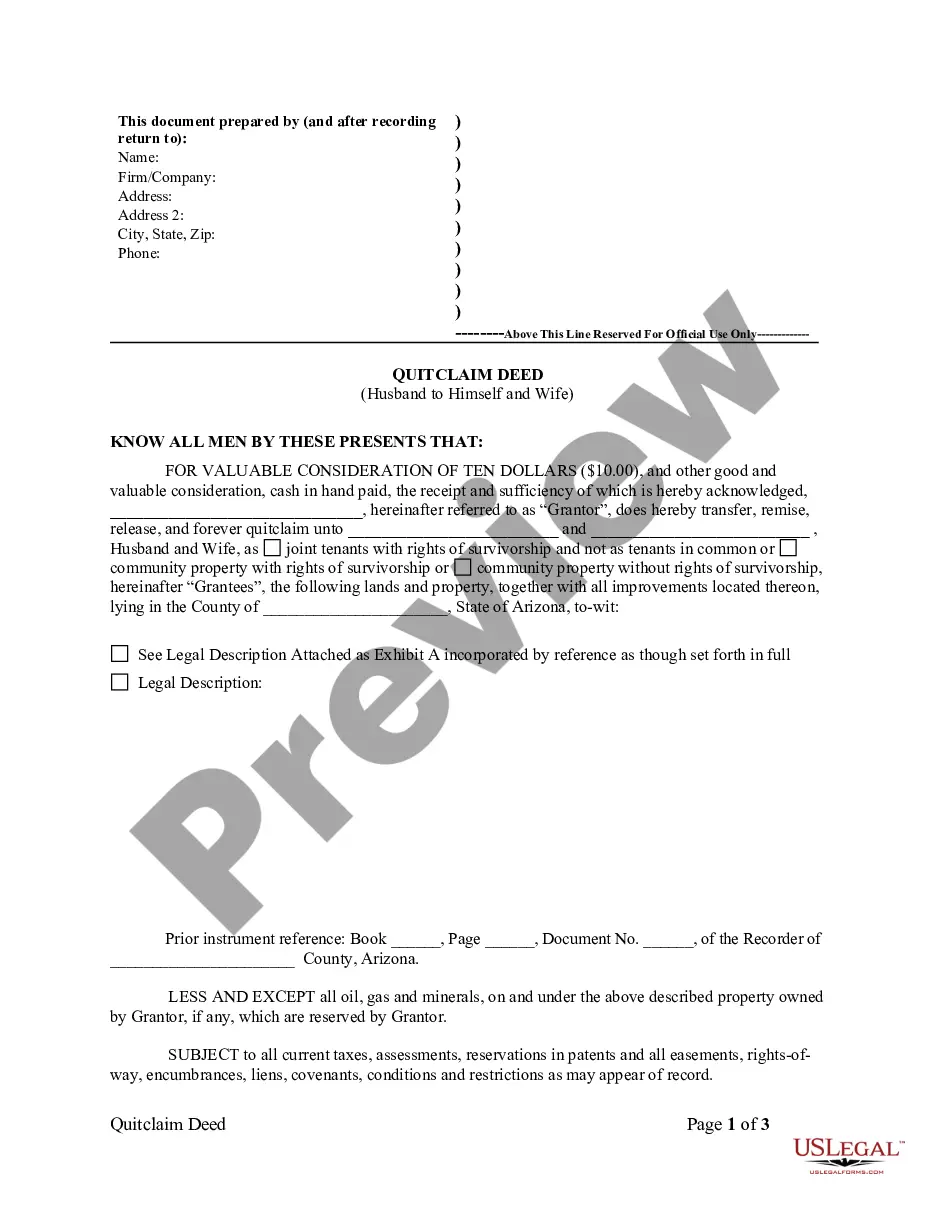

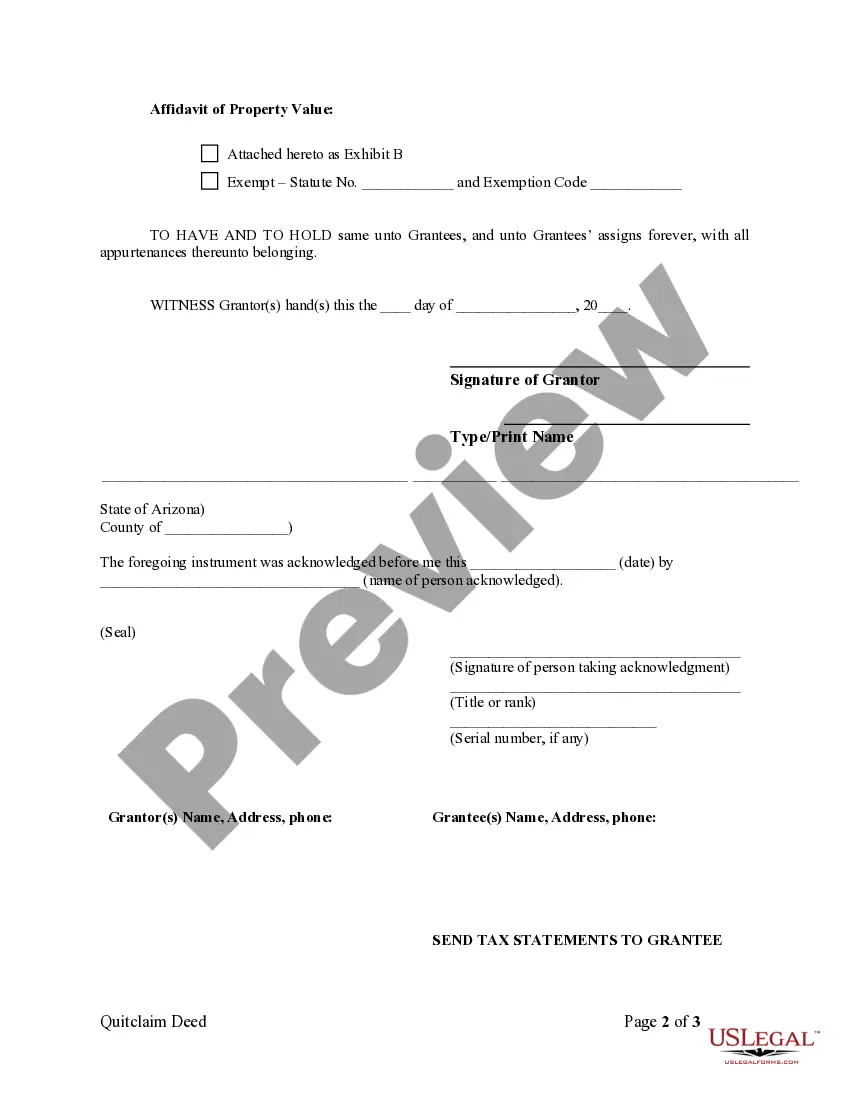

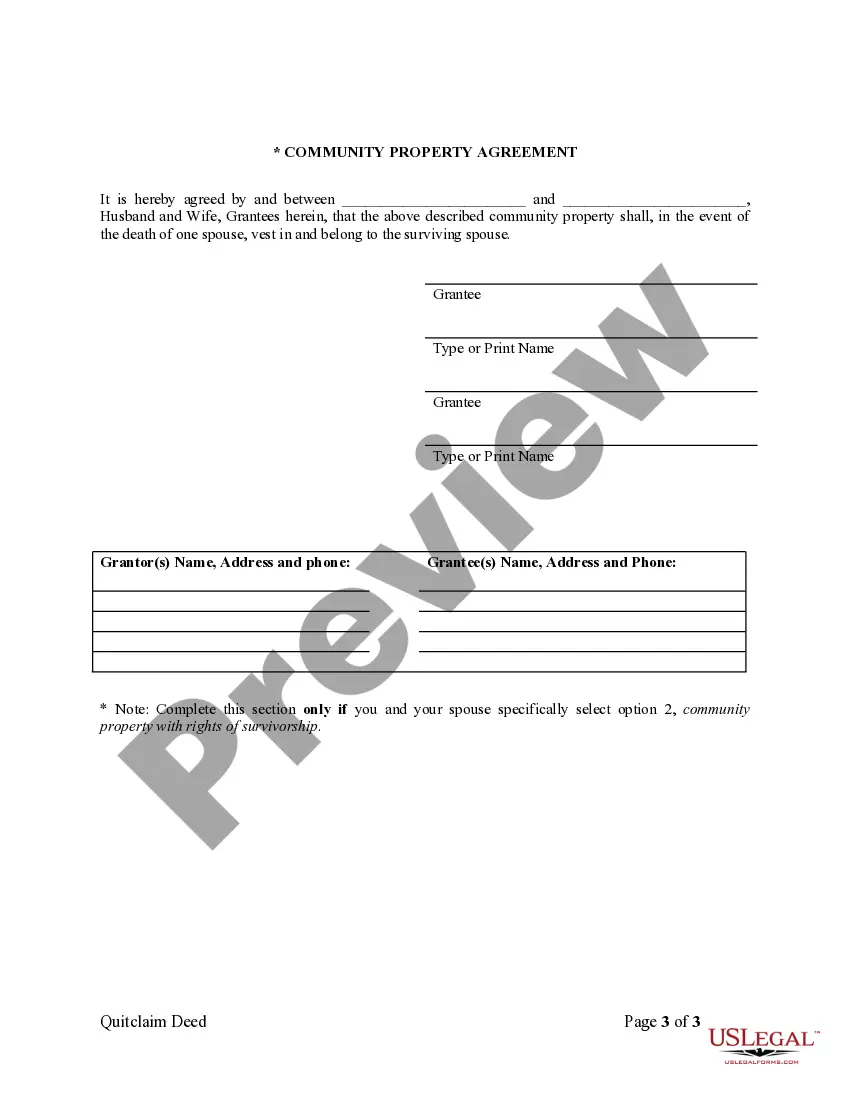

This Quitclaim Deed from Husband to Himself and Wife form is a Quitclaim Deed where the Grantor is the husband and the Grantees are the husband and his wife. Grantors convey and quitclaim the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

