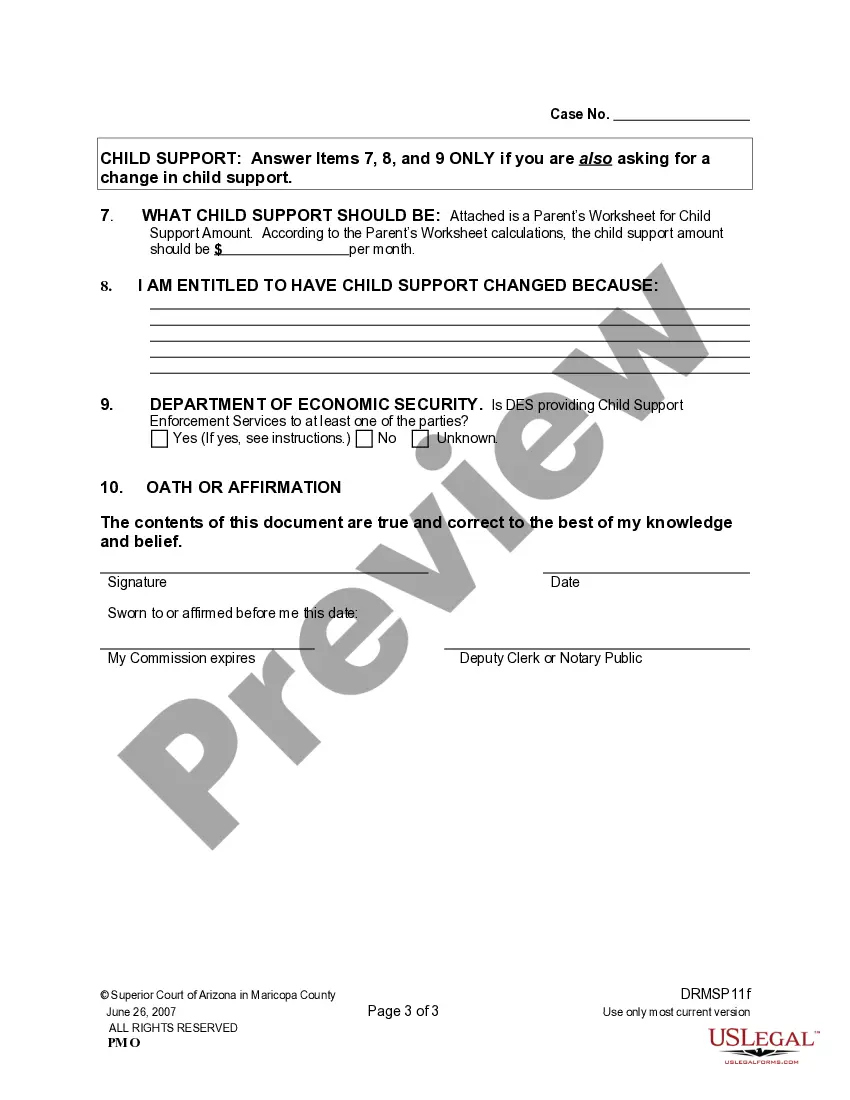

You can request a change in child support at any time if you believe there is a valid reason for modification. This includes substantial changes in income, employment status, or life events like marriage. Remember, legal guidelines dictate that you may need to demonstrate how your situation directly affects your child support obligations. Utilize resources from Uslegalforms to ensure that your request is well-prepared and clear.