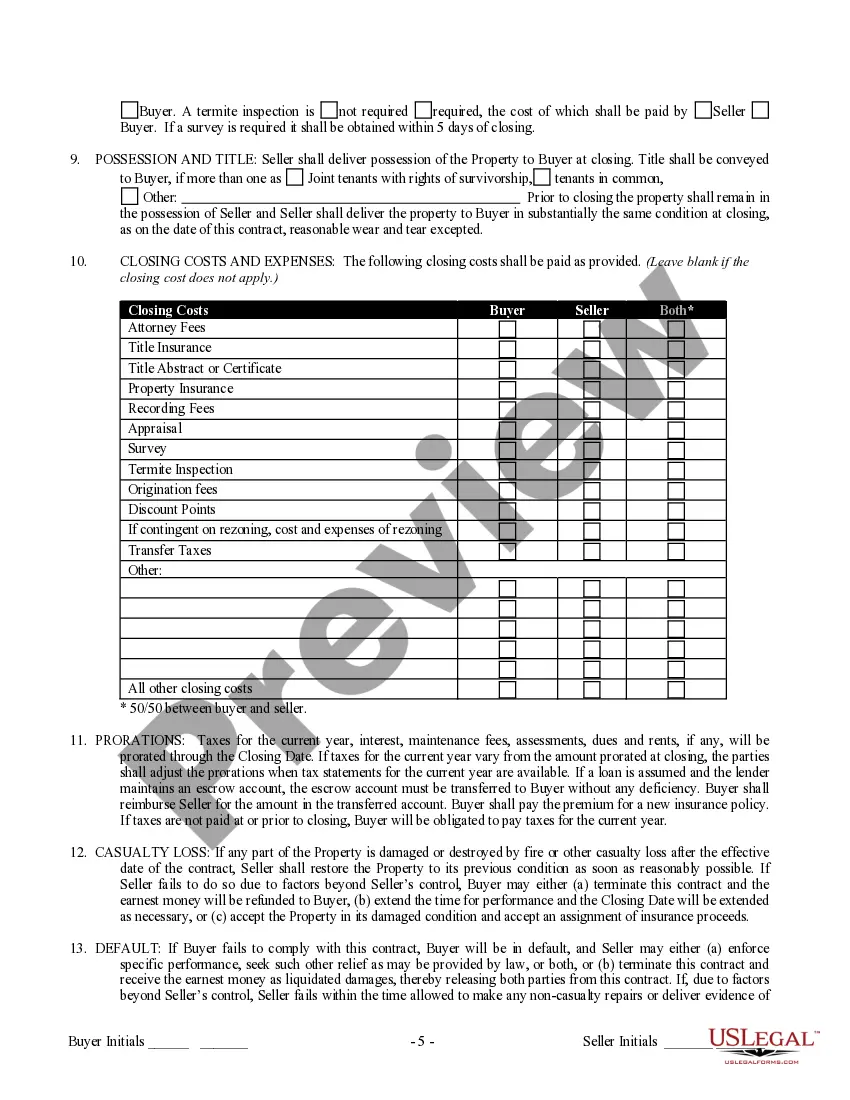

This form is a Contract for the sale of real estate for use in Arizona. It can be used for a cash sale, assumption or new loan buyer. The contract contains provisions common to a real estate transaction. No broker involved.

Az Sale Purchase Home With Bad Credit

Description

How to fill out Arizona Contract For Sale And Purchase Of Real Estate With No Broker For Residential Home Sale Agreement?

Drafting legal paperwork from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for a more straightforward and more cost-effective way of creating Az Sale Purchase Home With Bad Credit or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of more than 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-specific templates diligently put together for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can quickly find and download the Az Sale Purchase Home With Bad Credit. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Az Sale Purchase Home With Bad Credit, follow these recommendations:

- Review the document preview and descriptions to make sure you are on the the document you are looking for.

- Make sure the template you choose complies with the regulations and laws of your state and county.

- Choose the right subscription option to get the Az Sale Purchase Home With Bad Credit.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us today and turn document execution into something simple and streamlined!

Form popularity

FAQ

There are many implications of a declining credit score, but for the most part, your ability to sell your home will remain unaffected. One thing to be aware of though, is any liens on your property. Any outstanding liens are usually paid off by the selling party using the money from selling the home.

It's highly unlikely you'll qualify for a conventional mortgage with your credit score. The lending standards of both Fannie Mae and Freddie Mac require a minimum credit score of 620, and even this level requires a strong debt-to-income ratio and a rather large down payment.

If you plan to use a mortgage to buy a house, you'll most likely be unable to do so with a 400 credit score. But if you're paying in cash, it doesn't matter how low your score is.

What is the minimum credit score to buy a house in Arizona? The minimum credit score to buy a house in Arizona is 580. Borrowers will a lower credit score of 500 to 579 may also be eligible for select mortgage lenders.

Don't max out credit card debt ?The extra debt payment amount will offset your income and result in you qualifying for less mortgage financing,? Washington says. ?It will also lower your credit score, which could increase the cost of your loan.?