Quit Claim Form For Property

Description

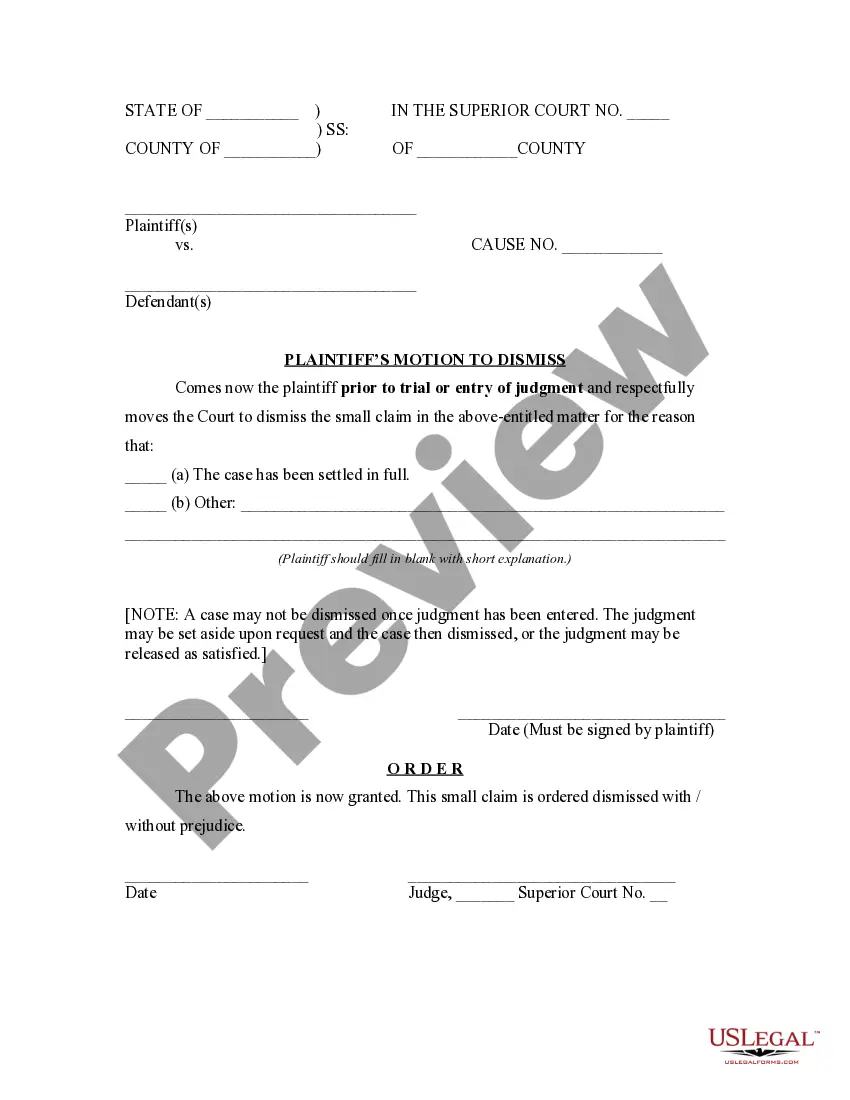

How to fill out Arizona Quitclaim Deed From Husband To Himself And Wife?

- Log into your US Legal Forms account if you have one. Click on the Download button to save the required quit claim form to your device, ensuring your subscription is valid.

- If you’re new to the service, start by reviewing the Preview mode and form description to confirm you’ve selected the correct quit claim form that matches your local jurisdiction.

- If you find any discrepancies in the form, utilize the Search tab to locate an alternative template that is more suitable.

- Purchase the document by clicking the Buy Now button and select your preferred subscription plan. You must register an account to access the library's forms.

- Complete the purchase by entering your credit card information or using your PayPal account to finalize the payment.

- Finally, download your quit claim form and save it on your device. You can access it anytime through the My Forms section in your account.

Using US Legal Forms gives you access to a robust collection of legal templates, outpacing competitors with its extensive offerings. Whether you're an individual or an attorney, you can easily find the forms needed for legal processes.

Don’t let the paperwork overwhelm you; take advantage of US Legal Forms for swift and precise document preparation. Start your journey today!

