A cover sheet is an informational form required to be filed in Civil cases. The coversheet contains names and addresses of parties, the case type, and other organizational information. The court uses this information for statistical purposes and to org

Aoc Disposition Sheet Arkansas Withholding Tax

Description

How to fill out Arkansas Cover Sheet - Circuit Court - Civil?

Finding a reliable source for the latest and suitable legal templates is part of the challenge of managing bureaucracy.

Selecting the appropriate legal documents requires accuracy and careful consideration, which is why it is crucial to obtain samples of Aoc Disposition Sheet Arkansas Withholding Tax exclusively from trustworthy providers, such as US Legal Forms.

Once you have the form on your device, you can modify it with the editor or print it and fill it out by hand. Eliminate the hassle that comes with your legal documentation. Browse the extensive US Legal Forms library to discover legal templates, assess their applicability to your situation, and download them immediately.

- A flawed template will consume your time and hinder the process you are dealing with.

- With US Legal Forms, you have minimal concerns.

- You can access and review all the information regarding the document’s application and significance for your case and in your jurisdiction.

- Utilize the catalog navigation or search bar to locate your template.

- Check the form’s description to confirm it meets the criteria of your state and locality.

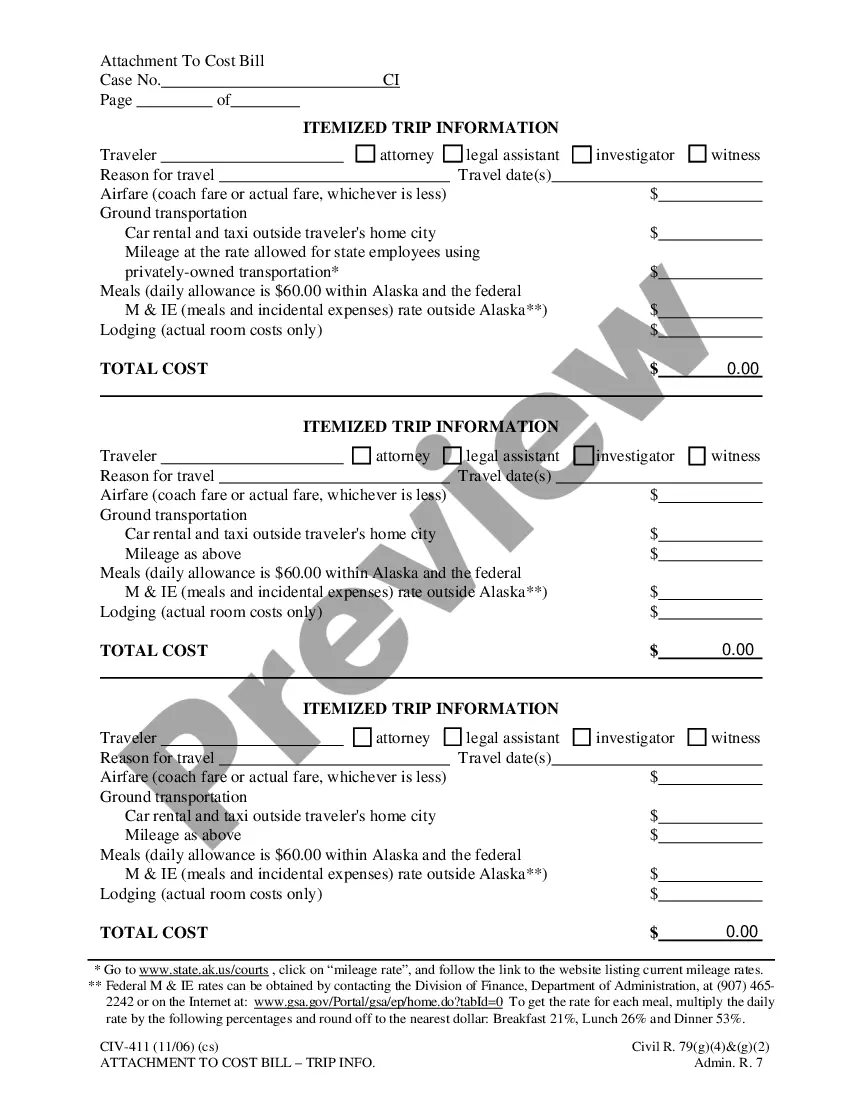

- If available, view the form preview to ensure it is indeed the document you are seeking.

- If the Aoc Disposition Sheet Arkansas Withholding Tax does not fulfill your requirements, return to the search for the appropriate document.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing plan that suits your needs.

- Proceed to the registration to finalize your acquisition.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Aoc Disposition Sheet Arkansas Withholding Tax.

Form popularity

FAQ

How to check withholding. Use the Tax Withholding Estimator on IRS.gov. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4.

You can find your Tax ID Number on any previous payment voucher you have received from the AR Department of Finance and Administration. If you're unsure, contact the agency at (501) 682-7290.

An employer is required to withhold tax from wages of employees who work within the State of Arkansas. An employer is not required to withhold Arkansas tax from the wages of any employee who does not work within the state of Arkansas. However, the employee's wages are still taxable.

FORMS: Preprinted forms will be mailed to your business after this registration has been processed. If you have not received your forms, contact our office at (501) 682-7290 for instructions.

Arkansas Code Annotated 26-51-919(b)(1)(A) requires a pass-through entity to withhold income tax at the rate of 7% on each nonresident member's share of distributed Arkansas income.