Payment Bond Form 25a

Description

How to fill out Arkansas Performance And Payment Bond?

There’s no further justification to squander time searching for legal documents to meet your local state obligations. US Legal Forms has gathered all of them in a single location and streamlined their accessibility.

Our platform provides over 85,000 templates for any business and individual legal situations categorized by state and area of application. All forms are expertly drafted and confirmed for authenticity, so you can be assured in receiving a current Payment Bond Form 25a.

If you are acquainted with our service and already possess an account, you must ensure your subscription is active before acquiring any templates. Log In to your account, choose the document, and click Download. You can also return to all obtained documents whenever needed by accessing the My documents section in your profile.

Print your form to complete it by hand or upload the sample if you prefer to use an online editor. Creating legal documents under federal and state regulations is fast and easy with our platform. Try US Legal Forms now to keep your paperwork organized!

- If you haven't used our service before, the procedure will require a few more steps to finalize.

- Here’s how new users can find the Payment Bond Form 25a in our catalog.

- Examine the page content thoroughly to confirm it includes the sample you need.

- To assist with this, utilize the form description and preview options if available.

- Employ the Search bar above to find another sample if the current one doesn't meet your needs.

- Click Buy Now adjacent to the template name when you identify the right one.

- Choose the most appropriate subscription plan and register for an account or Log In.

- Make payment for your subscription with a credit card or via PayPal to continue.

- Select the file format for your Payment Bond Form 25a and download it to your device.

Form popularity

FAQ

A payment bond protects against non-payment to subcontractors and suppliers, ensuring they receive their due compensation. On the other hand, a performance bond protects the project owner by guaranteeing that the contractor will fulfill the project's terms. These bonds address separate but crucial concerns in project management. When dealing with these, consider using the Payment bond form 25a to efficiently handle the payment assurance aspect.

An advance payment bond is designed to protect the advance payments made to a contractor before project completion, ensuring they meet their obligations. In contrast, a performance bond guarantees that the contractor will complete the project as specified in the contract. Both play critical roles in project security, but they function in different stages. It’s essential to assess your needs when selecting forms, such as the Payment bond form 25a.

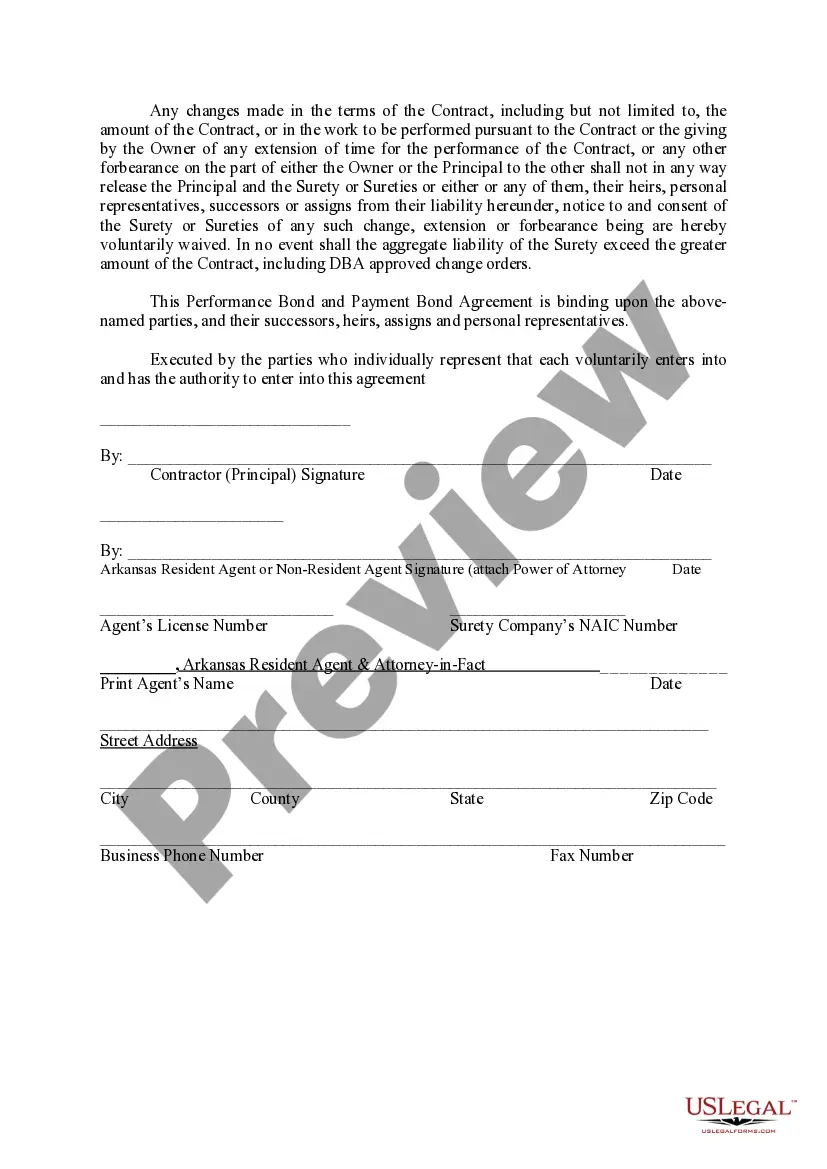

Filling out a performance bond requires careful attention to detail. First, you'll need the project details, including the scope of work, and the bond amount. Afterward, you fill in your information as the principal and provide details of the surety company. Using tools like the Payment bond form 25a simplifies this process, ensuring you include all necessary information correctly.

