Az Beneficiary Individual Death Withholding

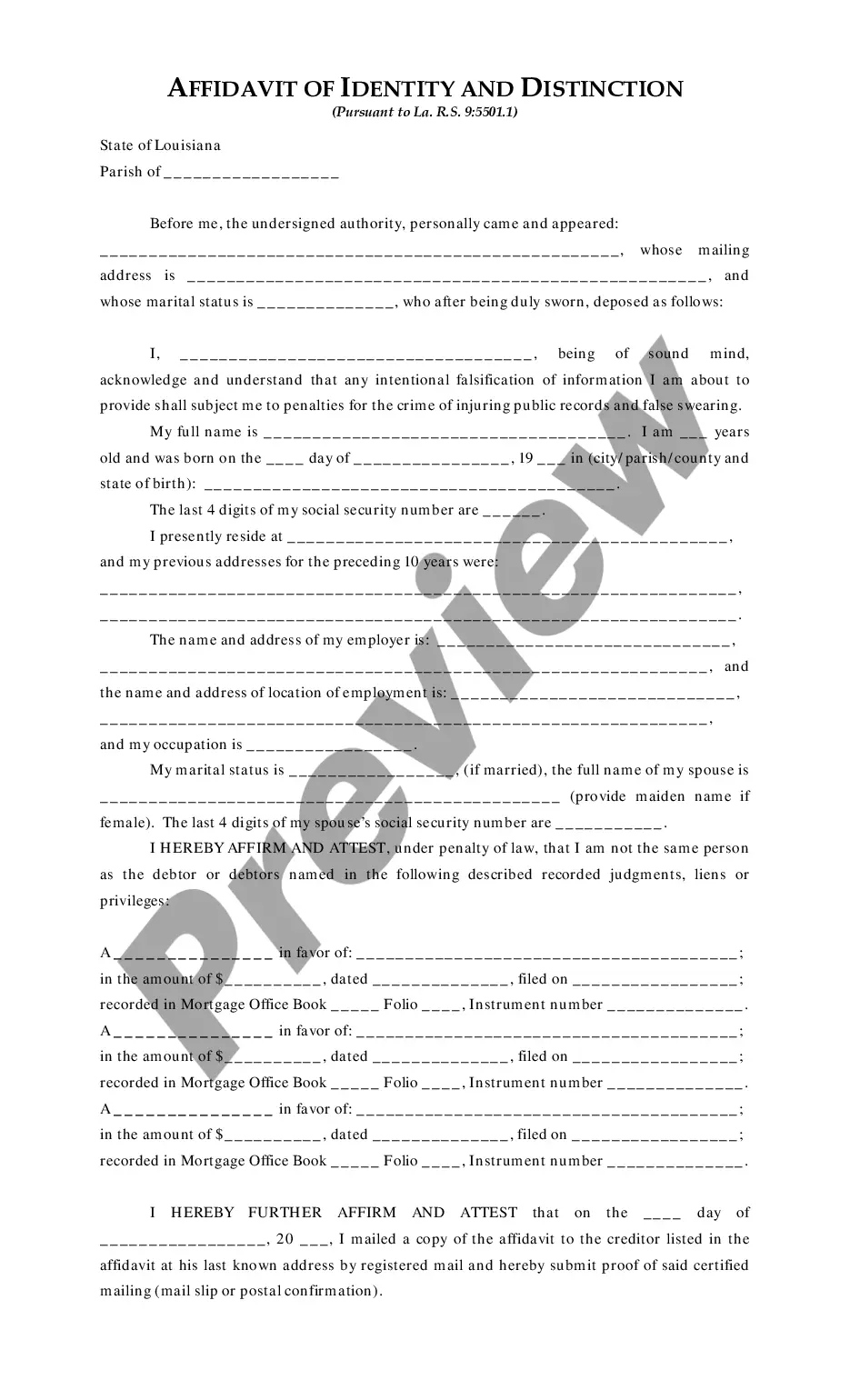

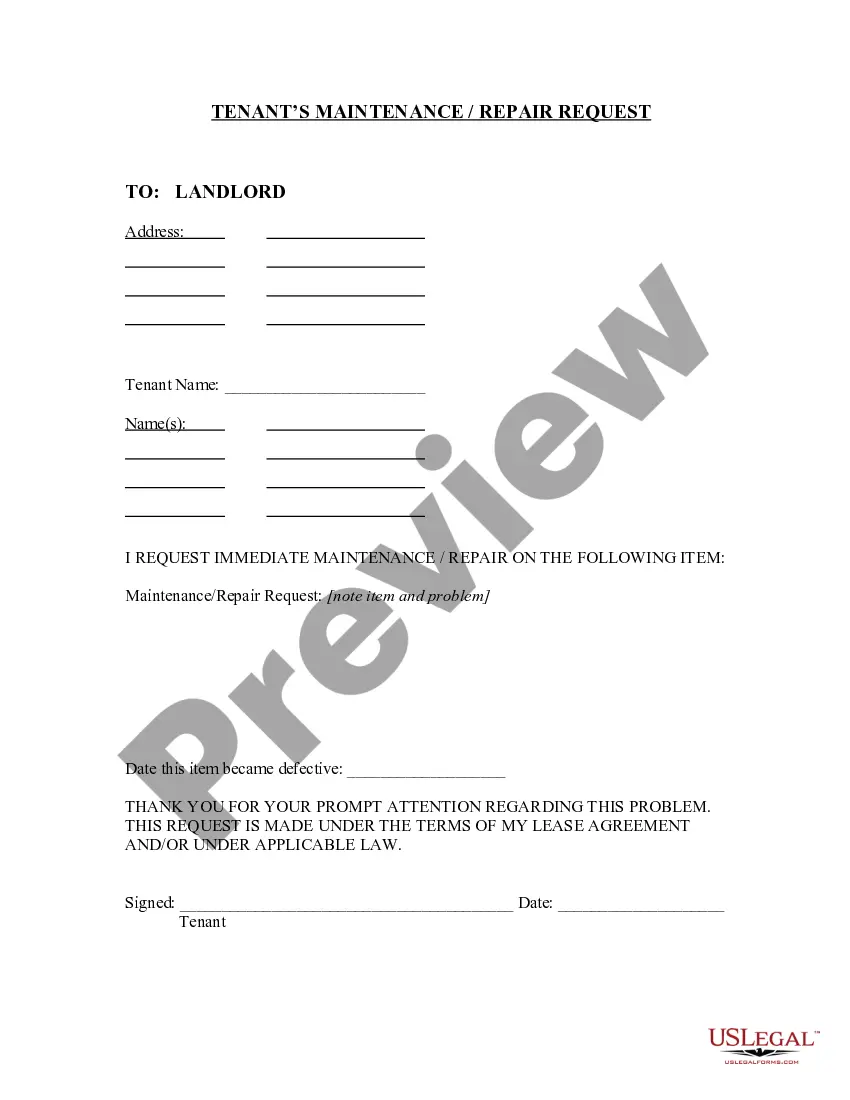

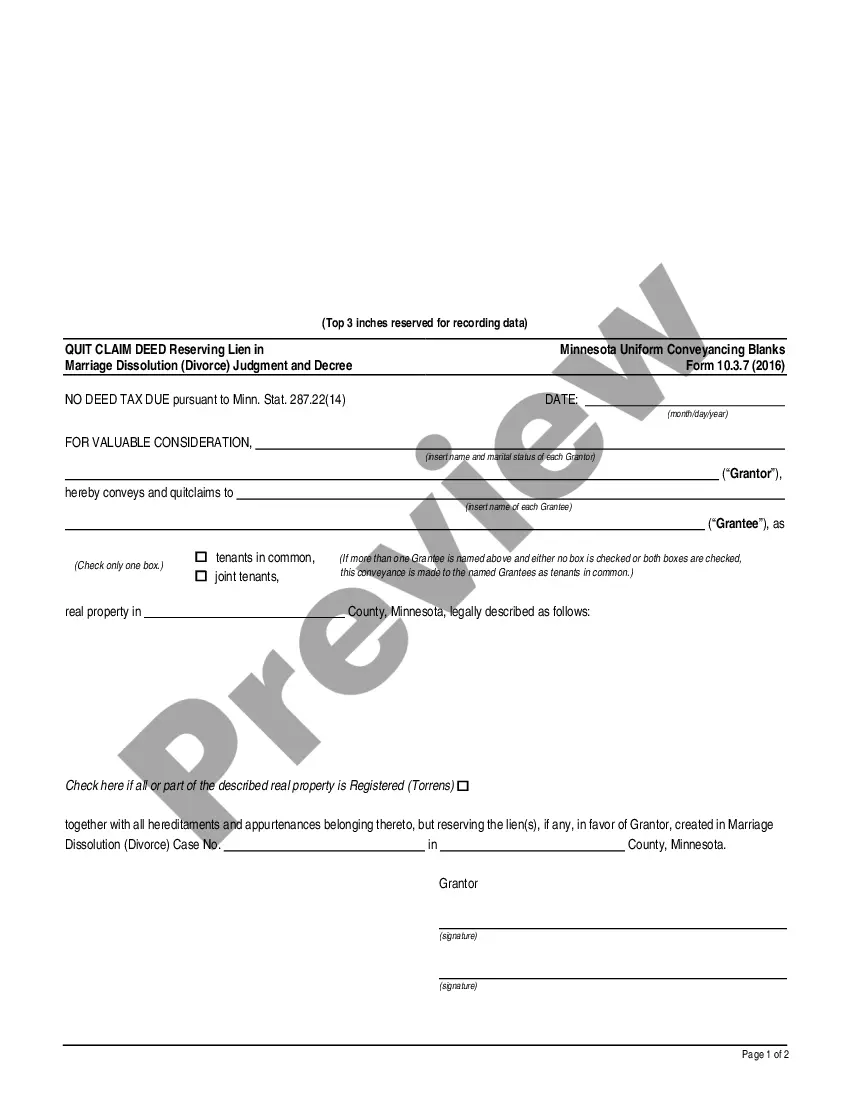

Description

How to fill out Arizona Beneficiary Deed For Individual To Individual?

Dealing with legal paperwork and processes can be a lengthy addition to your schedule.

Az Beneficiary Individual Death Withholding and similar forms frequently require you to search for them and determine the best approach to fill them out accurately.

Consequently, whether you are managing financial, legal, or personal issues, utilizing a thorough and useful online directory of forms when necessary will greatly assist.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific documents and a range of resources to help you complete your paperwork with ease.

Is this your first experience with US Legal Forms? Register and create a free account in just a few minutes and you’ll gain access to the form directory and Az Beneficiary Individual Death Withholding. Then, follow the steps below to fill out your form: Ensure you have found