Joint Tenants With Right Of Survivorship Deed With New York State

Description

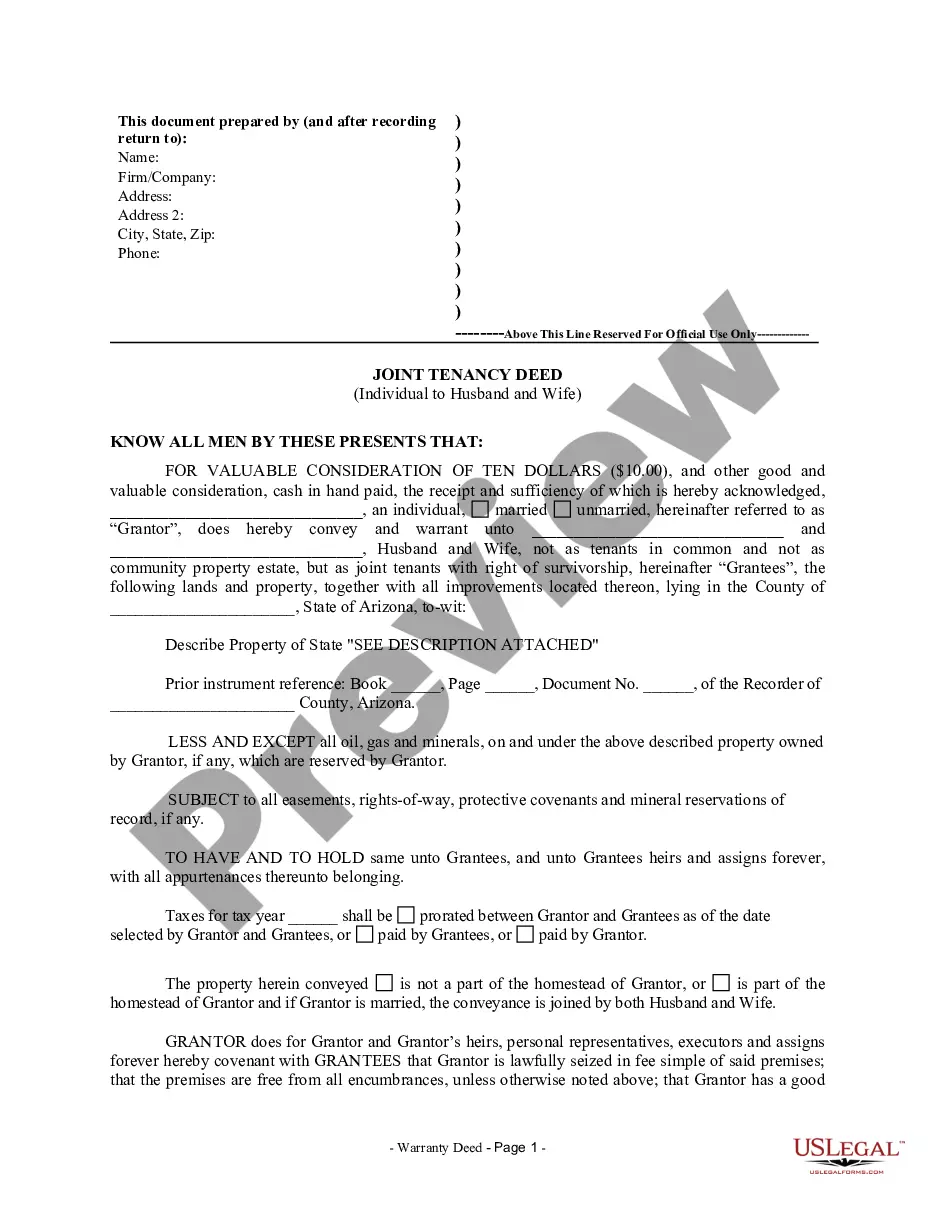

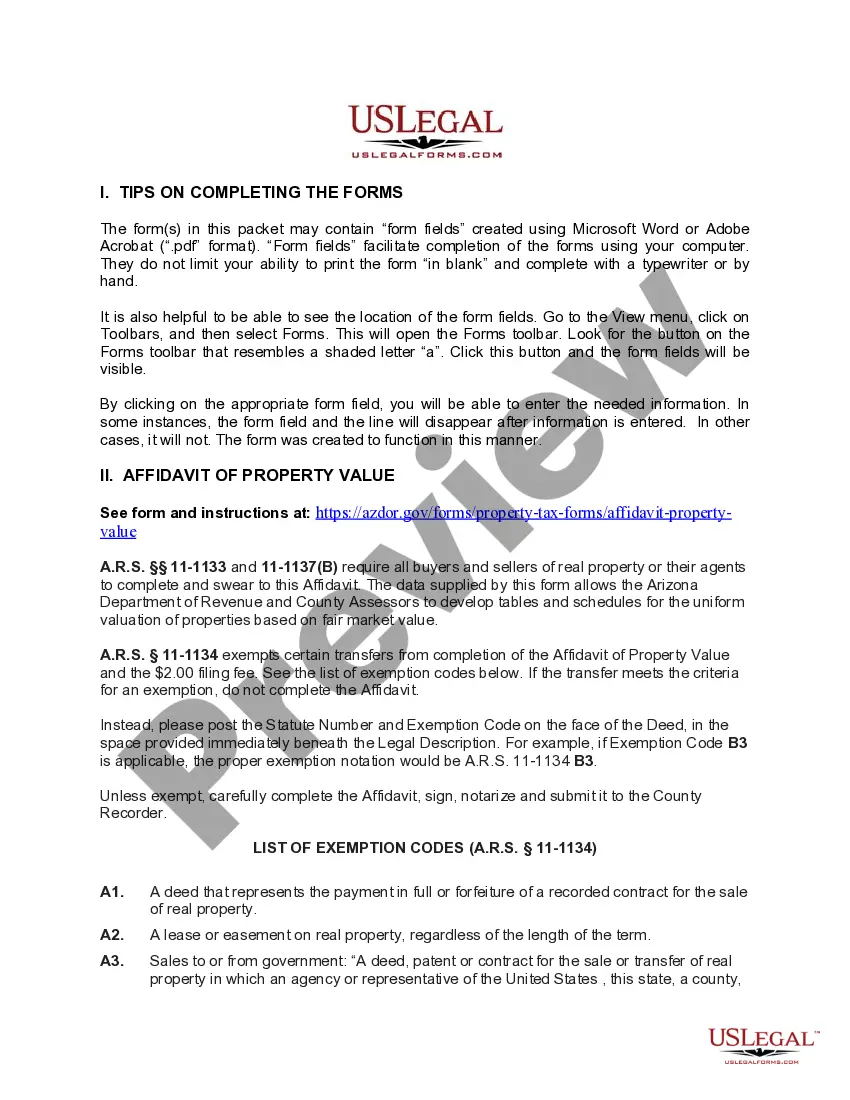

