Lady Bird Deed Texas Pros And Cons

Description

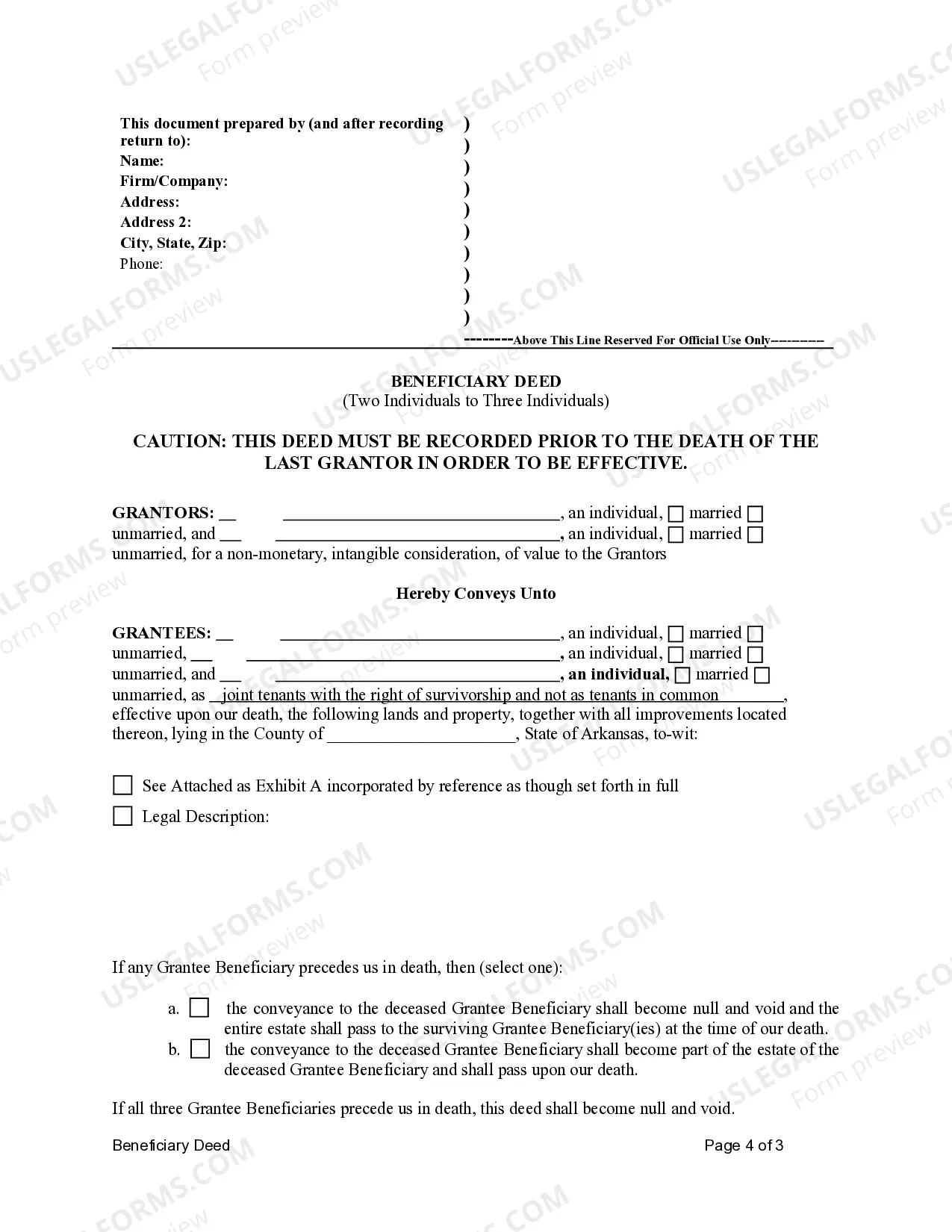

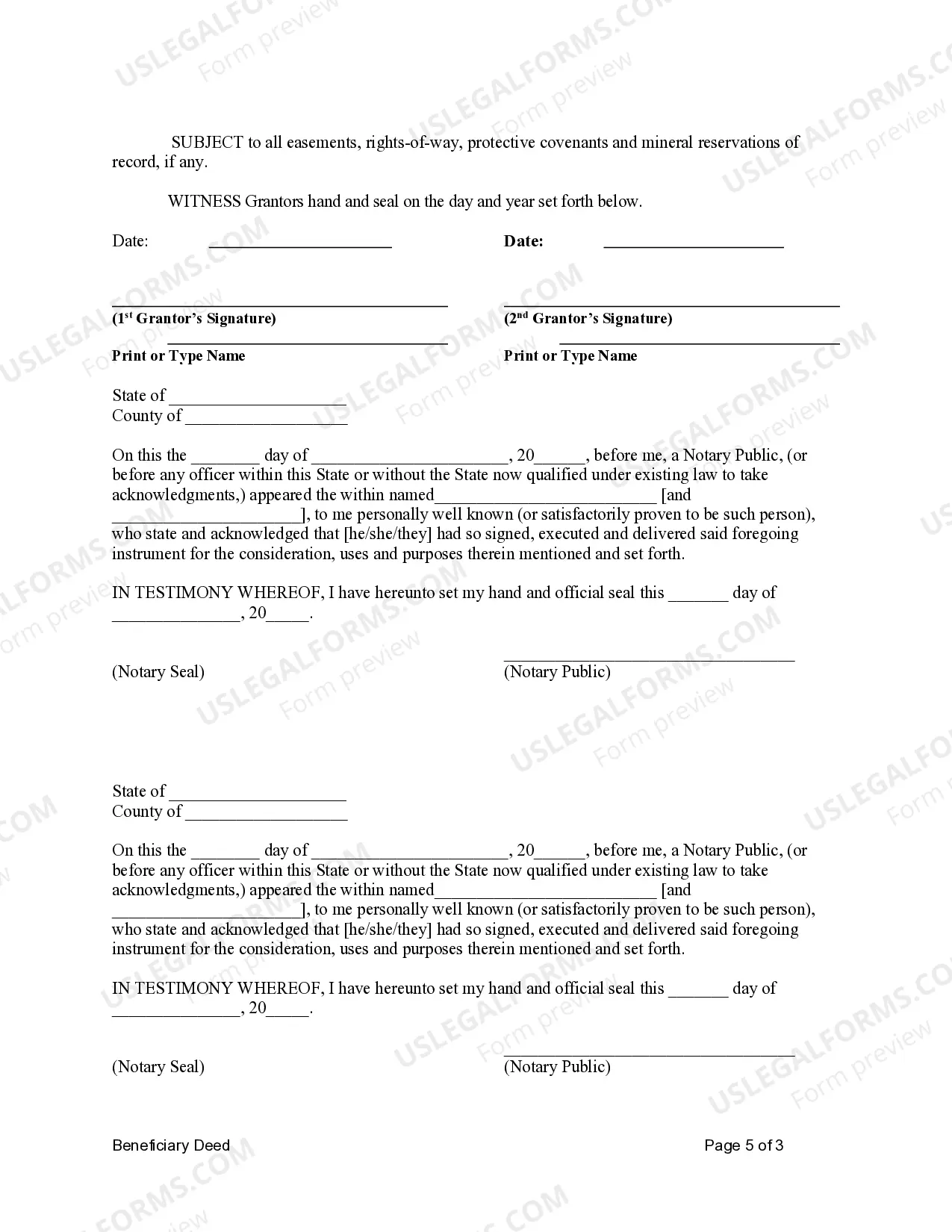

How to fill out Arkansas Beneficiary / Transfer On Death Deed From Two Individuals To Three Individuals?

Individuals often link legal documentation with complexities that only an expert can handle.

In some respects, this is accurate, since composing Lady Bird Deed Texas Benefits and Drawbacks requires significant knowledge of specific criteria, including state and county laws.

However, with US Legal Forms, everything has been simplified: ready-to-use legal documents for any personal and business scenario pertinent to state statutes are compiled in a single online directory and are now accessible to everyone.

All templates in our catalog are reusable: once purchased, they remain saved in your profile. You can access them whenever necessary through the My documents section. Explore all the advantages of using the US Legal Forms platform. Enroll today!

