Application For Writ Of Garnishment Form Arkansas Pdf Withholding

Description

How to fill out Arkansas Writ Of Garnishment?

Red tape necessitates exactness and correctness.

If you do not handle completing documents like Application For Writ Of Garnishment Form Arkansas Pdf Withholding on a daily basis, it may lead to some misinterpretations.

Selecting the proper example from the outset will guarantee that your paperwork submission proceeds smoothly and avoid any troubles of resending a file or executing the same task anew.

If you are not a subscribed user, locating the needed sample may necessitate a few additional steps.

- You can always find the appropriate sample for your documents in US Legal Forms.

- US Legal Forms is the largest online forms repository that houses over 85 thousand examples for diverse areas.

- You can acquire the latest and most pertinent version of the Application For Writ Of Garnishment Form Arkansas Pdf Withholding by simply searching on the site.

- Identify, save, and download templates in your account or consult the description to ensure you have the correct one available.

- With an account at US Legal Forms, it's effortless to gather, store in one location, and browse through the templates you have saved for easy access.

- When on the site, click the Log In button to validate your access.

- Then, navigate to the My documents page, where the history of your documents is maintained.

- Review the description of the documents and download those you require at any time.

Form popularity

FAQ

To stop a wage garnishment in Arkansas, you can file a motion with the court that issued the garnishment. This motion typically requires you to explain why the garnishment should end and you may also need to submit the Application for writ of garnishment form arkansas pdf withholding. Additionally, working with a legal professional can help you navigate this process effectively. Remember, staying proactive and informed about your options is crucial.

To answer a writ of garnishment, you first need to gather the required information. Use the Application for writ of garnishment form arkansas pdf withholding to guide your response. Make sure to file your answer with the court and serve a copy to the creditor. Understand the deadlines and ensure that your answer is complete to protect your rights.