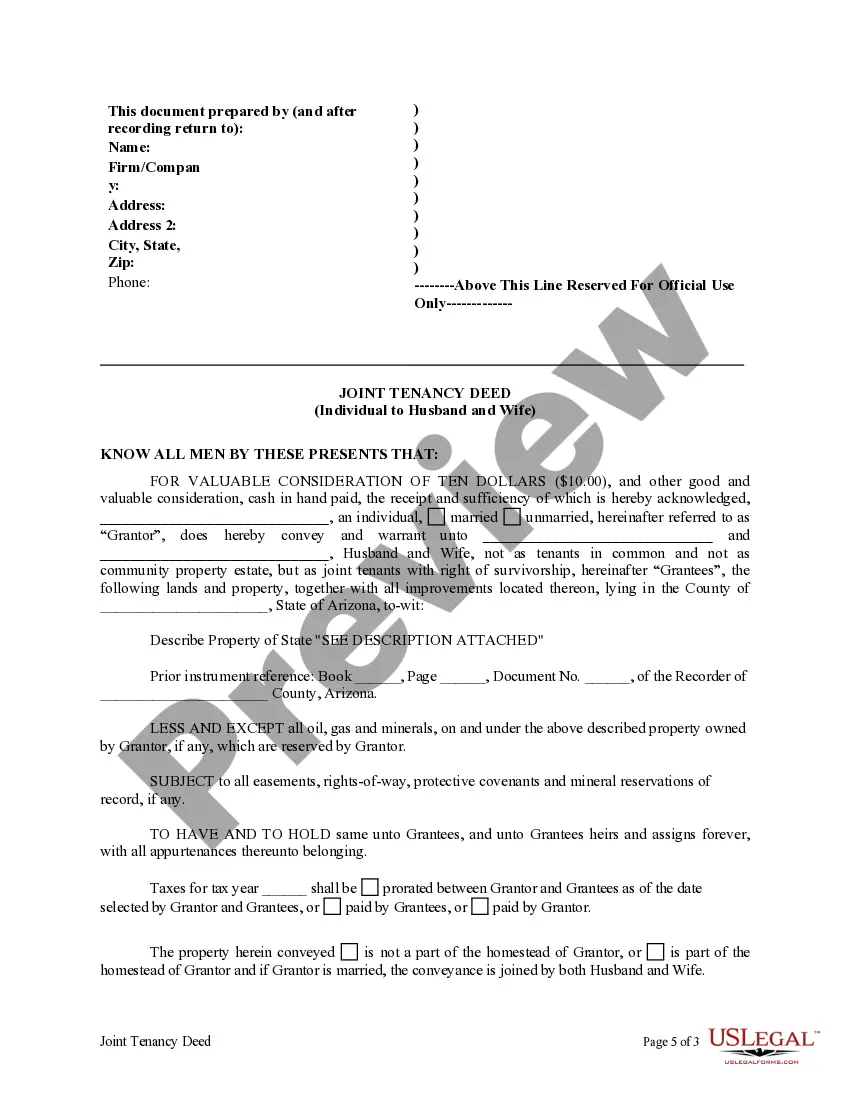

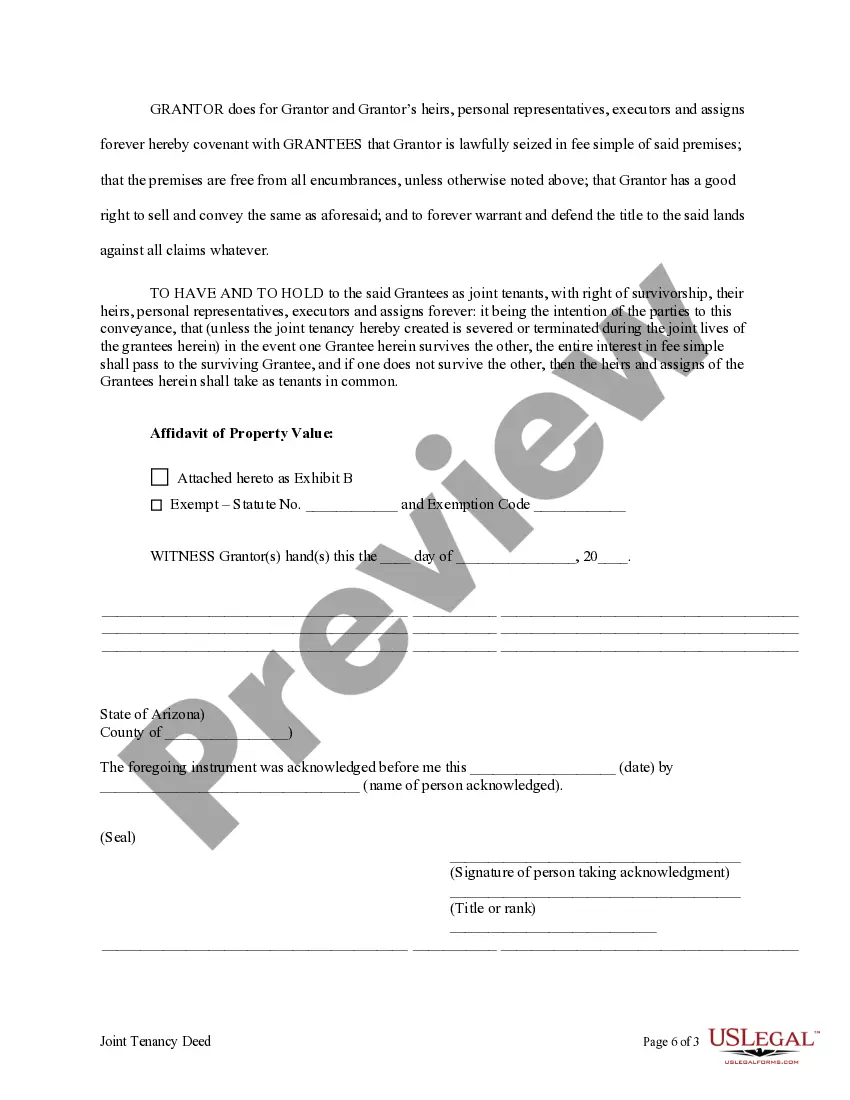

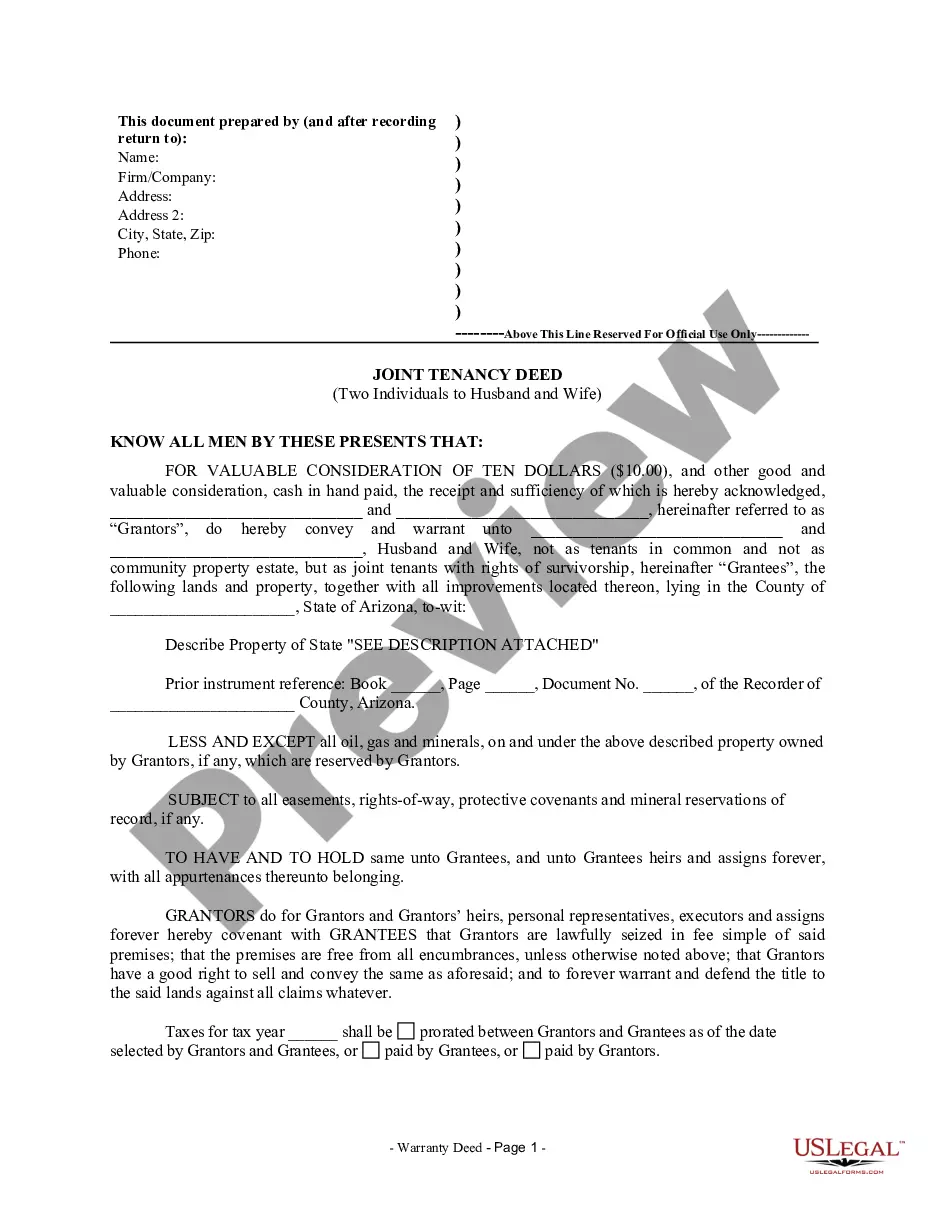

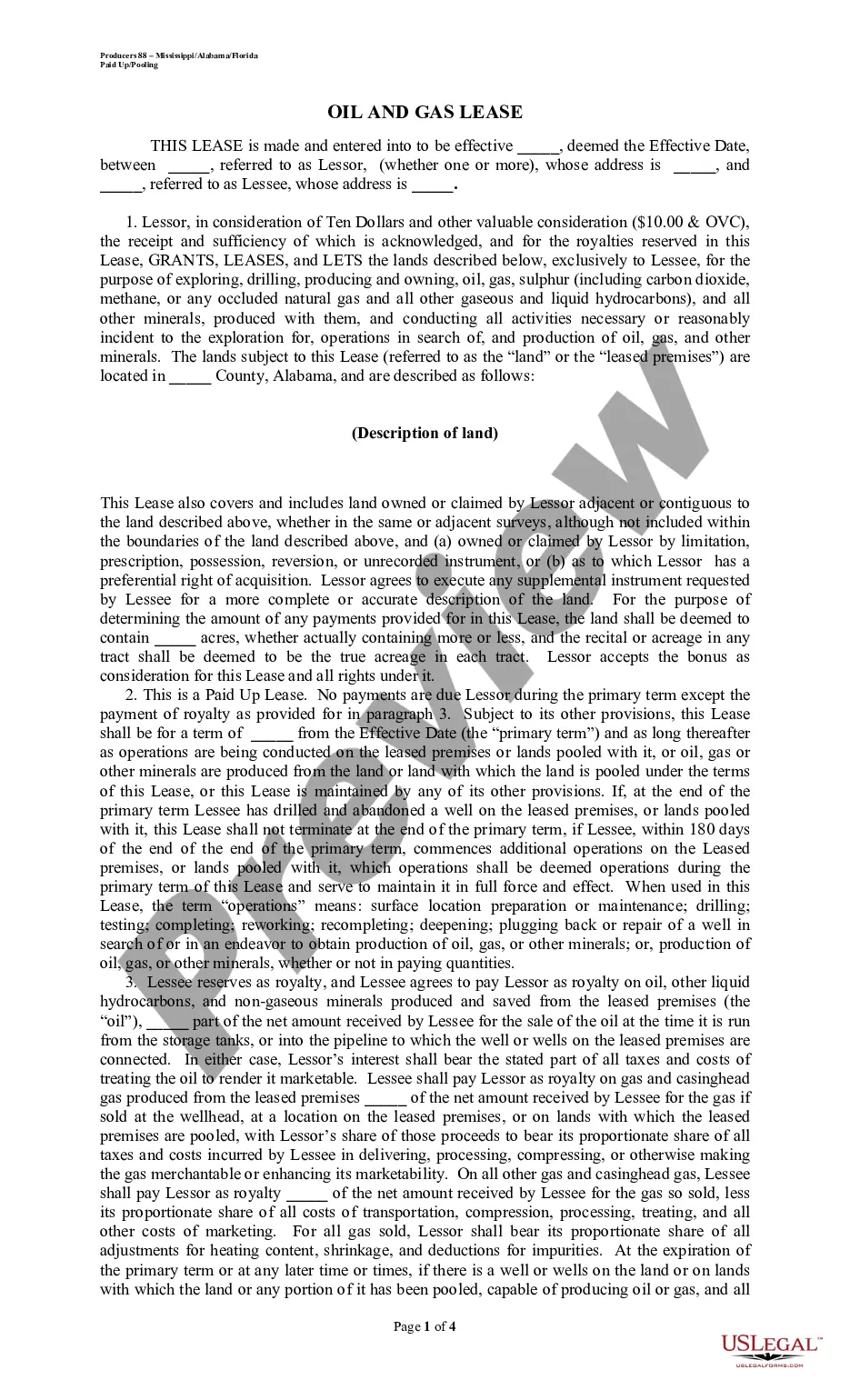

How to fill out Arizona Joint Tenancy Deed From Individual To Husband And Wife?

Dealing with legal documents and procedures can be a time-consuming addition to the day. Joint Tenants With Right Of Survivorship Deed With New York State and forms like it typically require that you search for them and navigate the best way to complete them appropriately. As a result, whether you are taking care of economic, legal, or individual matters, using a extensive and convenient web library of forms when you need it will help a lot.