Form popularity

FAQ

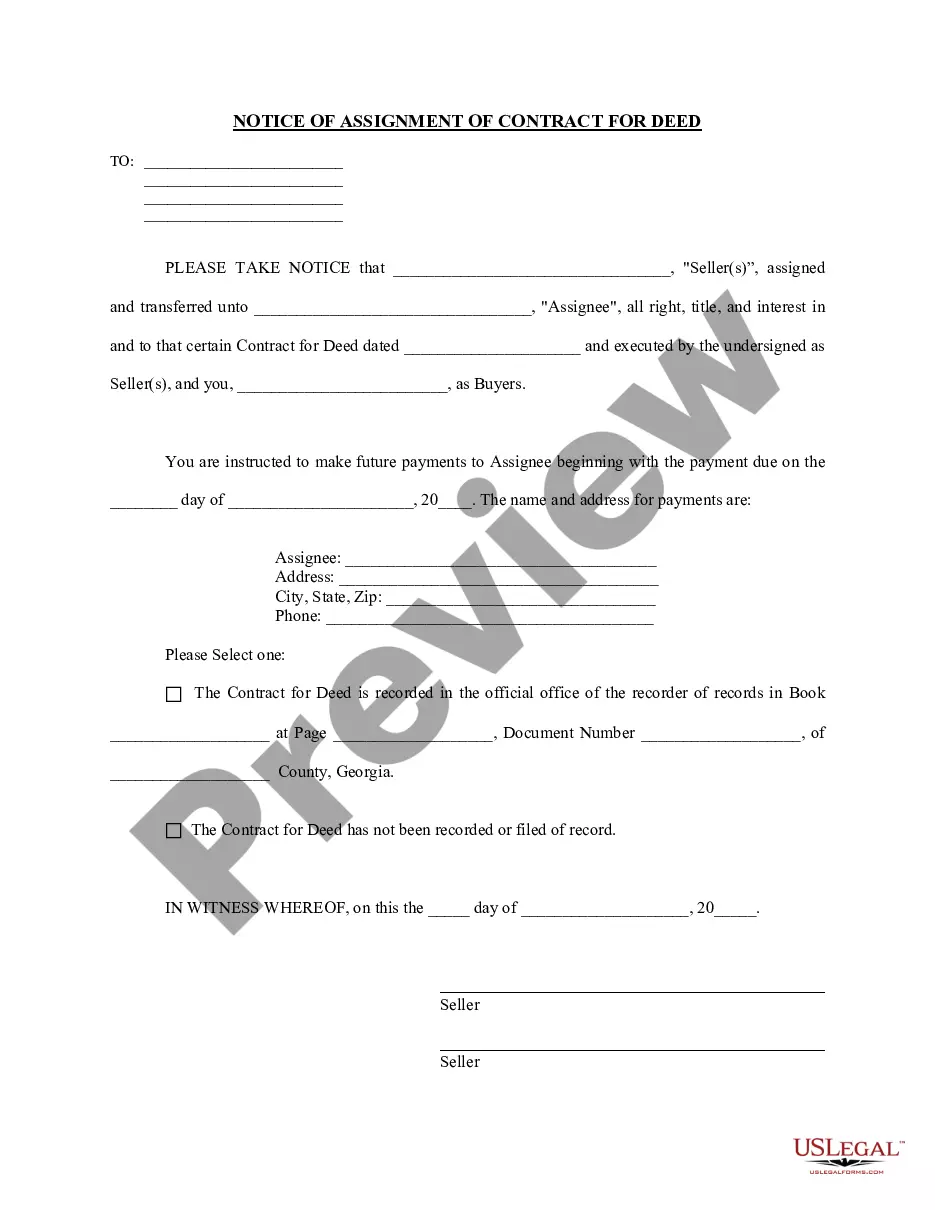

You can prepare a quit claim form for property yourself, as many templates and guidelines are available online, including those provided by platforms like US Legal Forms. However, while it might seem straightforward, you should ensure that the document meets all local legal requirements. If you're uncertain, seeking legal advice might save you time and potential difficulties later.

One of the main problems with a quit claim form for property is that it provides no protection for the buyer. If issues arise, such as undisclosed debts tied to the property, the new owner could face unexpected legal battles. It's essential to use due diligence and possibly consult legal resources to ensure that a quit claim deed is the right choice for your situation.

Quit claim forms for property are sometimes frowned upon because they do not guarantee that the person transferring the deed actually has clear title to the property. This lack of warranty can lead to disputes, especially if there are hidden liens or claims against the property. It's vital for potential property owners to understand these risks and consider a title search before proceeding with a quitclaim deed.

The usual reason for using a quit claim form for property is to facilitate a quick and straightforward transfer of ownership. Individuals often employ this method when dealing with family matters, such as divorce settlements or inheritance situations. By using a quitclaim deed, parties can avoid the complexities and expenses associated with more formal transfer methods.

People often use a quit claim form for property to transfer ownership quickly and with minimal paperwork, especially among family members or close friends. This type of deed can simplify the process when someone wishes to gift property or add someone to a title without financial transactions. Additionally, it is beneficial when the property ownership and boundaries are clear, making it a suitable option for informal transfers.

