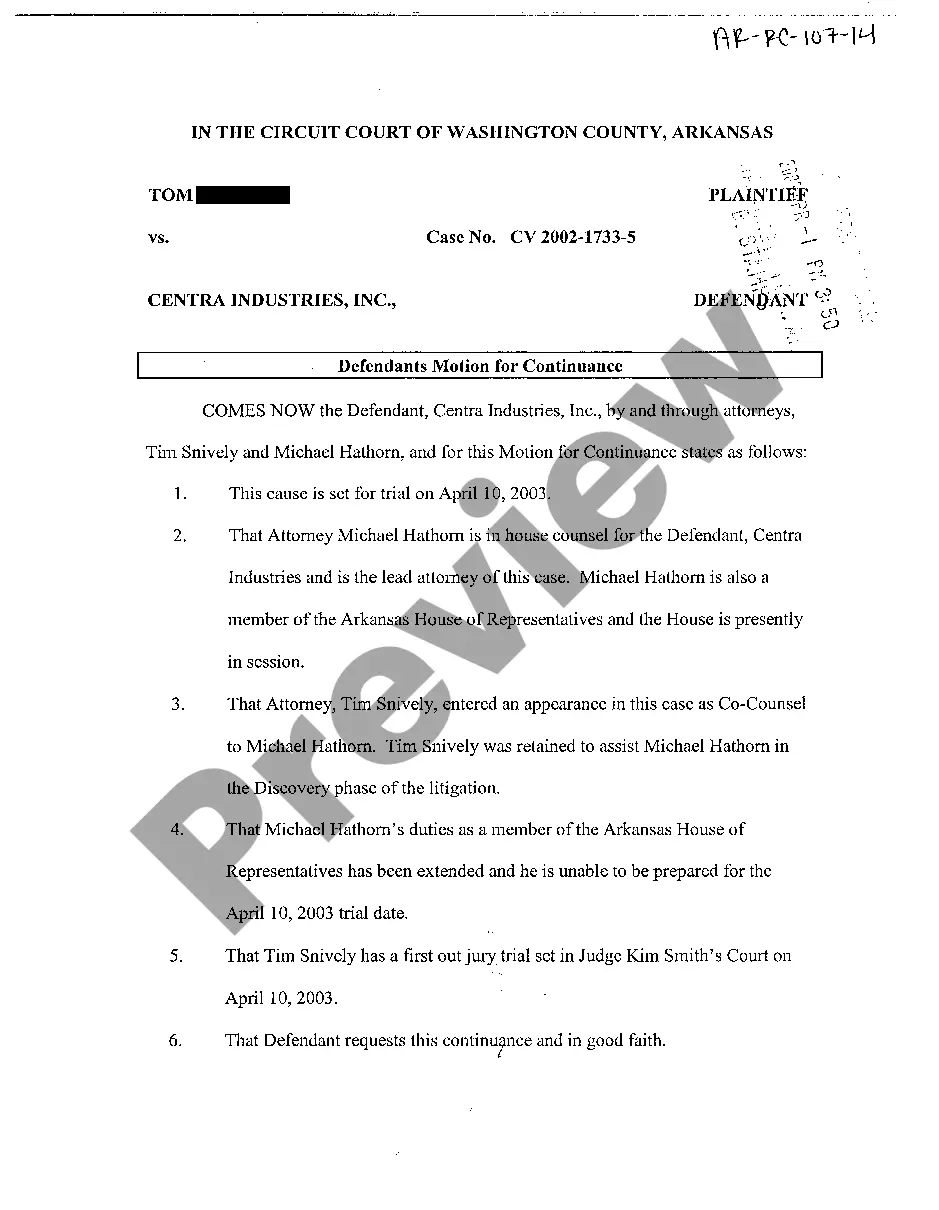

Motion For Continuance Arkansas Withholding Tax

Description

How to fill out Arkansas Defendant's Motion For Continuance?

Managing legal documents and processes can be a lengthy addition to your schedule.

Motion For Continuance Arkansas Withholding Tax and similar forms typically necessitate that you locate them and figure out how to fill them out appropriately.

Thus, whether you are handling financial, legal, or personal issues, having a comprehensive and functional online repository of documents readily available will be greatly beneficial.

US Legal Forms is the premier online platform for legal templates, providing over 85,000 state-specific documents along with various tools to assist you in completing your paperwork effortlessly.

Simply Log In to your account, locate Motion For Continuance Arkansas Withholding Tax, and download it instantly from the My documents section. You can also access previously saved documents.

- Explore the selection of relevant files accessible to you with just one click.

- US Legal Forms supplies you with state- and county-specific documents available for download at any time.

- Streamline your document management procedures with a top-notch service that enables you to prepare any document in just a few minutes without any extra or hidden charges.

Form popularity

FAQ

To determine the number you should use for tax withholding in Arkansas, refer to your employer or the documentation they provide. Each company has its unique setup, which includes withholding numbers. If you're navigating your Motion for continuance Arkansas withholding tax and need support, US Legal Forms can provide useful templates and assistance to streamline the process.

Your Arkansas withholding account number is usually provided by the Arkansas Department of Finance and Administration when you register for withholding taxes. If you've lost it, you can confirm your number by calling their office or checking previously filed tax documents. If you need assistance related to your Motion for continuance Arkansas withholding tax, US Legal Forms has helpful services to ensure you have everything you need.

The withholding tax rate for nonresidents working in Arkansas varies based on income brackets. It's important to check the latest guidelines from the Arkansas Department of Finance and Administration for the most accurate rate. For any issues regarding your Motion for continuance Arkansas withholding tax, consulting US Legal Forms can provide you with essential resources and templates.

The Arkansas withholding tax number is typically assigned to employers for reporting taxes withheld from employees' paychecks. If you need assistance finding this number, reaching out to the Arkansas Department of Finance and Administration is a smart choice. Also, keep in mind that your Motion for continuance Arkansas withholding tax may require some specific information regarding that number.

For inquiries about Arkansas state taxes, you can call the Arkansas Department of Finance and Administration. They can assist you with issues related to taxes, including any questions about your Motion for continuance Arkansas withholding tax. Their customer service representatives are knowledgeable and can guide you through the process.

The state withholding tax rate in Arkansas varies based on your income. Rates range from 0.9% to 6.9%, depending on your income bracket. If you are unsure about how the Motion for continuance Arkansas withholding tax affects your rate, using platforms like UsLegalForms can help you gather the right information to make informed decisions.

Yes, Arkansas has a state withholding tax that applies to wages earned by employees. Employers are required to withhold a portion of employees’ earnings to cover state taxes. If you are navigating issues related to the Motion for continuance Arkansas withholding tax, seeking help from experts like UsLegalForms can simplify the process.

The amount of tax withheld from your paycheck in Arkansas depends on your income level and filing status. It is recommended to use the state’s withholding calculator to get the most accurate estimate. Understanding the Motion for continuance Arkansas withholding tax can help clarify your obligations and avoid surprises come tax time.

To register for withholding tax in Arkansas, start by visiting the Arkansas Department of Finance and Administration website. There, you can complete the necessary registration form online. After registration, be sure to familiarize yourself with the rules surrounding the Motion for continuance Arkansas withholding tax to ensure compliance.

The withholding tax rate for non-residents in Arkansas is generally 6.0% on income earned within the state. When dealing with complex tax situations, you might consider submitting a Motion for continuance regarding your withholding tax. This can provide you with more time to address any tax liabilities or disputes. Utilizing the services offered by US Legal Forms can guide you through the process efficiently.