Arizona Probate Rules

Description

How to fill out Arizona Beneficiary Deed For Individual To Individual?

Securing a reliable location to obtain the latest and suitable legal documents is part of the challenge of navigating bureaucracy.

Acquiring the correct legal forms requires precision and meticulousness, which is why it is crucial to source Arizona Probate Rules solely from trustworthy providers, such as US Legal Forms.

Eliminate the stress associated with your legal documentation. Browse the comprehensive US Legal Forms database to discover legal templates, assess their applicability to your situation, and download them instantly.

- Make use of the library navigation or search bar to find your document.

- Examine the form’s description to verify if it meets the criteria of your region and state.

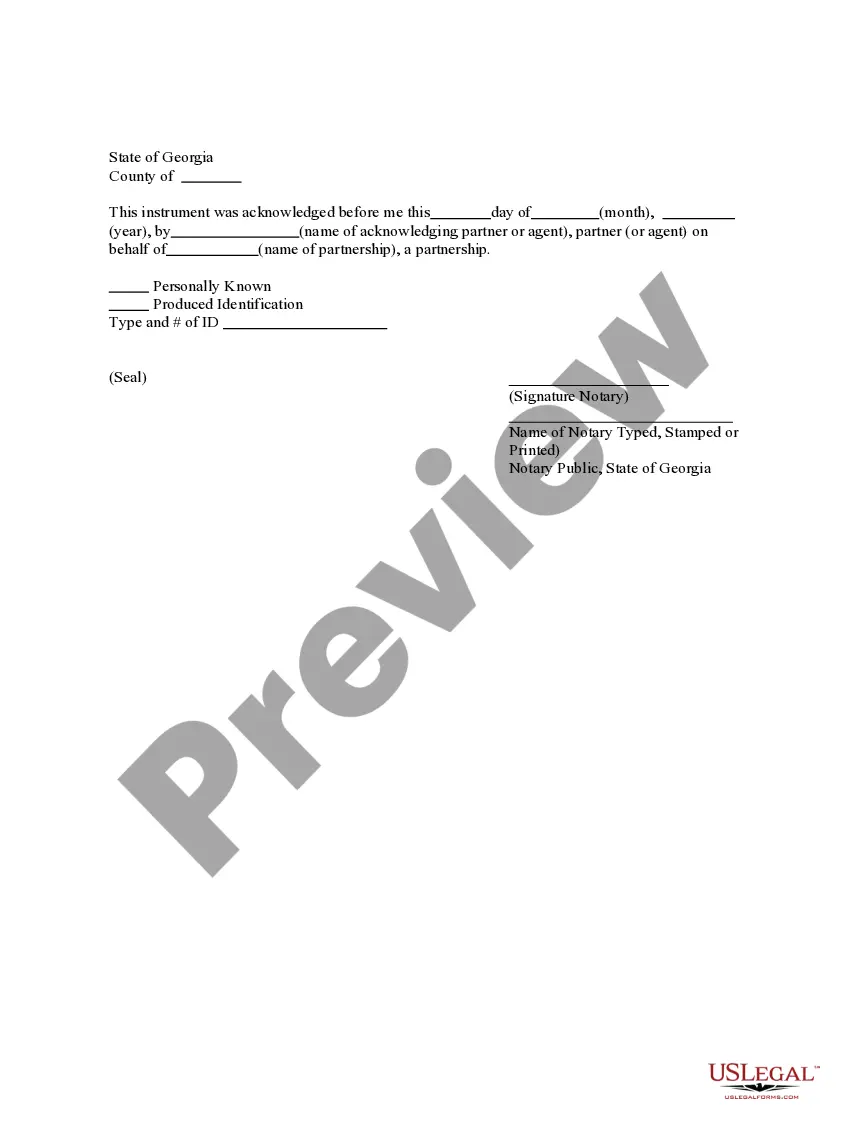

- If available, view the form preview to ensure the document is indeed the one you seek.

- If the Arizona Probate Rules do not align with your needs, return to the search to find the appropriate template.

- Once confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen documents in My documents.

- If you haven't created an account yet, click Buy now to obtain the document.

- Choose the pricing option that suits your requirements.

- Continue to the registration to complete your order.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Pick the file format for downloading Arizona Probate Rules.

- Once you have the document on your device, you can edit it using the editor or print it and fill it out by hand.

Form popularity

FAQ

Rule 27 of the Arizona Rules of Probate Procedure addresses the limitations on the duration of certain procedures within the probate process. It outlines the timeframes within which certain actions must occur after the death of the individual. Understanding this rule is crucial for adhering to timelines during probate. Consulting legal documents or resources like USLegalForms can clarify these specific details.

The Internal Revenue Service has said that the 2022 state tax rebate will not be taxed by the federal government. The $300 state tax relief rebate that nearly 800,000 Delaware residents received in 2022 will not be taxed by the federal government.

Individuals who were issued a rebate but have not yet received it may inquire about their status via website lookup or by contacting Division of Revenue Public Service at 302-577-8200 (Select option 1 for 2022 Delaware Rebate Information).

For assistance, you can contact the Public Service office at +1 866-276-2353 or locally at 1-302-577-8200. You will receive a tax return acknowledgement from the Delaware Division of Revenue when your return has been received and is being processed.

Enter your social security number or ITIN and expected refund amount below. If your refund is in a status of Pending, please allow 10-12 weeks for it to process. If you have any questions please contact the Delaware Division of Revenue at (302) 577-8200.

Lawmakers approved a one-time payment of $300 per adult resident in April to help people deal with rising costs of gas and groceries. In total, the state is returning about $240 million to Delawareans.

Online Help. Online, you may find a lawyer using services such as the Lawyer Locater in the Martindale Directory which provides access to the Law Directory, or you can use another of their free services, Lawyer Directory from LexisNexis or the Personal Injury Lawyer Directory from Martindale.