Quit claim forms for property are most often used for simple transfers of ownership between individuals. They are ideal in situations such as estate planning, divorce settlements, or gifting property to a family member. This straightforward method allows for quick resolution of property ownership without the complex processes associated with traditional property sales. By using these deeds, you can ensure that ownership changes hands efficiently.

An example of a quit claim form for property could be a situation where a parent transfers their home to their child without any monetary exchange. In this case, the parent signs a quitclaim deed indicating that they are relinquishing their ownership rights. This helps simplify the process of inheritance and keeps family properties within the family. Such deeds are commonly used in informal transfers among trusted individuals.

People who benefit most from a quit claim form for property are typically family members or friends who are transferring property between themselves. This process is often used in divorce settlements to quickly change ownership without extensive legal procedures. Additionally, individuals looking to clear up ownership issues can also find value in these deeds. They provide a straightforward solution when both parties are in agreement.

To fill out a quit claim form for property correctly, start by including the names and addresses of both the granter and grantee. Clearly describe the property being transferred by providing the legal description found in public records. Ensure you sign the deed in front of a notary to validate it. Finally, file the completed quit claim deed with your local county office to make the transfer official.

The main disadvantage of a quit claim form for property is that it does not guarantee clear title. If there are issues with the title, such as liens or claims from other parties, you may inherit those problems. Additionally, since a quitclaim deed transfers property without any warranties, the recipient assumes all risks. This lack of protection can lead to future disputes or financial burdens.