The Arkansas child support calculator for California is a valuable tool designed to assist parents in estimating the amount of child support to be paid or received within the Californian jurisdiction. This calculator takes into account various factors such as income, custody percentages, and related expenditures to determine a fair and accurate child support amount. Utilizing the Arkansas child support calculator can help parents avoid potential conflicts or inaccuracies when it comes to calculating child support obligations. By providing accurate financial information and following the guidelines set by the State of California, parents can determine an appropriate amount that ensures the well-being and financial support of their children. Keywords: Arkansas child support calculator, California, child support, estimation, income, custody percentages, expenditures, fair, accurate, obligations, conflicts, financial information, guidelines, well-being, financial support. Different types of Arkansas child support calculators for California may vary depending on the specific features and complexities they offer. Here are a few notable variations: 1. Basic Child Support Calculator: This type provides a straightforward estimation of child support obligations based on income, custody percentages, and general expenses. 2. Advanced Child Support Calculator: This calculator offers additional features and options, such as accounting for special circumstances like medical expenses, childcare costs, and educational expenses. 3. Shared Custody Calculator: Specifically tailored for cases where custody is split equally between both parents, this calculator considers shared custody percentages and calculates child support accordingly. 4. Self-Employed Calculator: Specifically designed for self-employed individuals, this calculator takes into account unique income situations and factors relevant to self-employment, ensuring more accurate calculations in these cases. 5. Arrears Calculator: This type of calculator assists individuals in determining the total amount of past-due child support, taking into account any missed payments or late fees. These different types of Arkansas child support calculators for California aim to offer tailored estimations based on individual circumstances, promoting fairness, accuracy, and compliance with California child support guidelines. Parents can choose the calculator that best suits their specific situation to ensure a reliable determination of child support obligations.

Arkansas Child Support Calculator For California

Description

How to fill out Arkansas Child Support Calculator For California?

Legal papers management might be overpowering, even for experienced professionals. When you are interested in a Arkansas Child Support Calculator For California and do not have the a chance to commit searching for the appropriate and updated version, the procedures might be stressful. A robust web form catalogue can be a gamechanger for anyone who wants to deal with these situations effectively. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, you can:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any demands you might have, from personal to enterprise papers, in one place.

- Use innovative tools to finish and control your Arkansas Child Support Calculator For California

- Access a resource base of articles, instructions and handbooks and resources connected to your situation and needs

Help save time and effort searching for the papers you will need, and make use of US Legal Forms’ advanced search and Preview feature to discover Arkansas Child Support Calculator For California and get it. In case you have a membership, log in in your US Legal Forms account, look for the form, and get it. Take a look at My Forms tab to view the papers you previously downloaded as well as control your folders as you can see fit.

Should it be your first time with US Legal Forms, make an account and obtain limitless use of all benefits of the platform. Listed below are the steps to take after accessing the form you want:

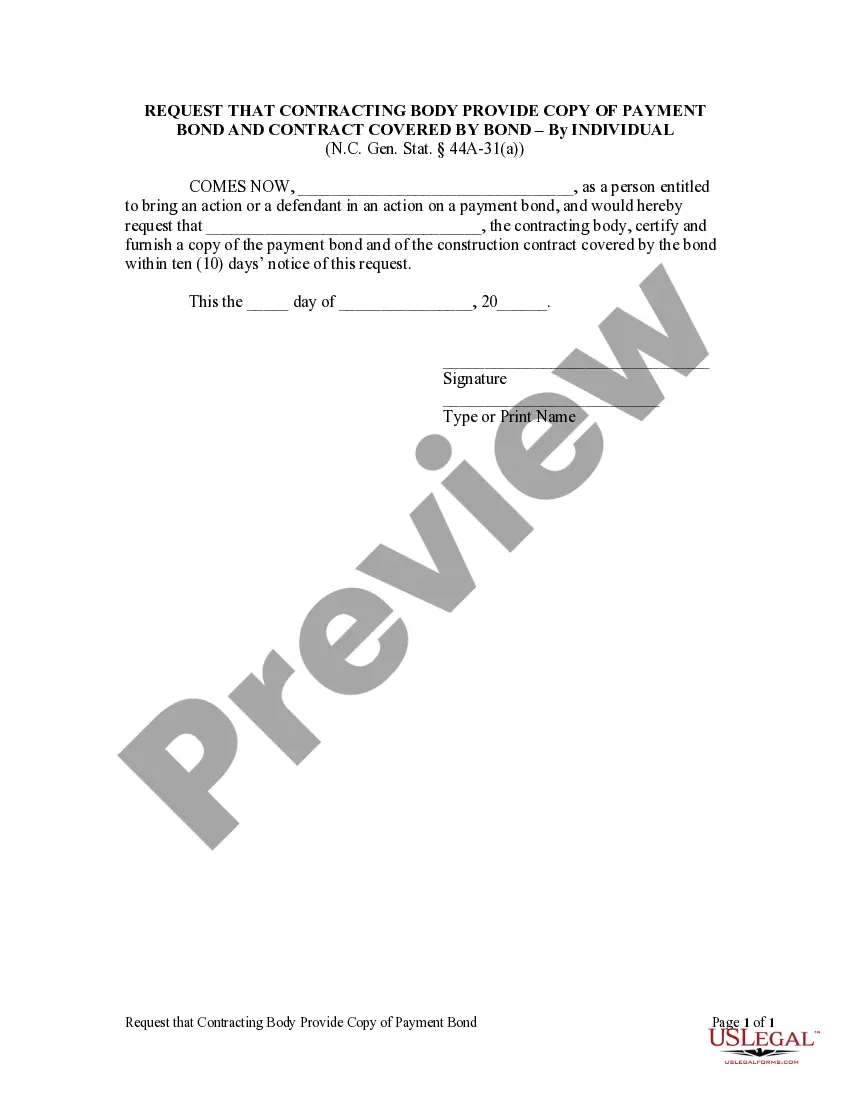

- Validate it is the right form by previewing it and reading through its description.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now once you are all set.

- Choose a monthly subscription plan.

- Find the file format you want, and Download, complete, eSign, print and send your papers.

Benefit from the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Transform your daily papers management in to a easy and intuitive process today.

Form popularity

FAQ

The following sections cover the steps you will need to do to maintain the good standing of your Rhode Island LLC. Create an LLC Operating Agreement. ... Get an Employer Identification Number (EIN) ... Submit an Annual Report. ... Pay the Corporate Tax, if Applicable.

You can get an LLC in Rhode Island in 3-4 business days if you file online (or 2 weeks if you file by mail).

LLCs in Rhode Island are taxed as pass-through entities by default. Rather than paying taxes at the entity level, LLCs pass profits and losses on to their members, who then pay taxes at the individual level. In Rhode Island, LLC members are subject to both federal and state personal income tax.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

Name your Rhode Island LLC. You'll need to choose a name to include in your articles before you can register your LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.

The main cost associated with starting an LLC in Rhode Island is the $150 fee to file your articles of organization, which officially register your business with the state. You'll also have a yearly recurring fee of $50 to file your LLC's annual report.

Rhode Island LLC Cost. The main cost associated with starting an LLC in Rhode Island is the $150 fee to file your articles of organization, which officially register your business with the state. You'll also have a yearly recurring fee of $50 to file your LLC's annual report.

The State of Rhode Island does not legally require businesses to adopt an operating agreement.