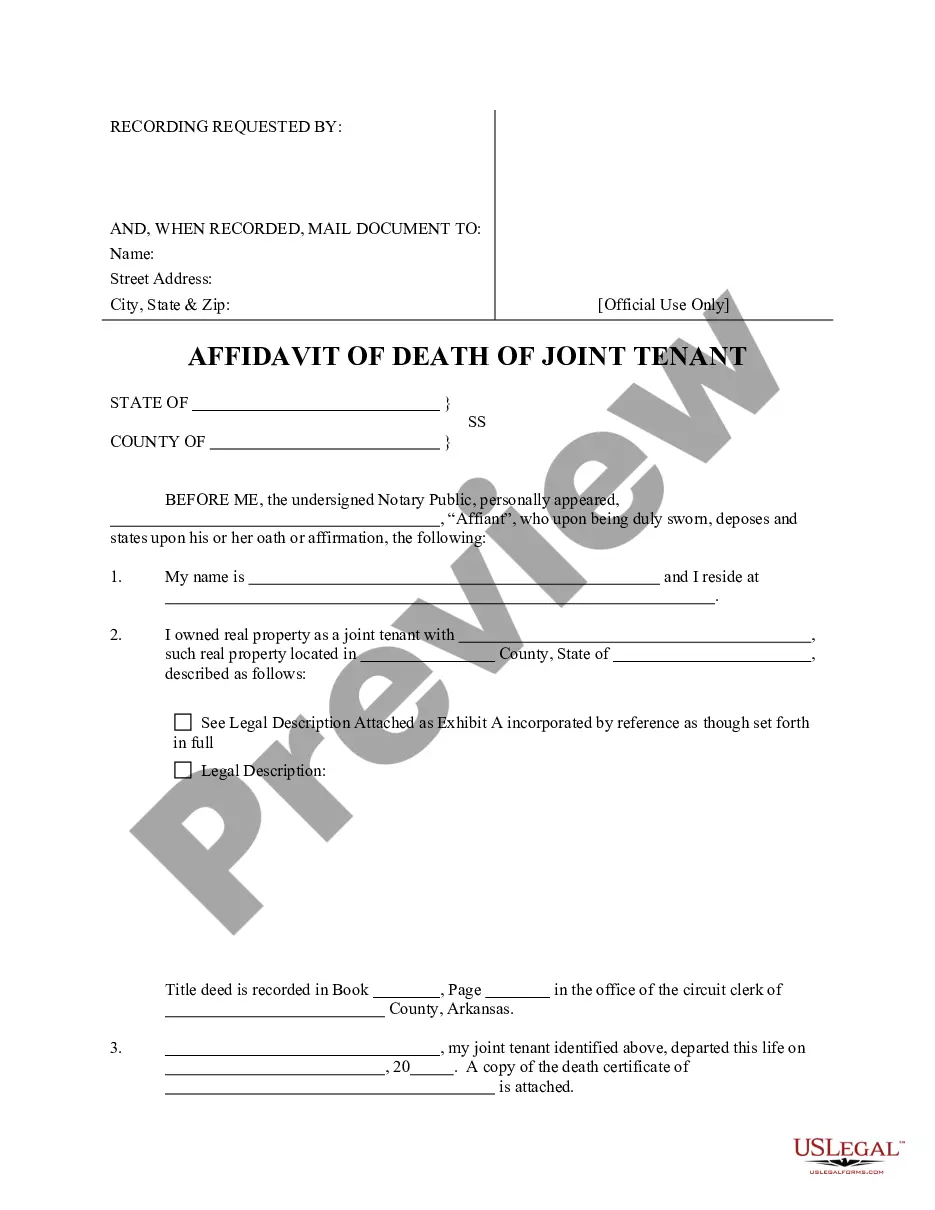

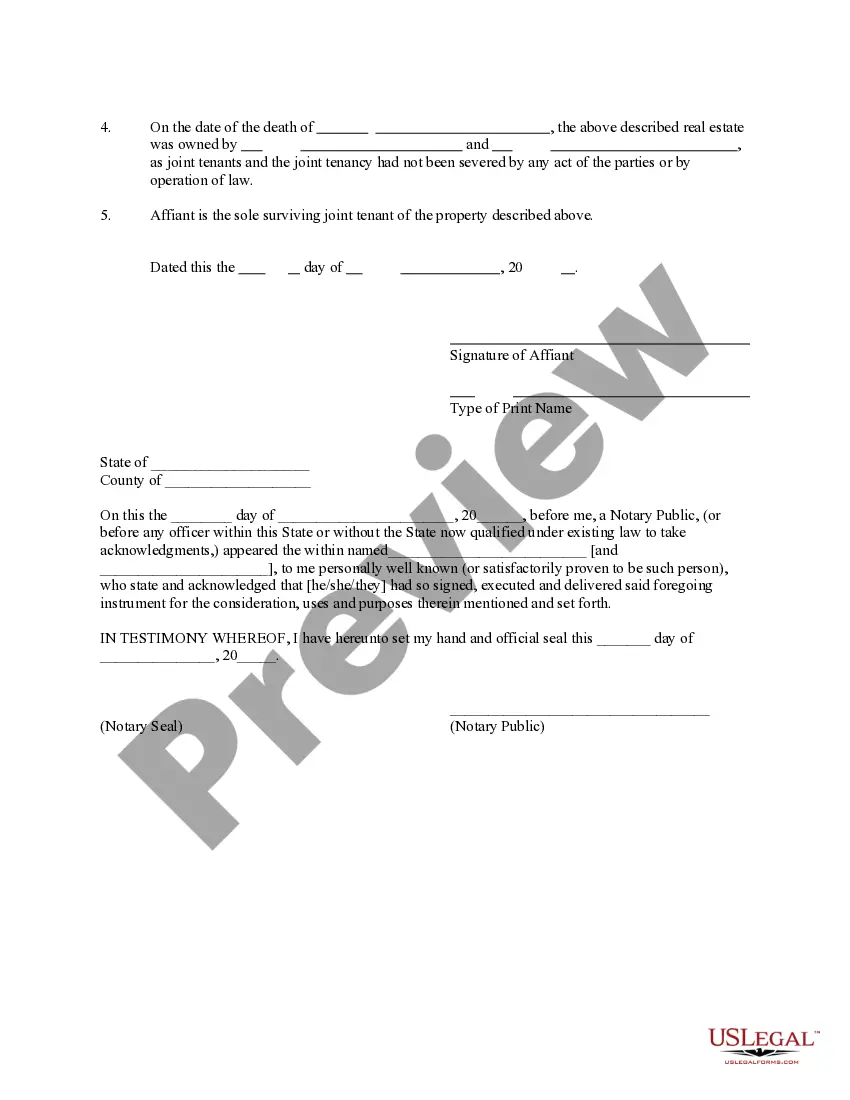

This form is an affidavit in which the affiant is the surviving tenant in a joint tenancy with the decedent. The form is used to establish the death of the decedent and the succession of the affiant to the interest of the decedent as a result of the joint tenantcy.

Affidavit Of Death Withdrawal Philippines

Description

How to fill out Arkansas Affidavit Of Death Of Joint Tenant?

There's no longer a necessity to waste time searching for legal documents to comply with your local state laws.

US Legal Forms has compiled all of them in one location and made them easily accessible.

Our platform offers over 85,000 templates for various business and personal legal situations, categorized by state and intended usage.

Utilize the search bar above to look for another template if the prior one wasn't suitable.

- All forms are expertly crafted and validated for authenticity, so you can trust in acquiring a current Affidavit Of Death Withdrawal Philippines.

- If you are already acquainted with our service and possess an account, verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all stored documents whenever necessary by accessing the My documents tab in your profile.

- If this is your first time using our service, the process will require a few additional steps to finalize.

- Here's how newcomers can access the Affidavit Of Death Withdrawal Philippines from our collection.

- Carefully review the page content to ensure it includes the example you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

The proper procedure is to inform the bank of the owner's death, to apply for a court order as executor or administrator to access the account (if the account is solely owned by the deceased with no payable on death designation), to use the money in the account to pay off creditors, and thereafter, distribute the

As clarified by the Bureau of Internal Revenue (BIR) itself in a circular on joint accounts, the executor, administrator or any legal heir/s may be allowed withdrawal within one year from the date of death of the depositor/joint depositor for as long as the amount withdrawn would be subject to the six percent final

RMC No. 62-2018 mandates the bank to require the executor, administrator, or any of the legal heirs applying for the withdrawal to present a copy of the Tax Identification Number (TIN) of the estate of the decedent and BIR Form No.

97 of the National Internal Revenue Code which now allows any withdrawal from the account of a deceased depositor without the need of payment of any estate tax, subject to a final withholding tax of 6% on the amount of the deposit.

Keep in mind that most banks won't allow you to withdraw money from an open account of someone who has died (unless you are the other person named on a joint account) before you have been granted probate (or have a letter of administration).