Quit Claim Example

Description

How to fill out Arizona Quitclaim Deed From Husband To Himself And Wife?

- If you're a returning user, log in to your account to access your document library. Make sure your subscription is active; if not, renew it according to your payment plan.

- For new users, start by browsing the Preview mode to find the quit claim example that suits your needs and adheres to local jurisdictional requirements.

- If the first option doesn't match your criteria, utilize the Search tab to find a suitable alternative. Once you locate the right form, move to the next step.

- Proceed to purchase the document by clicking the Buy Now button. Select a subscription plan that fits your requirements and create an account for full access.

- Finalize your purchase by entering your payment information, either through credit card or PayPal.

- After your payment is confirmed, download the quit claim example to your device and access it anytime from the My Forms section of your profile.

In conclusion, US Legal Forms offers an extensive, cost-effective solution for accessing a wide range of legal documents, including quit claim examples. With premium support from legal experts, you can ensure the accuracy and legality of your documents.

Start your journey today by visiting US Legal Forms and streamline your legal documentation process!

Form popularity

FAQ

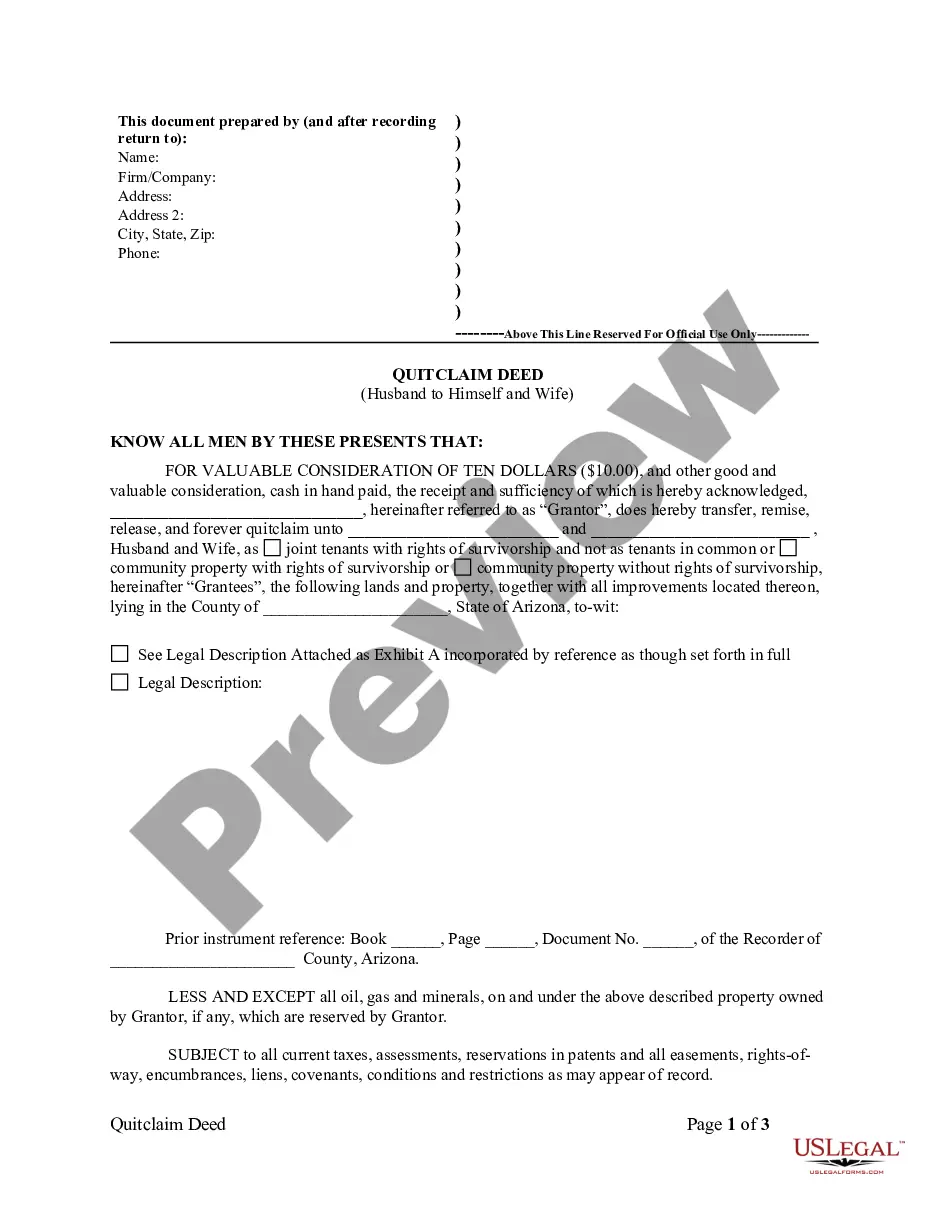

Writing a quitclaim deed involves a few essential steps. First, you need to gather the important information, including the names of the grantor and grantee, property description, and the effective date. Next, you'll draft the deed, ensuring it follows your state’s requirements. To see a clear quit claim example, visit US Legal Forms, where you can access templates tailored to your needs.