- US Legal Forms offers over 85k current documents categorized by state and field of application, so searching for Lady Bird Deed Texas Benefits and Drawbacks or any other specific template takes only a few minutes.

- Existing users with an active subscription must Log In to their account and click Download to retrieve the form.

- New users on the platform need to create an account and subscribe prior to saving any files.

- Here is a step-by-step guide on how to obtain the Lady Bird Deed Texas Benefits and Drawbacks.

- Carefully examine the page content to ensure it meets your requirements.

- Review the form description or check it using the Preview option.

- Search for another example via the Search bar above if the first one is unsuitable.

- Click Buy Now once you find the suitable Lady Bird Deed Texas Benefits and Drawbacks.

- Select a subscription plan that fits your needs and budget.

- Either create an account or Log In to continue to the payment page.

- Complete your subscription payment using PayPal or your credit card.

- Choose the format for your document and click Download.

- Print your document or import it into an online editor for quicker completion.

Form popularity

FAQ

Yes, a lady bird deed must be filed in Texas to be legally effective. This type of deed transfers property to beneficiaries while allowing the original owner to maintain control during their lifetime. When considering the lady bird deed Texas pros and cons, it's crucial to understand that filing this deed can simplify estate planning and avoid probate, but it also requires proper documentation. Using platforms like USLegalForms can help ensure you complete the necessary filings correctly.

The benefits of a lady bird deed in Texas include avoiding probate and retaining control over the property during the owner's lifetime. This type of deed enables homeowners to make changes to beneficiaries without needing consent, simplifying management decisions. Additionally, it can help protect the property from certain types of claims after death. Exploring the lady bird deed Texas pros and cons can provide clearer insights into its advantages for estate planning.

A lady bird deed works by allowing the property owner to retain full rights while designating beneficiaries for the property after their passing. This kind of deed bypasses probate, which can often be a lengthy and costly process. The property owner can modify the deed at any time, providing great flexibility in managing their estate. Understanding how a lady bird deed Texas pros and cons benefit you is vital for planning your estate effectively.

The lady bird deed can complicate the process of transferring ownership if not executed correctly. Additionally, there’s a risk that a property owner may become incapacitated, making it challenging to manage the property effectively. Due to these factors, it's crucial to weigh the lady bird deed Texas pros and cons carefully. Getting advice from a qualified professional can help in understanding these risks better.

Yes, you can sell a house that is under a lady bird deed in Texas. The property owner retains complete control and can sell or refinance without needing consent from beneficiaries. This flexibility is a significant advantage; however, potential sellers should consider the lady bird deed Texas pros and cons before making decisions. Consultation with a legal expert can clarify any concerns regarding the sale process.

One disadvantage of a lady bird deed is that it may not protect the property from Medicaid claims once the owner passes away. Additionally, all beneficiaries have equal rights to the property upon the owner's death, which can lead to disputes. Furthermore, if the property owner requires long-term care, transferring the property could affect eligibility. Evaluating the lady bird deed Texas pros and cons is essential for effective estate planning.

In Texas, the ladybird deed allows property owners to transfer their property directly to beneficiaries while retaining control during their lifetime. This means the owner can sell, mortgage, or change beneficiaries without any consent. The deed must clearly specify the property and the beneficiaries. Understanding the lady bird deed Texas pros and cons can help you make informed decisions about estate planning.

Despite its benefits, the lady bird deed has some disadvantages in Texas. It might not suit everyone, especially if there is a desire for more control over the property after death. Additionally, there can be challenges in managing property taxes or situations involving multiple heirs. Carefully assessing the lady bird deed Texas pros and cons can guide you toward the right estate planning strategy.

After the owner's death, the lady bird deed automatically transfers the property to the designated beneficiaries. Heirs should file the original deed with the county clerk's office to officially record the change of ownership. This process is relatively smooth compared to other methods of transferring property, making it an appealing choice. Evaluating the lady bird deed Texas pros and cons can provide clarity on next steps.

The lady bird deed can have favorable tax implications for beneficiaries in Texas. When property is inherited via this deed, beneficiaries typically receive a step-up in basis for tax purposes. This means they may face lower capital gains taxes if they later sell the property. Understanding these aspects as part of the lady bird deed Texas pros and cons can help heirs make informed decisions.