Grantor Corporation Forever For You

Description

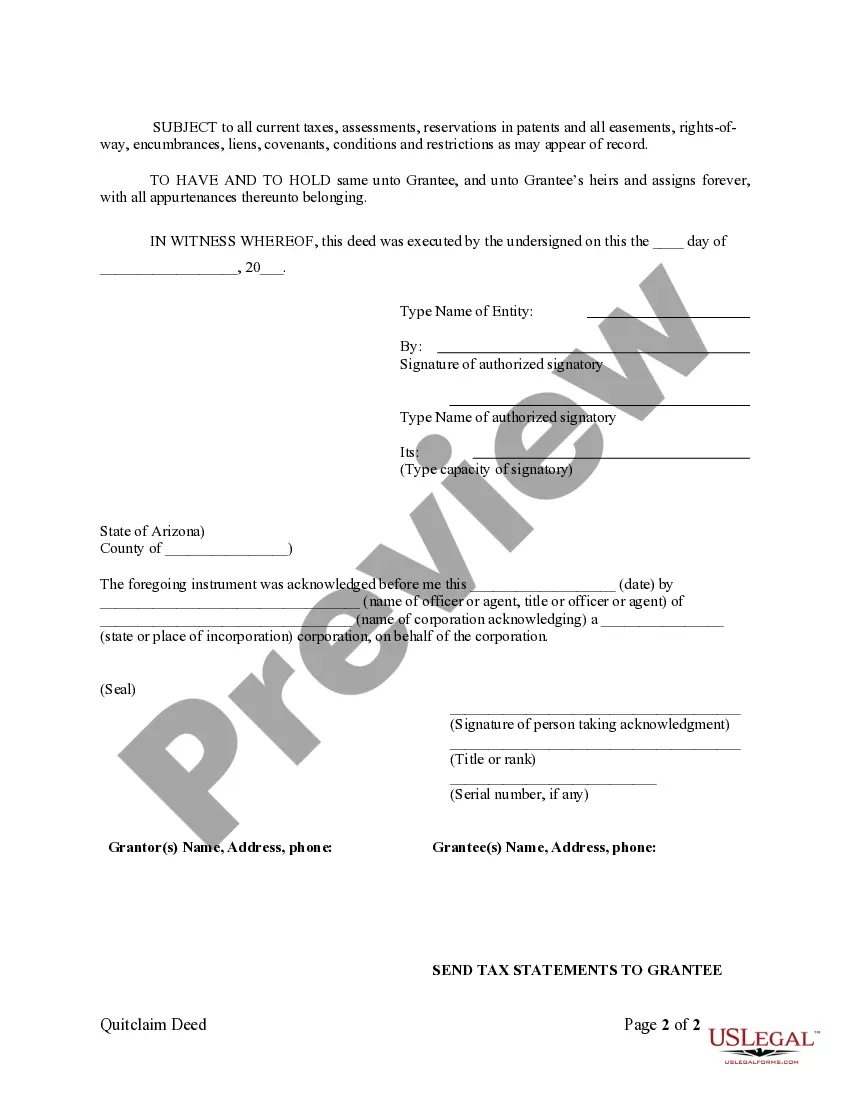

How to fill out Arizona Quitclaim Deed From Corporation To Corporation?

- If you're a returning user, log into your account and click the Download button next to the required form template. Ensure your subscription is active or renew it as needed.

- For new users, start by reviewing the Preview mode and details of the form you wish to obtain to ensure it meets your specific needs and complies with local regulations.

- If the chosen form doesn't fit, use the Search tab at the top of the page to locate alternative templates. Once you find the right one, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You'll need to create an account to access the library of forms.

- Complete your purchase using your credit card or PayPal information for a hassle-free transaction.

- Finally, download the template onto your device for completion, and remember that it's accessible anytime from the My Forms section of your profile.

By following these steps, you can easily download the legal documents you need with confidence, knowing that US Legal Forms provides accurate and user-friendly options.

Take action now to simplify your legal processes by exploring US Legal Forms today!

Form popularity

FAQ

Some states do not impose income taxes on trust earnings. States such as Nevada, South Dakota, and Wyoming offer favorable tax environments for trusts. By using a grantor corporation forever for you, you can potentially shelter assets from taxes more effectively. It's always a good idea to consult a legal professional or resources like USLegalForms to get accurate, up-to-date information.

In most scenarios, the grantor is indeed the owner, particularly at the time of the property transfer. However, once the transfer occurs, the ownership may shift to the grantee. Understanding this distinction is critical when using a grantor corporation forever for you. If you have questions about ownership, USLegalForms can provide valuable insight and documentation.

Yes, a corporation can serve as a grantor when it establishes a trust or transfers property. By utilizing a grantor corporation forever for you, businesses can effectively manage their assets and liability. This capability allows for greater flexibility in asset management. Consulting with USLegalForms can assist in navigating corporate responsibilities.

The grantor of a trust is indeed the person or entity that creates the trust and contributes assets to it. While the grantor retains control over the trust in many cases, the assets are legally owned by the trust itself. Through a grantor corporation forever for you, managing these details can simplify the process. For guidance, consider leveraging resources from USLegalForms.

Yes, a grantor is typically an owner who transfers property rights to another party. In the context of a grantor corporation forever for you, this means the owner can be an individual or a business entity. It's important to establish ownership before engaging in legal contracts. Properly understanding ownership can streamline the transfer process.

In most rental agreements, the landlord acts as the grantor, while the tenant is the grantee. This means the landlord grants the rights of use to the tenant. When discussing grantor corporation forever for you, it's essential to understand these roles clearly. This knowledge can help clarify your obligations and rights in a lease.

The grantor is the person or entity that creates a trust or conveys property through a deed. In the context of a grantor corporation forever for you, this can refer to an individual or corporation that transfers rights. Understanding the role of the grantor is essential for anyone involved in property transactions. If you need assistance with this process, consider using USLegalForms.

Deed restrictions are often permanent, meaning they can last indefinitely unless properly modified or removed. When you use a grantor corporation forever for you, these restrictions can impact property use and value. It's crucial to understand these limitations before purchasing property. Always seek legal advice to navigate these complexities.

The income of a grantor trust is reported by the grantor on their personal income tax return. This structure allows income to be taxed at the grantor's tax rates, which can be a beneficial arrangement. By working with uslegalforms and utilizing grantor corporation forever for you, you can efficiently manage income reporting and tax obligations.

When the grantor of a grantor trust passes away, the trust typically becomes irrevocable. This change means that the trust will need to file its own tax return going forward, affecting how income and distributions are handled. However, if you have established the grantor corporation forever for you, you can anticipate these changes and prepare accordingly.