A quitclaim deed is often used to transfer property ownership without guaranteeing the value or condition of the property. People typically use it for family transactions, such as passing property to a spouse or child. It serves as a simple solution for removing someone from a title or clarifying ownership. For more detailed guidance, consider a quit claim example to understand its application better.

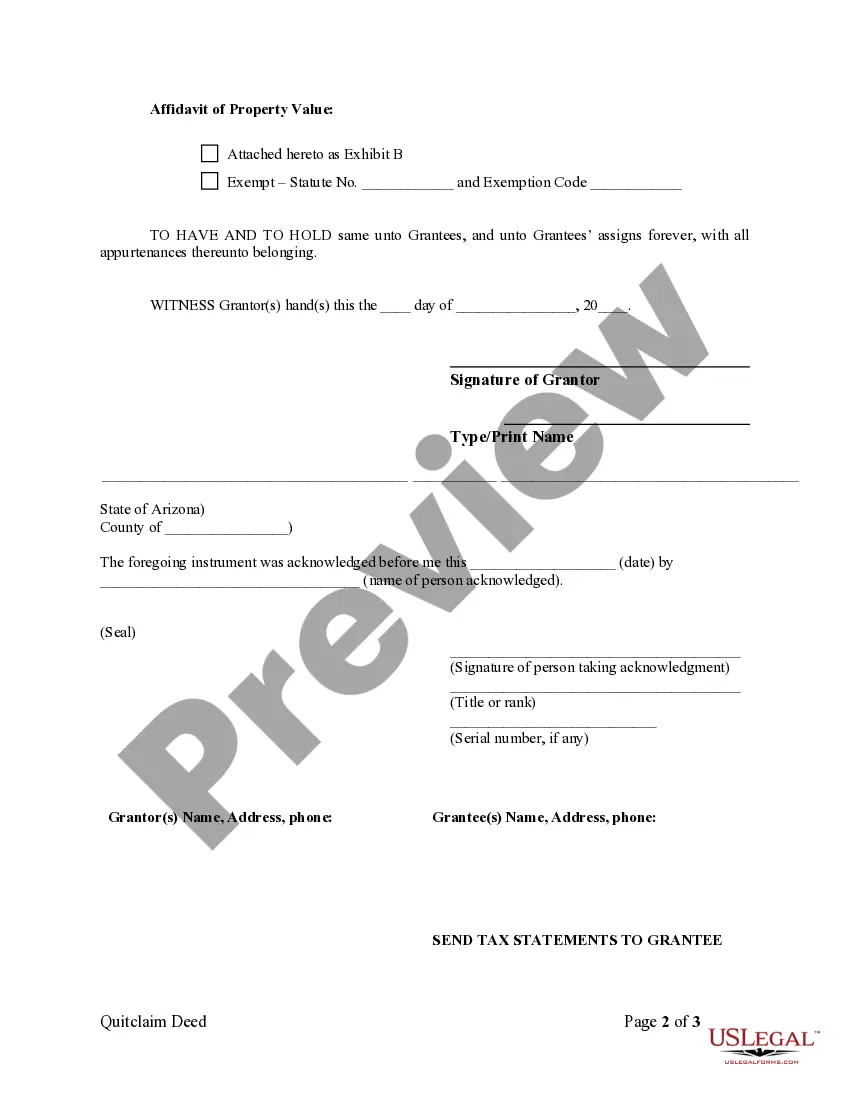

Filling out a quit claim form requires you to start with the names of the property’s owner and the individual receiving the property. You’ll need to provide a detailed legal description of the property to ensure clarity. After that, make sure to sign the form in front of a notary for validation. For a reliable quit claim example, explore tools offered by US Legal Forms that guide you through this process seamlessly.

To write a quit claim, start by clearly indicating the title of the document at the top. Next, state the names of the parties involved, including the grantor and grantee. Then, include a description of the property being transferred, along with a sentence that conveys the intention to relinquish any rights. For a comprehensive quit claim example, consider using resources or templates available from platforms like US Legal Forms.

Absolutely, you can do a quit claim deed yourself if you feel comfortable with the paperwork involved. Utilizing a quit claim example can offer you clarity on how to fill in the details properly. Make sure to research your local laws, as requirements may vary by state. If you encounter any confusion, seeking assistance from services like US Legal Forms can provide valuable support.

