Waiver Of Inventory And Accounting Without A Broker

Description

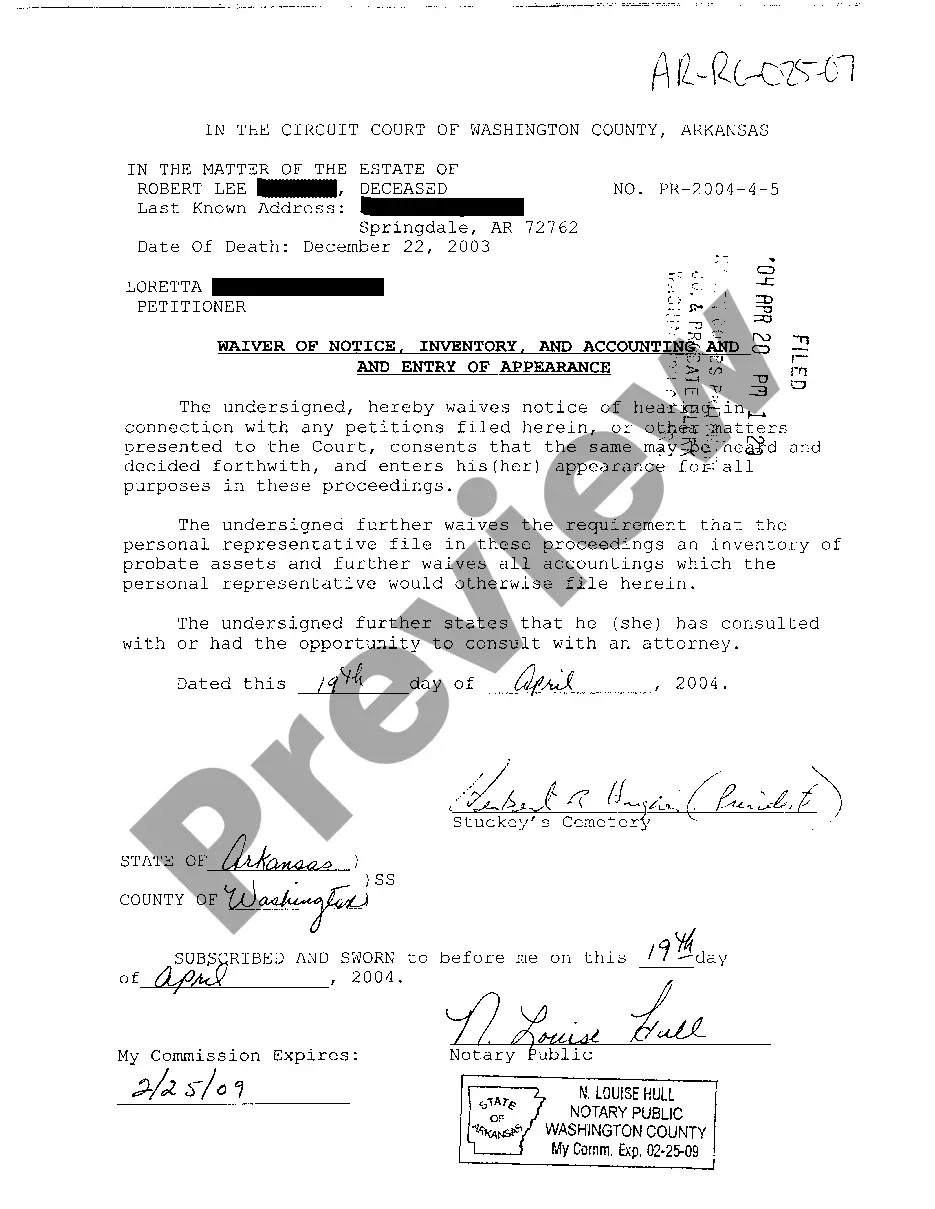

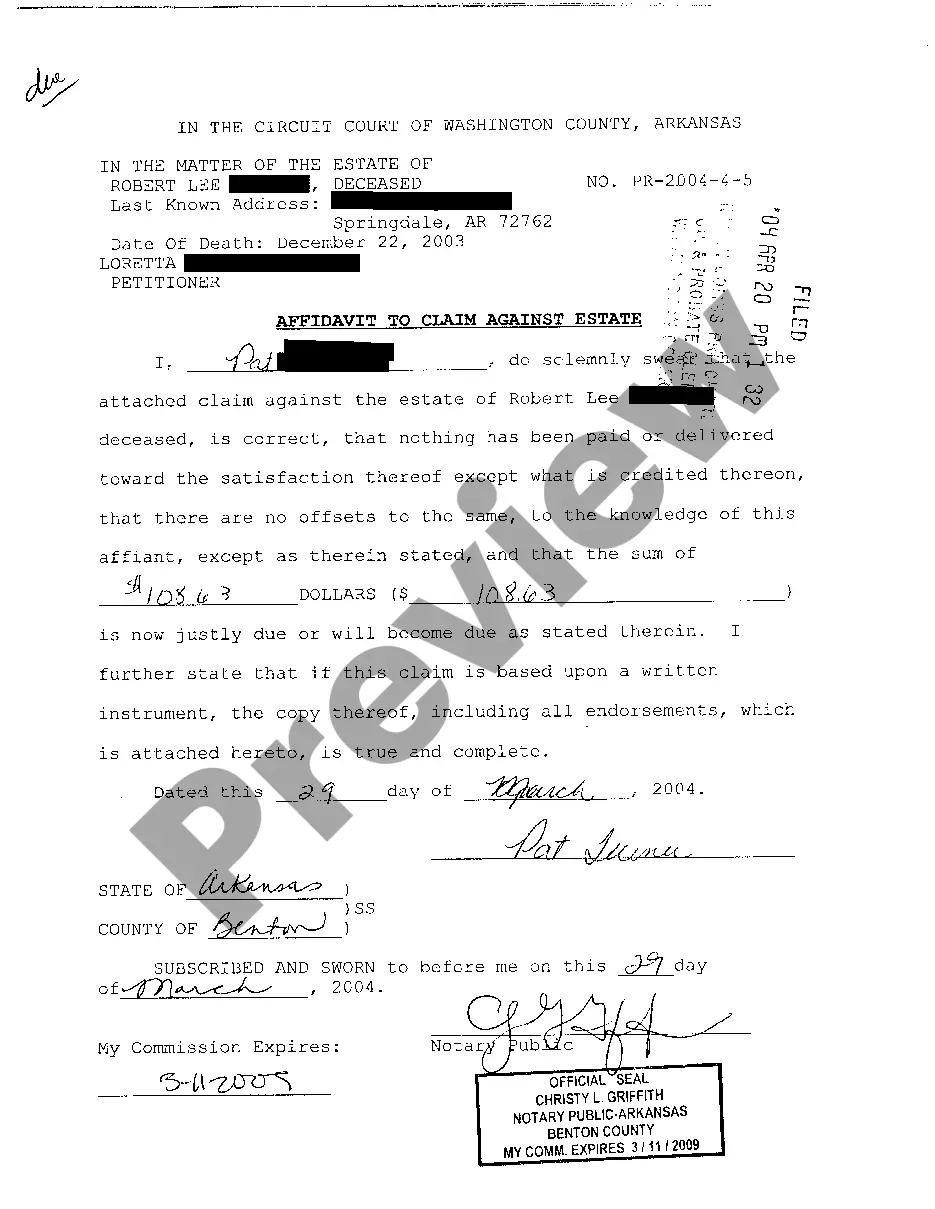

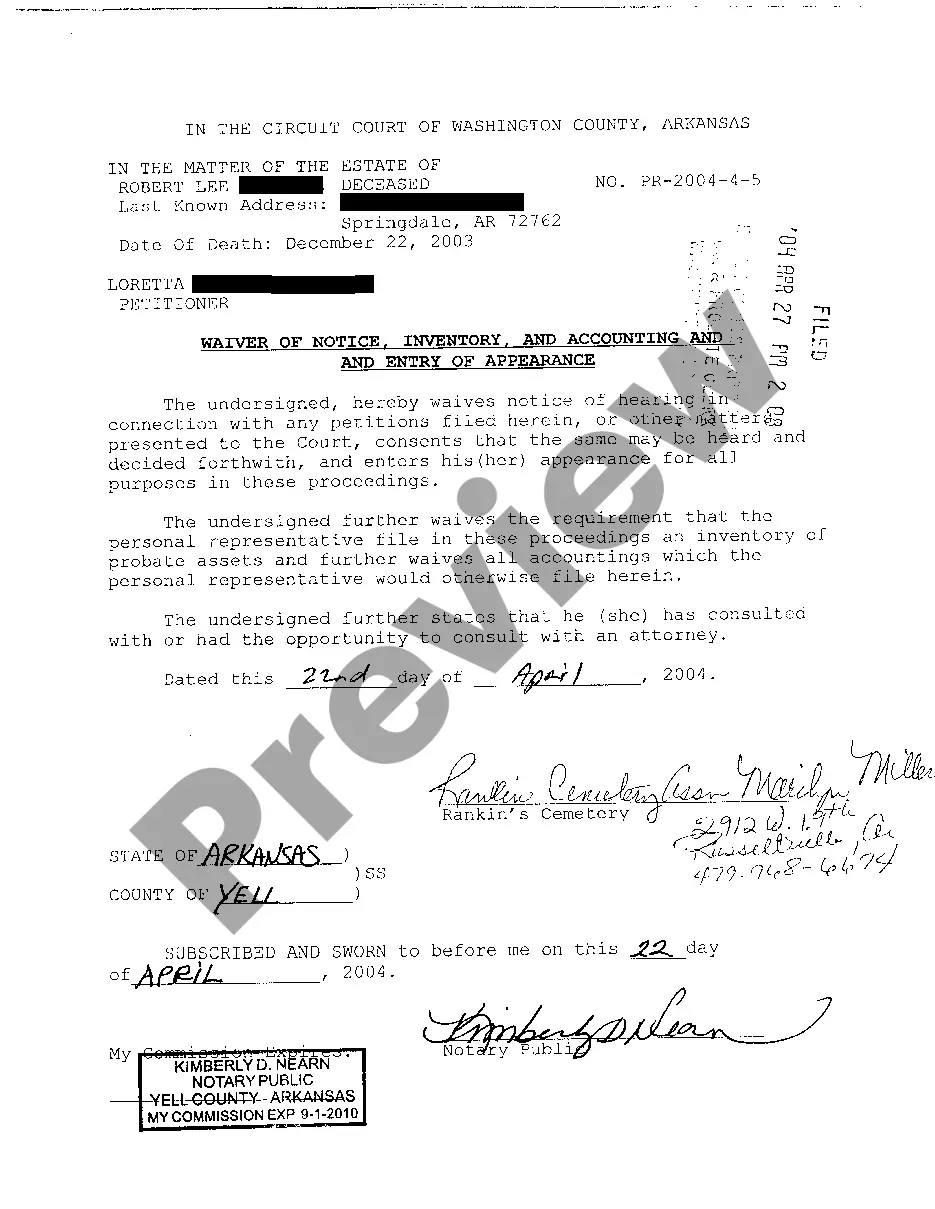

How to fill out Arkansas Waiver Of Notice, Inventory, And Accounting And Entry Of Appearance?

Finding a go-to place to access the most recent and relevant legal samples is half the struggle of working with bureaucracy. Discovering the right legal papers demands precision and attention to detail, which explains why it is vital to take samples of Waiver Of Inventory And Accounting Without A Broker only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and see all the details regarding the document’s use and relevance for your circumstances and in your state or county.

Take the following steps to finish your Waiver Of Inventory And Accounting Without A Broker:

- Make use of the catalog navigation or search field to find your sample.

- View the form’s description to ascertain if it suits the requirements of your state and region.

