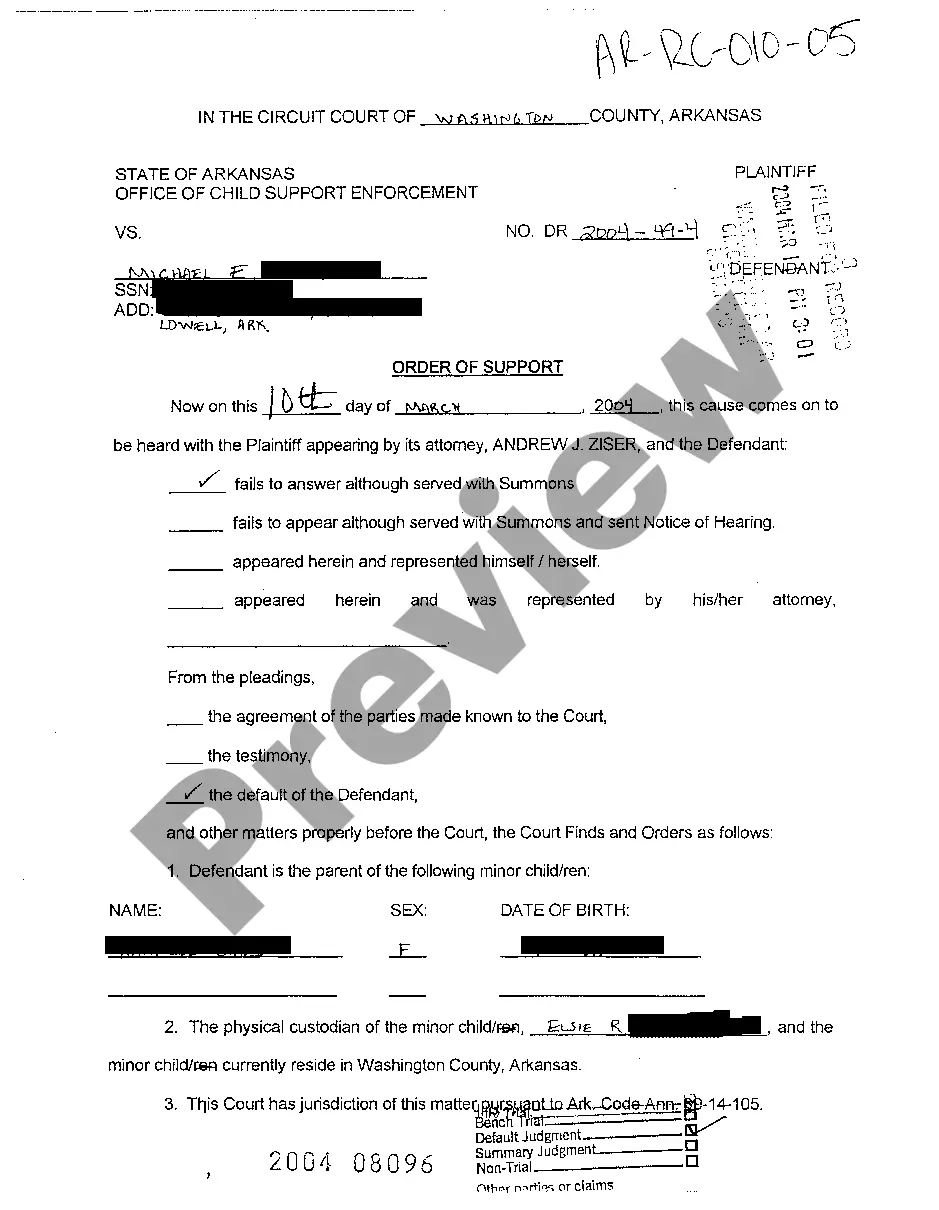

Arkansas Child Support Withholding Limits

Description

How to fill out Arkansas Child Support Withholding Limits?

How to locate professional legal documents that comply with your state regulations and prepare the Arkansas Child Support Withholding Limits without hiring a lawyer.

Numerous online services offer templates to address various legal situations and requirements.

However, it may require time to determine which of the available samples satisfy both your needs and legal standards.

Download the Arkansas Child Support Withholding Limits using the related button adjacent to the file name. If you do not have an account with US Legal Forms, then adhere to the following guide: Review the webpage you've accessed and check if the form meets your requirements. Utilize the form description and preview options if available. Search for an alternative sample in the header by providing your state if necessary. Click the Buy Now button when you identify the correct document. Select the most appropriate pricing plan, then Log In or create a new account. Choose your payment method (by credit card or through PayPal). Select the file format for your Arkansas Child Support Withholding Limits and click Download. The acquired templates stay in your ownership: you can always revisit them in the My documents tab of your profile. Join our collection and create legal documents independently like a seasoned legal expert!