Yes, you can complete a quitclaim deed on your own, provided you have the necessary information and documents ready. You can find examples online to guide you through filling out the required form accurately. However, it is wise to consult with a legal expert to ensure there are no complications. Platforms like US Legal Forms can help you navigate the process effectively.

One significant disadvantage of a quit claim deed is that it does not guarantee that the seller has a clear title to the property. Therefore, the buyer may assume financial risks if debts or liens affect the property. Furthermore, a quit claim deed does not provide legal protections, such as warranties or title insurance, which means buyers might face challenges in the future. This is why understanding a quit claim example before proceeding is crucial.

Writing a quit claim is straightforward. First, you need to use a quit claim form, which includes the names of the parties involved and a description of the property. Make sure to sign the document in front of a notary public for it to be legally binding. You can find various quit claim example templates online, which can guide you through the process.

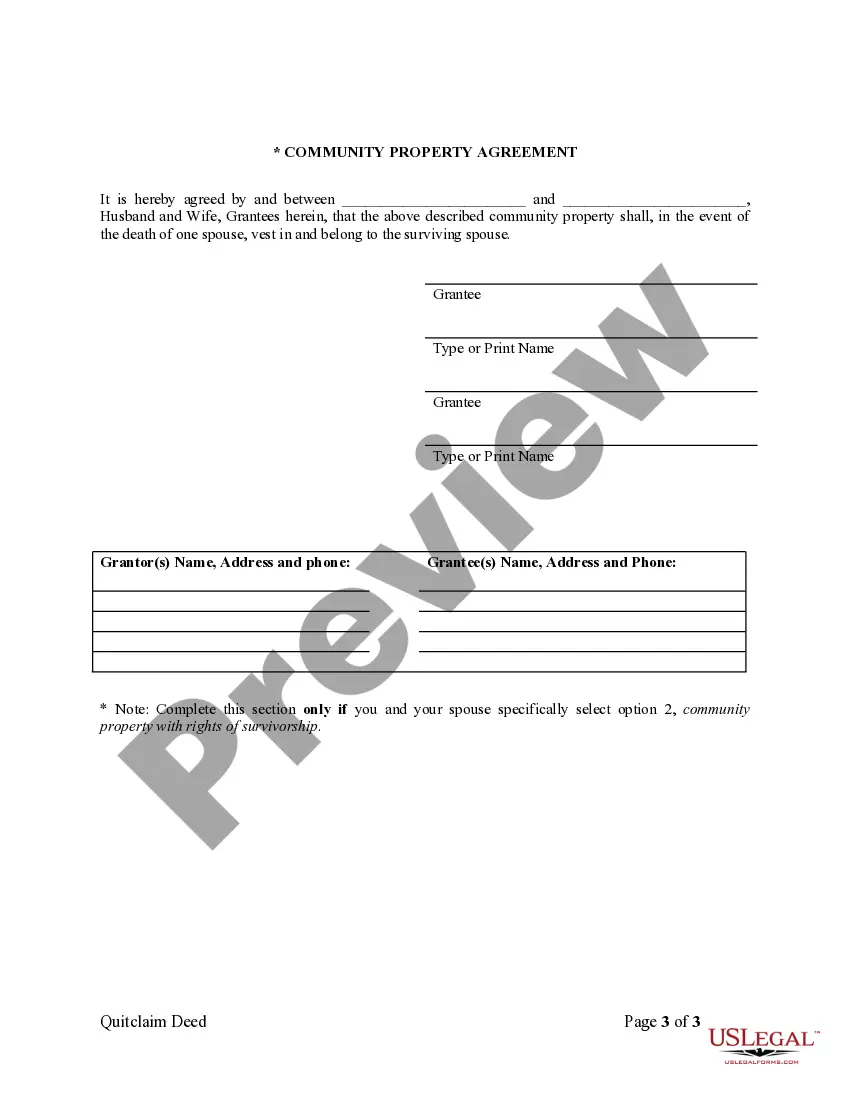

The most common use of a quit claim deed is for transferring property between family members, often in situations like divorce or inheritance. Since it does not require a sale or payment, it simplifies the process of passing property ownership. Many choose this method to avoid complicated legal proceedings. When you consider this option, using a service like USLegalForms can help streamline the documentation process.

Quitclaim deeds are often viewed with caution due to the lack of warranties regarding the title. This means that the grantor does not guarantee a clear title, which can lead to future disputes or claims against the property. Many professionals recommend using warranty deeds for transactions involving significant assets. It’s crucial to weigh the risks associated with a quit claim example before proceeding.