Dissolution Form For Corporation

Description

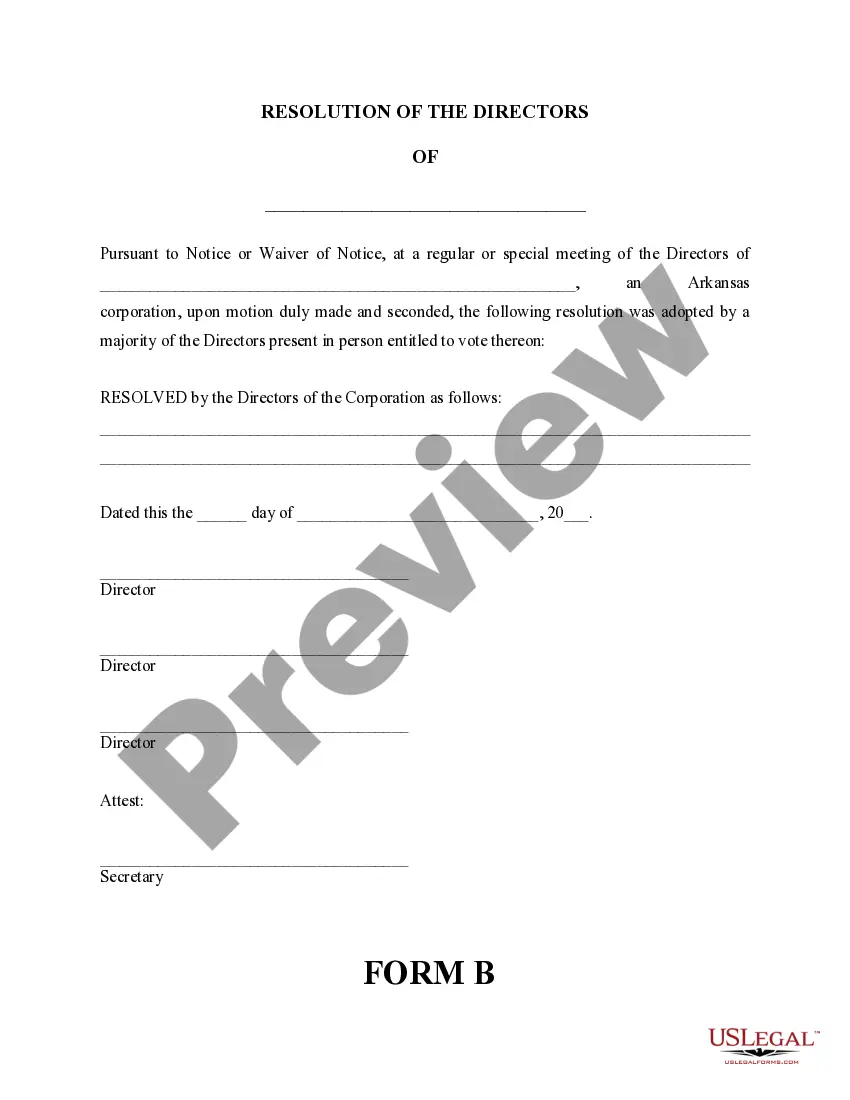

How to fill out Arkansas Dissolution Package To Dissolve Corporation?

Well-crafted official documents are one of the essential assurances for steering clear of issues and lawsuits, but acquiring them without assistance from a lawyer may be time-consuming.

Whether you need to swiftly locate a current Dissolution Form For Corporation or any other formats for employment, family, or business events, US Legal Forms is always ready to assist.

The process is even simpler for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen document. Additionally, you can access the Dissolution Form For Corporation at any time later, as all the documents ever obtained on the platform can be found within the My documents section of your profile. Save time and resources on drafting official paperwork. Try US Legal Forms now!