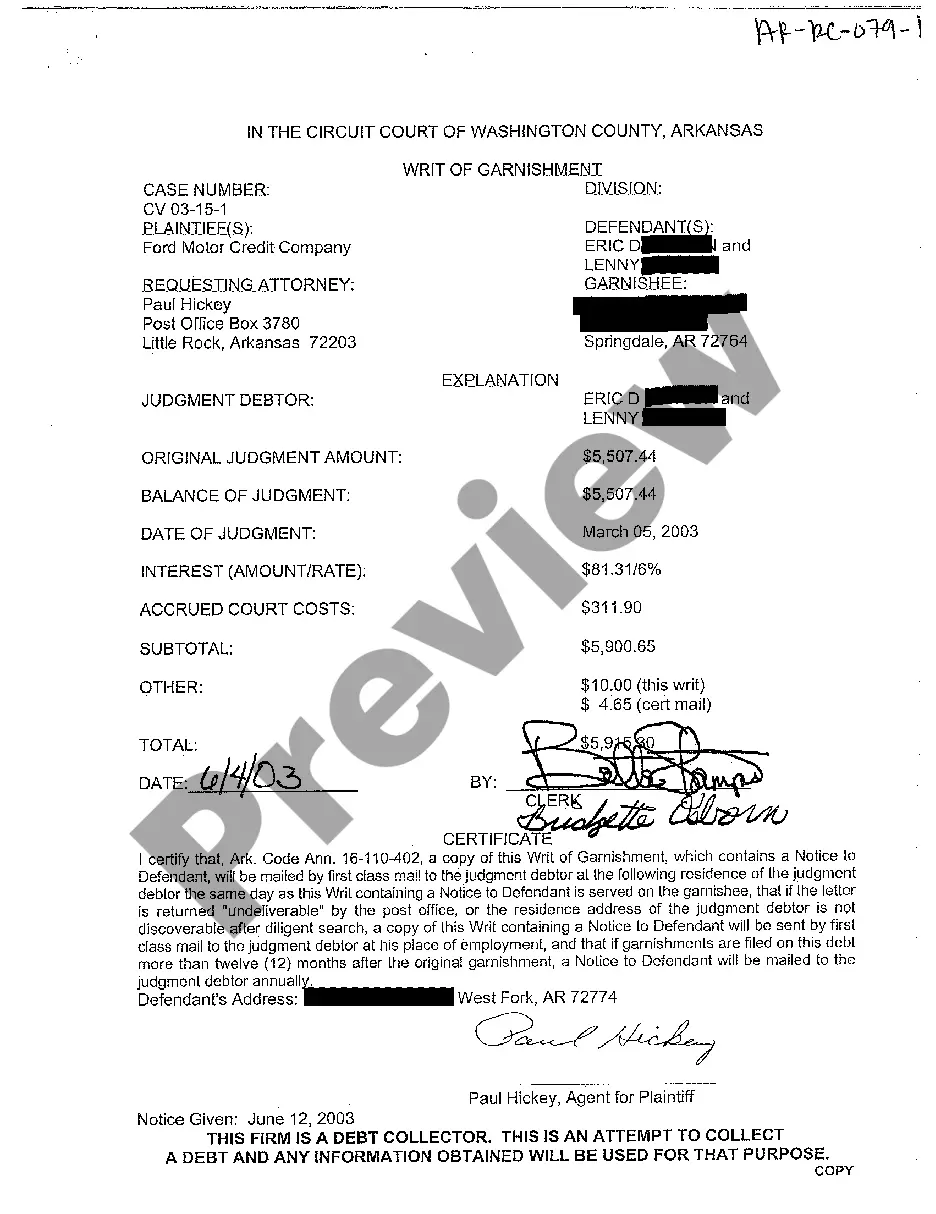

The application of a writ of garnishment is a legal request used to collect a debt owed to a creditor by seizing the debtor's funds from a third party, like an employer. It allows creditors to access a portion of the debtor's wages to satisfy unpaid obligations. To initiate this process, you need the Application for writ of garnishment form Arkansas PDF withholding, which outlines the essential details required to proceed legally. Utilizing platforms like US Legal Forms can simplify the process and ensure compliance.

To fill out a challenge to garnishment form, start by obtaining the necessary document from your local court or online resources. Clearly state the reasons for your challenge and provide any relevant evidence that supports your case. Make sure to include all required personal and case details. If this process feels overwhelming, consider using the Application for writ of garnishment form Arkansas PDF withholding from US Legal Forms for guidance.

Filing a garnishment in Arkansas involves several steps. Begin with obtaining a judgment in your favor, then gather and complete the Application for writ of garnishment form Arkansas PDF withholding. After filing this form with the appropriate court, you must provide the necessary details about the debtor's employer. Finally, once the court processes your application, it will issue a writ to the employer to start garnishing the wages.

To garnish wages in Arkansas, you must first obtain a judgment against the debtor. After securing the judgment, you can complete the Application for writ of garnishment form Arkansas PDF withholding and file it with the court. This form requires specific information, and it's crucial to follow the local rules for successful implementation. Once filed, the court will issue a writ, allowing you to garnish the debtor's wages.

In Arkansas, up to 25% of your disposable earnings can be garnished from your paycheck. However, if your disposable earnings fall below a certain threshold, a smaller amount may apply. This rule ensures that you have enough income to cover basic living expenses. It’s essential to understand these limits when dealing with the Application for writ of garnishment form Arkansas PDF withholding.

A writ of execution is a judicial order that allows a creditor to take possession of a debtor's property to satisfy a debt, while a levy is the actual seizure of that property. Essentially, the writ authorizes action, and the levy is the execution of that authorization. Both methods serve different purposes in debt recovery, and understanding each can enhance your strategy for collection.

The purpose of a writ of execution is to enforce a court judgment by allowing a creditor to seize the debtor's physical property or assets. This legal measure ensures that creditors can recover what is due to them. It is distinct from garnishment, and knowing when to use each can influence the effectiveness of debt collection efforts.

A writ of garnishment in Arkansas is a legal order that directs a third party, like an employer or bank, to withhold funds owed to a debtor in order to satisfy a creditor's claim. This process is initiated by submitting the Application for writ of garnishment form Arkansas PDF withholding. It is a valuable tool for creditors seeking payment for debts.