US Legal Forms is the top web platform of legal templates, offering over 85,000 state-specific forms and a number of resources that will help you complete your documents quickly. Check out the library of relevant papers open to you with just one click.

US Legal Forms offers you state- and county-specific forms available at any moment for downloading. Protect your papers managing operations by using a top-notch support that lets you make any form within a few minutes without extra or hidden charges. Simply log in in your account, locate Joint Tenants With Right Of Survivorship Deed With New York State and download it right away in the My Forms tab. You can also access formerly saved forms.

Would it be the first time making use of US Legal Forms? Sign up and set up an account in a few minutes and you will have access to the form library and Joint Tenants With Right Of Survivorship Deed With New York State. Then, stick to the steps below to complete your form:

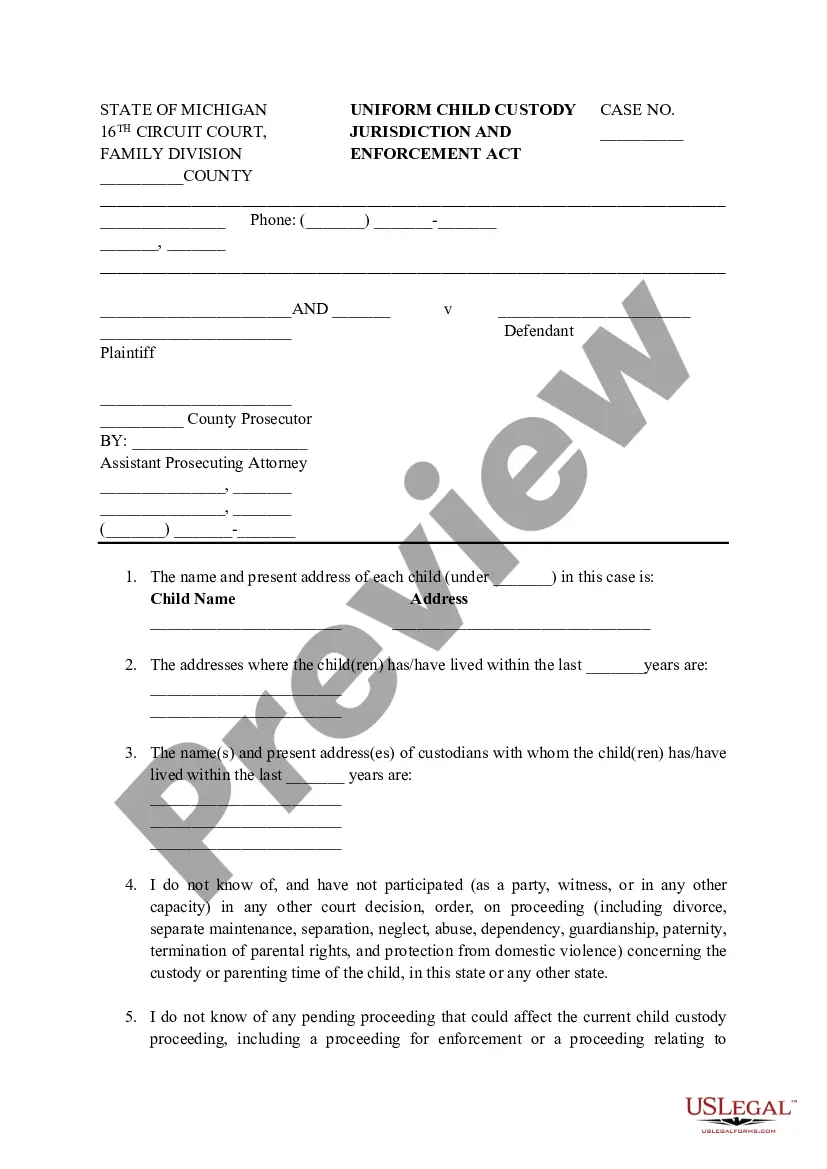

- Make sure you have found the correct form by using the Preview feature and reading the form information.

- Pick Buy Now as soon as ready, and select the subscription plan that is right for you.

- Press Download then complete, sign, and print the form.

US Legal Forms has twenty five years of expertise supporting users handle their legal documents. Discover the form you want today and improve any operation without breaking a sweat.