- US Legal Forms is a trusted platform that assists you in finding formal documentation created according to the latest updates in state law and helps you save on legal fees.

- US Legal Forms is not just an ordinary web directory.

- It consists of over 85,000 validated templates for diverse business and personal circumstances.

- All documents are categorized by area and state to expedite your search process and enhance convenience.

- Moreover, it integrates with robust tools for PDF editing and electronic signatures, allowing users with a Premium subscription to quickly finalize their paperwork online.

- It requires minimal time and effort to acquire the necessary documents.

- If you already possess an account, Log In and verify your subscription status.

Form popularity

FAQ

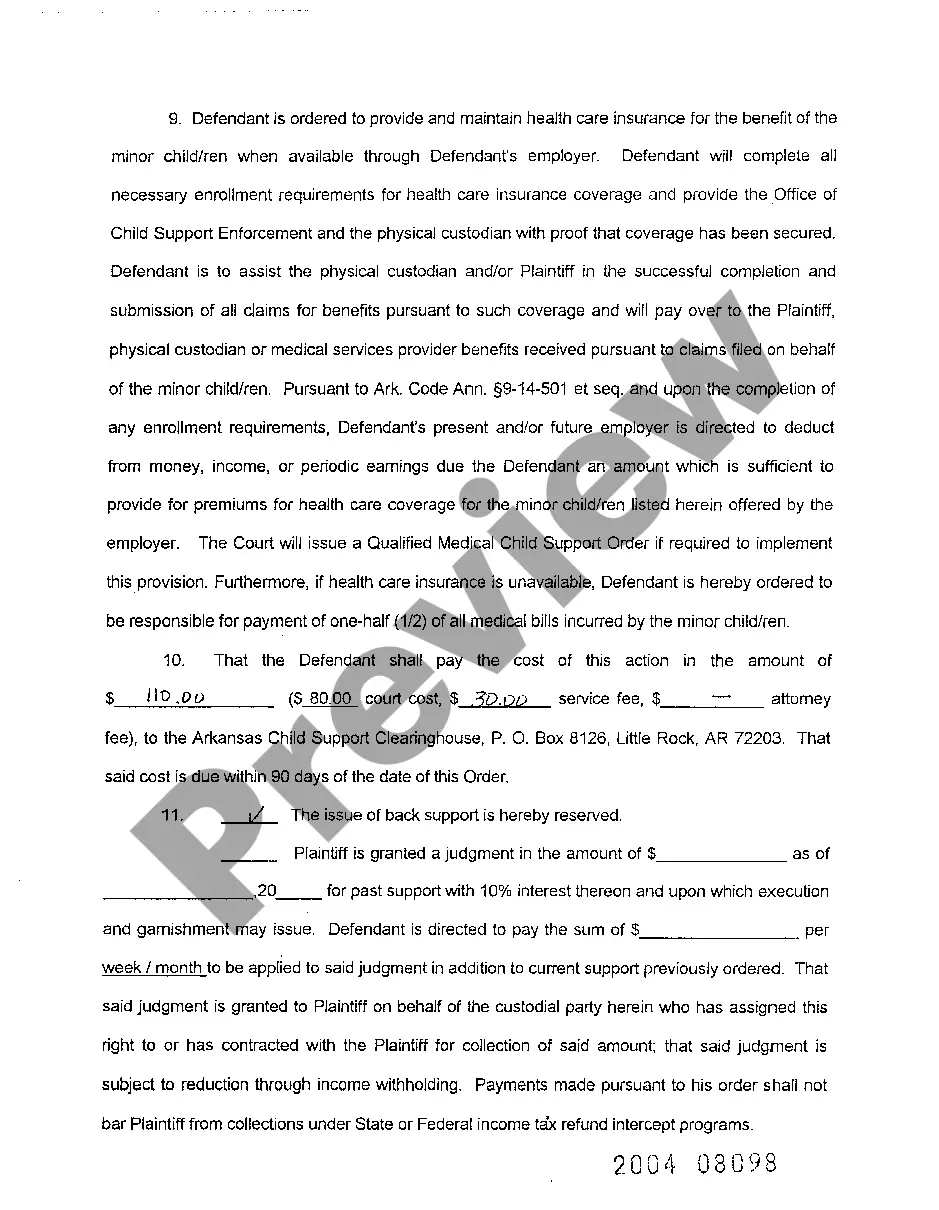

In Arkansas, all changes to child support orders must be signed by a judge. OCSE provides services that include changing an order if it's appropriate. To avoid unnecessary legal fees, OCSE does what we call a review before beginning the legal process.

