Waiver Of Inventory And Accounting Within A Business

Description

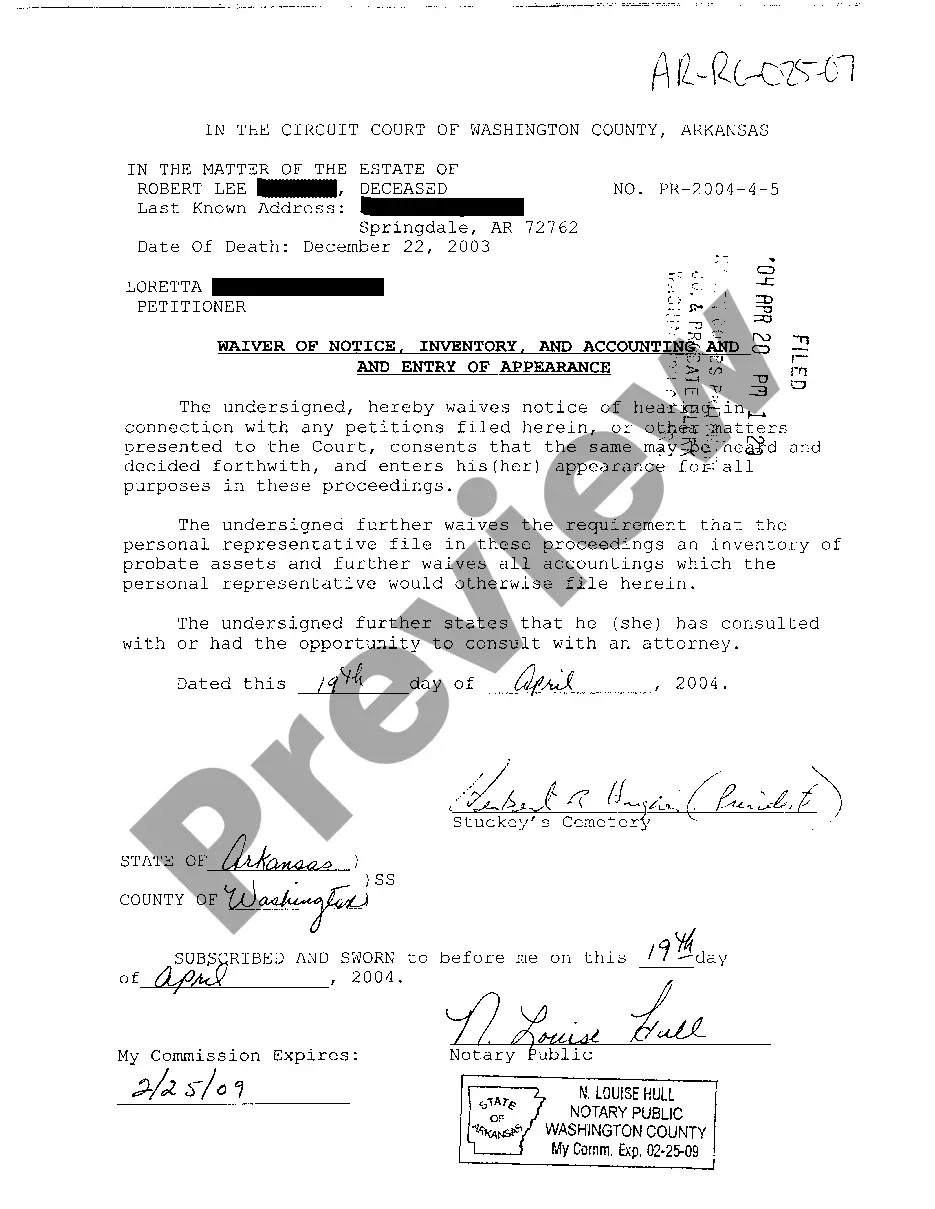

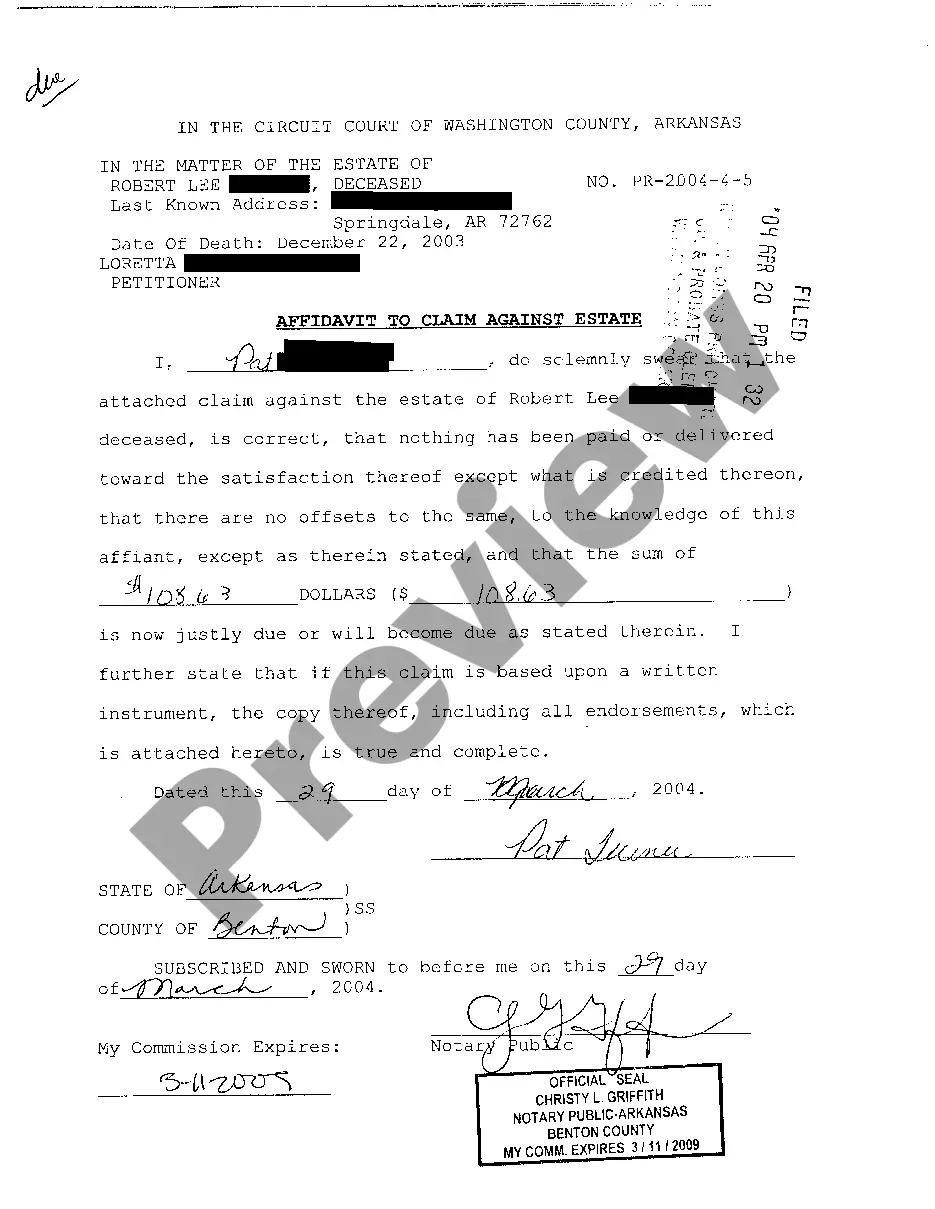

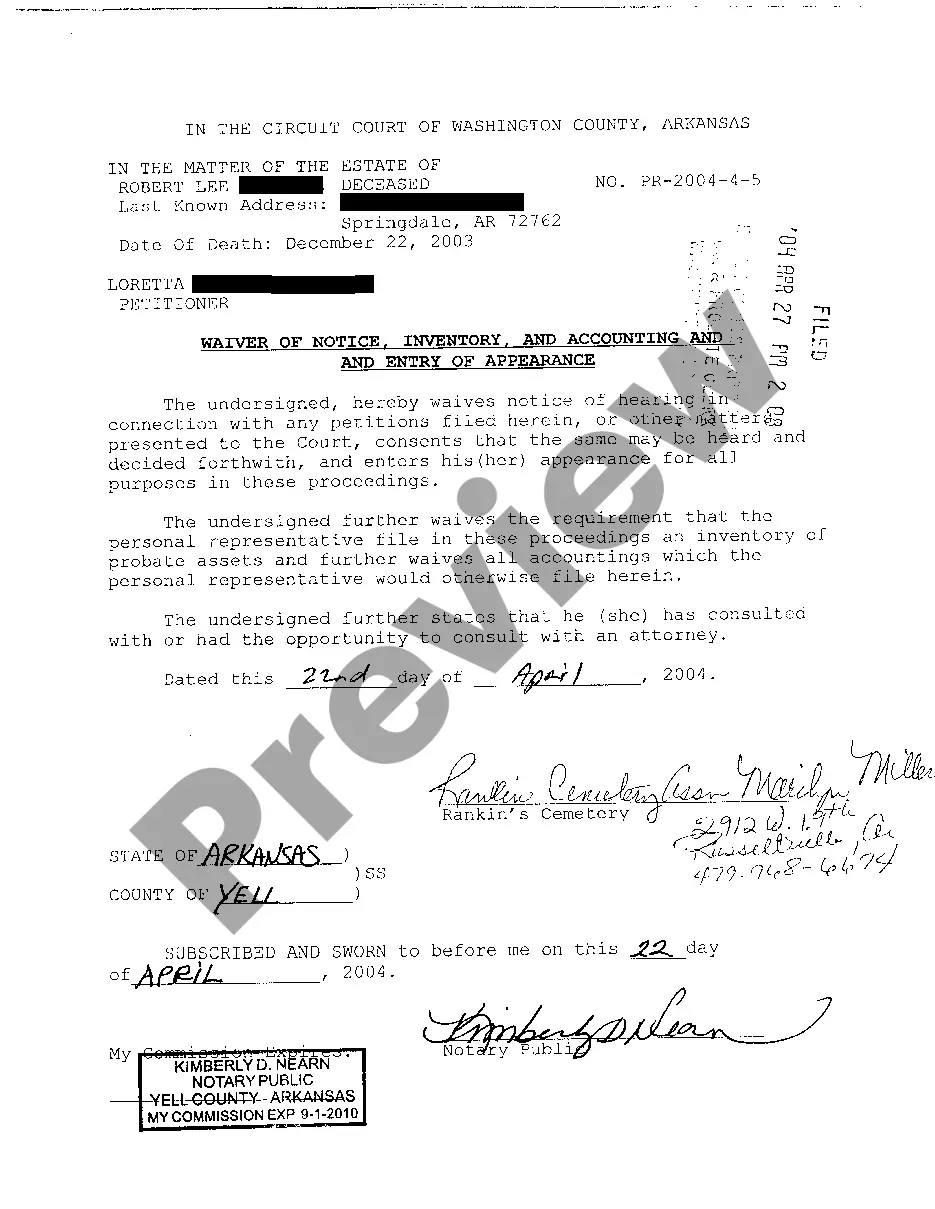

How to fill out Arkansas Waiver Of Notice, Inventory, And Accounting And Entry Of Appearance?

Legal management may be overwhelming, even for the most experienced specialists. When you are looking for a Waiver Of Inventory And Accounting Within A Business and do not get the time to devote looking for the appropriate and up-to-date version, the processes might be demanding. A strong online form catalogue can be a gamechanger for everyone who wants to handle these situations effectively. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any requirements you could have, from personal to business paperwork, all in one location.

- Use advanced resources to finish and control your Waiver Of Inventory And Accounting Within A Business

- Access a resource base of articles, guides and handbooks and resources relevant to your situation and requirements

Save time and effort looking for the paperwork you will need, and utilize US Legal Forms’ advanced search and Review tool to locate Waiver Of Inventory And Accounting Within A Business and acquire it. In case you have a monthly subscription, log in for your US Legal Forms account, look for the form, and acquire it. Review your My Forms tab to find out the paperwork you previously saved and also to control your folders as you see fit.

Should it be the first time with US Legal Forms, register an account and obtain unrestricted use of all advantages of the platform. Here are the steps to take after downloading the form you need:

- Validate it is the right form by previewing it and reading through its information.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now when you are ready.

- Choose a monthly subscription plan.

- Pick the formatting you need, and Download, complete, sign, print out and send your document.

Take advantage of the US Legal Forms online catalogue, backed with 25 years of expertise and trustworthiness. Enhance your everyday document administration in a easy and intuitive process right now.