Form popularity

FAQ

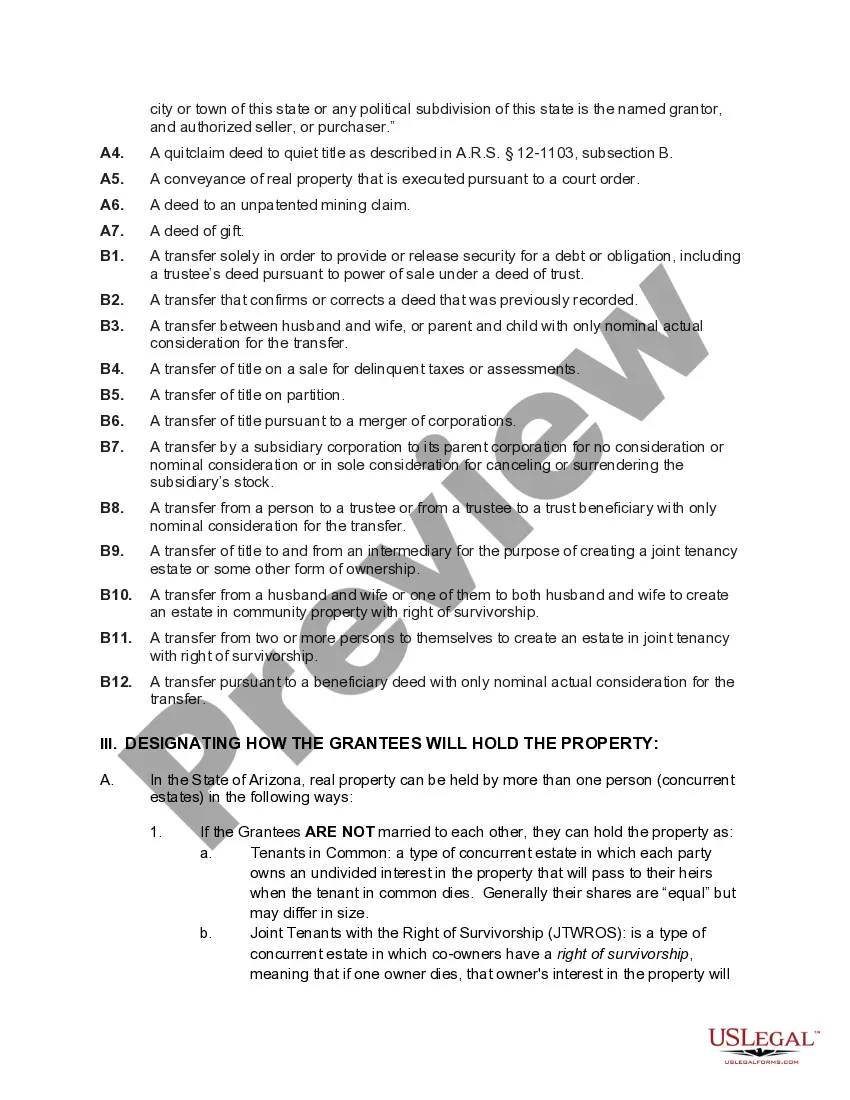

What is a right of survivorship? A right of survivorship means that property owned by multiple people will automatically pass to other owners when one owner dies. Not only does this ensure the immediate transfer of property, but it also avoids the lengthy and costly probate process.

Disadvantages of joint tenants with right of survivorship JTWROS accounts involving real estate may require all owners to consent to selling the property. Frozen bank accounts. In some cases, the probate court can freeze bank accounts until the estate is settled.

If Property is a Joint Tenancy, New York Laws Can Allow Probate Avoidance. When property is owned as a joint tenancy with rights of survivorship, this means that the co-owners are automatically going to inherit the property if any one of the owners passes away. This is what is meant by the right of survivorship.

In addition to any other means by which a joint tenancy with right of survivorship may be severed, a joint tenant may unilaterally sever a joint tenancy in real property without consent of any non-severing joint tenant or tenants by: (a) Execution and delivery of a deed that conveys legal title to the severing joint ...

Hear this out loud PauseIn New York, there are three ways to hold property with a co-owner: tenancy by the entirety, joint tenancy, and tenants in common. However, only two of these can have a right of survivorship. The others must go through probate to pass the property to another owner.