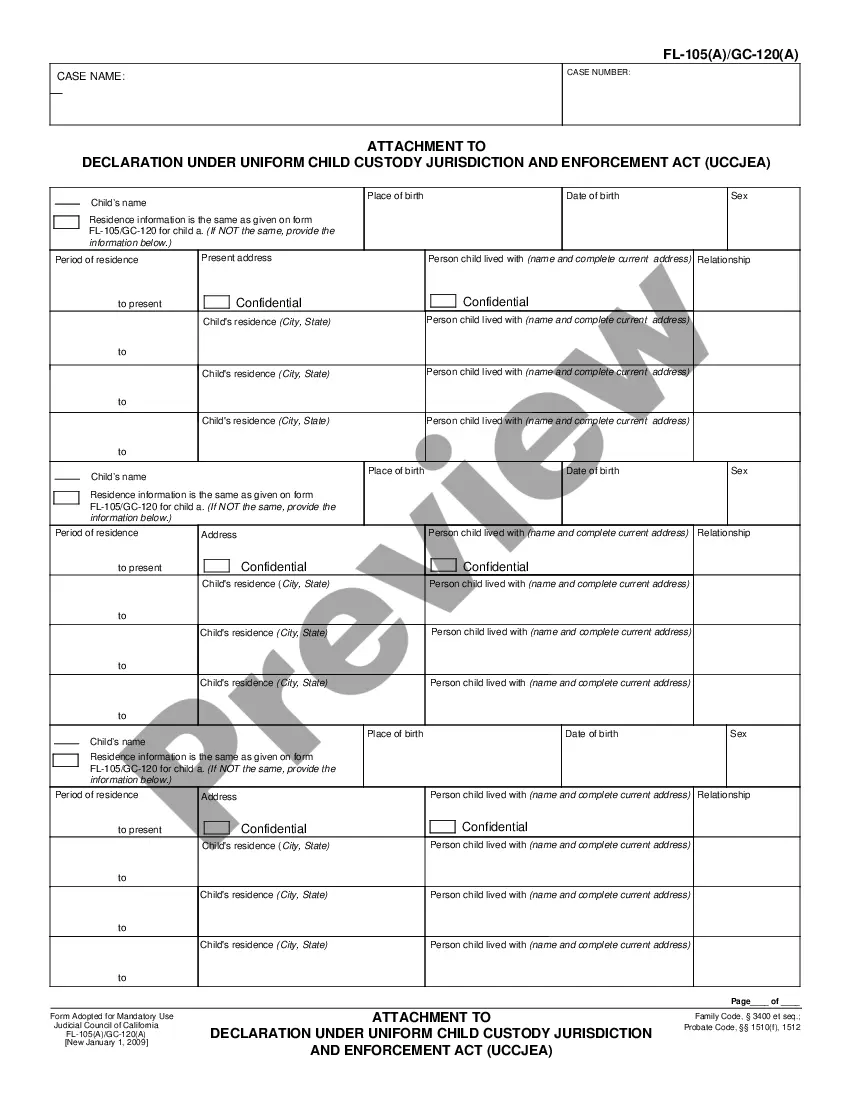

This is a financial statement that may be needed in a variety of litigation matters. This form may vary based on County. You should consult the clerk about whether this form will be required in your case and obtain the County specific form if required. USLF amends and updates forms as is required by Arkansas statutes and law.

Affidavit Of Financial Means Arkansas 2022 Withholding

Description

How to fill out Arkansas NEW Affidavit Of Financial Means (effective October 10, 2016)?

The Affidavit Of Financial Means Arkansas 2022 Withholding displayed on this page is a reusable official template composed by qualified attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and lawyers with more than 85,000 confirmed, state-specific documents for any commercial and personal situation. It’s the fastest, easiest, and most dependable method to acquire the paperwork you require, as the service ensures the utmost level of data protection and anti-malware security.

Re-download your documents when needed. Access the 'My documents' section in your profile to retrieve any previously purchased documents.

- Search for the document you require and review it.

- Browse through the file you searched and preview it or verify the form description to ensure it meets your needs. If it does not, use the search feature to locate the suitable one. Click 'Buy Now' once you locate the template you want.

- Register and Log In.

- Choose the subscription plan that fits your needs and create an account. Utilize PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

- Select the format you prefer for your Affidavit Of Financial Means Arkansas 2022 Withholding (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with a legally binding electronic signature.

Form popularity

FAQ

A financial affidavit form is a legal document that details an individual's financial status, including income, expenses, assets, and debts. In the context of the Affidavit of financial means Arkansas 2022 withholding, this form plays a critical role in demonstrating your financial capabilities for various legal matters, such as child support or court decisions. It helps judges and other legal entities assess your financial situation accurately. Using USLegalForms, you can easily obtain a reliable template for the Affidavit of financial means Arkansas 2022 withholding, ensuring compliance with local regulations.

An affidavit of financial status is a legal document that outlines an individual's financial situation. In Arkansas, this document is often required for various legal proceedings, including those related to withholding issues. When you prepare an affidavit of financial means for Arkansas in 2022, it ensures that you provide accurate information regarding your income and assets. You can use platforms like US Legal Forms to easily create a compliant and customized affidavit to meet your specific needs.

An Affidavit of heirship in Arkansas is typically filled out by a person who wishes to establish the heirs of a deceased individual. Often, this includes family members or individuals familiar with the deceased's finances and relationships. It is important to have clear and verified information to support the claims in the affidavit, especially regarding any Affidavit of financial means arkansas 2022 withholding.

In Arkansas, an Affidavit of financial means outlines an individual’s income, expenses, assets, and liabilities. This document is crucial when individuals seek to demonstrate their financial situation to the court or other authorities. Accurate completion is essential for the Affidavit of financial means arkansas 2022 withholding, as it can influence critical outcomes.

A financial affidavit serves as a formal declaration of an individual’s financial status. It is often used in court proceedings or financial transactions to provide a clear picture of income and expenses. When preparing an Affidavit of financial means arkansas 2022 withholding, this document helps ensure that all parties understand your financial position.

Filling out an affidavit of financial information requires you to provide clear and accurate financial data. Start by entering your personal details, then list your monthly income alongside any ongoing expenses. Accuracy is key, especially with the Affidavit of financial means arkansas 2022 withholding, as this document can impact various legal decisions.

An affidavit becomes legally valid when it is executed properly and meets certain criteria. It must contain a declaration of truth, be signed by the affiant, and usually require a witness or notary public. For the Affidavit of financial means arkansas 2022 withholding, ensure all required elements are included to maintain validity.

Completing a financial affidavit involves providing a comprehensive overview of your financial situation. You must accurately list your income, expenses, assets, and liabilities. This is crucial for ensuring that your Affidavit of financial means arkansas 2022 withholding is filled out correctly and reflects your true financial status.

To fill out an affidavit sample, start by gathering all necessary information and documents. Clearly state your full name, address, and the specific purpose of the affidavit. Be sure to include the details that are relevant to your situation, such as income and expenses, particularly when it pertains to the Affidavit of financial means arkansas 2022 withholding.

An affidavit carries significant weight as a sworn statement used in various legal contexts. It acts as evidence affirming the truth of the information presented, like the affidavit of financial means for Arkansas 2022 withholding. Courts often view affidavits as reliable documents, which can influence decisions in legal cases. Because of its legal standing, accuracy and truthfulness in these affidavits are paramount.