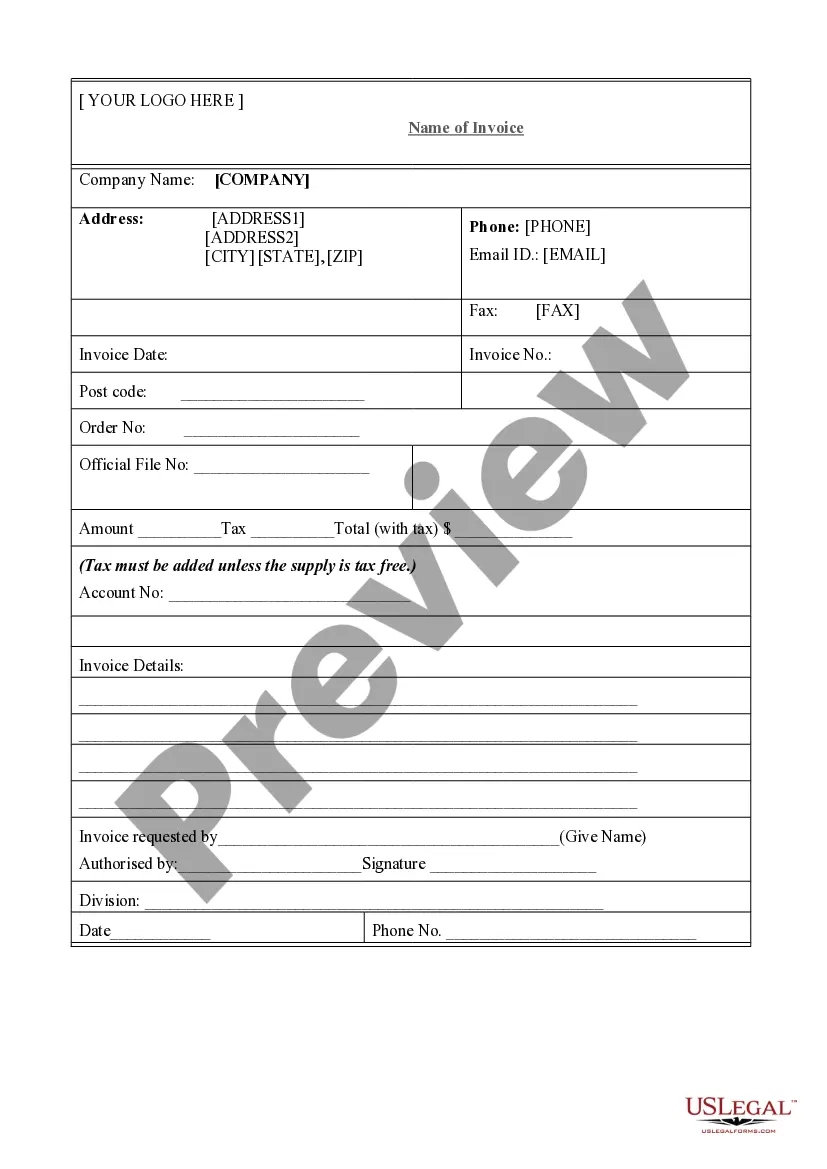

- Ensure that the form fits your situation and locality by reviewing the description and preview.

- Search for another example (if necessary) through the Search bar in the header of the page.

- Press Buy Now once you find the correct template.

- Select the pricing option, Log In to your account, or create a new one.

- Choose your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select either PDF or DOCX file format for your Dissolution Form For Corporation.

- Hit Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Yes, an S corporation is required to file form 966 when it intends to dissolve, regardless of its tax status. This form informs the IRS of your intent and outlines the necessary steps for dissolution. By filing the dissolution form for corporation correctly, you help ensure a smooth transition through the closure process. Our USLegalForms platform provides the necessary forms and guidance to help you navigate this requirement.

Yes, you should cancel your EIN when you close your business, as it helps the IRS track your tax obligations. Once you dissolve your corporation and file the relevant dissolution form for corporation, you can proceed with cancelling your EIN. This action ensures that you are no longer associated with tax liabilities for your business. For guidance, consider our USLegalForms platform for assistance throughout this process.

To dissolve an S corporation, you need to follow a series of steps, starting with the board of directors voting to approve the dissolution. Next, you must file your dissolution form for corporation with the state, ensuring all debts and liabilities are settled. Afterward, notify the IRS and complete any necessary final tax returns. Using the USLegalForms platform can simplify this process and provide you with the correct forms.

If you fail to file form 966, you may encounter complications during the dissolution process of your corporation. This form is crucial as it officially notifies the IRS about your corporation's intent to dissolve. Not filing may lead to ongoing tax obligations, penalties, or even legal issues. To avoid these problems, consider using our USLegalForms platform to access a comprehensive dissolution form for corporation.

The first step to terminate a corporation is to hold a meeting with your board of directors to vote on the decision to dissolve. Afterward, you need to file a dissolution form for corporation with your state. This initial step sets the stage for a smooth and legally compliant dissolution process.

To file an article of dissolution, gather required information about your corporation, including the name and date of dissolution. Then, complete the relevant forms provided by your state and submit them along with any required fees. Consider including the dissolution form for corporation to ensure compliance.

Yes, if you are dissolving an S Corp, you must file Form 966 with the IRS. This form notifies the IRS of your intention to dissolve and provides details about your corporation. Additionally, do not forget to submit your dissolution form for corporation at the state level to complete the process.

You inform the IRS that your business is closed by submitting a written statement or the necessary IRS forms. It is crucial to include your business's name, address, and the employer identification number, along with the dissolution form for corporation. Ensure you notify the IRS promptly to avoid potential penalties.

The process of dissolving a corporation typically involves filing a dissolution form for corporation with the state, paying any outstanding debts, and notifying all relevant parties. Afterward, ensure you cancel any business licenses and permits. Following these steps helps eliminate any future liabilities related to your business.

You can notify the IRS of your corporation’s dissolution by submitting a written request or using specific forms. Include important details such as your business name, employer identification number, and the dissolution date. Using the dissolution form for corporation simplifies this process and helps ensure all necessary information is included.