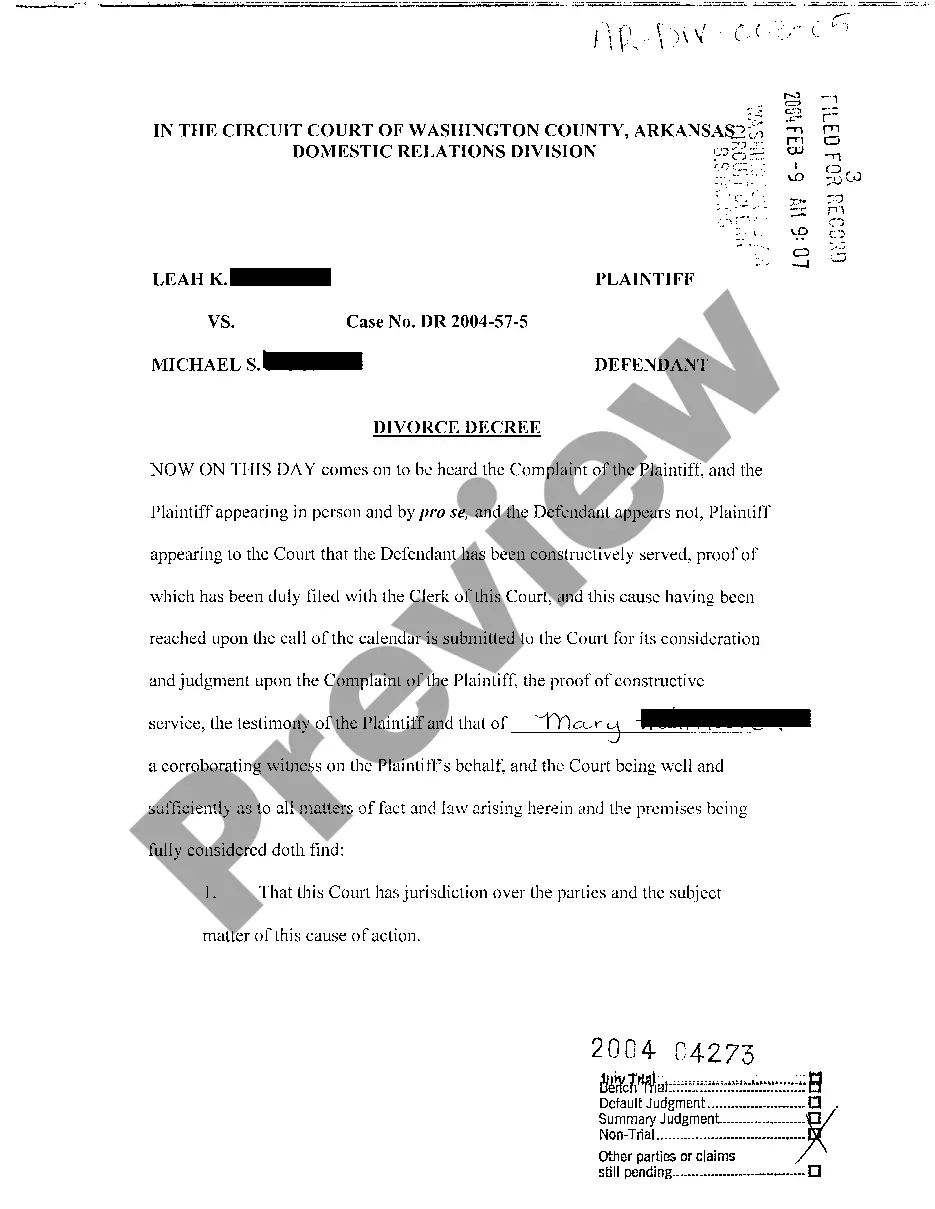

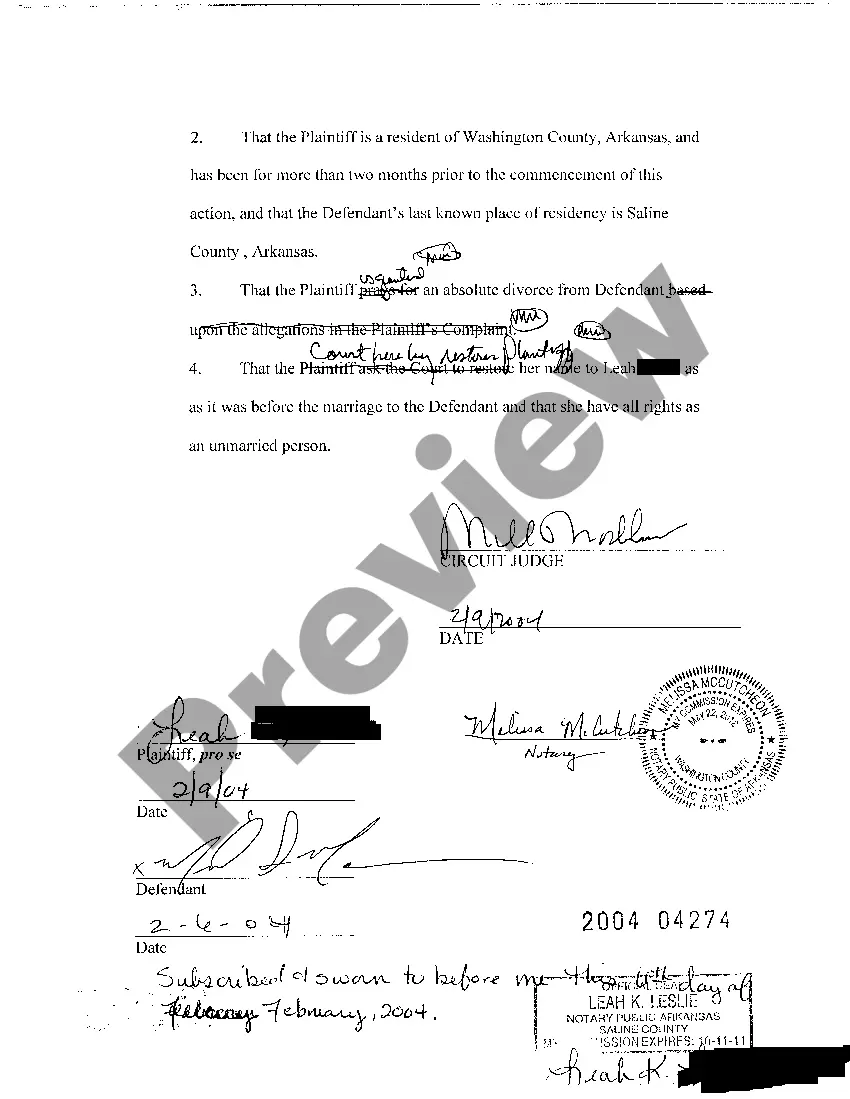

Arkansas Divorce Requirements

Description

How to fill out Arkansas Divorce Decree On Divorce With No Children?

Acquiring legal documents that comply with federal and local laws is crucial, and the internet provides numerous choices to select from.

However, what’s the advantage of spending time searching for the accurately prepared Arkansas Divorce Requirements sample online if the US Legal Forms digital library already compiles such documents in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 fillable templates created by attorneys for various professional and personal situations.

Examine the template using the Preview feature or through the text outline to ensure it fulfills your needs.

- They are straightforward to navigate with all paperwork categorized by state and intended use.

- Our experts keep up with legislative changes, so you can be assured your documents are current and compliant when obtaining an Arkansas Divorce Requirements from our site.

- Acquiring an Arkansas Divorce Requirements is quick and effortless for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you require in your preferred format.

- If you are a newcomer to our site, follow the steps outlined below.

Form popularity

FAQ

If the vehicle was a gift or was purchased from a family member, use the Statement of Transaction {Sales Tax Form} (pdf) (at NY State Department of Tax and Finance) (DTF-802) to receive a sales tax exemption.

An Affidavit of Gift of Motor Vehicle (SU 87-65) is required in addition to the Vehicle Gift Letter. A separate plate gift letter must be used for non-immediate family members.

Rhode Island has one of the nation's shortest timeframes where heirs can submit a will to probate. Probate must be filed in court within 30 days of the heir being notified of the person's death.

Gifts from non immediate family members must have gift letter notarized. Immediate family members for purposes of taxation are : parent, step-parent, sibling, step-sibling, spouse, child, or step-child. Complete the Affidavit of Gift of Motor Vehicles form if the vehicle is a gift.

Non-Titled Vehicles Rhode Island does not title vehicles model year 2000 and older. If you would like to obtain documentation in lieu of a title, you must provide the following documents: Bill of Sale (if you are not the current registered owner). Identification.

In Rhode Island, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Gifted Vehicles Immediate Family: No sales tax on the vehicle unless outstanding taxes are due. A signed letter of gift is required to exempt you from the sales tax. Immediate family members for purposes of taxation are: parent, step-parent, sibling, step-sibling, spouse, child or step-child.

"We have eliminated the car tax a year ahead of schedule, and the vast majority of Rhode Islanders will never receive another car tax bill.