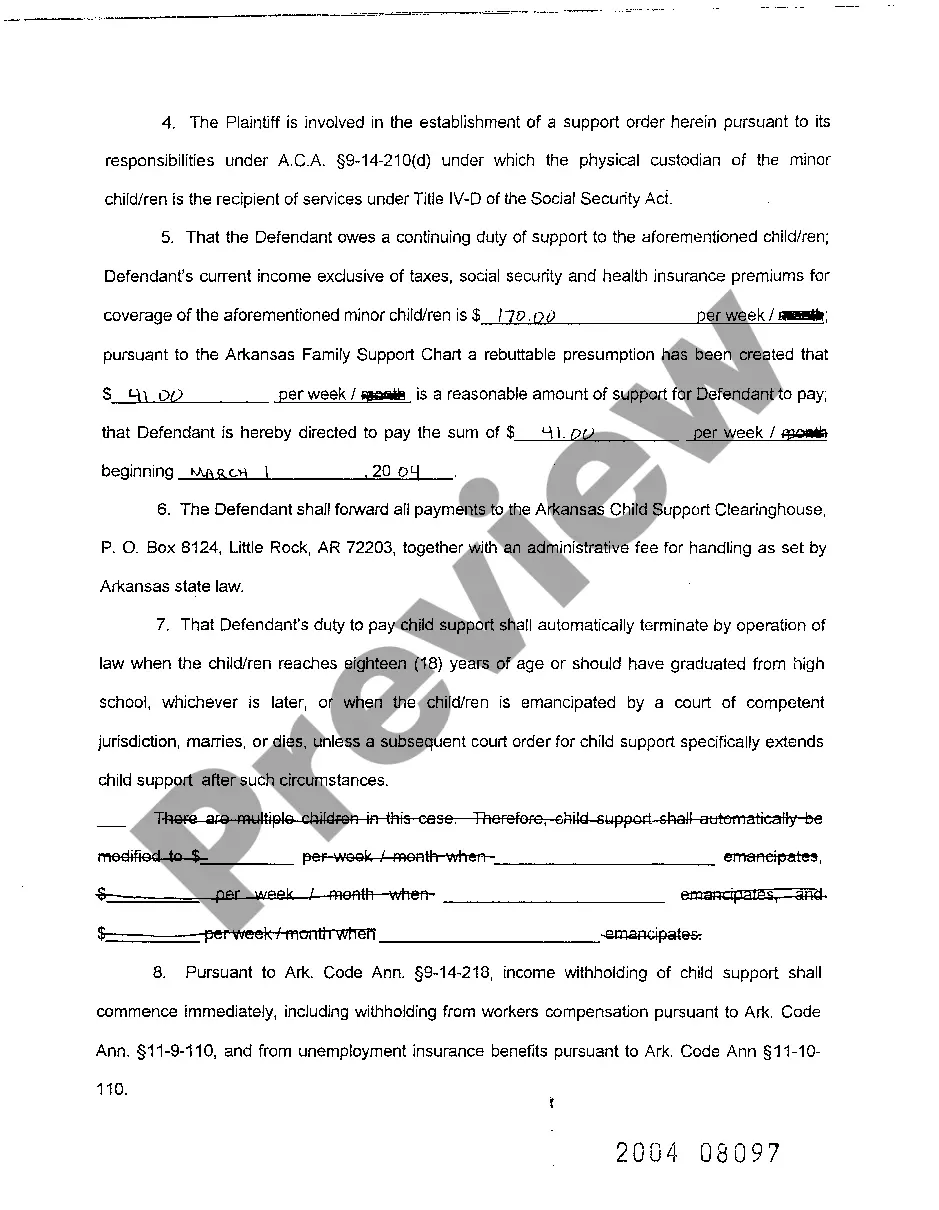

Unlike most other states that consider both parents' incomes, child support charts in Arkansas only consider the net income of the non-custodial parent, along with the number of supported children.

The Arkansas statute of limitations on enforcement of child support arrears is five years past age 18 for any arrears that have not been adjudicated. Adjudications are valid for ten years and may be revived every ten years thereafter.

How much back-child support is a felony in Arkansas? Currently, if you owe more than $10,000 in child support, you may face class C felony charges. Furthermore, any amount above $25,000 is a class B felony.

10. Allowable deductions include income taxes; withholding for Social Security, Medicare, and railroad retirement; medical insurance payments for dependent children; and, support a parent pays for other dependents pursuant to court orders.