Form popularity

FAQ

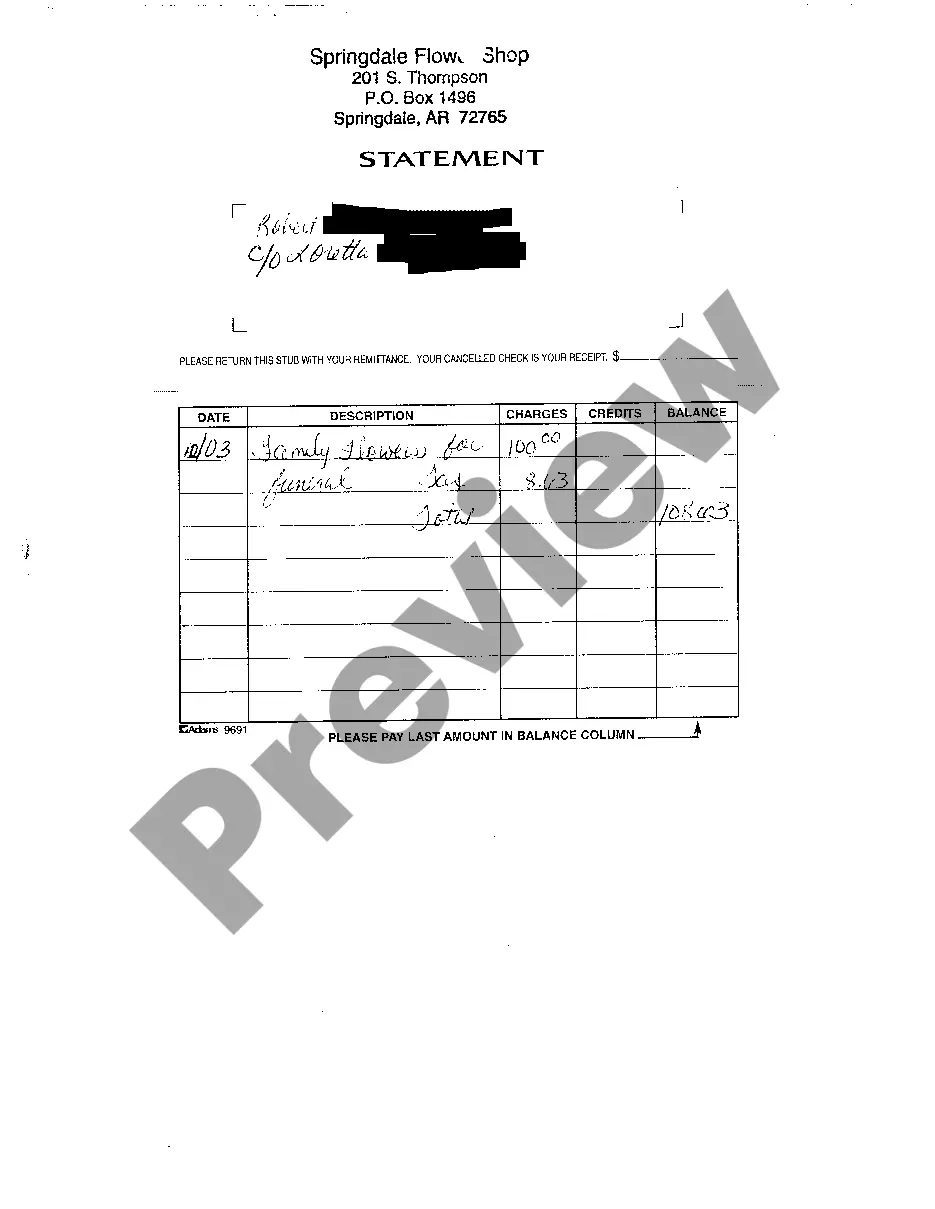

A waiver of accounting is a voluntary waiver by all heirs and beneficiaries that eliminates a very time-consuming and expensive accounting process by the Personal Representative. In order for a probate estate to be closed, the court requires the filing of a petition for final distribution.

All beneficiaries do not need to formally approve estate accounts; however, it is best practice for the Executor(s) and main beneficiaries to sign the estate accounts to show a legal agreement across all parties. Nevertheless, the beneficiaries are entitled to receive a copy of them and review the information.

Georgia Law typically requires the executor to file an inventory and annual returns with the probate court. This keeps the probate process transparent and accounts for all the assets in the estate. However, there are cases where the will itself might exempt the executor from this requirement.

Moreover, a personal representative is required to provide an accounting of all transactions of the estate during its administration (unless the beneficiaries sign a written waiver of this requirement, see Fla. Prob. R. 5.180).

Until the 30-day period reserved for objections has not passed and the final accounting is accepted by all the parties involved, the estate will not be closed. A Waiver of Accounting is a document that allows both the personal representative and the beneficiaries to circumvent this impediment.