The primary purpose of a payment bond is to ensure that all parties involved in a project, including subcontractors and suppliers, receive payment for their services and materials. This bond provides financial protection, maintaining trust in the contracting process and supporting smooth project execution. By using the Payment bond form 25a, you can efficiently manage the payment bond requirements and ensure compliance.

A performance bond ensures that a contractor completes a project according to the contract terms, while an advance payment bond protects the funds given to the contractor before work begins. Essentially, the performance bond focuses on project completion, whereas the advance payment bond addresses payment security. For a comprehensive understanding of these bond types, consider using the Payment bond form 25a.

SF 26, often referred to as the Award Bond form, is used to confirm the government's acceptance of a contractor's bid. This form acts as a guarantee that the contractor will enter into a binding agreement and provide the necessary payment and performance bonds. Understanding SF 26 and its relationship with the payment bond form 25a can help you navigate government contracting more smoothly.

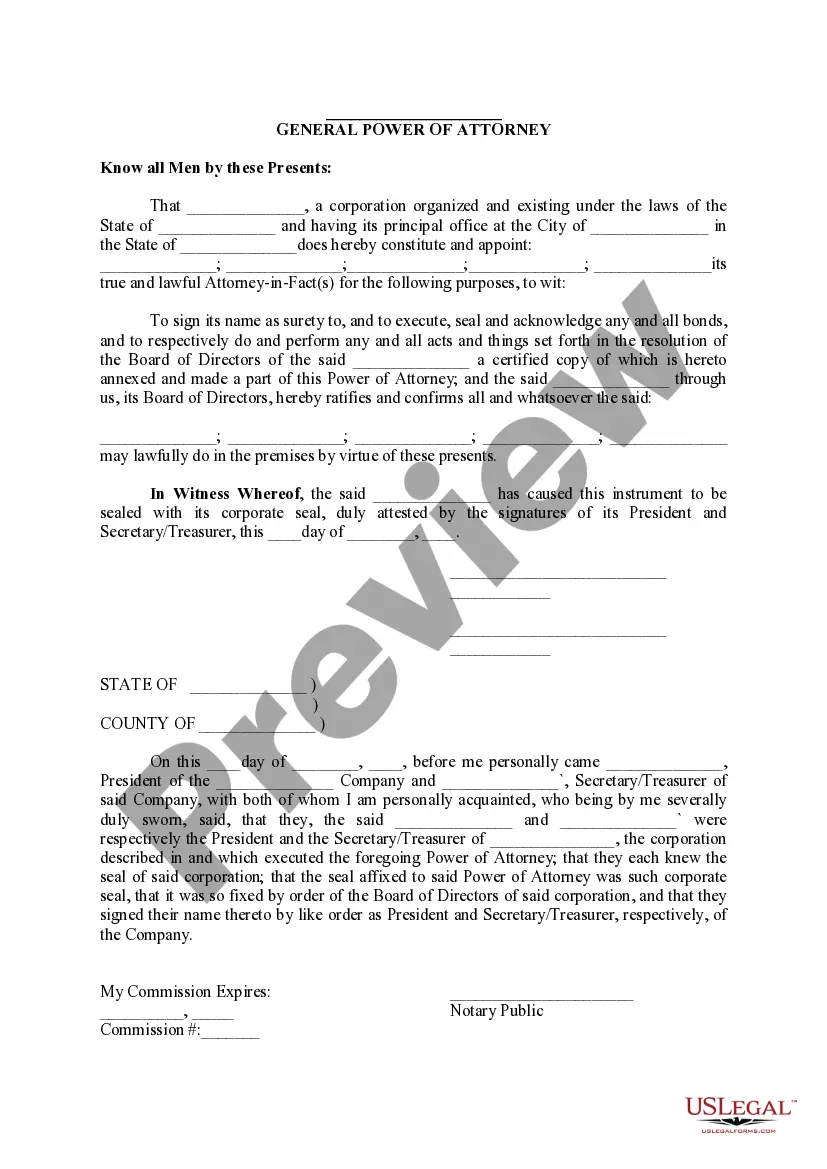

SF 25, also known as the Performance Bond form, is used by the federal government to guarantee that contractors will perform their obligations under a contract. This form needs to be submitted during contract bid processes for projects exceeding certain thresholds. When working on federally funded projects, knowing about SF 25 and the requirement for a payment bond form 25a can be crucial.

A surety bond is a broader category that includes various types of bonds, including payment bonds and performance bonds. Specifically, a performance bond guarantees the completion of a project, while a payment bond ensures that subcontractors and suppliers receive payment for their work. Understanding these distinctions helps you choose the right bond for your needs, such as the payment bond form 25a.

To obtain a payment bond, start by gathering the necessary information about your project and the requirements set forth by the relevant authorities. You can then apply for a payment bond form 25a through a licensed surety company or an online platform like uslegalforms. This platform simplifies the process, allowing you to efficiently complete and submit your payment bond application.

In insurance, the two main types of bonds are surety bonds and fidelity bonds. Surety bonds protect against contractor default, ensuring obligations are met under contractual agreements. On the other hand, fidelity bonds offer protection against employee dishonesty. Utilizing resources like the payment bond form 25a streamlines processes related to these bonds.