the correct form by utilizing the Review feature and examining the form description. Select Buy Now when you are ready, and choose the monthly subscription plan that fits your needs. Click Download and then complete, eSign, and print the form. US Legal Forms has twenty-five years of experience helping users manage their legal paperwork. Find the form you need today and streamline any process effortlessly.

- Explore the collection of relevant documents available to you with just a single click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your document management processes using a high-quality service that allows you to create any form in minutes without additional or hidden fees.

- Simply Log In to your account, locate Az Beneficiary Individual Death Withholding and obtain it immediately in the My documents section.

- You can also access forms that you have previously downloaded.

Form popularity

FAQ

If you file a return and claim a refund for a deceased taxpayer, you must be: A surviving spouse/RDP. A surviving relative. The sole beneficiary.

The Canada Revenue Agency requires you to fill out the terminal tax return either six months after the time of death or on April 30 of the year following the date of death. For example, if the person died on February 2, 2023, you must file the terminal tax return by July 30, 2023, or April 30, 2024.

In the year of a spouse's death, the surviving spouse usually is considered married for the entire year, for tax purposes. Therefore, the surviving spouse can file a joint return for that year. This rule also applies if both spouses die during the same tax year.

If paper-filed, write ?Deceased,? the taxpayer's name, and the taxpayer's date of death across the top of the final return. If e-filed, follow the directions provided by the tax software and be sure to indicate the taxpayer is deceased and the date of death.

The Legal Representative The court appoints an administrator ? often a spouse or next of kin ? when the will does not name an executor or there is no will at all. In Quebec, a liquidator acts as the legal representative, acting as either executive or administrator depending on the terms of the will.