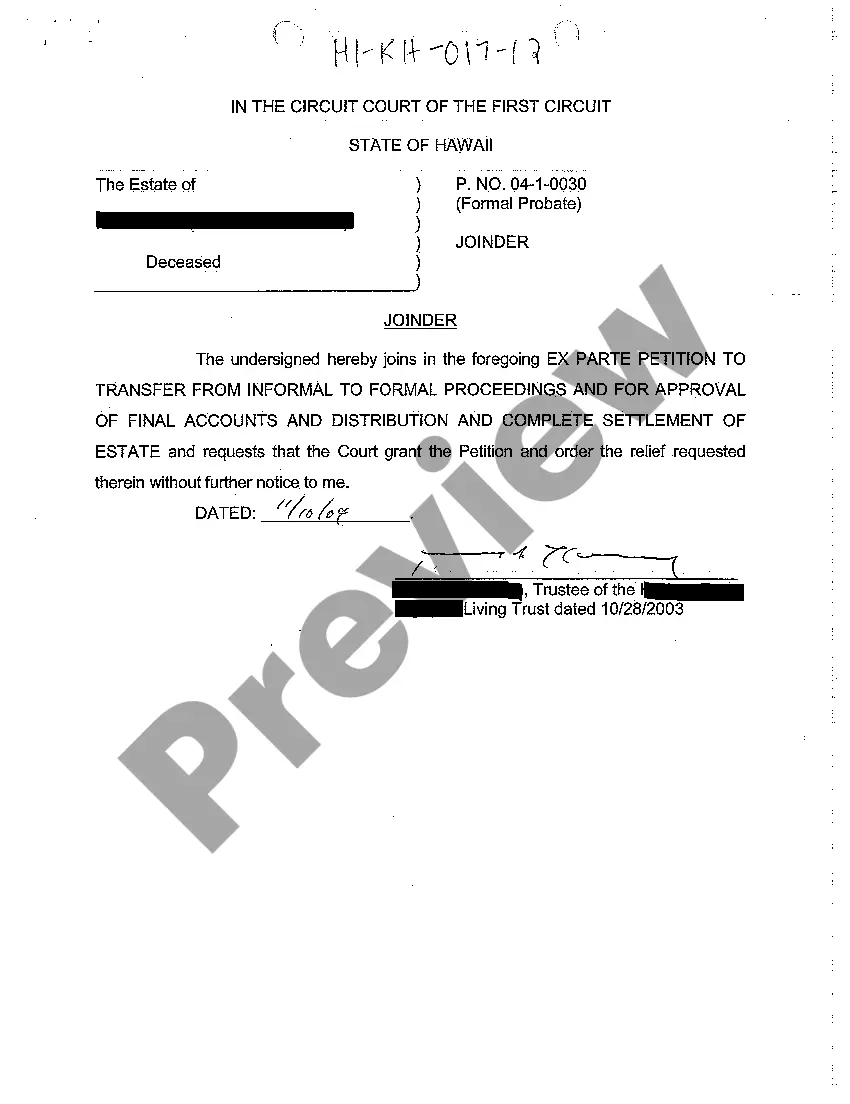

- View the form preview, if there is one, to ensure the form is the one you are interested in.

- Resume the search and look for the proper document if the Waiver Of Inventory And Accounting Without A Broker does not suit your requirements.

- If you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that suits your requirements.

- Go on to the registration to finalize your purchase.

- Complete your purchase by choosing a payment method (bank card or PayPal).

- Pick the file format for downloading Waiver Of Inventory And Accounting Without A Broker.

- Once you have the form on your device, you may alter it using the editor or print it and finish it manually.

Get rid of the headache that accompanies your legal documentation. Discover the comprehensive US Legal Forms catalog where you can find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Key Takeaways On How To Write A Waiver Choose a waiver template. Determine the type of activity or service. State the purpose of the waiver. Identify the risks. Include a title. Include customer information. Include waiver terms. Include a statement of understanding.

Black's Law Dictionary1 defined Waiver to mean the voluntary relinquishment or abandonment - express or implied - of a legal right or advantage;? The party alleged to have waived a right must have had both knowledge of the existing right and the intention of forgoing it.

Examples of waivers include the waiving of parental rights, waiving liability, tangible goods waivers, and waivers for grounds of inadmissibility. Waivers are common when finalizing lawsuits, as one party does not want the other pursuing them after a settlement is transferred.

How do you write a waiver example? ?I, [customer name], hereby waive any and all legal rights against [business name] and their employees for any injuries or damages that may occur during the [event name] event on [date].?

Types of Waivers Waiver of Liability. A waiver of liability is a provision in a contract by which any person participating in an activity forfeits the right to sue the organization conducting the activity in case of injuries. ... Waiver of Premium. ... Waiver of Subrogation. ... Loan Waiver.